Inside Manufacturing: A Reinforced Thermoplastic Car Hood?

Low-density GMT-cored sandwich construction and novel inductive mold-heating strategy are a viable option for horizontal body panels.

Since the mid-'80s, glass-reinforced, injection-molded thermoplastics have seen limited use in vertical exterior auto body panels — primarily in fenders and doors, notably on General Motors' Saturn lines. But conventional wisdom has held that reinforced thermoplastics lack sufficient stiffness to prevent creep across large, unsupported horizontal surfaces, such as hoods, deck lids and roofs, in thicknesses practical for the application. Thermoplastics' high coefficient of thermal expansion (CTE) can make them a fit-and-finish nightmare when affixed to or placed adjacent to metal components. Additionally, few of these materials have the thermal stability to withstand the high temperatures inside bake ovens used in automakers' paint lines. For these reasons, automakers looking to reduce weight and add design features to conventional steel panels have had to opt either for more costly aluminum or thermoset composites.

Among thermosets, sheet molding compound (SMC) has been used for both horizontal and vertical body panels since the 1950s. Although its benefits include low CTE, high stiffness, reasonably efficient production via compression molding and online paintability, critics claim that SMC is relatively heavy, requires labor-intensive prep to achieve a Class A finish and has minimal elongation, making it prone to brittle failure during crashes. Carbon fiber-reinforced composites, primarily hand-layed prepregs, have gained ground in high-end sports cars and supercars, but the production methods are too slow and labor intensive for high-volume production.

GE Plastics (Pittsfield, Mass.) and Azdel Inc. (Forest, Va.) — the latter, GE's 20-year joint venture with PPG Industries (Pittsburgh, Pa.) — have been working to develop a product for horizontal body panels since Azdel's inception. Their latest collaboration, now several years into development, is called high-performance thermoplastic composite (HPPC). The unique, reinforced thermoplastic sandwich construction offers molders of horizontal body panels not only lower specific gravity at a given modulus (hence, lower part mass) and greater ductility and impact than metals or thermoset composites, but also lower tooling costs and faster cycle times, the latter thanks to an inductive mold-heating technology developed by RocTool (Le Bourget du Lac, France).

Trends Drive Change

Several trends favor adoption of a thermoplastic option by OEMs. For 20 years, average annual production volume per vehicle nameplate has consistently decreased, thanks mainly to tougher global competition and a proliferation of OEMs in developing countries. Consumer demand for new features and OEM need for greater differentiation in a crowded marketplace has shortened nameplate lifecycles (before model facelift or phase out). This shifts the economies of scale in favor of plastics because horizontal body panels are the largest exterior vehicle parts and, hence, have the most expensive tooling. When vehicle builds fall below 50,000 units annually, there simply is not enough time to amortize the cost of the multimillion-dollar tooling required for metal stamping before the next changeover. Moreover, increasing fuel prices have forced automakers to put their vehicles on crash "weight-out"programs, particularly for large parts like hoods. Finally, new regulations in Europe and Japan are calling for designs that, in the event of a car/pedestrian collision, prevent the pedestrian's legs from "submarining"under the front end of the vehicle and, instead, propel the pedestrian up and onto the hood. Thermoplastics present intriguing energy-management possibilities in front-end and hood impact scenarios.

"The market demand for lightweight, horizontal body panels is significant and it's growing,"explains Derek Buckmaster, global market director – body panels and glazing at GE Plastics – Automotive. "We've been working to develop a suitable product that meets application needs and is commercially viable.â€

The GE/Azdel team started with a list of target part properties: modulus similar to steel; CTE and mass similar to aluminum; impact resistance/energy management capabilities greater than either; and a Class A surface that would need no postmold prep and could be painted online or offline. The cost was to be comparable to current solutions (aluminum, SMC) with tooling costs appropriate for low-to-moderate production volumes. According to Buckmaster, "The toughest challenge has been to develop a lightweight material that is cost-effective at automotive production volumes.

Several common material/process combinations have been evaluated and rejected. Extruded single- and multilayer-sheet products (3-mm/0.12-inch wallstock) — the latter featuring layers of unreinforced and chopped-fiber materials to facilitate thermoforming — and injection-moldable pelletized resins with 2-mm to 12-mm (0.10-inch to 0.47-inch) chopped-glass reinforcement were eliminated because stiffness was too low and CTE was too high. Conventional GMT blanks for compression molding were considered and even prototyped. Although parts were stiff enough, and Class A finish could be had via inmold decoration, they failed to meet mass targets. The team also considered Azdel's low-density GMT (LD-GMT), trademarked Superlite, with long (13-mm/0.5-inch) glass fiber reinforcement that provided better stiffness and impact strength. Its high glass content moderated CTE and reduced mass, yet the material could be compression molded to form parts with the complexity of a hood. However, Superlite alone lacked sufficient mechanicals for a horizontal panel application.

