Airbus reports solid Q1 2022 results, forecasts 720 commercial aircraft deliveries by end of year

Reflects solid performance across commercial aircraft, helicopter and defense businesses with 142 aircraft delivered in Q1, with developing activities for A321XLR, A320 Family and A400M.

Photo Credit: Getty Images

Airbus SE (Amsterdam, Netherlands) has reported consolidated financial results for its first quarter (Q1) ending March 31, 2022, as well as forecasted totals for 2022.

“These Q1 results reflect a solid performance across our commercial aircraft, helicopter and defense businesses. Our 2022 guidance is unchanged, even though the risk profile for the rest of the year has become more challenging due to the complex geopolitical and economic environment,” Guillaume Faury, Airbus chief executive officer (CEO), says. “Looking beyond 2022, we see continuing strong growth in commercial aircraft demand driven by the A320 Family. As a result we are now working with our industry partners to increase A320 Family production rates further to 75 aircraft a month in 2025. This ramp-up will benefit the aerospace industry’s global value chain.”

Gross commercial aircraft orders increased to 253 (Q1 2021: 39 aircraft) with net orders of 83 aircraft after cancellations (Q1 2021: -61 aircraft). The order backlog amounted to 7,023 commercial aircraft on March 31, 2022. Airbus Helicopters booked 56 net orders (Q1 2021: 40 units) and was awarded a contract for the Tiger MkIII attack helicopter upgrade program. Airbus Defence and Space’s order intake by value increased to €3.2 billion (Q1 2021: €2.0 billion), corresponding to a book-to-bill ratio of around 1.3. Included is the Eurodrone global contract signed in Feb. 2022, covering the development and manufacturing of 20 systems and five years of initial in-service support for Germany, France, Italy and Spain.

Consolidated revenues increased 15% to €12.0 billion (Q1 2021: €10.5 billion), mainly reflecting the higher number of commercial aircraft deliveries and a favorable mix. A total of 142 commercial aircraft were delivered (Q1 2021: 125 aircraft), comprising 11 A220s, 109 A320 Family, six A330s and 16 A350s. The financial results reflect 140 commercial aircraft deliveries after the reduction of two aircraft previously recorded as sold in Dec. 2021 for which a transfer was not possible due to international sanctions. Revenues generated by Airbus’ commercial aircraft activities increased 17%, mainly reflecting the higher deliveries and favorable mix. Airbus Helicopters delivered 39 units (Q1 2021: 39 units), with revenues rising 7% mainly reflecting growth in services and a favorable mix in program. Revenues at Airbus Defence and Space increased 16%, mainly driven by the Military Aircraft business and following the Eurodrone contract signature. One A400M transport aircraft was delivered in Q1 2022.

Consolidated EBIT Adjusted is an alternative performance measure and key indicator capturing the underlying business margin by excluding material charges or profits caused by movements in provisions related to program, restructuring or foreign exchange impacts as well as capital gains/losses from the disposal and acquisition of businesses. According to Airbus, this increased to €1,263 million (Q1 2021: €694 million). It includes a non-recurring positive element of €0.4 billion related to the re-measurement of past service cost in the retirement obligations and also reflects efforts on competitiveness and the impact from cost containment. An amount of €-0.2 billion was recorded in Q1 2022 resulting from the impact of international sanctions against Russia.

EBIT Adjusted related to Airbus’ commercial aircraft activities increased to €1,065 million (Q1 2021: € 533 million), mainly reflecting higher deliveries as well as the efforts on competitiveness and the effect from cost containment. It also includes the non-recurring impact from retirement obligations, partly offset by the impact of international sanctions against Russia.

Commercial aircraft production for the A320 Family is progressing towards a monthly rate of 65 aircraft by summer 2023, in a complex environment Airbus says. Following an analysis of global customer demand as well as an assessment of the industrial ecosystem’s readiness, the company is now working with its suppliers and partners to enable monthly production rates of 75 in 2025. This production increase will benefit the entire global industrial value chain. Airbus will meet the higher production rates by increasing capacity at its existing industrial sites and growing the industrial footprint in Mobile, U.S., while investing to ensure that all commercial aircraft assembly sites are A321-capable.

