What's new in automotive front-end modules?

Composite and hybrid composite/metal solutions reduce cost and weight and increase assembly efficiency on passenger vehicles.

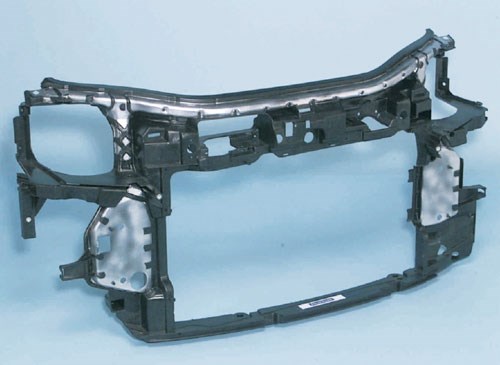

Modular front ends are revolutionizing passenger vehicle design and assembly. Automotive front-end modules (FEMs) typically are multipiece assemblies that integrate a large number of components: forward lighting, radiators and cooling fans, air conditioning (A/C) condensers, grille-opening reinforcement (GOR) panels, crumple zones, bumpers with decorative fascia, hood latches, washer bottles, plus electronics and wiring, although specific components can vary by tier supplier and OEM. Rather than use the traditional method of piecemeal assembly on the OEM production line, FEMs, which are supplied by a tier integrator, provide a complete system for closing out a vehicle’s front end at the assembly line. Because of this, they work best with so-called open-architecture builds that are reinforced to support the front-end module. To date, FEMs have been used on compact and midsize cars, and more recently on large sedans, all with monocoque/unibody architecture. They also have found application on SUVs and full-size pickups that feature body-on-frame constructions. While FEMs might not yet be appropriate for every vehicle, they bring many benefits to automakers in appropriate circumstances.

Modular-build benefits

By outsourcing a complete front end, an OEM not only eliminates a significant number of assembly-line steps and the need to interface with numerous subsystem suppliers, but also reduces tooling costs and, therefore, improves its working capital. Because the underlying structure of FEMs can be standardized to an extent, they allow common designs to be used across multiple models sold into multiple geographies, providing cost savings, say some sources, on the order of 20 to 30 percent. Model differentiation is achieved by varying skins and cosmetic treatments, which supports the general trend of OEMs toward more global platforms with local-model versions.Further, FEMs can be added late in the assembly sequence, allowing autoworkers to stand inside the engine compartment and build from the firewall out rather than bending over fenders, which improves assembly-line ergonomics. This build method also allows installers to insert engines from the front rather than lower them into a substantially finished engine bay from above, reducing the need for expensive overhead cranes. Additionally, the use of FEMs improves fit-and-finish on the vehicle’s front end, accurately locating headlamps, bumpers, fascia and grilles in a single package, and in some cases providing styling opportunities that would not be possible with conventional builds. Finally, dimensional accuracy is much easier to control on a large, highly integrated composite part than on an assembly of multiple stamped-metal parts, where errors multiply via stack tolerances.

For the tier integrator, providing an entire FEM rather than its individual components means more opportunities to add value and increase sales because tier engineers now perform most of the design and development work required to bring it to production. Further, a significant way that suppliers add value is by taking advantage of the opportunity to consolidate parts and functions, which then reduces weight and cost and the chance of warranty claims.

Materials options

The structural carrier for FEMs — which is mechanically fastened to the chassis and onto which lights, bumpers, hood latches and other subcomponents are attached — can be produced in all-metal, hybrid metal/composite, or all-composite designs. System material selection is influenced by many factors, including vehicle size, the loads it is likely to see in use, the strength of surrounding geometries, the mass of components that will be attached to the carrier, and the OEM’s dimensional tolerances. There is, therefore, a broad range of FEM designs currently in use.The concept of modular front ends was pioneered by Volkswagen AG in the early 1990s with all-metal carriers. Volkswagen was the first OEM to implement FEMs widely on VW and Audi models. Carrier designs subsequently evolved into hybrid metal/composite and then all-composite systems. While FEMs were widely adopted by automakers throughout Europe and by many Asian OEMs, they have been slow to catch on in North America. Although Chrysler LLC uses FEMs across its product lines (perhaps the result of a decade spent in partnership with Daimler AG) and Ford Motor Co., Nissan Motor Co. and Hyundai Motor Co. are increasingly adopting them, neither General Motors Corp. nor Toyota Motors Co. are said to be sold on the idea yet.

