Carbon fiber market: Gathering momentum

All signs point to increasing demand from many market sectors. Will capacity keep pace?

While the chill of global recession persists, a subtle change has occurred in the carbon fiber marketplace. Confidence was evident at CompositesWorld’s annual Carbon Fiber 2011 conference in Washington, D.C. (Dec. 5-7), at the Washington Marriott hotel. With The Boeing Co.’s composites-intensive Dreamliner already in service and the Airbus A350 XWB almost ready for final assembly, demand for aerospace-grade fiber is already strong. Yet, according to conference presenters, industrial demand is surging (see the sidebar “CF 2011: Comment on end-markets and initiatives,” below). A few years ago, Carbon Fiber conference participants celebrated small victories in new niche applications and discussed the “what ifs” on the horizon. Now the horizon isn’t so distant — fiber consumers are emerging in droves from nearly every conceivable market sector, ready to try carbon composites in a huge range of applications. Forget the What’s a composite? question; it’s now Is there enough fiber to sustain growth?

“The conference presentations ranged from the industry’s early days to its growth potential in the wind energy, automotive and aerospace sectors,” reports event cochair Tom Haulik, carbon fiber sales manager at Hexcel (Stamford, Conn.). “There is a strong sense of optimism as carbon fiber manufacturers put heavy investment in new innovations that will increase capacity and performance, while providing solutions for cost-sensitive applications.”

Chris Red, principal of Composites Forecasts and Consulting LLC (Gilbert, Ariz.), and industry consultant Tony Roberts of AJR Consultant (Lake Elsinore, Calif.) were on hand again, joined this year by David Service, CEO of Bluestar Fibres Co. Ltd. (Grimsby, U.K.). Red, as always, delivered a wealth of information and data on market demand, and Roberts discussed the flip side of fiber capacity. Service offered insight into the critical link in the supply chain — fiber precursor.

Carbon fiber supply

On the supply side, there have been several new entrants since the 2010 conference, including Hyosung (Gyeonggi-do, South Korea), that are on course to manufacture 8,000 metric tonnes (17.637 million lb) by 2020, estimates Roberts. SABIC Innovative Plastics (Riyadh, Saudi Arabia), he believes, will produce 5,000 metric tonnes (>11 million lb) by that same date, in Saudi Arabia and Italy, through its partnership with Montefibre SpA (Milan, Italy). He also called out Turkish manufacturer AKSACA Carbon Fibers (Istanbul, Turkey), which recently formalized a joint venture with The Dow Chemical Co.’s (Midland, Mich.) European entity on Dec. 20, 2011, to commercialize carbon fiber products worldwide. Also new is a Toray Industries Inc. (Tokyo, Japan) line in South Korea; a Moses Lake, Wash., facility opened by SGL Carbon SE (Wiesbaden, Germany); Alabuga Fibre LLC (Tartarstan, Russia), which produces 1,500 metric tonnes (>3.3 million lb); and, he believes, an Iranian plant of unknown capacity. According to Roberts, “Every country wants a carbon fiber plant,” and more announcements will come from South Korea and South America before year’s end.

Roberts also reported that 18 companies in China claim to produce polyacrylonitrile (PAN) with a combined nameplate (maximum) capacity of 9,200 tonnes (nearly 20.3 million lb). Plants range, in theory, from 30 to 1,500 metric tonnes (66,140 to 3.3 million lb). Yet sources inside China say actual production is between 500 and 1,000 metric tonnes (1.1 million and 2.2 million lb). To address the glaring discrepancy, Roberts compared the reported 2010 market demand for carbon in China (9,785 metric tonnes/21.572 million lb) against reported imports of carbon fiber into that country (8,737 metric tonnes/19.262 million lb). The comparison of imports to demand shows that internal production is not yet meaningful. “The Chinese are currently working on improving the quality and performance of their fiber,” he stated.

