Carbon Fiber: Refiguring the supply/demand equation

CW editor-in-chief Jeff Sloan returns from Carbon Fiber 2015 in Knoxville TN, US, with news that carbon fiber demand will outstrip supply by 2020, prompting expansion in the 2018-2019 timeframe that could include sources in China.

As I write this, I’m just back from the 2015 edition of CompositesWorld’s annual Carbon Fiber conference (Dec. 8-10, Knoxville, TN, US). It was, as usual, an informative and interesting exploration of where and how carbon fiber is applied today, and where and how it might be applied in the future.

The pre-conference seminar featured Chris Red, principal of Composites Forecasts and Consulting LLC (Mesa, AZ, US), who revised his data on carbon fiber supply and demand — highly anticipated and coveted information that always sheds light on how the composites market is evolving. We’ll provide a more in-depth review of Red’s and other’s presentations in the February issue of CompositesWorld, but in the meantime, I’ll provide here a quick review of what I heard and what struck me as important.

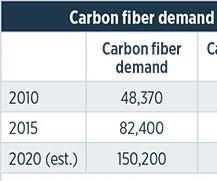

First, the data from Chris Red. The chart at left shows Red's prediction for overall carbon fiber demand and supply through 2020. As you can see, he anticipates demand will outstrip supply by the end of that period, which likely will prompt additional expansion from carbon fiber suppliers — perhaps in the 2018-2019 timeframe. Through 2024, Red also anticipates a compound annual growth rate (CAGR) in carbon fiber demand of 9.21%.

Red divides the carbon fiber market into three segments: consumer/recreational, aerospace and industrial. As has been the case for several years now, growth will be driven primarily by the industrial segment, which accounts for 75% of carbon fiber demand. Within the industrial sector, most of the activity will be centered on pressure vessels (5,364 MT in 2015, 22.2% CAGR), automotive (10,056 MT in 2015, 13.4% CAGR) and non-wind energy (2,800 MT in 2015, 25.9% CAGR).

Aerospace remains a stalwart of carbon fiber, but with the Boeing 787 and the Airbus A350 XWB in production, and with no major aircraft program on the horizon other than the 777X wings, growth will be relatively modest: 15,460 MT in 2015, 3.42% CAGR.

There were two questions asked several times during Carbon Fiber 2015. The first concerned replacements for the Airbus A320 and Boeing 737, which likely will be designed/developed in the 2025-2030 timeframe. The first question was whether or not carbon fiber will be used to fabricate their fuselages. Unlike the 787 and A350, these smaller craft have thinner-walled fuselages, and composites at that thickness are more susceptible to damage from runway debris and other impacts. Further, the build rates of these planes demands throughput capacity greater than current composites technology provides. Those who fielded this question expressed hope that as the next decade approaches, composite materials and processes will have evolved sufficiently to meet these needs.

The second question was geopolitical: What about China? Conventional wisdom at the conference indicated that Chinese industry in general, and the Chinese government in particular, are working diligently to develop carbon fiber manufacturing capacity that could complicate the supply/demand picture over the next decade. China’s biggest challenge appears to be development of a source of high-quality polyacrylonitrile (PAN) precursor for carbon fiber manufacture. However, given China’s vast chemical resources, it seems only a matter of time before this challenge is met.

There were, of course, many other topics tackled at the conference, including automotive, wind, recycling, additive manufacturing and the 777X wings. For more information on these subjects, click on "Highlights from Carbon Fiber 2015" under "Editor's Picks" at top right. CW’s staff will follow up with some final observations in CW's February issue.

Related Content

Composites end markets: Sports and recreation (2025)

The use of composite materials in high-performance sporting goods continues to grow, with new advancements including thermoplastic and sustainability-focused materials and automated processes.

Read MoreLife cycle assessment in the composites industry

As companies strive to meet zero-emissions goals, evaluating a product’s carbon footprint is vital. Life cycle assessment (LCA) is one tool composites industry OEMs and Tier suppliers are using to move toward sustainability targets.

Read MoreCorebon induction heating

This sidebar to CW’s August 2024 feature article reviews this technology for more efficient composites manufacturing and why it aligns with Koridion active core molding.

Read MoreWatch: A practical view of sustainability in composites product development

Markus Beer of Forward Engineering addresses definitions of sustainability, how to approach sustainability goals, the role of life cycle analysis (LCA) and social, environmental and governmental driving forces. Watch his “CW Tech Days: Sustainability” presentation.

Read MoreRead Next

Highlights from Carbon Fiber 2015

Carbon Fiber 2015 once again offered an engaging roster of speakers, and some eye-opening presentations.

Read MoreUltrasonic welding for in-space manufacturing of CFRTP

Agile Ultrasonics and NASA trial robotic-compatible carbon fiber-reinforced thermoplastic ultrasonic welding technology for space structures.

Read MoreCeramic matrix composites: Faster, cheaper, higher temperature

New players proliferate, increasing CMC materials and manufacturing capacity, novel processes and automation to meet demand for higher part volumes and performance.

Read More