German composites industry group reports on thermoplastics pre-JEC

I and other members of the CompositesWorld team are preparing for our annual trek to Europe for the JEC World trade show event. A new AVK report came across the desk, with some information about thermoplastic composites in Europe, just in time.

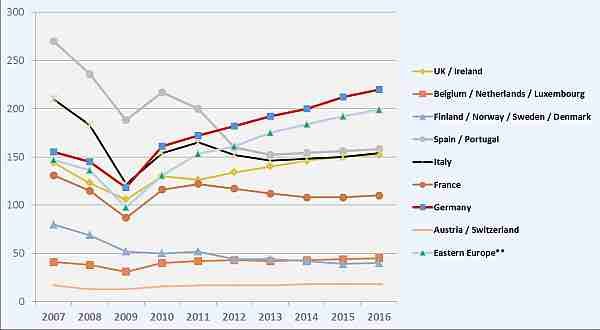

Figure 1 from AVK's recent thermoplastic market report

I and other members of the CompositesWorld team are preparing for our annual trek to Europe for the JEC World trade show event. Each year, we try to make the most of the travel and visit composites fabricator companies or supplier facilities, to stay in touch with European sources and new applications. And, the JEC event always affords an opportunity to meet and reconnect with industry friends, from around the globe. So it was serendipitous timing that a report from Germany’s AVK – Industrievereinigung Verstärkte Kunststoffe e. V. (Frankfurt, Germany), that country’s oldest industry group representing plastics and composites, came across the desk, with some information about thermoplastic composites in Europe.

According to the AVK report, the European market for fiber-reinforced plastics and composites has been growing steadily for a number of years now, based on the group’s 2016 market report. But, there are differences depending on market segment. Growth rates differ, sometimes substantially, from one region or country to another and also with regard to manufacturing processes. Some segments are even in decline.

Where regions are concerned, strong growth has been especially noticeable in the German market in recent years. Germany’s market share in the biggest composites segment – glass-fiber reinforced plastics (GRP) – was around 13% in 2007, and by 2016 it had reached 20% (see Fig. 1, above, showing GRP production in kilotonnes on the vertical axis). Other regions and countries have experienced losses in market shares.

These differences, says AVK, can be explained by major variations in the predominant use of composites in each country. For example, in countries where most of the volume has always been taken up – and continues to be taken up – by state-subsidized infrastructure projects, there has been a far greater impact from cost pressure and negative economic developments, compared to regions where composites are largely applied in sectors that have recovered more quickly from the economic crisis. In Germany, for instance, large volumes of composites have been flowing into research and development, transport and the electrical and electronics industries.

Funds for research and development, particularly in the mobility sector, have increased greatly in recent years, due to growing efforts to achieve lightweight construction. This has been of special benefit to the German market with its characteristic focal areas and state subsidies, says AVK.

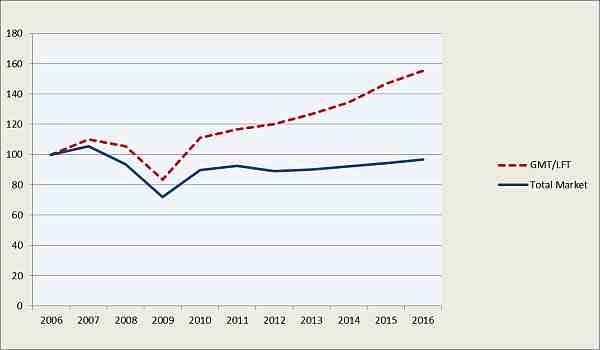

Figure 2

Another factor supporting this positive trend is an increased interest in thermoplastic composites systems. In recent years above-average growth has been noticeable both in long-fiber and continuous fiber-reinforced composites (LFT/GMT, see Fig. 2 comparing development of GMT/LFT with total market value; numbers above 100% show growth, numbers below 100% mean market shrinkage).

Due to the specific qualities of those material systems and especially their benefits in serial manufacturing, it is often believed that thermoplastic composites are beacons of hope, says the report, making it possible to move more vigorously into new areas of application, especially large-scale production and structural market segments.

For quite a while now – since 2000 – many AVK members have collaborated within a special workgroup on thermoplastic composites. The EATC (European Alliance for Thermoplastic Composites) comprises more than 20 companies and institutions, and is considered an “expert task force” of the AVK. Its activities include a regular seminar on the subject of thermoplastic Composites, which was recently held on March 2 in Weasel.

Also, nearly two years ago, several well-known raw material manufacturers formed an alliance under the umbrella of the AVK and decided to conduct a long-term project. Its purpose is to establish the more widespread use of continuous fibre-reinforced thermoplastics in the automotive industry. The project group is continually in touch with numerous OEMs, seeking to generate specific results that will eventually benefit the entire market. The first phase of this project was concluded recently, when the project group also decided to continue its work. A further roadshow on the subject has been scheduled for this summer, with a presentation of the latest results.

Take a look at the EATC’s web site, which has an interactive graphic at the “Automotive Applications” page (here’s the link: http://www.eatc-online.org/?page_id=11). At first glance, it looks completely blank. But, click on one of the automotive OEMs along the left side, and you’ll see that automaker’s parts, for each model, and what material is being used. A basic quick look at how many European OEM are incorporating composites, and in how many models.

CW will continue to keep tabs on the AVK’s market information, and we’ll of course report back on what we learn at the JEC World event — which will be heavily focused on composites’ inroads into mobility markets. Come visit us at our booth/stand in Hall 5, C75.

Related Content

Plant tour: Teijin Carbon America Inc., Greenwood, S.C., U.S.

In 2018, Teijin broke ground on a facility that is reportedly the largest capacity carbon fiber line currently in existence. The line has been fully functional for nearly two years and has plenty of room for expansion.

Read MoreComposites end markets: New space (2025)

Composite materials — with their unmatched strength-to-weight ratio, durability in extreme environments and design versatility — are at the heart of innovations in satellites, propulsion systems and lunar exploration vehicles, propelling the space economy toward a $1.8 trillion future.

Read MorePlant tour: Airbus, Illescas, Spain

Airbus’ Illescas facility, featuring highly automated composites processes for the A350 lower wing cover and one-piece Section 19 fuselage barrels, works toward production ramp-ups and next-generation aircraft.

Read MoreOtto Aviation launches Phantom 3500 business jet with all-composite airframe from Leonardo

Promising 60% less fuel burn and 90% less emissions using SAF, the super-laminar flow design with windowless fuselage will be built using RTM in Florida facility with certification slated for 2030.

Read MoreRead Next

Thermoplastic composite materials and processing interactions

Selection of product material formats and their interactions with various process methods heavily influence a final TPC part’s properties and fabrication options.

Read MoreCutting engine weight via thermoplastic composite guide vanes

Greene Tweed replaces metal stator vanes with its DLF material co-molded with a metal leading edge that meets performance, cost and high-rate production targets while cutting 4 kg per engine.

Read MoreFrom PMCs to sandwich composites: Tracing the path of test method standardization

Over the decades, progression of PMC and sandwich composite test method development and standardization has been shaped by the requirements of the composites industry.

Read More