Plant tour: Spirit AeroSystems, Wichita, KS

Spirit AeroSystems was an established aerospace supplier when it earned that distinction, winning the contract for the Boeing 787’s Section 41. Now its sights are set on the next generation of aircraft.

In 2003, when The Boeing Co. (Chicago, IL, US) announced plans for the development of what was to become its 787 commercial jetliner, much was made of the fact that the plane would be the first to feature a fuselage, wings, tail and other major structures fabricated from carbon fiber composites, rather than the aluminum that had been the standard for the previous several decades. Almost as notable, however, was Boeing’s decision to farm out fabrication of these major structures to a network of global suppliers that would build complete subassemblies, each of which would ultimately be joined at Boeing’s final assembly line in Everett, WA, US. The list of these suppliers, now well known, includes Mitsubishi Heavy Industries and Kawasaki Heavy Industries (Tokyo, Japan), Alenia Aeronautica (Naples, Italy) and, most notably in the United States, Spirit AeroSystems.

Spirit was chosen to manufacture the 787’s entire forward fuselage — called Section 41 — which includes the cockpit, cockpit windscreens, two doors, nine passenger windows and all of the avionics, cockpit seating and wiring. Measuring 6.2m in diameter and 12.8m long, Section 41 is, arguably, the most complex of the plane’s fuselage sections.

That Spirit would be selected to supply 787 structures was no surprise. The company’s history dates back to 1927, when aviation legend Lloyd Stearman relocated his Stearman Aviation Co. from California to Wichita. Just two years later, Boeing — which at the time was known as the United Aircraft and Transport Corp. — acquired Stearman. The Boeing Wichita plant would go on to manufacture some of the most iconic military aircraft in American history, including the B-29 Superfortress, the B-47 Stratojet and the B-52 Stratofortress.

In 2005, by the time Boeing had begun 787 manufacturing development in earnest, the Wichita campus had been sold by Boeing and renamed Spirit AeroSystems. Eric Hein, Spirit’s senior director, R&D and ManTech, contends that the company — now with additional locations in the US (Kansas, Oklahoma and North Carolina) as well as in Scotland, France and Malaysia — is home to the world’s largest commercial aircraft manufacturing capability. In addition to the 787, Spirit builds major structures (mostly metallic) for Boeing’s 737, 747, 767 and 777; the Airbus A320, A350 (also composites-intensive) and A380; the Bombardier CSeries; the Mitsubishi MRJ; the Sikorsky CH-53K (helicopter); and the Bell V-280 (tiltrotor). Spirit, says Hein, had US$7 billion of revenue in 2017 and enjoys a US$46 billion backlog.

Throughout the firm’s growth, Spirit’s Wichita location has remained the heart of the company’s operations. With 150 buildings spread over 600 acres, filled with 10,700 employees, it is a manufacturing city unto itself, busy with trucks, cars and shuttles delivering people and goods throughout the campus.

The 787 forward fuselage manufacturing is confined to one very large building, near the edge of the campus. Here, all composites manufacturing, internal structures installation, and systems integration is performed before the finished product is shipped off to Everett for final assembly.

Monolithic fuselage

CW’s tour of the 787 production area is led by José Sanchez, Spirit’s senior manager, 787 operations. Spirit AeroSystems builds its portion of the 787 fuselage as a monolithic structure, combining an automated fiber/tape placement process with co-cured stringers to form a one-piece barrel. (Notably, Airbus later designed the comparable A350 XWB with a fuselage that comprises carbon fiber composite panels, rather than a one-piece structure; Spirit fabricates fuselage panels for the A350 in Kinston, NC, US, and assembles them in France.)

Composite materials used to fabricate 787 primary structures, as has been widely reported, come from Toray Industries (Tokyo, Japan) and are Torayca 3900-series carbon fiber-reinforced toughened prepreg using intermediate modulus T800S fiber. Prepreg is provided as UD tape, slit tape (for automated fiber/tape placement) and woven fabrics.

The 787 fuselage design stipulates two basic composites fabrication operations: Stringer cutting and forming and fuselage skin fiber placement. The trick is in combining the stringers with the fiber-placed skin to enable a co-cured structure. Because of this, Spirit and, by extension, Boeing, attach much significance to the processes performed at the first stop on the tour: Stringer fabrication.