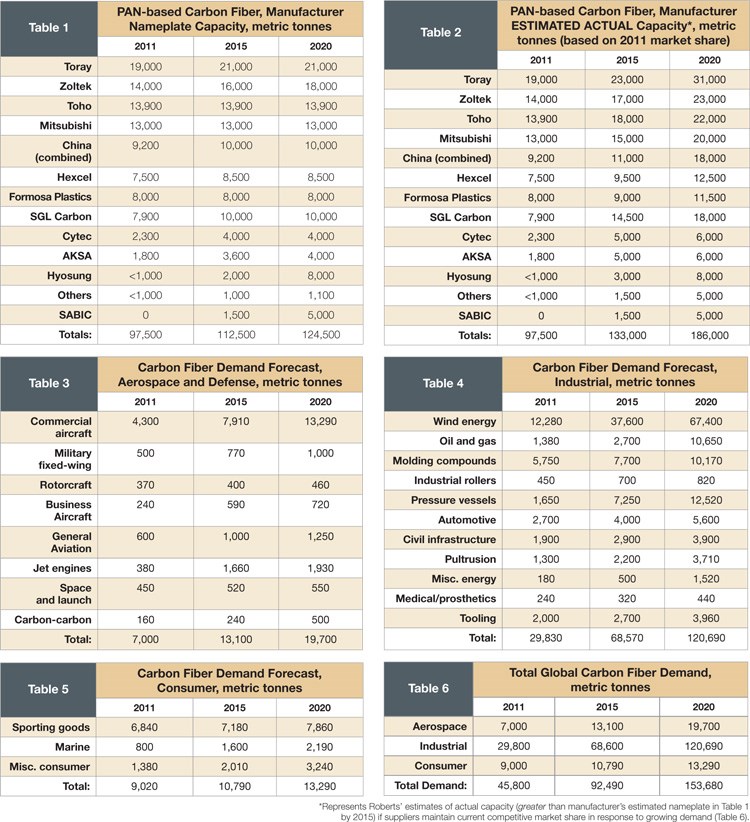

Roberts’ data (Table 1) show PAN-based carbon fiber nameplate capacities. Actual output varies from 60 to 70 percent of nameplate numbers because the process efficiency is dependent on fiber size (the lowest efficiency/greatest knockdown occurs for the smallest fiber sizes). This year Roberts did not break out small-tow and large-tow quantities because, in his view, producers will shift to more large tow to meet industrial demand. And he points to Mitsubishi Rayon Co. Ltd.’s (MRC, Tokyo) new P330-series 60K fiber as “changing the goal posts” for large-tow fiber. “Small-tow dominance is fading. The new large-tow MRC fiber sets a new industrial fiber standard in terms of performance.”

Finally Roberts believes that given predicted demand, fiber manufacturers will actually have to produce more than their stated nameplate quantities over the next decade, as reflected in Table 2. In fact, in comparison to Red’s demand figures (to come), Roberts thinks demand will exceed capacity as soon as 2015, if growth remains robust.

One way of bolstering fiber supply to meet coming demand could come via recycling efforts. Jim Stike, CEO of Materials Innovation Technologies (MIT, Fletcher, N.C.), presented a paper on his company’s progress in making carbon fiber recycling profitable. His firm has developed a range of products that incorporate recycled fibers, from mats to slurry-molded custom shapes. Stike’s customers include Trek Bicycle (Waterloo, Wis.).

Carbon fiber demand

Red’s theme for the demand side of the equation was “an industry evolving into high-volume processing.” As this implies, he believes the key to further market expansion — he predicts 235 percent growth by 2020 — is continued development of high-rate manufacturing methods. Beginning with the aerospace and defense markets (Table 3), Red sees a trend toward greater composites use, with carbon composites becoming the predominant aircraft structural material. He expects that jet aircraft engines, turbofans and turbojets, will provide strong opportunities for composites, particularly in the engine hot sections. “There’s a carbon/ceramic material coming that will be adopted for engine structure,” he revealed. He also cites more use of automated manufacturing in engine components for growing adoption. Space vehicles (orbital and launch) is another key market for big growth over the next decade, in Red’s view.

Once again, Red’s data clearly identified the wind turbine blade sector as the largest industrial consumer of carbon, and once again, Red predicted that wind energy will continue to grow significantly and wind farm refurbishment will provide a huge opportunity. As he did past conferences, Roberts disagreed, cautioning that the massive wind developments seen recently in China will slow due to grid connectivity issues. However, a presentation by Dr. Nirav Patel (GE Energy – Advanced Sourcing Engineering, Greenville, S.C.), seemed to support Red’s view (see an article on the subject, writtien by Dr. Patel, by clicking on "What is carbon fiber's place ...." under Editor's Picks," at top right). GE Energy is increasing carbon fiber use, not only in blades but in other business areas. Patel said 24K or greater standard-modulus carbon fiber will form primary structures of 1,600 next-generation 48.7m/160-ft blades for its new 1.6-100 turbines. He also claims that in 2012 alone, GE Energy expects to consume ~3,000 metric tonnes (~6.6 million lb) of carbon fiber.