Concerning the A321XLR, the company continues to work towards a first flight by the end of Q2 2022. Initially planned for the end of 2023, the entry-into-service is now expected to take place in early 2024 in order to meet certification requirements.

Airbus Helicopters’ EBIT Adjusted increased to €90 million (Q1 2021: €62 million), partly driven by growth in services and favorable mix in programs. It also reflects non-recurring elements, including the impact from retirement obligations.

EBIT Adjusted at Airbus Defence and Space was €106 million (Q1 2021: €59 million), mainly driven by military aircraft and following the Eurodrone contract signature. It also reflects the non-recurring impact from retirement obligations, partly offset by the consequences for the space business from the international sanctions against Russia.

On the A400M program, development activities continue toward achieving the revised capability roadmap. Retrofit activities are progressing in close alignment with the customer. Risks remain on the qualification of technical capabilities and associated costs, on aircraft operational reliability in particular with regard to power plant, on cost reductions and on securing export orders in time as per the revised baseline.

Consolidated self-financed R&D expenses totaled €586 million (Q1 2021: €620 million).

Consolidated EBIT (reported) amounted to €1,429 million (Q1 2021: €462 million), including net adjustments of €+166 million.

These adjustments comprised:

-

€ +190 million related to the dollar pre-delivery payment mismatch and balance sheet revaluation;

-

€ -11 million related to the A380 program;

-

€ -13 million of other costs including compliance.

The financial result was €166 million (Q1 2021: €59 million). It mainly reflects the positive net impact from the revaluation of certain equity investments, partially offset by the revaluation of financial instruments as well as the net interest result of €-76 million. Consolidated net income was €1,219 million (Q1 2021: €362 million) with consolidated reported earnings per share of €1.55 (Q1 2021: €0.46).

Consolidated free cash flow before M&A and customer financing was €213 million (Q1 2021: €1,202 million), reflecting the level of deliveries, competitiveness and the impact of cost containment, partly offset by an increase in working capital mainly driven by inventory. Consolidated free cash flow was €161 million (Q1 2021: €1,164 million).

On March 31, 2022, the gross cash position stood at €22.8 billion (year-end 2021: €22.7 billion) with a consolidated net cash position of €7.7 billion (year-end 2021: €7.7 billion). The company’s liquidity position remains strong, standing at €28.8 billion at the end of March 2022.

Outlook

Airbus says the guidance issued in Feb. 2022 remains unchanged. As the basis for its 2022 guidance (before M&A), the company assumes no further disruptions to the world economy, air traffic, the company’s internal operations and its ability to deliver products and services.

On this basis, Airbus targets to achieve in 2022 around:

- 720 commercial aircraft deliveries;

- EBIT Adjusted of €5.5 billion;

- Free Cash Flow before M&A and Customer Financing of €3.5 billion.

In addition, the U.S. Department of State has granted Airbus a nine-month extension of the duration of the Consent Agreement settling civil violations of the International Traffic in Arms Regulations (ITAR). Airbus initiated this request for an extension because it had to redirect internal Export Control resources to the tracking and implementation of recent export control restrictions and international sanctions against Russia and Belarus. The company does not expect the Consent Agreement extension to have an impact on the other agreements approved on Jan. 31, 2020 with the U.K., French and U.S. authorities.

Related Content

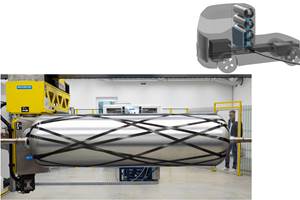

Materials & Processes: Fabrication methods

There are numerous methods for fabricating composite components. Selection of a method for a particular part, therefore, will depend on the materials, the part design and end-use or application. Here's a guide to selection.

Read MoreCarbon fiber in pressure vessels for hydrogen

The emerging H2 economy drives tank development for aircraft, ships and gas transport.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreCryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreRead Next

From the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;maxWidth=300;quality=90)