Early designs featured steel carriers, but these evolved into hybrid systems, combining composites and metal as OEMs became more comfortable with the FEM concept and composite systems were proven. The first hybrid systems were bonded with special adhesives; later developments featured insert-molded steel reinforcements. In recent years, the structural carriers of many FEMs have become entirely composite. Thermoplastic resins are the most common matrices, with polypropylene (PP) and nylon (polyamide or PA) the most commonly specified. Initially, all-composite FEM designs were focused on compression-moldable glass-mat thermoplastic (GMT) composites with chopped-fiber mats. For cost reasons, GMT was replaced by injection-molded pelletized long-fiber thermoplastics (LFT), first PA and then PP. More recently LFT has found competition from inline-compounded (ILC) injection- or compression-molded direct-LFT (D-LFT). However, on some newer carriers — notably, those on heavier vehicles subject to higher loads — hybrid metal/composite designs have returned or the OEM has gone back to GMT with selective placement of engineered textiles for added stiffness and strength. It remains to be seen whether these more robust systems will proliferate on heavier vehicles or, as was the case with smaller cars, if they will be replaced by LFT and D-LFT.

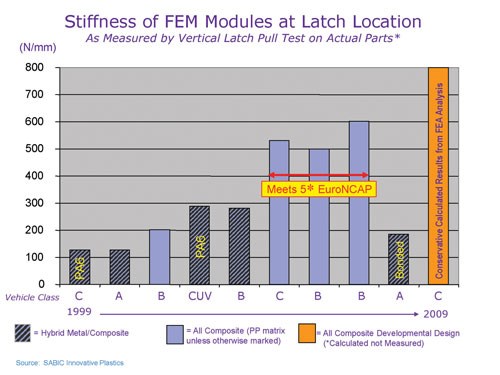

The graph at right, provided by SABIC Innovative Plastics (Pittsfield, Mass.), charts the increasing stiffness of hybrid and all-composite FEM module designs at the latch location as measured on actual parts via the latch pull test. The trend moves away from hybrid systems toward all-composite designs, and away from nylon and toward polypropylene matrices, yet stiffness generally increases despite removal of metal and use on larger vehicles. A developmental all-composite design still under investigation by SABIC is calculated from FEA results rather than measured on actual parts, but is projected to offer a significant increase in stiffness.OEMs choose the technology that fulfills their bill of process at the lowest overall systems cost. For smaller A-/B-size platforms with a robust body-in-white, little additional metal reinforcement is required to meet the vehicle’s structural requirements, so they are usually the best targets for all-composite FEM carriers. With larger C-/D-size platforms, additional cross-car structures may be necessary, so hybrid steel/composite FEMs may be required.

Trends driving change

Tom Goral, SABIC’s market development manager, notes, “The continuous challenge with selling the value proposition of front-end modules is getting credit for all the systems savings. Cost is king. Weight is important, too, but it is very difficult to get OEMs to commit to a credit based on dollar-per-kilogram saved.” Total systems costs need to be accounted for, he explains, because piece price for the modular unit can be greater than the total cost of individual front-end components. “For years, it’s been difficult to fully capture the supply-chain value for cost savings, including both direct and indirect assembly time, as well as warranty savings,” Goral contends. “Fortunately, system-sourcing decisions, vehicle size and vehicle architecture have already proven the value of integrated FEMs in Europe.”Norm Guschewski, director, business development – exterior modules at tier supplier Decoma International, an operating group of Magna International (Aurora, Ontario, Canada), says, “The growing push for open front-end architecture by automakers requires some sort of an FEM solution. The level of integration and component content will vary by OEM, based on their confidence in executing the right product with the right business case for their environment. All of our customers are focused on the cost impact, and it remains the strongest overall driver.” Some customers, he notes, focus more on the total cost of the system and its assembly as opposed to component costs. As a result, their methods for business-case analysis differ considerably. “The assembly efficiencies FEMs bring quickly translate to cost savings,” says Guschewski. “That’s where our own manufacturing flexibility becomes critical. Decoma has supplied more than 2 million FEMs using nearly all the materials and processing technologies available in the marketplace.”

Craig Dlugos, application development engineer, Ticona (Florence, Ky.), adds, “I think you’ll always have different types of materials used in FEMs, depending on design requirements.” Designs that locate the radiator and hood latch in-plane with the mounting locations can take advantage of a design that utilizes more composites, he explains. But if the mounting points have a large offset to the hood latch and radiator, then, he says, the strength and stiffness of steel are better suited to carry the loads. Dlugos agrees that cost, for now, will still be the driver, “Weight will be looked at more carefully with the new CAFE regulations coming into play,” he allows, “but current FEMs are lighter than traditional methods, so they are well positioned.”

