Antiballistics: Composites in the cross hairs

An increasing quantity and variety of fiber/polymer solutions are stopping bullets and blast debris in armored ground vehicles and stationary structures.

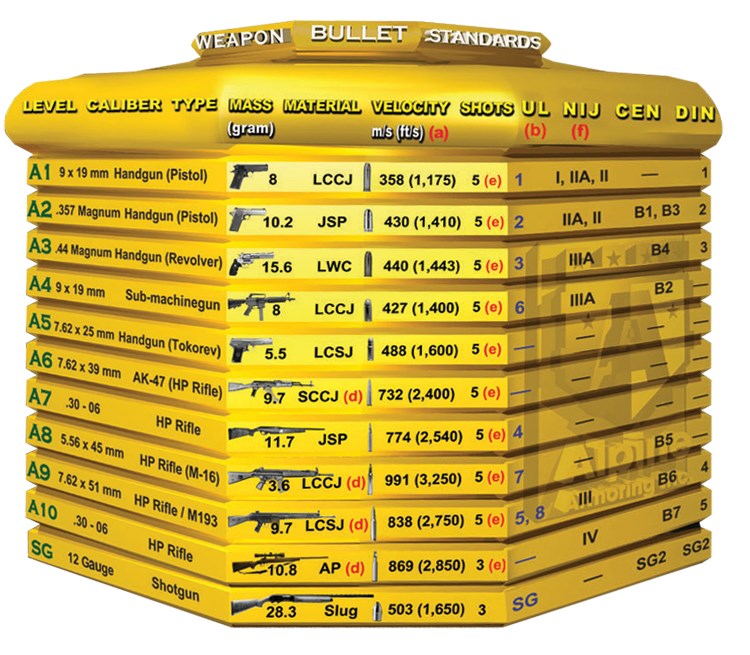

In war zones, such as Iraq and Afghanistan, “asymmetric warfare” pits guerrilla-style insurgencies against conventional armed forces and the civilians they protect. Attacks often come at close quarters in civilian-populated areas, putting both combatants and noncombatants in harm’s way. Armor systems are in great demand to harden both military and commercial vehicles and buildings, ranging from soldier deployment shelters and government buildings to private homes, against a formidable array of threats: rocket-propelled grenades (RPGs), mortars, armor-penetrating sniper fire, small-arms weaponry, improvised explosive devices (IEDs), explosively formed projectiles (EFPs), and blast debris, such as glass fragments (see international threat-level ratings chart, at right).

Road warriors

Military light tactical vehicles (LTVs) and noncombatant support vehicles that were not designed for front-line action are increasingly under fire, especially as targets of IEDs. In the U.S. each military service branch has “uparmoring” programs for its LTVs, using “B-Kits,” or armor applied to vehicles already fielded, and more recently, “A-cab” armor, designed into vehicles by the OEM. At the same time, commercial vehicles that deliver fuel, food and water to deployed troops are also gearing up with B-Kit packages.

Armor, however, adds weight, negatively affecting vehicle maneuverability, fuel efficiency and maintenance. David Fecko, new business development manager for structural glass fiber supplier AGY (Aiken, S.C.) points out that “a support truck that carries 10 tons of supplies and now requires 2 tons of additional armor will have its transport effectiveness reduced by 20 percent. Composite armor is one of the best ways to counteract this weight penalty.”

So good, in fact, that Marcia Price, president of Vector Strategy (Southern Pines, N.C.), a consulting firm that assesses the military armor procurement market and issues forecasts, projects that the U.S. Department of Defense will spend $16 billion (USD) on 550 million lb (250 metric tonnes) of ground vehicle armor between 2009 and 2015. Of that total material, composites content in these programs is likely to go up from 15 percent today to 25 percent over the eight-year span, with the balance comprising steel, aluminum, titanium, ceramics, and transparent (glass or clear polymer) armor.

