Bio-Composites Update: Bio-Based Resins Begin to Grow

Substituting agricultural for fossil-based feedstocks in polymer resins is not new, but maturing technology now promises composites less dependent on petrochemicals for their performance.

A few years back, when a barrel of oil cost less than $50 (USD), the use of soybean oil and corn ethanol in resins for composites manufacturing was intriguing, interesting and environmentally responsible, but not an economic or resource imperative. That is rapidly changing. The cost of a barrel of oil recently raced past $100 ($110 as of this writing) and as a result, interest in development of sustainable resources is growing. Consumer and OEM calls for reduced weight, increased efficiency and a smaller carbon footprint in products that are made from or burn oil are loud and expected to get louder. The good news is that advances in biotechnology and genetic engineering are helping materials suppliers create soy- and corn-based derivatives that are increasingly capable replacements for petrochemicals in unsaturated polyester, polyurethane and even epoxy resin formulations. Bio-composites are here to stay, and understanding their potential role in future applications will be critical to any composites fabricator.

MARKET SIZE AND THE SLEDGEHAMMER

One thing the U.S. has much of is soybeans and corn, thus the opportunity for application of byproducts of these crops is substantial. The most commonly used soybean byproduct, polyol, comes from soybean oil. Corn’s most prominent byproduct is ethanol. The United Soybean Board (USB), in its 2007 report on soy-based thermoset plastics, identifies construction, transportation and marine as the end markets that hold the most promise for soy oil use in composite parts and components. Further, the USB report emphasizes that the current global market for fiber-reinforced thermoset composites is 1.7 billion lb (771,000 metric tonnes). According to the USB, if all the thermoset resins that today could be replaced with soy-based ingredients actually were replaced, the potential market for soy-based resins would be 1.1 billion lb (499,000 metric tonnes), or 100 million bushels of soybeans. Corn ethanol, in addition to its use in some resins, also is becoming a major fuel source, stressing the overall supply of the world’s corn. Because of this growth, corn and soybean prices have steadily increased in the last year. Soybeans have increased the most dramatically, rising from $5.67/bushel in January 2005 to $10.10/bushel by the end of 2007. Corn, over the same period, has increased from $2.23/bushel to $3.73/bushel.

Despite this activity, the use of soybean oil and corn ethanol in resins and plastics is relatively nascent — although it does enjoy a storied history. Henry Ford in 1941 famously demonstrated the strength and impact resistance of his company’s all-plastic-body car concept when he took a sledgehammer to its decklid during the vehicle’s introduction. The car featured 70 percent cellulose fibers in a phenolic resin matrix extended with soybean meal, a by-product of the soybean oil extraction process. Although Ford’s bio-based composite proved the concept’s merit, it was quickly forgotten as the auto industry geared up to mechanize U.S. troops with steel trucks, tanks and other wheeled vehicles. Given oil’s abundance and low price at that time, petrochemicals soon proved to be the least expensive feedstock for plastics, with chemistries conducive to resin performance. Likewise, glass replaced cellulose as the composite reinforcement of choice. It would be several decades before agricultural sources were earnestly re-explored as viable feedstock alternatives.

Although soybeans and corn took a backseat to petrochemicals, their abundant supply kept them in the R&D labs of chemical processors, if not in mainstream products. It wasn’t until the mid- to late-1990s, as concerns about biodegradability, sustainability and the depletion of oil reserves were raised that commercial development of viable bio-based resins occurred.

MARKET DRIVERS TODAY

Initial bio-based resins development has focused almost exclusively on the use of soybean and corn oil as a feedstock, but not necessarily because these plants are chemically the most adaptable to resin che-mistry requirements. Stephen Myers, director of the Ohio BioProducts Innovation Center (OBIC), based at The Ohio State University (Columbus, Ohio), points out that facilities and equipment already in place to produce soy-bean oil, corn oil and other derivatives for food and animal use provide a ready source of feedstock for new materials development.

The OBIC was established in 2005 and is funded by a grant from the State of Ohio designed to encourage, fertilize and grow new technology. Ohio, says Myers, is particularly keen on bio-based materials development because it sees the technology as a near-perfect marriage of the state’s long experience in plastics and composites processing with its large and fertile agricultural base. The OBIC acts as a networking partner to link researchers, manufacturers and end users to foster innovation and development. The OBIC has three core functions — all focused exclusively on bio-based materials development: to fund investment in research, to establish academic networking for innovation and to link research to industry needs. Myers calls it “cell to sell” research, but ultimately the program is designed to meet the needs of the materials market. “Basically, we’re looking at projects that use genetics to biologically modify materials for use in composites and other materials,” says Myers.