Displacing metals

Critical to the FEM carrier’s metal-hybrid-composite segue have been numerous breakthroughs in materials, process, and analysis tools, not the least of which have been the development of long-fiber thermoplastic pellets, longer fiber in-line compounded products and novel methods for joining metals to composites in hybrid systems. Special adhesives developed by Dow Automotive (Auburn Hills, Mich.) were an enabling technology for some of the earliest hybrid FEMs, which were bonded systems. Later, insert molding was used as special techniques were developed to ensure a strong bond between metal and composite to prevent delamination during collisions. The patented Plastic/Metal Hybrid (PMH) technology, developed by Lanxess Corp. (Redmond, Wash.) and Venture Plastics Inc. (Newton Falls, Ohio), combines glass-reinforced polyamide (nylon) with deep-drawn, perforated sheet-metal inserts. PMH was used for FEM carriers on vehicles from Audi AG, BMW AG, Chrysler, Ford, Nissan, Mercedes-Benz, and VW.Asked about other developments that contributed to the spread of FEM technology, our industry experts had this to say: “The main driver for moving to FEMs in the first place was industry’s and — more importantly — specific OEMs’ desire to improve vehicle fit and finish,” says Decoma’s Guschewski, pointing out that steel carriers couldn’t provide the integration features that in today’s hybrid and composite systems allow for small gaps between lamps, fascia and grille systems. Parts integration and offline assembly of the appearance items, he contends, guarantee tight gaps and improved capabilities because tolerance stacks are no longer an issue.

“Today, it’s assembly practices that set one supplier apart from another,” he observes. “Many of these are proprietary and provide cost advantages. We feel assembly technologies will continue to play a major role in further growth of FEMs in the market.”

Matthew Marks, SABIC’s market development manager – STAMAX Products, acknowledges the role of analysis software. “FEA/CAE tools are very important for the development of a vehicle structure. OEMs continue to accelerate platform timelines, decreasing product development time, which means greater emphasis is placed on predictive-modeling tools instead of traditional prototype and test (make and break) methods.” Noting that techniques for modeling thermoplastics have improved dramatically over the past decade, he maintains, nevertheless, that industry-wide, materials characterization and understanding of the behavior of long-glass fiber composites are still in their infancy. “Correlation to actual part performance is still not as accurate as it could be,” he says. “Accurate and reliable material-property characterization is key to providing design engineers with the tools they need to do predictive analysis, reduce product lead times, and accelerate development and production launch timelines.”

New & novel modules

For nearly a decade, it looked like the evolutionary track for FEMs would be a linear progression away from metal and toward hybrid and then all-composite carriers. Recent developments, at first glance, suggest a retrenchment of sorts, until one considers the types of vehicle that are incorporating FEMs. For example, the recently launched ’09MY Dodge Ram pickup from Chrysler features an FEM developed by Decoma, using a hydroformed steel upper tube. Use of a hybrid carrier with a robust steel tube does not mean Chrysler or Decoma are losing confidence in composite solutions. Rather, this FEM is being used on a full-size pickup subject to extremely high loads because it has a body-on-frame construction.Guschewski explains, “This design is similar to one we’ve previously launched on the Jeep Wrangler, another body-on-frame vehicle. Our unibody FEMs aren’t designed with tubes because they aren’t subject to these higher frame loads. We focus on fit and finish enhancement while developing the lightest and most cost-competitive carrier that meets the given vehicle’s structural requirements. Injection-molded carriers continue to provide our FEM designs with the highest level of integration at the lowest mass and cost.”

Another recently launched hybrid carrier, shown on Ford of Australia’s full-size Limited Edition Falcon sedan, is the first to combine a closed-section hydroformed steel tube with a 30-percent glass-reinforced polyphenylene ether/polyamide (PPE/PA) blend. Metal and composite are joined during injection molding via a geometric feature in the hydroformed tube that allows plastic to flow locally from outside to the inside of the tube, creating a robust 3-D attachment that SABIC calls SmartLoc. This technique eliminates the need for mechanical fasteners or adhesives and offers higher section stiffness in a limited packaging environment. The system helped this vehicle achieve a 5 Star Crash Rating — the first Australian vehicle to do so. The hybrid carrier also helps provide greater styling freedom, a 30-percent mass and 70-percent part-count reduction, a packaging-space reduction that allows for aggressive lighting design, and improved airflow to reduce radiator warranty issues.

A novel and somewhat exotic concept for a front-end module just launched by Valeo (Paris, France) is said to reduce the severity of pedestrian injuries by 20 to 40 percent. Called the Safe4U, this FEM has both passive and active protection systems. Use of energy-absorbing materials like malleable steel helps optimize passive protection for vehicle occupants and pedestrians and allows automakers to meet new European Pedestrian Impact Phase 2 Standards, which go into effect in 2010. Its active pedestrian-detection system combines radar placed above the upper crosspiece and two cameras, one on each side of the bumper that are said to be able to distinguish pedestrians from other hazards. Once the system has identified the risk of collision, two actuators release the upper crosspiece from its supports in less than 100 milliseconds, causing the upper part of the front end to swing back. The system is reversible: if no impact occurs, actuators move back into position and reconstitute the front end. While such a system might seem overkill to North American readers, Europeans as well as many Asian automakers are scrambling to meet tougher pedestrian protection standards not yet in place in the Americas.