Force-absorbing fibers

The blunt force impact of high-velocity ammunition and IED blasts require that armor dissipate the initial shock wave-energy and also stop and contain back-surface fragmentation (“frag”) or spall. Dana Granville, senior materials engineer for the Materials Applications Branch of the Weapons and Materials Research Directorate at the U.S. Army Research Laboratory (ARL, Aberdeen Proving Ground, Md.), observes that “composites do an excellent job of providing consistent, controlled absorption of kinetic energy. Compared to baseline rolled homogenous steel, composites improve protection while reducing areal weight and, as such, represent an enabling technology in both soft and hard armor.”

Among the earliest and most successful composite armor systems are those reinforced with aramid fiber. Vehicle applications using DuPont Protection Solutions’ (Richmond, Va.) Kevlar aramid fiber/phenolic matrix panels began 20 years ago on Bradley Fighting Vehicles and continue today in thousands of Humvees and mine-resistant, armor-protected all-terrain vehicles (MRAP/MATVs). As of July 2009, nearly 14,000 armored MRAP vehicles have been fielded in Iraq and Afghanistan. Models fitted with Kevlar-based armor include Buffalo, Cougar (opening photo), Maxx-Pro, RG-33 and Ridgback (see photo, at right). “Under recent independent testing, cross-plied unidirectional panels made with Kevlar demonstrated excellent protection against kinetic-energy and shaped-charge threats, such as RPGs, in large part by reducing the spread of spall vs. steel alone,” reports Tucker Norton, DuPont’s North American ballistics technology leader. “Additionally, Kevlar does not rely on delaminable claddings for flame-resistance protection.” Notably, the company announced a new Armor Technology Center in Wilmington, Del., in September, and is investing more than $500 million to build a new Kevlar manufacturing facility in South Carolina.

TEIJIN ARAMID BV (Arnhem, the Netherlands) also manufactures para-aramid fiber for antiballistic applications under its Twaron brand name, most recently, its LFT HB1 product for hard armor.

Honeywell Advanced Fibers and Composites (Morristown, N.J.) produces Spectra high-modulus polyethylene (HMPE) fiber and Spectra Shield four-layer laminate in roll form for hard armor applications. The supplier launched Spectra Shield II in 2007, with its Spectra S3000 HMPE fiber, and credits its performance not only to fiber backbone chemistry, but also to a processing strategy that bonds the fiber in parallel strands. Impregnated with an advanced PE matrix, Spectra S3000 fibers help boost ballistic properties in Spectra Shield II laminates by more than 20 percent in armor for ground vehicles, as well as aircraft and body armor. Last year, Spectra Shield II SR-3130 was introduced to offer higher rigidity properties in armor applications.

Lori Wagner, armor industry technical leader for Honeywell Advanced Fibers and Composites, explains that, in the past, hard armor customers had to choose between armor panel rigidity and vehicle performance. “If a ballistic material does not contribute to an end product’s rigidity,” she explains, “then other materials must compensate, and that can add more weight.” She also points directly to improvements made by Honeywell in its proprietary gel-spinning process used to manufacture Spectra HMPE fibers. “Innovations in our fiber and laminate processing techniques, combined with accurate computer modeling, are allowing us to exploit the benefits of combining materials and to make the most out of Spectra’s unique performance attributes. Ultimately, this is affecting acceptance of composites in armor as a replacement for steel.”

Another source of advanced PE fibers used in armor is DSM Dyneema (Heerlen, The Netherlands). Dyneema HB 26 and HB 80 fibers reportedly provide added rigidity and multiple-hit protection in hard armor panels, with less weight than alternative materials. Dyneema panels used in police vehicles can weigh less than 5 kg/m2 and, hybridized with steel or ceramic strike faces, reduce areal density by as much as 75 percent. Moreover, DSM says its PE-reinforced panels are more easily cut to conformable shapes, and they reportedly are more durable than panels made from other materials because Dyneema better resists moisture, chemicals and UV radiation.