Red is less enthusiastic than some about the adoption of carbon composites in cars: “It will be another decade before we see massive adoption of composites in automotive.” Representatives from Oak Ridge National Laboratory (ORNL, Oak Ridge, Tenn.) were more optimistic, in a preconference seminar on low-cost carbon fiber for the automotive market. ORNL is actively involved in several partnerships, including one with Dow, to explore the market for automotive carbon fiber made from alternative precursors, including lignin, olefin and polyethylene. And recent announcements of partnerships between carmakers and carbon producers portend an upsurge in automotive composites: General Motors (Detroit, Mich.) recently teamed with TEIJIN ARAMID BV (Tokyo, Japan) to push a part-per-minute process for carbon-fiber car parts, and a BMW and SGL Technologies GmbH (Wiesbaden, Germany) joint venture is already producing carbon fiber for two of BMW’s forthcoming battery-powered BMW electric commuter cars (see “SGL Automotive ...." under "Editor's Picks," at top right).

Red forecasts that aerospace demand (Table 3) will increase by 180 percent during the next decade, with 95 percent of that fiber delivered as unidirectional or woven prepregs. For industrial components (Table 4), he predicts 310 percent growth, with energy applications dominating the space. Consumer applications (Table 5), a more mature market, will grow a mere 47 percent in the next 10 years. By 2020, says Red, industrial uses will dwarf all others, with wind energy, by far, the largest in that space.

Is there enough precursor?

The final presenter, Service, painted a less rosy picture of the coming decade. After he explained the fiber production process, including the various precursor solvent technologies employed, he reiterated Roberts’ and Red’s predictions that carbon fiber sales will increase to 80,000 or 90,000 metric tonnes (176.4 million to 198.4 million lb) by 2015, with major growth in the industrial sector. But he warned that because 2.2 lb of precursor is required to make 1 lb of carbon fiber, nearly 300,000 metric tonnes (661.4 million lb) would be required in 2015, almost double the output of 2011. Although global acrylonitrile production per year is 6 million metric tonnes (13.227 billion lb), the chemical is a necessary feedstock for many products. Further, its cost is steep, currently between $1,500 and $3,000 per metric tonne, which directly affects precursor cost. He estimates that it will take about $30 million to build a plant capable of 1,000 metric tonnes (2.2 million lb) of PAN precursor annually, and he’s unaware of any near-term plans for big new facilities or plant expansions. Given these precursor, realities, Service estimates that the per-pound cost is now $10.90, up 32 percent compared to 2001.

So ... on to maturity, or a return to cyclical downturns for lack of capacity? That question has been asked every year for decades, Roberts points out. Greater use of carbon fiber now appears inevitable. How that demand will be met is unclear, but emerging fiber producers, fiber recycling efforts and fibers from alternative precursors might yet and forever smooth the ups and downs of the industry.

Related Content

Composites end markets: New space (2025)

Composite materials — with their unmatched strength-to-weight ratio, durability in extreme environments and design versatility — are at the heart of innovations in satellites, propulsion systems and lunar exploration vehicles, propelling the space economy toward a $1.8 trillion future.

Read MorePrepreg compression molding supports higher-rate propeller manufacturing

To meet increasing UAV market demands, Mejzlik Propellers has added a higher-rate compression molding line to its custom CFRP propeller capabilities.

Read MoreWelding is not bonding

Discussion of the issues in our understanding of thermoplastic composite welded structures and certification of the latest materials and welding technologies for future airframes.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreRead Next

What is carbon fiber's place in wind energy systems?

CW Conferences director Scott Stephenson shares insights fro the recent 2011 Carbon Fiber conference (Dec. 5-7, 2011, in Washington, D.C.) presented by Nirav Patel, senior lead engineer of GE Energy-Manufacturing Technology (Greenville, S.C.).

Read MoreNext-gen fan blades: Hybrid twin RTM, printed sensors, laser shock disassembly

MORPHO project demonstrates blade with 20% faster RTM cure cycle, uses AI-based monitoring for improved maintenance/life cycle management and proves laser shock disassembly for recycling.

Read MoreScaling up, optimizing the flax fiber composite camper

Greenlander’s Sherpa RV cab, which is largely constructed from flax fiber/bio-epoxy sandwich panels, nears commercial production readiness and next-generation scale-up.

Read More