Although the GMT of the earliest composite FEM carriers has been replaced with LFT and D-LFT, an interesting exception is the new Mercedes S-Class luxury sedan. It features a 3.4-kg/7.5-lb engineered-fabric-reinforced GMT carrier produced by Innomotive Systems Europe (Hainichen, Germany) with material supplied by Quadrant Plastic Composites (Lenzburg, Switzerland). The GMT carrier enhances crash performance, provides high thermal stability, reduces mass, and allows for functional integration not possible with steel.

There are a number of vehicles coming out with all-composite FEM carriers. Recently launched were two small cars from Mercedes, the Vito and Viano models, and one from Hyundai, the Getz. Both automakers use a lightweight front-end construction that allows for integration of additional functionality in components, which in turn saves assembly time, reduces costs, and lowers mass. Carriers for all three vehicles make use of injection-molded pelletized LFT-PP.Ticona’s Dlugos explains, “There were two main reasons for choosing long-fiber-reinforced thermoplastic in these applications. First, the material has very-high energy absorption capacity, an advantage that shows its true value in a crash. The front end deforms, absorbing the impact energy and therefore weakening forces that otherwise would be acting on the vehicle’s occupants. Second, LFT brings the necessary rigidity to this application.” In each of the three small cars, the carrier also serves as a mounting location for the lighting system, radiators, and fenders. No less important, he contends, is the FEM’s positive impact on night-driving safety. “High dimensional stability was particularly important,” he explains, “for integration of the lighting elements to keep headlamps properly focused.”

More market penetration

Speaking about what the future might hold, Zumhagen says, “Composite FEM carriers will continue to penetrate and grow in North America as OEMs and their supply chains learn to take advantage of the favorable combination of part and tooling integration, weight and systems-cost savings FEM carriers can provide.” He feels that trends will favor greater use of long glass-reinforced thermoplastics, especially PP compounds, with little to no major metal reinforcements. These will be processed increasingly by D-LFT methods, he says, using either complete molding systems, offered by machinery OEMs such as Dieffenbacher (Eppingen, Germany) and Krauss-Maffei Corp. (Florence, Ky.), or those that can be added to existing equipment, such as Plasticomp LLC’s (Winona, Minn.) Pushtrusion process. The latter, says Zumhagen, “provides a cost-effective alternative for molders who have existing presses and don’t want to purchase more costly turnkey systems.”Marks of SABIC notes, “Economic indicators are driving the industry to small cars and lightweight systems. Full composite FEMs will continue to increase in usage as design engineers become more familiar with long-glass fiber materials and technology.”

Decoma’s Guschewski adds, “Our customers who focused on fit-and-finish and part integration and enhancement opportunities and who executed well have informed us that they will continue with this strategy.” Those OEMs who question their strategies, he claims, have admitted that they focused their FEMs completely on the cooling system components and neglected the equally important Class A components. “Unfortunately those FEMs did not deliver the results the OEM expected because they did not work to minimize tolerance stacks.”

With tougher CAFE requirements in the U.S. and higher pedestrian-protection standards coming on in Europe and parts of Asia, expect to see more innovative uses of materials, processes, and design in FEMs as suppliers attempt to pare cost as well as kilograms.

Related Content

Henkel receives Airbus qualification for European aerospace manufacturing facility

The adhesive company’s Montornès, Spain, plant has been approved as a standard and raw materials supplier for various Airbus platforms, adding to its work in lightweighting, fuel efficiency and automation.

Read MoreMaterials & Processes: Fabrication methods

There are numerous methods for fabricating composite components. Selection of a method for a particular part, therefore, will depend on the materials, the part design and end-use or application. Here's a guide to selection.

Read MorePro-Set named official materials supplier for New York Yacht Club American Magic

Competitive sailing team prepares for the 37th America’s Cup beginning in August 2024 with adhesives, resins and laminate testing services for its AC75 monohull construction.

Read MoreScott Bader acquires Satyen Polymers, enhances commitment to Indian customers

Under the agreement, India-based Scott Bader Pvt. Ltd. will assume responsibilities for direct sales and marketing for all resin and gelcoat products, bring composites and adhesives to Indian market.

Read MoreRead Next

CW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;maxWidth=300;quality=90)