Grown in abundance in Ohio, soybeans and corn are a major focus of the OBIC’s efforts. Myers sees a bright future in these plants as a resource for a variety of material types. “The more we increase the yield of the plant — barrels of oil per acre — the more attractive it becomes,” he says, noting that the program goes beyond mere fabrication of a market for a prolific plant and is more than a method for manufacturers to market themselves as environmentally sensitive. “‘Green’ isn’t what’s pushing this,” claims Myers. “It’s sustainability.” Manufacturers are looking for material functionality, cost reduction, risk mitigation, source diversity and novel chemistries. Agricultural resources, according to OBIC, offer a replenishable means to all those ends. “The plant kingdom offers thousands of varieties of chemistries, and there’s much, much more we have yet to discover.”

EARLY SPROUT: BIO-SMC

Although sustainability is the primary driver of current bio-based materials development, it was an effort by John Deere (Moline, Ill.) to enhance its “green” profile and appear more farmer-friendly that produced one of the newest bio-composites. John Deere approached Ashland Performance Materials, Composite Polymers (Columbus, Ohio) in 1999 with an idea for a marketing feedback loop: Use soybean oil and corn ethanol in resin to make sheet molding compound (SMC) composite panels for John Deere tractors and combines used by farmers to harvest soybeans and corn.

Ashland went to work on the concept and eventually developed and commercialized ENVIREZ 1807, a soybean oil- and corn ethanol-based unsaturated polyester resin for SMC use. The resin contains 13 percent soybean oil and 12 percent corn ethanol. The balance is a traditional mix of petroleum-based chemicals, and the combination produced a resin that reduced petrochemical use and still met mechanical and performance specifications. John Deere had the material molded into a series of tractor panels that it branded HarvestForm. More than 350 lb/159 kg of the material appeared in styling panels on 2001-2003 model year 9750 John Deere Harvester combines. HarvestForm SMC also was used in hood and side panels on a 2004 John Deere tractor and in hood components on a 2003 backhoe.

Tests of the material for mechanical and surface performance and paintability, as well as testing conducted by John Deere, proved ENVIREZ comparable to standard SMC resins. Research done by OmniTech International (Midland, Mich.) for Ashland shows that one batch (17,000 kg/37,478 lb) of ENVIREZ 1807 used in an application represents 10 barrels of crude petroleum saved and a 15,000 kg/33,069 lb reduction in CO2 emissions during manufacturing, farming and processing soybeans and corn into oil and ethanol respectively.

Roman Loza, a research fellow at Ashland and one of the developers of ENVIREZ, says the John Deere project took advantage of the low cost of soybean oil and proved the validity of “increasing nonfood uses of these products. It showed farmers that what they grow has a broader market.”

It also opened a window on a whole new market for Ashland. Since the introduction of ENVIREZ 1807, Ashland has been busy developing additional resin types for a variety of composites manufacturing processes and end market applications. ENVIREZ Q11500 is a marine infusion product for above-the-waterline boat manufacturing applications. ENVIREZ LB6764-109 is the resin transfer molding (RTM) version. In May, look for an announcement from Ashland that it is introducing ENVIREZ L86300 and 86400INF. The former is designed for hand layup work, while the latter, as the name implies, is suited for infusion. Both are designed for building and construction applications and feature Susterra, a corn sugar glycol developed by a joint venture (JV) between DuPont (Wilmington, Del.) and Tate & Lyle (London, U.K.) called DuPont Tate & Lyle BioProducts (Loudon, Tenn.). Susterra is based on the JV’s Bio-PDO technology, which uses 1,3 propanediol (PDO), a three-carbon diol that’s produced using refined corn syrup.

Ashland expects that the bio-content of the two new materials using Susterra will reach 15 percent and is targeting the building and construction market; demand for bio-based products in this sector has increased substantially. Stephanie Carter, industry manager at Ashland, points to two drivers of this trend: the Leadership in Energy and Environmental Design (LEED) green building rating system, and the U.S. Department of Agriculture’s (USDA) BioPreferred program. LEED provides a set of standards for environmentally sustainable construction of buildings and facilities of all types and encourages use of bio-based and other materials sourced from renewable resources. The BioPreferred program was launched following passage in the U.S. of the Farm Security and Rural Investment Act (FSRIA), which directed the USDA to implement a program for identifying and designating bio-based products; it also directed all federal agencies to purchase bio-based products as long as they are “reasonably available, reasonably priced and comparable in performance” to traditionally used petroleum-based alternatives. Given that the federal government purchases more than $400 billion worth of goods and services annually, this is not a market to be ignored. The BioPreferred program tracks products that qualify as bio-based and serves as a resource for federal purchasing agents. “There is a long-term effort,” says Loza, “to move away from petrochemical resources.”