David Cordova, VP of business development for DSM Dyneema subsidiary Life Protection Americas (Stanley, N.C.), explains that in armor, the unidirectional configuration of the fibers in DSM’s Dyneema UD product allows the energy transferred from the impact of a bullet or other threat to be distributed axially along the fiber length much faster and more efficiently than that energy can be distributed through conventional woven fabrics. This is because the absorption power of the yarn in woven fabrics is diminished at the crossover points, where the fibers are crimped — these points reflect rather than absorb the shock waves of the impact, Cordova maintains. In armor panels made with Dyneema UD, the fibers are not crimped and, therefore, much more of the material, he says, is engaged in stopping a projectile.

Also used in MRAP armor are Tensylon ultrahigh-molecular-weight polyethylene (UHMWPE) tape and composite products from BAE Systems Tensylon HPM Inc. (Cincinnati, Ohio and Monroe, N.C.). Produced by a proprietary solid-state extrusion process developed in an ARL program, Tensylon reportedly combines extremely low weight with higher resistance to creep and higher tensile modulus and strength than aramids or gel-spun UHMWPEs. Earlier this year, BAE Systems received a $2.6 million U.S. Army contract to apply armor made with Tensylon to heavy equipment transporter (HET) vehicles, which are used to move combat-loaded main battle tanks to and from the battlefield.

Glass fiber is competing with aramid and ceramic fibers for cost and weight benefits in Humvee and MRAP armor in the form of AGY’s S-1, S-2 and S-3 Glass grades. “We believe there is an opportunity to improve the tensile strength of our S-Glass fibers,” observes AGY’s Fecko. “An S-Glass fiber is tremendously strong — pristine tensile strength is 4,890 MPa, nearly ten times the strength of steel and about one-third the density — but much of its strength can be lost in processing the virgin glass into a composite material. Our challenge is to manufacture glass fibers and convert them into composite armor panels without decreasing their best properties.”

Last year, AGY introduced two new glass fibers for armor: Featherlight and Quicksilver. Compared to standard S-2 Glass, Featherlight offers a 5 to 10 percent increase in protection, and Quicksilver is a lighter weight yet cost-competitive fiber, compared to E-glass. Fecko says AGY is working with the ARL on a new glass fiber sizing “that we expect to result in a new family of products in 2010.”

Jon Stowell, sales and marketing director for Advanced Composites Group Ltd. (ACG, Heanor, Derbyshire, UK) recalls that ACG supplied the S-2 Glass/phenolic prepreg used as early as the 1980s for armor on Land Rover vehicles operating in Northern Ireland. “Before then, ACG provided this prepreg system for combat helmets,” he adds, “because it offered the best balance of frag protection and backface deformation, durability and cost.” Today, he contends, those who specify ballistic requirements for Middle East conflicts are “drawing upon S-2 Glass/phenolic as an armor material of choice when combined with ceramic plates.”

ACG expects up to 25 percent growth in its sales to the ballistics market in 2010. Says Stowell, “customers are approaching ACG to engage in collaborative development programs that will see the emergence of structural armor solutions utilizing low-cost composite manufacturing techniques, such as out-of-autoclave and compression molding.” Cougar 4X4s are being converted to MRAP Ridgbacks using armor panels made with ACG prepregs. Ridgbacks will be used by British troops in the Middle East.

Alternatives to aramid

New to the fray is Innegra S high-modulus polypropylene (HMPP) fiber, a product of Innegra Technologies (Simpsonville, S.C.). Innegra S is engineered for lighter weight and greater durability properties in armor panels than can be had with aramid fiber alone.

Innegra S has shown positive results in hybridization with aramid fibers in rigid armor by delivering a high level of ballistic protection at a lower total cost per panel. In testing, a compression-molded hybrid panel that incorporated Innegra S 2800-denier fiber was impacted with a .44 magnum bullet. The panel’s performance equaled that of an all-aramid construction, suggesting that for optimum price/performance, panels could use a 75:25 ratio of Innegra S to aramid fiber.