The GE/Azdel team then conceived the idea of using Superlite as the core of a sandwich construction, with tough, thin, continuous fiber-reinforced skins. While the company's unidirectional GMTs (mat-reinforced GMTs with additional uni reinforcement along one axis) were ruled out as skin material for weight reasons, the team evaluated unidirectional tapes and wovens combined with engineering thermoplastic resin and formed by solvent, slurry, powder and melt processes. The commingling of glass and thermoplastic fibers and film stacking also were assessed. Unidirectional tape offered the best balance of mechanical/aesthetic properties and cost. Part stiffness improved significantly without adding much mass or thickness, particularly when stacked two-up at 0° and 90° orientations on both the top and the bottom of the sandwich, with skin layers approximately 0.4-mm/0.02-inch thick. That said, Azdel's Jesse Hipwell, commercial technology leader and an HPPC team member, emphasizes that sandwich construction offers the potential for great versatility. "We expect to be able to tailor the properties of the material by changing the number and types of layers,"he explains. The thickness and number of layers, the reinforcement orientation and type (woven, nonwoven, braid), fiber type (e.g., glass, carbon, aramid) and/or the matrices can be varied to suit the application. The choice of resin, for example, depends on the application. However, skin and core matrices must be from the same resin family to eliminate the need for tie layers — a restriction that facilitates recyclability and good cost control.

Developmental sampling of offline-paintable grades, based on GE's Noryl PPX resin, a blend of modified-polyphenylene oxide and polypropylene, commenced in fourth-quarter 2006. Sampling of nonconductive and conductive grades for online painting should follow, respectively, in third- and fourth-quarter 2007. Online grades will feature resins with higher temperature and chemical resistance, e.g., skins with GE's Xenoy polycarbonate/polybutylene terephthalate (PC/PBT) blend — which has a track record for painted exterior body panel usage — and cores impregnated with Valox PBT. Early tests indicate good dimensional response to 60-minute thermal cycles at 210°C/410°F. In parallel, the program has evaluated products with prefinished surfaces achieved via in-mold decoration (IMD) using GE's Lexan SLX co-extruded films, which are multilayer paint-film offsets with pigment in the middle layer. Experiments also have been conducted with clear films over woven fabrics for a high-tech look. There is even the opportunity to use Valox iQ, GE's new "green"polyester, which is repolymerized from postconsumer soda bottle recyclate, in skin and core matrices.

Tackling Tooling and Processing

To make HPPC economically viable in the auto industry, the production process would have to deliver parts the size of a hood, with Class A surfaces out of the tool, in volumes of up to 50,000 units annually. The GE/Azdel team estimated that this scenario would require cycle times as short as two minutes.

The physics of putting heat into and taking heat out of tools and parts that large in such short cycles suggested that existing technology could use some help. GE and Azdel had been analyzing several forms of rapid tool heating. Although the team had an inductive mold heating technology of its own in the works in 2004, it also was considering RocTool's inductive heating technology, called the Cage System. "We decided that RocTool's technology was furthest ahead,"Hipwell recalls, "so we began working with them.

Conventional tool heating systems (particularly for thermoplastics) heat the entire tool, which then must be cooled during each molding cycle. The need to shorten the thermal cycle for such a large mass makes toolmaking complicated and expensive. In contrast, RocTool's patented Cage System uses electromagnetic induction to rapidly heat only the tool surface that is in direct contact with the part. The process works because a magnetic field produces an electrical field — a phenomenon long harnessed to operate electrical generators, transformers, and induction motors — and similarly, an electrical field generates a magnetic field. When a current is passed through an inductive loop (formed by coils of electroconductive materials wound around a magnetically conductive body), a magnetic field is formed. In the Cage System, a nonmagnetic frame supports the induction coils. The frame is assembled around the outside of the tool along with the generator that drives current through the inductors. The induction coils are designed with quick disconnects to facilitate part demolding and tool changeover. (The system is so named because the frame that holds the inductors surrounds the tool and, when the tool is closed, looks like a cage.) The induced magnetic field penetrates the tool placed inside the inductive loop to a depth defined as the electromagnetic skin depth, which varies as a function of current frequency. Because the Cage System operates at a frequency of 10 kHz to 50 kHz, the tool surface is heated to a depth of 0.1 mm to 0.3 mm (0.004 inch to 0.012 inch) depending on the mold alloy. RocTool says molds require no special construction methods, unusual materials or special surface coatings or skins. Common tooling materials, such as P20-family steel alloys, may be used.