THE NEXT FRONTIER

The development of the Susterra material based on the PDO glycol shows that chemical innovation using bio-materials is expanding beyond oils. Bob Moffit, product manager at Ashland Composite Polymers, says research and development efforts now focus not only on glycols but also on bio-based acids and styrenes.

Unlike petrochemical research, plant chemistry research is in its germinal stages, with great potential for growth, expansion and exploration. “I think we’ve pretty much exhausted petrochemical chemistry,” says Moffit. Darcy Culkin, senior research chemist at Ashland, sees agricultural feedstocks as nearly inexhaustible sources of innovation. “There are more and different plants in the world and therefore more opportunity to develop bio-alternatives.”

Ultimately, researchers are looking for ways to boost the fraction of bio-based content in resin to minimize dependence on nonrenewable, petroleum-based chemicals without compromising performance. How far these efforts can go is unknown. Ashland is evaluating the use of a renewable glycol in conjunction with the soy oil and corn ethanol already employed in its ENVIREZ 1807 product, which could increase bio-content to 47 percent. Will that number ever reach 100 percent? OBIC’s Myers thinks the need for petrochemicals will never vanish because plant-based oils and sugars are just not chemically robust enough to fully replace petrochemicals without adversely affecting part performance. “I see the industry mainly using the plant and the plant world to complement petrochemical use, but never to fully replace it,” he says.

Ashland has mounted a substantial R&D effort in support of its ENVIREZ product line, recognizing composites fabricators are unlikely to replace a tried-and-trusted petrochemical-based resin with a bio-based resin unless the alternative offers easy replacement potential. “Ultimately,” says Carter, “the customer has to be able to drop this product into a process and not worry about changing the process to accommodate the material.” Further, mechanical and performance properties have to be nearly identical or highly competitive. When these hurdles are cleared, fabricators have to be sold on the value of incorporating a sustainable material into their production processes. “We need to help them understand where the value’s coming from to go through the work to change to a bio-based material,” says Moffit.

Two other players in the composites/plastics industry are sourcing soybean oil or corn ethanol for resins. Urethane Soy Systems Co. (Volga, S.D.) offers SoyMatrix, a soy-based polyurethane marketed for pultrusion and filament winding applications. The reported benefits of SoyMatrix include enhanced weight-to-strength ratio, reduced or no use of glass mat, faster processing line speed and no VOC (volatile organic compound) emissions, specifically styrene. It has a tensile strength of 98,340 psi/678 MPa, flex strength of 216,667 psi/1,494 MPa, compressive strength of 53,029 psi/365.6 MPa, elongation of 27.8 percent and unnotched Izod impact of 25.34 ft-lb.

In the market for several years and particularly active in the food packaging sector has been NatureWorks LLC (Minnetonka, Minn.), a joint venture of Cargill (Minneapolis, Minn.) and Teijin Ltd. (Tokyo, Japan). NatureWorks produces a thermoplastic resin using a proprietary polylactide (PLA) polymer derived from plant sugars. Notably, the company’s production capacity is beyond that of a pilot plant: The firm’s Blair, Neb., polymer manufacturing facility came on line in 2002 and now has a capacity of 300 million lb (140,000 metric tonnes) of polymer. The PLA can be thermoformed, extruded, injection molded and compression molded. To date, it’s been used primarily to produce food containers, cups and service ware because of the resin’s optical clarity. However, Toyota has used the material, sans reinforcements, to compression mold spare tire covers. The larger question is how the material performs when reinforced glass fiber.

In other materials development activity, Solvay SA (Brussels, Belgium) announced in early 2006 that it was building a facility in Tavaux, France, to produce epichlorohydrin via a patented process called Epicerol. Epicerol’s primary feedstock is glycerine, a byproduct of rapeseed oil, which is used to manufacture bio-diesel. The glycerine is substituted for propylene to make epichlorohydrin, which in turn is used to make epoxy. Solvay expects to produce 10 metric tonnes (22,046 lb) of epichlorohydrin annually by 2010 at the French plant, and another 100,000 metric tonnes (220.5 million lb) annually at another facility in Thailand.

In the same vein, Dow Chemical Co. (Midland, Mich.) announced in March 2007 that it was building its own glycerine-to-epichlorohydrin facility in Shanghai (China) Chemical Industry Park — this following the launch of a demonstration facility in Stade, Germany, in 2006. Like Solvay’s plant, the Dow facility will use epichlorohydrin to manufacture epoxy. The facility is expected to come online in late 2009 or early 2010 and will have annual capacity of 150,000 metric tonnes (331 million lb).

