Speaking Out: U.S. must correct export control inequities

As those who manufacture composites for military systems know, the U.S. government’s export control policy is sorely in need of revision. Our Cold War-era export control system, disjointed trade promotion agenda and restrictive visa policies are complicated, outdated and counterproductive. They no longer effectively

As those who manufacture composites for military systems know, the U.S. government’s export control policy is sorely in need of revision. Our Cold War-era export control system, disjointed trade promotion agenda and restrictive visa policies are complicated, outdated and counterproductive. They no longer effectively fulfill their core purpose, which is to promote legitimate trade with foreign customers, strengthen the defense industrial base and ensure the security of our allies. In many cases, as the following examples illustrate, we are our own worst enemy. We must have the courage to acknowledge these problems and take corrective action.

Currently, the U.S. export control system is bifurcated. The export of munitions is administered by the Department of State under the International Trafficking in Arms Regulations (ITAR). The export of “dual use” (military and nonmilitary) items is administered by the Department of Commerce under the Export Administration Regulations (EAR). Additionally, the Departments of Defense, Treasury and Homeland Security have advisory and enforcement roles. With so many “cooks in the kitchen,” it is no wonder that our export control system is one of the most complicated and confusing on earth. One of the overriding themes found in many Government Accounting Office (GAO) export policy control reports over the years is the lack of communication and agreement among the agencies of jurisdiction. A perfect example of this is the treatment of civil aircraft parts. Under current practice and law, civil aircraft manufacturers are not certain if they are regulated under the ITAR or the EAR. Further, the Departments of State and Commerce are currently at odds regarding the jurisdiction of these items. Because the agencies of jurisdiction don’t agree, it is easy to understand why the aerospace industry lacks clarity and direction on this subject.

Many of these policies have not been updated since the end of the Cold War, despite several legislative efforts in Congress and new threats to our national security that have emerged over the past 15 years. Other member countries in the international export control regimes, however, have adjusted their policies in line with their individual worldviews — worldviews that often are not in line with U.S. policy. As a result, U.S. companies are denied export opportunities, which are readily exploited by companies from the other member states. This negatively affects U.S. national security concerns and the defense industrial base. This also makes U.S. firms unreliable suppliers.

The U.S. government must establish a targeted, focused export control policy that clearly defines national security and foreign policy priorities. To be effective, that policy must target products that truly enhance the military might of countries or persons of concern, yet also must facilitate the interoperability of our security partners, such as the coalition forces in Afghanistan and Iraq.

I have repeatedly heard from our closest allies that U.S. export controls harm their military readiness and their ability to participate in joint missions in theater. One truly illustrative statement was made in a July 2006 speech to U.S. congressional staff by British Major General Gilchrist, who, for nine months, was the deputy commanding general of Operation Enduring Freedom in Afghanistan. “From a soldier’s perspective,” said Gilchrist, “U.S. export controls are seen as overly bureaucratic, only serving to delay the transfer of vital information necessary to support and protect our troops. It seems bizarre that we can, in fact, exchange secret operational information and top-secret intelligence more easily than we can exchange unclassified technical information, which is export-controlled.”

Although the trend at the U.S. Department of Defense (DoD) is to procure more and more of its defense articles from foreign manufacturers, foreign militaries are purchasing less from American manufacturers, in part because their governments do not want to be encumbered by the extraterritorial constraints imposed by U.S. export controls. In fact, a senior member of my staff was advised recently by a highly ranked British official that Great Britain’s equivalent to the Future Combat Systems — the Future Rapid Effect System (FRES) program — requires that participating firms not have parts and components sourced from the U.S. If an American firm wishes to participate, it will have to create its entire product on foreign soil to avoid U.S. regulations. Meanwhile, foreign competitors are advertising that they are “ITAR-free” as a competitive marketing advantage when bidding against U.S. competitors for contracts. How’s that for promoting U.S. exports?

Our overly broad controls may cost the U.S. its superiority in the production of key technologies. This loss of leadership could irreparably damage the U.S. defense industrial base and pose a permanent threat to our national security. We could find ourselves in a position where we are forced to rely on foreign firms for our most basic defense technologies and supplies.

