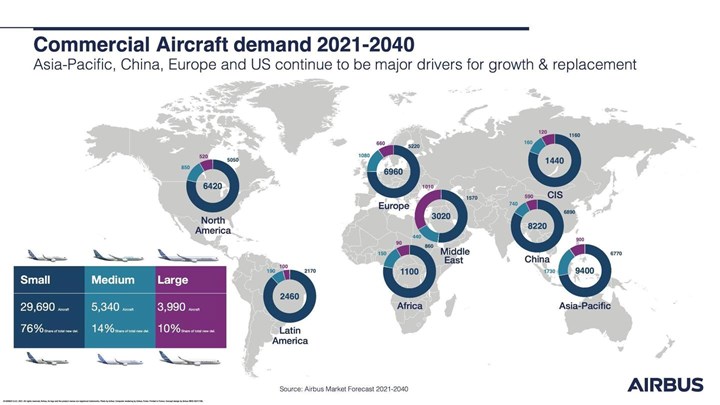

Airbus anticipates Asia-Pacific region will need more than 17,600 new aircraft by 2040

Air freight is set to more than double in the Asia-Pacific region by 2040, with 30% of the new passenger and freighter aircraft to replace older, less fuel-efficient models.

Airbus (Toulouse, France) has reported that within the next 20 years, passenger traffic growth of 5.3% per annum and accelerated retirement of older, less fuel-efficient aircraft will see the Asia-Pacific region require 17,620 new passenger and freighter aircraft. Nearly 30% of these will replace older, less fuel-efficient models.

“We are seeing a global recovery in air traffic and as travel restrictions are further eased the Asia-Pacific region will become one of its main drivers again. We are confident of a strong rebound in the region’s traffic and expect it to reach 2019 levels between 2023 and 2025,” says Christian Scherer, chief commercial officer and head of Airbus International. “With an ever greater focus on efficiency and sustainable aviation in the region, our products are especially well positioned.”

In a region which is home to 55% of the world’s population, China, India and emerging economies such as Vietnam and Indonesia will be the principal drivers of growth in the Asia-Pacific region. GDP will grow at 3.6% per year compared to the world average 2.5% and double in value by 2040, Airbus notes. The middle class, who are the likeliest to travel, will also increase by 1.1 billion to 3.2 billion and the propensity for people to travel is set to almost triple by 2040.

Of the demand for 17,620 aircraft, 13,660 are in the Small category like the A220 and A320 Family. In the medium- and long-range categories, Asia-Pacific will continue to drive demand with some 42% of global requirement. This translates to 2,470 Medium- and 1,490 Large-category aircraft.

Cargo traffic in Asia-Pacific will also increase at 3.6% per annum, well above the global 3.1% average and will lead to a doubling in air freight in the region by 2040. Globally, express freight boosted by e-commerce will grow at an even faster pace of 4.7% per year. Overall, reflecting that strong growth over the next 20 years, there will be a need for some 2,440 freighters, of which 880 will be newly build.

“Our modern portfolio offers a 20-25% fuel burn and CO2 advantage over older-generation aircraft and we pride ourselves that all our aircraft products are already certified to fly with a blend of 50% SAF, set to rise to 100% by 2030 [see “Declaration of Toulouse hails European commitment to decarbonize aviation”],” Scherer adds. “In addition, our newly launched A350F offers efficiency gains of 10-40% compared to any other large freighter, existing or expected, both in terms of fuel consumption and CO2 emissions. ”

Globally, in the next 20 years, Airbus predicts that there will be a need for some 39,000 newly build passenger and freighter aircraft, of which 15,250 will be for replacement. As a result, by 2040 the vast majority of commercial aircraft in operation will be the latest generation, up from some 13% today, considerably improving the CO2 efficiency of the world’s commercial aircraft fleets.

Airbus reports the global aviation industry has already achieved large efficiency gains, as shown by the 53% decline in aviation’s CO2 emissions per revenue passenger kilometer since 1990. Airbus’ product range reportedly supports at least a 20% CO2 efficiency gain over previous-generation aircraft. In view of further ongoing innovations, product developments, operational improvements, as well as market-based options, Airbus has a clear ambition to achieve the air transport sector’s target to reach net-zero carbon emissions by 2050.

Related Content

PEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreThe state of recycled carbon fiber

As the need for carbon fiber rises, can recycling fill the gap?

Read MoreCarbon fiber in pressure vessels for hydrogen

The emerging H2 economy drives tank development for aircraft, ships and gas transport.

Read MoreA new era for ceramic matrix composites

CMC is expanding, with new fiber production in Europe, faster processes and higher temperature materials enabling applications for industry, hypersonics and New Space.

Read MoreRead Next

Airbus C295 technology demonstrator makes maiden flight, proves novel design, manufacturing processes

C295 Flight Test Bed 2 (FTB2) tests OOA composite semi-morphing wing, flaps and flap tabs, as well as SatCom antenna for future turboprop aircraft.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More