APPLICATIONS AND RESEARCH

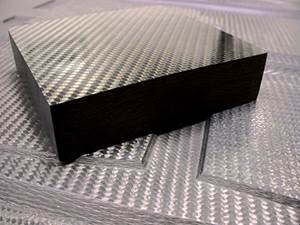

NEC Corp. (Tokyo, Japan) in April 2007 announced the development of a new bio-plastic that combines carbon fiber with a plant-based polylactic acid (PLA) resin. The material reportedly conducts heat more efficiently than steel and will be used in an NEC mobile phone. Available with carbon fiber loadings of 10 or 30 percent, the resin offering heat diffusion properties comparable to and double that of stainless steel, respectively. NEC previously developed a kenaf fiber-reinforced PLA resin for a similar mobile phone.

Waterless Co. (Vista, Calif.), a manufacturer of no-flush, water-saving urinals and already environmentally attuned, caught wind of the soybean potential and decided to give Ashland’s ENVIREZ 1807 a try. The resin was used in the manufacture of the company’s glass fiber urinals and passed all of the relevant performance and safety tests. “The urinals have been tested according to the American National Standards Institute [ANSI] for warpage, loads, scratch resistance and other categories,” says Klaus Reichardt, managing partner. “The urinals with the soy resin performed as well as other standard materials, with similar costs. With performance equal to other materials, the environmental attributes of soy were very attractive.”

Among the most active researchers of soy-based resins for automotive has been, naturally, Ford Motor Co. Dating back to Henry’s sledgehammer days, the company has looked for opportunities to integrate soy into everything from seat foam to fenders. The most tangible result of this effort was the 2003 introduction of the Model U concept car, which used a glass fiber-reinforced soy-based resin in the tailgate (see photo, p. 35). Since then, Ford has been active researching bio-resins and compatibility with a variety of fillers and reinforcements.

Several of Ford’s recent papers on this topic were presented at the 2006 and 2007 Society of Plastics Engineers’ (SPE) Automotive Composites Conference and Exposition (ACCE) in Troy, Mich. Cynthia Flanigan, Christine Perry, Ellen Lee, Dan Houston, Debbie Mielewski and Angela Harris, all in Ford’s Research and Advanced Engineering department, explored the effect of glass and hemp reinforcement for SMC use in ENVIREZ and AROTECH. The latter is a standard petrochemical-based SMC resin produced by Ashland. Overall results showed that the soy-based resin with natural reinforcement is a viable alternative for select thermoset applications within the automotive industry. The only challenge the researchers identified was a tendency of the natural fibers to absorb moisture, although the scientists report that they have identified methods for mitigating this problem.

Ford’s Harris and Lee also evaluated filler loadings in NatureWorks PLA. The goal was to increase crystallinity and performance of the PLA using natural fillers and yet produce a composite that is fully compostable. Fillers evaluated included soy flour, purified cellulose powder, organically modified nanoclay and talc. Results of testing showed that talc and nanoclay are more effective reinforcing agents than cellulose or soy flour. Talc, nanoclay and cellulose are more effective nucleating (polymer chain phase transition) agents than soy flour.

This and other work throughout the composites industry make clear that the bio-composites market, although long-lived, is still in the very early stages of growth and development. However, the market forces that have spurred the most recent surge in bio-resin development are here to stay and inevitably will push more renewable, sustainable plant products into the composites resin stream.

Related Content

Materials & Processes: Resin matrices for composites

The matrix binds the fiber reinforcement, gives the composite component its shape and determines its surface quality. A composite matrix may be a polymer, ceramic, metal or carbon. Here’s a guide to selection.

Read MoreEuropean boatbuilders lead quest to build recyclable composite boats

Marine industry constituents are looking to take composite use one step further with the production of tough and recyclable recreational boats. Some are using new infusible thermoplastic resins.

Read MoreJEC World 2024 highlights: Glass fiber recycling, biocomposites and more

CW technical editor Hannah Mason discusses trends seen at this year’s JEC World trade show, including sustainability-focused technologies and commitments, the Paris Olympics amongst other topics.

Read MoreEuropean SUSPENS project targets green composites production

The 13-partner program will addresses the challenge of reducing the environmental footprint of sandwich and hollow composite structures via bio-sourced resins and carbon fiber precursors.

Read MoreRead Next

From the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read More

.jpg;maxWidth=300;quality=90)