According to a Reuters article entitled, “Pentagon to study if export controls keep firms out,” (authored by Andrea Shalal-Esa; dated March 6, 2007), the DoD is concerned that current export control policies keep nontraditional contractors out of the defense market. This concern stems from a report prepared for Bill Greenwalt, Deputy Undersecretary of Defense for Industrial Policy, by the Institute for Defense Analyses (Alexandria, Va.). The report notes industry concern over the long wait times for approval of export licenses, but it also points out, in Greenwalt’s words, that potential defense contractors “don’t want to do business with [the Department of Defense] for fear that their products will become ITAR-controlled and therefore they will not be able to go out on the marketplace.”

That’s easy to understand. When thinking of items that are sold to DoD and controlled as munitions, one envisions guns, tanks, airplanes and submarines. But ITAR control extends to nuts, bolts, brackets and even adhesives if they are originally designed or modified for military end use. While many, if not all, of these items can serve a dual purpose, are they truly a matter of national security? When we restrict the export of these items for military purposes, it ends up hurting our commercial exports as well.

This is especially injurious because of unilateral implementation. Restrictions on U.S. firms for foreign policy purposes far exceed the restrictions placed on firms in any other country. While anecdotes abound regarding the loss of contracting opportunities for U.S. firms, hard data is difficult to come by. But consider the trends in high-technology goods, the leading U.S. export. In 2000, high-tech exports were 28 percent of our total exports, in 2003 they were 23.6 percent, but in 2006 they were only 21.2 percent. While many other factors contribute to this overall trend, unnecessary regulatory constraints — restraints not faced by multinational compe-titors — play a role.

A large aerospace company that has a presence in the district I represent has more than 70 engineers dedicated to reviewing original design intent for aircraft parts to prove the items are indeed for civil application and were not designed or modified for military application. I wonder how many HPC readers work for companies that are in the same boat — using engineers for compliance purposes rather than producing innovative new composites technologies.

I understand that some com-posites companies now participate in a Department of Commerce Composites Technical Working Group, which has become a great example of industry/government collaboration for better regulation and compliance. I am delighted to hear that composites manufacturers are taking a proactive approach to better government. Rather than sitting back and complaining, you are engaging with regulators to explain the practical impact of controlling composite materials as your technology evolves. I’d like to see this collaborative process replicated across other industries.

I am doing something very similar on Capitol Hill with my colleagues Joe Crowley and Earl Blumenauer. We have formed the Congressional Export Control Working Group. Our purpose is to bring Congress, the Administration, the regulated community and allied nations toge-ther for policy discussions. We ed-ucate interested members of Congress and their staffs (more than 40 offices to date) about the importance of good controls to the competitiveness of firms in their districts. Much of the focus is on promoting good governance.

The working group has hosted four events and is in the process of developing a fifth. The meetings now will focus on engaging members of Congress and staff, principal administrators, and foreign govern-ments in high-level policy discus-sions focused on streamlining the current system. Your input is wel-come regarding additional topical discussions that aid in providing clarity and predictability to the U.S. export control regime.

One significant way that composites manufacturers can contribute to this endeavor is by making your elected officials aware of your significant positions as employers and revenue generators within their districts. Invite them into your plants. Acquaint them with your products and the competitive challenges you face in the global marketplace. They need to know how export control policies affect their constituents.

It is your voices — much more than mine — that ultimately will turn the tide.

Related Content

CAMX 2022 exhibit preview: Conductive Composites

Conductive Composites expands its portfolio of multifunctional electrically conductive composite materials with a new line of NiShield nonwovens and NiBond electrically conductive two-part structural epoxy adhesive.

Read MoreMaterials & Processes: Fabrication methods

There are numerous methods for fabricating composite components. Selection of a method for a particular part, therefore, will depend on the materials, the part design and end-use or application. Here's a guide to selection.

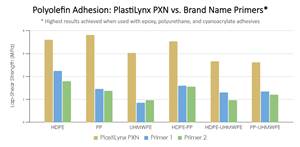

Read MoreXlynX’s PlastiLynx PXN crosslinking primer enhances polymer adhesion

PFAS-free diazirine primer makes surfaces receptive to all manner of adhesives, including epoxies and polyurethanes, outperforming alternative options by 150-350%.

Read MoreScott Bader acquires Satyen Polymers, enhances commitment to Indian customers

Under the agreement, India-based Scott Bader Pvt. Ltd. will assume responsibilities for direct sales and marketing for all resin and gelcoat products, bring composites and adhesives to Indian market.

Read MoreRead Next

Composites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read More

.jpg;maxWidth=300;quality=90)