Company CEO Brian Morin cites flexible production volume as a manufacturing advantage his company provides to customers. “Innegrity can expand production capacity incrementally and based on demand. For the U.S. military, we can build capability beyond what is needed today, and turn that off during peacetime,” he claims. “This is due, in large part, to the fact that the capital required per pound for annual output of our HMPP fiber is about one-tenth that required for aramid fiber.”

Innegra S also is compatible with glass and carbon fiber in thermoset and thermoplastic matrices. Its low density (0.84 g/cm³) provides very lightweight but strong composites when combined with low-density thermoplastic films. Morin says Innegra S/carbon hybridization in ballistic panels, in addition to cost savings, demonstrates 38 percent greater Gardner impact resistance and 77 percent greater Izod impact.

TechFiber (Tempe, Ariz.) combines aramid and Innegra S HMPP fibers in its T-Flex H and I-Flex H unidirectional fabrics, developed for hard armor applications. The uni fabrics are bonded together with high-performance thermoplastic films under pressure in a patented process to form hybrid panels. TechFiber general manager Miles Rothman reports that the performance of the hybrid fabric, in composite ballistic panels that also might integrate a ceramic strike face, is attracting increasing attention among armor makers. Increased demand for ballistic materials is spurring a $3 million expansion of the company’s production facilities, starting in 2010.

Meanwhile, Milliken & Co. (Spartanburg, S.C.) says it can provide energy absorption and stiffness comparable to that of aramid-reinforced composites, in its Tegris composite, which features fiber and matrix of PP. Sold to armor integrators in fabric or panel forms (P1200, P1400 and P4000), Tegris can be “tuned” or tailored to fulfill specific impact and stiffness requirements in single- or multilayer rigid panels. Eric Brockman, Milliken’s national sales manager, points out that “a single layer of Tegris is 0.005 inch [0.01 cm] thick and weighs only 0.2 lb/ft², allowing for rapid thickness build up in armor panels, depending upon the desired threat-level protection.”

Testing in several vehicle platforms and in a project with ARL in blast mitigation panels has demonstrated that Tegris will exhibit engineered delamination, that is, delamination that occurs in predictable stages, absorbing impact waves behind a ceramic or steel strike face. With weight and cost bogies such a priority for military customers, Brockman believes thermoplastic options have a chance to raise the bar against incumbent materials.

Gimme shelter

Although its products are under consideration for light tactical vehicle armor, Montrose, Colo.-based Polystrand’sThermoBallistic sheet has been field-tested primarily in blast mitigation applications on military tenting and deployment shelters, in the fast growing market for armor in at-risk stationary structures, military and civilian.

Polystrand president Ed Pilpel believes his company’s ThermoBallistic composite sheets, which combine E-glass, AGY’s S-2 Glass, or aramid fibers in a PP or PE matrix, “are helping bring thermoplastic armor into the mainstream through lower cost and processing advantages.” He explains that the sheet material “is a finished composite when it goes out the door, unlike an A-staged thermoset prepreg, although the structural properties of the final panels may change when integrated into a total armor package under thermoforming or autoclave molding.” Polystrand’s composite sheet features 0°/90° cross plies and can be “compaction pressed” at only 100 psi in 40 to 60 percent less time than required by semi-rigid composites, with less waste and no outgassing of volatile organic compounds (VOCs).

“The low waste and no VOCs or ‘green’ aspect of thermoplastics are becoming more important to our military customers,” Pilpel claims. “When thermoset composites in blast shielding for deployment shelters are used in a desert environment, the release of VOCs can drive soldiers out of their tents,” Pilpel claims. That said, he admits that “thermoplastics offer a paradigm shift from 30 years of thermoset materials that are mil spec’d and well documented and understood. It will take some time to get a comparable database in place for thermoplastics.”

