AFP/ATL evolution

A view of the trends in automated fiber placement and automated tape laying from inside the supply chain.

Web Industries Inc. (Marlborough, Mass.) is among the few composites industry suppliers situated at a critical focal point in the aerospace supply chain. The provider of slitting, cutting and winding services is responsible for formatting much of the thermoset- and thermoplastic-based carbon fiber tapes used in automated tape laying (ATL) and automated fiber placement (AFP) processes that produce some of the world’s largest and most important commercial aircraft structures.

Situated between the carbon fiber prepreg material manufacturer and the composite part manufacturer, the company occupies a front-row seat among the observers who assess the many trends now impacting the commercial aerospace manufacturing community.

Web Industries has developed composite converting processes for several high-profile aerospace programs, including the Boeing 787 and the Airbus A350 XWB. But the genesis of these programs, and the designs that came out of them, are now a decade or so in the past. Resin, fiber and manufacturing processes have matured significantly since then, putting pressure on suppliers to keep up. Rate production for the 787 and A350 XWB alone will demand significant increases in manufacturing speed and agility, and the materials now shipped by Web Industries must be optimized to meet that challenge. The upshot is that the job description of an aerospace supplier, today, is complex, and becoming more so by the day. HPC caught up with several Web Industries employee-owners to get their view of this fast-changing market.

Jim Powers, a business development manager in Web’s advanced composites group, notes that Web and other converters, composite material manufacturers and aircraft parts fabricators are all riding the same business and technology maturation curve. “As the markets and applications grow, suppliers are developing more specialized products for each application,” he says. “It’s no longer good enough to rely only on the process that landed you the legacy program.” This means adapting to changes in ATL/AFP equipment designs, tape and tow thickness requirements, new resin types, variations in impregnation levels, spread tows, out-of-autoclave (OOA) technologies and the application of thermoplastics, where the processing method might employ in situ heating/consolidation of the precision-slit tape at the spool head/tooling, via laser, gas or infrared technology. “Thermoplastics historically have been a challenge to automate because it’s a boardy, stiffer material,” he reports. “And it’s just not tacky.”

“There’s an awful lot of emphasis on smoothing things out and speeding things up,” adds Dan Ott, Web’s global strategic accounts manager, who notes that Boeing, Airbus and their suppliers have done much to bring their ATL/AFP processes to maturity. Fabricators, for a time, favored narrow tapes, Ott recalls, but points out, “These have given way to ‘design for manufacturing,’ meaning wider tapes and increased productivity.”

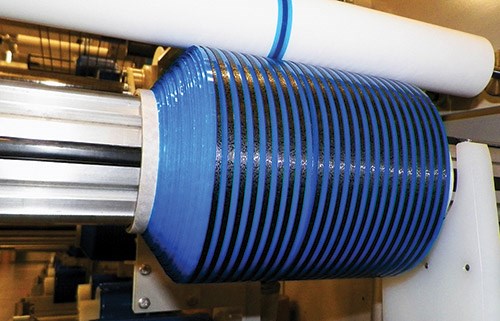

ATL/AFP heads must lay tape down faster, turn faster, accelerate faster and decelerate faster. This has forced changes in tape spool format and design. “Spools are experiencing much different forces than when we first got into these programs,” he says, adding that demands of newer ATL/AFP machines must be matched with designs for improved spool performance developed by Web.

Then there is the increase in resin variation. “There were only one or two or three basic materials in the early days,” argues Ott. “Today, areal weights range from less than 100 to more than 300 [g/m2]. That requires a greater range of capability from our technologies.” T.R. Dreyer, another business development manager in Web’s advanced composites group, also reports an increase in demand for high-heat polyimide and bismaleimide.

Aircraft wing manufacturing, in particular, is pushing increased tape width. Current demand, Ott says, is to scale up to spools with tapes 0.25 inch to 0.5 inch (/6.4 mm to 12.7 mm) wide. But beta programs are looking at tapes 0.75 inch to 1 inch (19 mm 25.4 mm) wide on the narrow end of the spectrum, to 1.25 inches to 1.5 inches (31.8 mm to 38.1 mm) on the wider end. “I don’t think the jury is settled on where this is going to end up,” he contends, but tape width and spool size will be key pieces in the puzzle.

Among the newest fiber tape formats is the placement of dry fiber tapes, created from wide rolls of woven materials that incorporate a thermoplastic binder, which Ott calls a “different animal.” “Sizing on dry fibers is limited and infusion is challenging,” he says. “It’s a very different approach than the processes we’re most familiar with.” Powers agrees, noting that dry fiber tends to fray more easily, which puts weave properties at risk.

Adding to this complex equation of fiber and resin variation is a host of emerging technologies and market concerns that are likely to impact ATL/AFP manufacturing. These include increased adoption of thermoplastics, foreign object detection requirements, new braid formats, compression molding and, says Powers, applications in oil and gas (carbon fiber/PEEK composites in piping). “Price targets in this market are different than aerospace but materials, consolidation and performance requirements are very similar,” he quips.

Phil Johnson, director of sales for Web’s advanced composites group, asks the eternal question that hangs over a company like Web Industries, and keeps it in business: “What is the next generation of manufacturing process for thermosets and thermoplastics, and what role can Web play in bringing that new technology to market?”

Related Content

The potential for thermoplastic composite nacelles

Collins Aerospace draws on global team, decades of experience to demonstrate large, curved AFP and welded structures for the next generation of aircraft.

Read MoreCombining multifunctional thermoplastic composites, additive manufacturing for next-gen airframe structures

The DOMMINIO project combines AFP with 3D printed gyroid cores, embedded SHM sensors and smart materials for induction-driven disassembly of parts at end of life.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreIndustrializing additive manufacturing in the defense/aerospace sector

GA-ASI demonstrates a path forward for the use of additive technologies for composite tooling, flight-qualified parts.

Read MoreRead Next

Ultrasonic welding for in-space manufacturing of CFRTP

Agile Ultrasonics and NASA trial robotic-compatible carbon fiber-reinforced thermoplastic ultrasonic welding technology for space structures.

Read MoreScaling up, optimizing the flax fiber composite camper

Greenlander’s Sherpa RV cab, which is largely constructed from flax fiber/bio-epoxy sandwich panels, nears commercial production readiness and next-generation scale-up.

Read MoreCeramic matrix composites: Faster, cheaper, higher temperature

New players proliferate, increasing CMC materials and manufacturing capacity, novel processes and automation to meet demand for higher part volumes and performance.

Read More