This highly automated line features an American GFM (Chesapeake, VA, US) cutting table cutting Torayca 3900-series prepreg into plies. These are transferred to a kitting table, where plies are manually stacked, guided by an overhead LAP Laser (Erlanger, KY, US), and prepared for forming. Sanchez says this stringer fabrication line embodies much of the intellectual property Spirit developed for Section 41 manufacture and is a critical part of the facility’s operation.

Preformed stringers, as they come off the stringer line, are next transferred by operators to an adjacent Section 41 mandrel that will become the focus of all composites fabrication operations, going forward. The mandrel, says Sanchez, which bears the shape and dimensions of the forward fuselage section, is fabricated from a carbon fiber/bismaleimide (BMI) composite and comprises six segments. Each segment is divided laterally along the mandrel’s length. Machined into the surface of each mandrel section, also running the length of tool, are slots, into which the preformed stringers are placed, with the flat bottom of the stringer facing outward.

After all stringers have been placed in their slots, operators overwrap the entire mandrel with an interwoven wire fabric (IWWF), made by Toray Composites (America) Inc. (Tacoma, WA, US), which provides lightning strike protection for the entire 787 fuselage. This whole structure is then overwrapped with plastic bagging film. The film holds the IWWF and stringers in place as the mandrel is wheeled via manually guided vehicle to the next station — automated fiber placement (AFP) — and then is removed for AFP.

Perhaps no process has come to symbolize composites use on the 787 more than the AFP system used to fabricate the fuselage skin. AFP, even as the 787 program dawned, had been used for many years, so it was not new to composites manufacturing. What was new, with the 787, was the scale of the application. Few composite structures made with AFP have come close to the size of even one 787 fuselage section.

When Spirit established 787 production in Wichita, AFP was done with a 32-creel machine supplied by Ingersoll Machine Tools Inc. (Rockford, IL, US). However, in the early 2000s, Boeing began working with automation specialist Electroimpact (Mukilteo, WA, US) on the development of a new AFP machine that would feature modular, interchangeable heads. Each head would store all of the carbon fiber spools for a given type of operation and could be relatively easily swapped out, depending on the tape width required.

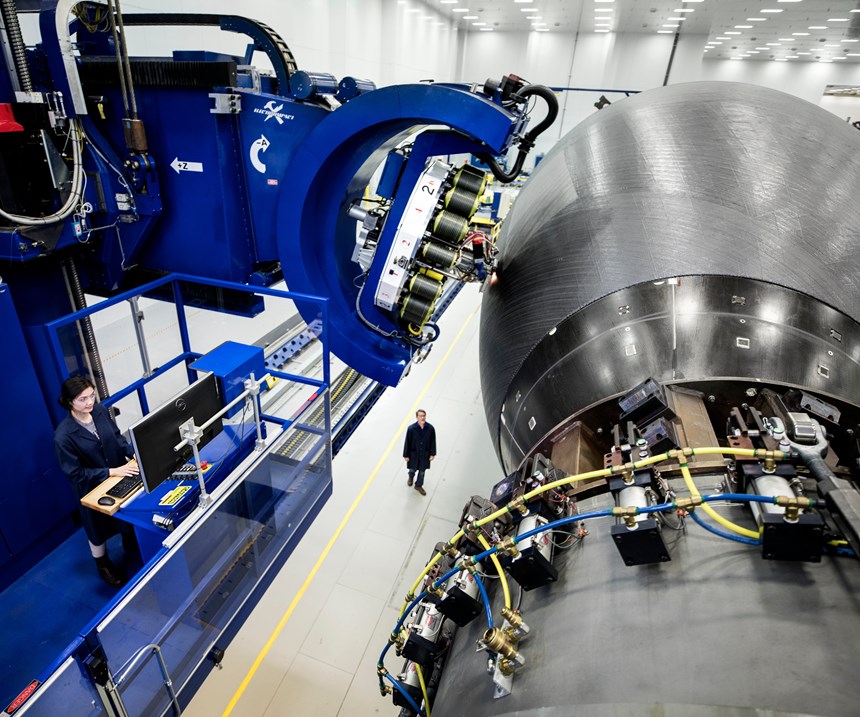

Although Spirit still has its original Ingersoll machine, it is used in a back-up role. This is because Spirit eventually acquired two Electroimpact machines to do the bulk of Section 41 skin fabrication. Sanchez says the Electroimpact AFP machines, each outfitted with a 16-spool head (0.25- and 0.50-inch-wide/6.35- and 12.7-mm-wide tows), work together to apply material to the mandrel. The mandrel is horizontally mounted and turned on a spindle, while the heads traverse along each side, placing tows, mostly in relatively short, highly proscribed courses. Visitors can easily see, in the bright lights of the plant, the diverse, multi-angled collection of tows that have already been placed on the mandrel.