As the magnetic field fluxes (in response to changing current), heat is generated via the Joule effect. For a given electrical current flowing through the inductor, a magnetic field proportional to and perpendicular to the electrical current forms and flows along the tool's surface in the opposite direction. If a closed tool is used, then the magnetic field forms in the air gap between core and cavity. Polymeric material placed in the air gap is quickly heated on both sides by conduction. Since a small percentage of the tool's total mass is heated, thermal transfer is rapid (on the order of a few seconds, depending on target temperature and material thickness). Mold temperature is controlled by current output from the electromagnetic generator to the inductors. Thermocouples in the tool surface provide temperature feedback, offering a high degree of control. In fact, it is possible to have two or three distinct temperatures within each molding cycle. When current is killed in the induction loop, the magnetic field and the heat it produces die, clearing the way for rapid cooling of the tool surface and part. Simple water-filled cooling lines placed near the tool's surface are sufficient to chill the tool quickly. These features permit much more rapid heating (often without a preheat stage), curing (in the case of thermosets) and quenching of the tool than can be accomplished with conventional mold heating/cooling systems. The system reportedly yields excellent Class A surfaces because the tool can be rapidly preheated prior to material transfer, preventing premature freezing of skins, which sometimes results when a preheated GMT blank is placed in a cool tool. It also greatly reduces part warpage.

In March 2006, Azdel acquired an exclusive license to use and sub-license the Cage System to make Class A thermoplastic parts for transportation applications using compression molding or thermoforming. Since then, the GE/Azdel team has combined the Cage System and other process features to create a proprietary production method called Induction Molding, which is tailor-made for fast cycling of large automotive body panels.

The Four-Minute Hood

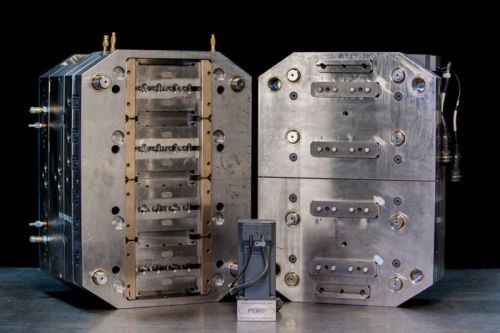

GE, Azdel and RocTool have designed and commissioned three tools to mold demonstrator hoods at 1:4, 1:2 and full scale. According to Matt Boulanger, business development manager at RocTool, the induction-heating technology is readily scalable to part dimensions. "Size is really not an issue,"he explains. "It's just a question of power adjustment. Bigger parts require bigger generators for the inductor. The largest parts we've converted so far with our system are 1.8m by 1. 5m [5.9 ft by 4.9 ft]. We also are working on multicavity tools and have found that induction heating works in that situation as well.

To date, outer skins for three different size hoods and an outer door skin have been produced via Induction Molding. While GE acknowledges its two-minute target has not been realized to date, it says the goal is within sight. According to Boulanger, cycle times were around 10 minutes in 2004, but with the addition of induction heating, it dropped to as low as four minutes. While there are still many issues to be resolved before HPPC technology is ready for commercial launch, the four-minute cycle looks promising.

Current production steps are as follows: Tooling for the part is mounted in a conventional, vertical compression-molding press. The sandwich blank (LD-GMT core and uni-tape skin layers) is heated in an indexing infrared oven to temperatures above 200°C/392°F while the surface of the compression tool is simultaneously heated above 240°C/464°F via Cage System technology. (These steps take between 30 seconds and 2 minutes.) The blank is manually transferred into the heated tool (eventually this will be done robotically) and the press is closed. The inductively heated mold raises the blank temperature from 220°C to 250°C (428°F to 482°F) in a target time of 15 to 30 seconds, and, under low pressure (40 bar to 50 bar or 580 psi to 870 psi) the blank is shaped. There is quasi-flow within the sandwich structure, yet the part still maintains a good surface.

