Markforged goes public with merger to one

The 3D printer company’s merger with special-purpose acquisitions company (SPAC) one is expected to close in summer 2021.

Markforged (Watertown, Mass., U.S.), supplier of carbon fiber and metal additive manufacturing platforms, announced on Feb. 24 that it has entered into a definitive agreement to merge with one, a special-purpose acquisition company sponsored by A-star. Upon completion of the transaction, the combined company will retain the Markforged name and be listed on the New York Stock Exchange under the ticker symbol “MKFG.”

The transaction, which has been unanimously approved by the boards of directors of both Markforged and one, is expected to close in the summer of 2021, subject to the approval of both one and Markforged stockholders and regulatory approvals, as well as and other customary closing conditions.

Following the completion of the transaction, Shai Terem will continue to lead Markforged as president and CEO. Kevin Hartz, founder and CEO of one, will join Markforged’s board.

According to Markforged, the combined company will have an estimated post-transaction equity value of approximately $2.1 billion at closing. The transaction will provide $425 million in gross proceeds to Markforged, assuming no redemptions by one shareholders, including a $210 million PIPE at $10.00 per share from investors including Baron Capital Group, funds and accounts managed by BlackRock, Miller Value Partners, Wasatch Global Investors and Wellington Management, as well as commitments from M12 – Microsoft’s Venture Fund and Porsche Automobil Holding SE, existing Markforged shareholders. Markforged says net transaction proceeds will support its continued growth across key verticals and strengthen its competitive advantage with new products, proprietary materials and expanded customer use cases.

Markforged’s Terem comments, “We’ve been at the forefront of the additive manufacturing industry, and this transaction will enable us to build on our incredible momentum and provide capital and flexibility to grow our brand, accelerate product innovation, and drive expanded adoption among customers across key verticals. We’re focused on making manufacturing even better by capitalizing on the huge opportunity ahead, and we are making this important leap through our new long-term partnership with Kevin Hartz and the entire team at one.”

Hartz adds, “When launching one, our priority was to partner with a company with exceptional founders, visionaries and operators taking a differentiated approach in large and growing markets. Markforged ticked all of those boxes and more.”

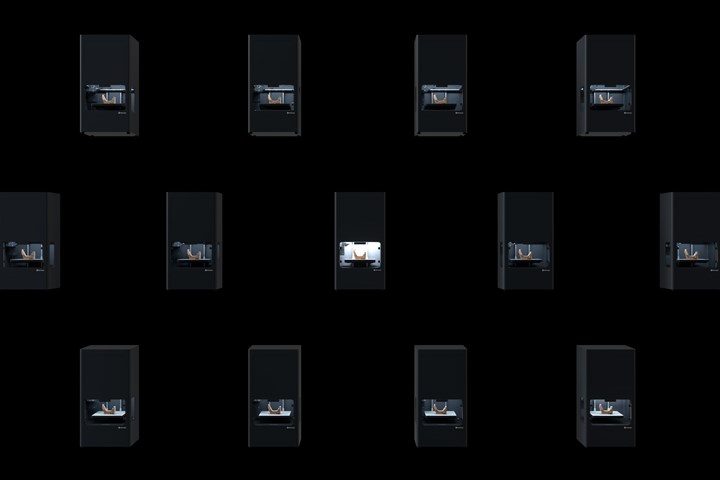

Founded in 2013, Markforged’s artificial intelligence (AI)-powered and intuitive additive manufacturing platform is used by customers in many markets, including industrial automation, aerospace, military and defense, space exploration, healthcare and medical and automotive. The platform combines precise and reliable 3D printers with industrial-grade materials and cloud-based machine learning software, providing modern manufacturers with the resources to create more resilient and agile supply chains while saving time and money. Markforged says its suite of industrial and professional-grade, metal and continuous carbon fiber-reinforced composite printers are used in 10,000 facilities across 70 countries. The company reports generated revenue of approximately $70 million in 2020.

Related Content

-

Scaled Composites Model 437 aircraft to be flown for Beacon autonomy testbed

Northrop Grumman subsidiary part of Digital Pathfinder development of stealth aircraft with wings using continuous carbon fiber additive manufacturing and determinate assembly.

-

Industrializing additive manufacturing in the defense/aerospace sector

GA-ASI demonstrates a path forward for the use of additive technologies for composite tooling, flight-qualified parts.

-

Al Seer Marine, Abu Dhabi Maritime unveil world’s largest 3D-printed boat

Holding the new Guinness World Record at 11.98 meters, the 3D-printed composite water taxi used a CEAD Flexbot to print two hulls in less than 12 days.

.jpg;width=70;height=70;mode=crop)