Sanchez would not reveal how long it takes the two Electroimpact machines to completely place all fiber for one fuselage skin, except to say that it is “very fast.” All AFP operation is managed by three operators at the machine. One works in a control booth that overlooks the mandrel while the other two walk the floor under and next to the mandrel, flashlights in hand, looking for problematic gaps, laps, unevenness, wrinkles and foreign object debris (FOD) on the surface of the prepregged tows. Flaws must be addressed/fixed before the structure is cured.

Next stop for Section 41, following another all-over bagging, is the autoclave. Spirit Wichita operates two massive Thermal Equipment Corp. (TEC, Rancho Dominguez, CA, US) autoclaves. The fuselage section is cured overnight, after which the structure is debagged and the six-part mandrel is disassembled and removed, section by section, through the wide end of the fuselage.

Post-process finishing

What follows for Section 41 is several days of traveling from station to station as the entire structure progresses towards completion. This includes a visit to an MTorres (Torres de Elorz, Spain) Torresmill 5-axis gantry routing and drilling machine, which drills holes for the fuselage frames and other interior structures, as well as door openings, windows and front landing gear opening. The fuselage also goes through pulse echo nondestructive inspection (NDI), paint preparation, painting, window glass installation, door installation and all interior structures/systems installation. The first interior structures installed are the circular frames (metallic and composite), which are attached to the stringers and the fuselage skin. Throughout these processes, Section 41 is worked on at each station keel up or keel down, depending on the activity involved.

During CW’s visit, approximately 30 workstations were viewed, and each one held a Section 41 structure in some state of assembly, and each section leaves Wichita ready for immediate integration at the Boeing FAL in Everett. Boeing currently builds 12 787s each month, and is committed to 14 per month by 2019 — an unusually large number for a widebody aircraft.

Sanchez notes that Spirit has been working on Section 41 fabrication — either developmentally or in actual production — for almost a decade. Any bugs, kinks and idiosyncrasies that might have existed were long ago identified and worked out. Meeting that 14-shipsets-per-month build rate, he says, will not be a problem.

Next-generation R&D

As the tour leaves the Section 41 manufacturing facility, CW is led outside to a neighboring building for a meeting with Pierre Harter, director, advanced research at Spirit. Previously an engineer at now-defunct Denver, CO, US-based Adam Aircraft and at Bombardier (Montreal, QC, Canada), and a Wichita State University graduate, Harter leads CW into what appears to be a nondescript, multi-hallway, multi-doored building that nevertheless quickly reveals itself to be the hub of Spirit’s composites research and development effort.

As sophisticated as Spirit’s Section 41 manufacturing line is, the inarguable fact is that it uses composites manufacturing technology that was new more than a decade ago. The realities of aerospace qualification (both cost and time) and manufacturing force Spirit and like suppliers to settle on a manufacturing technology for an aircraft structure early on, and then stick with it for the duration of the program. The ability to upgrade equipment and materials, therefore, often is limited, regardless of how advantageous might be more recent advances in composites fabrication technology.

Harter’s job, therefore, is to evaluate new and emerging composite materials and technologies and determine which are likely to find a home on next-generation aircraft. Indeed, with the 787 and the Airbus A350 in production, the entire commercial aerospace supply chain is busy anticipating the next major commercial program and its members are each making sure that they acquire the knowledge and expertise the OEMs need from them.

Conventional wisdom says the next formally announced program will be Boeing’s single-aisle, twin-engine New Middle-Market Airplane (NMA, or 797), which would effectively replace the 757. This plane is expected to enter the market sometime around 2025. Although it will certainly use composites, the questions before Spirit’s R&D team are how much? Where? And what kind? No one knows the answers yet, so Harter and his team are evaluating all options. Thus, the array of materials, equipment and projects in development at Spirit is currently dizzying. “We are working on a variety of projects,” Harter says. “Out-of-autoclave, fast RTM, thermoplastics, innovative tooling, inline inspection, fiber steering. We want to be ready for whatever the OEMs need.”