When the blank reaches the target temperature, which varies based on the matrix resin, water is circulated through the tool's subsurface channels, quickly cooling the mold surface and part. When the setpoint temperature is reached, the tool is opened.

In a production scenario, the mold will open automatically and the part will be removed robotically, deflashed automatically (both waterjet and laser trimming are being evaluated) and then bonded adhesively to an inner panel, which may be HPPC or metal. (Welding of HPPC to HPPC also is being evaluated.) The process at this stage of development is illustrated in the Step photos.

Early Customer Feedback

During 2005, feedback on early full-size hood samples, from a panel of seven Tier suppliers with experience in polymer-based exterior applications, helped the GE/Azdel team refine its product- and process-development goals. It also reaffirmed the importance of developing materials for two painting options: an inherently conductive material for online painting (to eliminate the need for primer and to prevent overspray during painting) and an offline-paintable grade that would be ideal for smaller production volumes (<10,000 units=""/year). The Tier suppliers, representing Asian, European and North America vehicle production, also evaluated the entire production process that had been proposed, including the induction-heating technology.

While the process is subject to geometric limitations similar to those encountered in thermoforming (e.g., deep draws with sharp angles or tight radii, and complex thickness transitions are out because the sandwich structure discourages material flow), its full design potential is still being explored. HPPC technology initially is targeting relatively simple horizontal body panels that are currently made from sheet steel, aluminum or SMC. "We have a 'torture tool' that pushes the limits of the material so we can better understand factors like draw ratios and minimum radii,"says Buckmaster. "This work is ongoing, so we don't yet have a full understanding of geometric capabilities. We do see this product having a potential fit in many exterior applications where the geometric requirements are not too severe."HPPC likely will be a good fit for panels with gently curved shapes, such as roofs, trunk lids, door skins, retractable hardtop skins, rocker panels and even tailgate skins. "However, we're not focusing on parts like fenders because their shapes are too complex to form from sheet materials,"he notes.

A lot depends on the final design of the material (developmental sandwich designs now being tested are described as "third-generation"and are not considered final) and the selected manufacturing process. But initial indicators are that HPPC horizontal body panels are viable. Cost models indicate that the proposed online-paintable, conductive materials — positioned to compete against aluminum and SMC — may be commercially attractive at production volumes up to 50,000 parts/year. The offline-painted version, which will compete against other thermosets (glass- and carbon-reinforced), are expected to be commercially attractive in volumes under 10,000 parts/year. If everything else goes well, the first commercial applications are still 12 to 18 months away.

Adds Buckmaster, "Several OEMs who have seen the product also have expressed interest in semistructural applications, but we're focusing our development efforts around Class A, and specifically targeting horizontal body panel applications. This is one of the toughest performance requirements to meet, but if we can get a Class A finish out of the tool, then we'll open up a large market.

Related Content

Syensqo, Teijin Carbon achieve aerospace qualification for composite resin

Resin infusion system Prism EP2400 achieves NCAMP qualification with Teijin Carbon’s advanced NCF and UD reinforcements.

Read MoreFlyber launches U.K. composites manufacturing site for advanced mobility applications

The startup’s design automation and composite material layup and curing technologies target lightweighting for aerospace, UAVs, eVTOL and high-performance mobility platforms.

Read MoreCOMPINNOV TP2 project promotes use of thermoplastics in aerospace

Completed in 2023, COMPINNOV TP2 explored thermoplastic composites, enhancing the understanding between prepregs and production methods to foster the potential for French aerospace innovation.

Read MoreComposite Integration presents webinar on liquid resin infusion

On July 30, 2025, company experts will discuss the role of LRI in delivering scalable, OOA composite production for the aerospace sector.

Read MoreRead Next

Cutting 100 pounds, certification time for the X-59 nose cone

Swift Engineering used HyperX software to remove 100 pounds from 38-foot graphite/epoxy cored nose cone for X-59 supersonic aircraft.

Read MoreCeramic matrix composites: Faster, cheaper, higher temperature

New players proliferate, increasing CMC materials and manufacturing capacity, novel processes and automation to meet demand for higher part volumes and performance.

Read MoreNext-gen fan blades: Hybrid twin RTM, printed sensors, laser shock disassembly

MORPHO project demonstrates blade with 20% faster RTM cure cycle, uses AI-based monitoring for improved maintenance/life cycle management and proves laser shock disassembly for recycling.

Read More

.jpg;width=70;height=70;mode=crop)