Block Island offshore wind farm off the coast of Rhode Island. Photo Credit: AWEA

Wind energy continues to dominate in this segment and remains, far and away, the world’s largest market for glass fiber-reinforced composites. It’s also competing with other heavy users — such as the aerospace industry — for carbon fiber use as blades get longer and blade builders look for ways to lightweight the massive structures without sacrificing performance.

According to the American Wind Energy Assn. (AWEA, Washington, D.C., U.S.), despite challenges due to the coronavirus pandemic, the U.S. wind industry installed more than 2,500 megawatts (MW) of new wind power capacity in the second quarter of 2020, bringing total American wind energy capacity to nearly 110,000 MW. Released Oct. 29, AWEA’s third quarter market report announced the U.S. installed an additional almost 2,000 MW of new wind power capacity in the third quarter, setting a record for third-quarter additions and bringing total American capacity to nearly 112,000 MW.

AWEA says that onshore and offshore wind development in the U.S. “remained resilient” in the first half of 2020 despite the pandemic, partially due to tax flexibility issued by the U.S. government, with 43,628 MW of wind capacity in the development pipeline (a 4% year-over-year increase from the second quarter of 2019). AWEA says that 21% of wind energy development in the U.S. is from offshore wind. Examples of current offshore development projects include a floating offshore wind technology demonstration project off the coast of Maine under development by the University of Maine (UMaine, Orono) and partners; a 480-MW offshore wind farm off the coast of France employing GE Renewable Energy's (Paris, France) Haliade turbines; a floating offshore wind platform in South Korea under development by 2030; four new floating offshore wind farms off the coast of Spain announced by Greenalia (Galacia, Spain); the Hollandse Kust Zuid 1,500-MW offshore wind farm in development off the coast of Europe; and many others.

Some of this growth is likely driven by the U.S. production tax credit (PTC), a federal subsidy that provides a per-kilowatthour (kWh) tax credit for the first 10 years of a wind farm’s operation. The PTC passed in 2016 and provided a 2.3 cents-per-kilowatthour credit. The PTC credit has decreased incrementally each year until its expiration at the end of 2019, when it was extended by one year and provided a tax credit of 1.5 cents per kilowatthour.

However, not all wind energy news has been as optimistic — for example, carbon fiber manufacturer Hexcel Corp. (Stamford, Conn., U.S.) reported in its third quarter 2020 results that wind energy sales had experienced a decline of 41.5% compared to the third quarter of 2019, reflecting a customer demand shift in the U.S. market. As a result, Hexcel reported closure of its wind energy glass fiber prepreg production facility in Windsor, Colo., U.S. in early November 2020.

According to the Global Wind Energy Council (GWEC, Brussels, Belgium), 60.4 gigawatts (GW) of new wind energy was installed in 2019, the second largest year on record and a 19% increase over 2018 — 6.1 GW of offshore capacity and 54.3 GW onshore. In May 2020, the GWEC predicted that wind energy would “be a key building block for economic recovery” post-COVID-19 globally. In August 2020, the GWEC estimated offshore wind will grow to more than 234 GW by 2030 (compared to 29.1 GW at the end of 2019) despite the economic downturn, and led by expected exponential growth in the Asia-Pacific region.

Reimagining longer wind blades

The size of wind turbines continues to increase as well. Twenty or more years ago, when the first large-scale, commercial wind-generated power came on line, wind farms comprised turbines rated at 1 MW or less, with glass fiber-reinforced blades that typically ranged from 10 to 15 meters long. Today, offshore, 6 to 9-MW turbines with blades 65-80 meters long are the norm.

In September 2018, MHI Vestas announced that its V164 turbine platform had achieved a power rating of 10 MW, making it the first commercially available double-digit wind turbine. The turbine has a tip height of 191 meters and each blade is 80 meters long. In early 2019, Siemens Gamesa Renewable Energy (SGRE, Zamudio, Spain) launched the SG 10.0-193 DD, the company’s first 10+ MW offshore wind turbine. It features 94-meter-long blades — each the same length as one soccer field — with a swept area of 29,300 square meters.

The annual energy production of one SG 10.0-193 DD is said to be sufficient to supply about 10,000 European households with electricity. In addition, Siemens Gamesa is constructing the world’s largest wind turbine blade test stand in Aalborg, Denmark. The site will be capable of performing full-scale tests on the next generations of SGRE rotor blades and is expected to be fully operational before the end of 2019. Siemens Gamesa says the first tests will be on the 94-meter-long blades for the SG 10.0-193 DD offshore wind turbine.

The largest and most powerful wind turbine in development is the Haliade-X, developed by GE Renewable Energy. Towering 260 meters over the sea (more than five times the height of the iconic Arc de Triomphe in Paris, France), the Haliade-X 12 MW carries a 220-meter-diameter rotor. Designed and manufactured by LM Wind Power, the 107-meter-long blades are said to be the longest offshore blades to date — longer than a soccer field. GE revealed the first nacelle for the Haliade-X 12-megawatt offshore wind turbine in July 2019, at its production site in Saint-Nazaire, France. In 2020, GE announced that the Haliade-X 12 MW had been issued a provisional DNV GL type certificate, a major milestone for the prototype. GE also announced that Dogger Bank Wind Farm, a planned joint venture wind farm off the coast the U.K., will include a new 13-MW variant of the Haliade-X.