The centerpiece of the Spirit Wichita composites lab is a 16-spool (0.125-, 0.25-, 0.5-inch tows) Electroimpact AFP machine, which Harter says is used to conduct trade studies on the use of inline automated inspection, as well as for a variety of other activities, including prototyping. The goal of the automated inspection system, says Harter, is to eliminate the time-consuming, laborious work we’ve witnessed earlier on the tour, watching AFP technicians, with flashlights, looking for problematic laps, gaps, wrinkles and FOD.

Spirit, Harter says, is evaluating a LASERVISION system from Aligned Vision (Chelmsford, MA, US), which is forcing Spirit to rethink what is and is not a true defect, “and to rethink how we characterize defects.” He says the system could be in operation on the production floor by the end of this year.

Beyond the AFP system, Spirit has a variety of other projects in the works at various levels of technological readiness (TRL). These include the following:

- A shape-memory polymer tool (TRL 6),

- A spar section made with Hexcel’s (Stamford, CT, US) HiTape (dry fiber) using RTM (TRL 6),

- An infused spar with embedded sensors for in-situ process control, cured with the aid of either an autoclave or an oven (TRL 4),

- A frame made with steered AFP and hot drape forming (TRL 6),

- And 3D-printed tooling manufactured on Wichita State University’s Big Area Additive Manufacturing (BAAM) machine, supplied by Cincinnati Inc. (Harrison, OH, US).

Other areas of research, says Harter, include stitched preforms, robotic AFP/ATL, and AFP head innovation. The latter has grown out of a late-2016 challenge at Spirit to double AFP laydown rates within two years. Harter says he and his associates have found, in efforts to meet this challenge, that “once the robotic processes are optimized, you run into the limits of head/machine technology,” meaning that the limiting factor of AFP speed becomes fiber tow dispensation efficiency. Spirit is working with Electroimpact and material suppliers on technologies designed to increase total throughput.

The final stop on the Spirit Wichita tour is material and component testing. Not surprisingly, Spirit has robust capability here, including 15 mechanical testing machines (11-50 kip capability) supplied by MTS Systems Corp. (Eden Prairie, MN, US), environmental testing chambers, strain gauge capability, metrology systems and high-bay space for full-scale component testing — wing structures and thrust reversers were under active stress during CW’s visit.

As the tour comes to a close, goodbyes are exchanged and the Spirit AeroSystems’ massive Wichita campus recedes at CW’s departure, it is easy, given Spirit’s considerable composites capabilities, to wonder how the next decade will look for this major aeromanufacturer. In the global aerospace world, its suite of capabilities is, arguably, without equal. Spirit AeroSystems, it seems, is poised for whatever the future has in store.

Related Content

Industrializing additive manufacturing in the defense/aerospace sector

GA-ASI demonstrates a path forward for the use of additive technologies for composite tooling, flight-qualified parts.

Read MorePlant tour: Collins Aerospace, Riverside, Calif., U.S. and Almere, Netherlands

Composite Tier 1’s long history, acquisition of stamped parts pioneer Dutch Thermoplastic Components, advances roadmap for growth in thermoplastic composite parts.

Read MoreMFFD longitudinal seams welded, world's largest CFRTP fuselage successfully completed

Fraunhofer IFAM and partners have completed left and right welds connecting the upper and lower fuselage halves and sent the 8×4-meter full-scale section to ZAL for integration with a cabin crown module and testing.

Read MoreThe next-generation single-aisle: Implications for the composites industry

While the world continues to wait for new single-aisle program announcements from Airbus and Boeing, it’s clear composites will play a role in their fabrication. But in what ways, and what capacity?

Read MoreRead Next

Ceramic matrix composites: Faster, cheaper, higher temperature

New players proliferate, increasing CMC materials and manufacturing capacity, novel processes and automation to meet demand for higher part volumes and performance.

Read MoreNext-gen fan blades: Hybrid twin RTM, printed sensors, laser shock disassembly

MORPHO project demonstrates blade with 20% faster RTM cure cycle, uses AI-based monitoring for improved maintenance/life cycle management and proves laser shock disassembly for recycling.

Read MoreCutting 100 pounds, certification time for the X-59 nose cone

Swift Engineering used HyperX software to remove 100 pounds from 38-foot graphite/epoxy cored nose cone for X-59 supersonic aircraft.

Read More