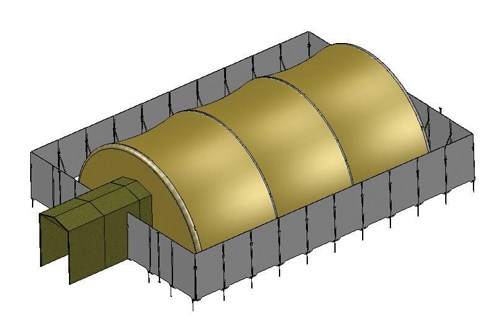

The University of Maine, in conjunction with the U.S. Army’s Natick Soldier Research, Development and Engineering Center (Natick, Mass.), has developed composite panels that form modular ballistic protected systems (MBPS) for temporary military shelters. Drawing upon staff expertise at the University’s Advanced Engineering Wood Composites Center (AEWC), requirements for the MBPS have been established as high fragmentation capture and blast wave pressure survivability, rapid installation and set-up, light weight, and reusability. AEWC’s answer turns to reinforced polymer skins over a wood core in panels approximately 4-ft wide by 7-ft long (1.2m by 2.1m) and weighing 90 lb/41 kg each. Fitted into a frame system, the panels line the outside of standard military tents. Initial panels were constructed in 2007 and subjected to ballistic blast overpressure testing. Test success has resulted in accelerated panel development and initiation of transition to the field.

“It is important to note that the MBPS is more than just a collection of panels,” states Dr. Habib Dagher, professor of civil and structural engineering at AEWC. “Each shelter application requires specific mounting and attachment hardware, blast-resistant doors and all shipping/installation support data, which affects overall design.” Panels are designed to absorb blast energy without breaking apart, yet feature support points as much as 8 ft/2.4m apart. “Hardware is designed to reduce peak loads on the shelter structure within the effects of blast energy.” AEWC continues efforts to reduce panel weight and installation time, and to work with panel manufacturers on optimizing specific production parameters.

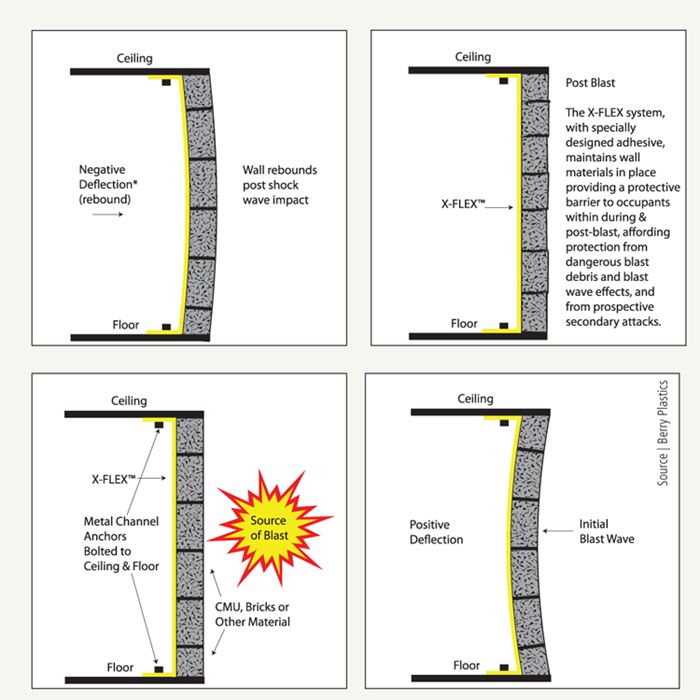

Another blast protection product developed with the U.S. Army is X-FLEX, a peel-and-stick blast-mitigation material from Berry Plastics Corp. (Evansville, Ind.). Comprising aramid scrim fabric sandwiched between two layers of polyurethane film, the product features, on one side, an adhesive specially designed to adhere to construction surfaces, including brick and concrete. X-FLEX came out of a cooperative R&D agreement with the Army Corps of Engineers’ Engineer Research and Development Center (ERDC, Champaign, Ill.). “It was critical that we develop a system that is easy to deploy without special equipment but provides threat-level protection in line with ERDC goals,” says Elizabeth Curran, director of engineering protective systems for Berry Plastics’ Tapes and Coatings division. X-FLEX, she says, meets those criteria: “Unlike other composite blast mitigation systems, X-FLEX is immediately effective and requires no drying time.”