In addition, as wind turbines get larger and blade lengths continue to increase, carbon fiber reinforcement in spar caps — incorporated as the reinforcing member of wind turbine rotor blades — has become an efficient way to reduce overall weight and increase blade stiffness to prevent tower strikes in the event of sudden wind gusts.

According to Philip Schell, executive VP, carbon fiber, Zoltek Corp. (St. Louis, Mo., U.S.), roughly 25% of wind turbines are now manufactured with carbon fiber spar caps. Although that figure is trending upward, it also underscores that most turbines are still built entirely from glass fiber composites. He adds that when all cost/performance trade-offs are considered, a solid case can be made for substituting carbon fiber for glass fiber in the manufacture of spar caps for turbine blades 55 meters long and longer. As one example, in June 2019, SAERTEX (Saerbeck, Germany) announced its infusion-optimized unidirectional, 618-gsm, non-crimp carbon fiber fabric was used to produce an 87.5-meter, 800-millimeter carbon fiber spar cap prototype made using vacuum infusion technology.

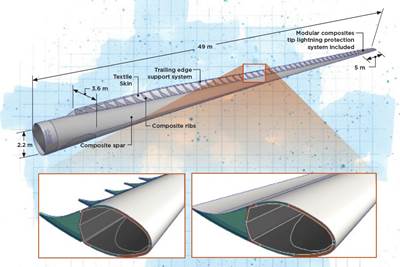

Alternative, equally composites-intensive wind blade designs are also in various stages of development, such as ACT Blade Ltd.’s (Edinburgh, Scotland) skeleton-based design, and various vertical-axis wind turbine (VAWT) designs from the University of Texas, Sandia National Laboratories (Albuquerque, N.M., U.S.) and others.

Recycling wind blades

Over time, however, these wind turbine blades wear out and need to be replaced. In response, the industry is increasingly discussing solutions regarding what to do with — and in particular, how to recycle —decommissioned composite turbine blades. For example, in 2020 the European Composites Industry Association (EuCIA, Brussels, Belgium), WindEurope (Brussels) and the European Chemical Industry Council (Cefic, Brussels) jointly released a new report presenting their recommendations for the recycling of wind turbine blades; the American Composites Manufacturing Association (ACMA, Arlington, Va., U.S.) also released a report assessing various issues related to wind blade recycling.

Wind blade recycling has also been an area of increasing research and development, both by academic institutions and corporations. In January 2020, global wind blade manufacturer Vestas (Aarhus, Denmark) announced that it plans to produce zero-waste wind turbines by 2040, as part of its company focus on sustainability. In September 2020, Arkema (Colombes, France) announced the launch of the ZEBRA consortium, a project aiming to create the first 100% recyclable wind turbine and combining the efforts of Arkema, Canoe, Engie, LM Wind Power, Owens Corning and Suez.

Within academia, in August 2020, the University of Tennessee (Knoxville, Tenn., U.S.) announced that it had received $1.1 million in funding from the Department of Energy’s (DOE) Small Business Technology Transfer (STTR) program and Wind Energy Technologies Office to develop a new technology for the large-scale recycling of wind turbine blades into new recycled composites.

Composites use in other renewable energy markets

Though not as widely used as in the wind energy market, composites are also used to add power or length to in other renewable energy applications such as blades for tidal and hydroelectric turbines, designed to harness energy from ocean waves, streams or rivers. For example, in 2019, AC Marine & Composites Ltd. (ACMC, Gospart, U.K.) was awarded a contract to build four 10-meter composite blades for Orbital Marine Power Ltd.’s (Orkney and Edinburgh, U.K.) 2-MW stream tidal turbine, said to be the most powerful tidal turbine yet designed. In 2020, Australian fabricator Advanced Composite Structures Australia (ACS-A, Melbourne) announced the development of a novel spiral-shaped, glass fiber composite hydroelectric turbine blade prototype for renewable energy startup Kinetic NRG (Southport, Australia).

Related Content

Ceramic matrix composites: Faster, cheaper, higher temperature

New players proliferate, increasing CMC materials and manufacturing capacity, novel processes and automation to meet demand for higher part volumes and performance.

Read MoreTrends fueling the composites recycling movement

Various recycling methods are being considered for composites, from novel dismantling and processing, to building capacity and demonstrating secondary use applications.

Read MoreComposites end markets: New space (2025)

Composite materials — with their unmatched strength-to-weight ratio, durability in extreme environments and design versatility — are at the heart of innovations in satellites, propulsion systems and lunar exploration vehicles, propelling the space economy toward a $1.8 trillion future.

Read MoreThermoplastic composite fabrication: Thermal processing

Establish a proper thermal cycle during TPC rapid forming and achieve reproducible, successful parts through key material selection and process method understanding.

Read MoreRead Next

Wind energy: Gale force growth ahead

Columnist Dale Brosius addresses recent accomplishments, forecasts and recycling challenges affecting the wind energy industry — and composites use within it.

Read MoreReimagining wind blade design

Wind turbine blade architecture is so well established that it’s difficult to imagine there might be a better alternative. ACT Blade’s skeleton-based design is a step in that direction.

Read MoreWind energy leaders present recommendations for recycling wind turbine blades

The EuCIA, Cefic and WindEurope recently released a joint report aimed to accelerate wind turbine blade recycling efforts.

Read More

.jpg;width=70;height=70;mode=crop)