Used primarily in existing buildings, X-FLEX is designed to keep a wall, or much of it, intact during a blast wave and then resist damage, post-blast, from fragmentation debris. Curran indicates that protection initiatives have become a major business segment for Berry Plastics, “and we have invested significantly to help address the many government-owned and private facilities that need blast mitigation systems.”

Norplex-Micarta (Postville, Iowa) has been offering its glass/phenolic ShotBlocker sheet in rigid ballistic building panels since 1997 and for military vehicles in the past three years. Rated to the highest-level DOS certification (Level 7), ShotBlocker is suitable for safe rooms, guard stations, and infrastructure wall and door structures. The company’s director of business development Alan Johnson says that ShotBlocker sheets incorporate glass fiber supplied by AGY and Owens Corning Composite Solutions Business (Toledo, Ohio), optimally at 80 percent loading in phenolic matrices, using resins supplied by Ashland LLC (Dublin, Ohio) and Georgia-Pacific Chemicals LLC (Atlanta, Ga.). Over the past year, the company has delivered more than 1 million lb/453,590 kg of composite armor sheet, specifically designed to combat EFPs.

Other composite blast mitigation systems include BlastShield from BAE Systems (Houston, Texas), which features Spectra yarn in fixed interior window protection, and low-cost, pultruded glass/phenolic panels from KaZaK Composites (Woburn, Mass.). KaZaK helped develop the High Expansion Ratio Shelter (HERS) temporary shelter system prototype for the U.S. Army, and is currently working with several U.S. Department of Defense agencies toward the use of its composite panels, not only in ground vehicles and structures but also in helicopter and ship protection. Jerry Fanucci, KaZaK president, feels confident that “large pultruded panels are the key to the cost-effective implementation of composites in many military applications because larger panels mean fewer joints, less assembly cost and lighter weight.” The company has built a “superscale” pultruder that can manufacture composite sandwich panels greater than 10-ft/3.1m wide and of unlimited length.

Peace of mind

During an armed attack, the use of composites can be, literally, a matter of life or death. Although no material system can bring peace in today’s war zones, the protection that composites can provide against ballistic and blast threats is well proven. As these materials proliferate, more lives will be saved and the resulting armor technologies will afford, at least, greater peace of mind.

Related Content

Materials & Processes: Fibers for composites

The structural properties of composite materials are derived primarily from the fiber reinforcement. Fiber types, their manufacture, their uses and the end-market applications in which they find most use are described.

Read MorePlant tour: Albany Engineered Composites, Rochester, N.H., U.S.

Efficient, high-quality, well-controlled composites manufacturing at volume is the mantra for this 3D weaving specialist.

Read MoreMFFD thermoplastic floor beams — OOA consolidation for next-gen TPC aerostructures

GKN Fokker and Mikrosam develop AFP for the Multifunctional Fuselage Demonstrator’s floor beams and OOA consolidation of 6-meter spars for TPC rudders, elevators and tails.

Read MoreRUAG rebrands as Beyond Gravity, boosts CFRP satellite dispenser capacity

NEW smart factory in Linköping will double production and use sensors, data analytics for real-time quality control — CW talks with Holger Wentscher, Beyond Gravity’s head of launcher programs.

Read MoreRead Next

Composites on the frontlines

Armored vehicle applications on the ground and in the air fuel a growing, evolving market forhigh-performance materials.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More

.jpg;maxWidth=300;quality=90)