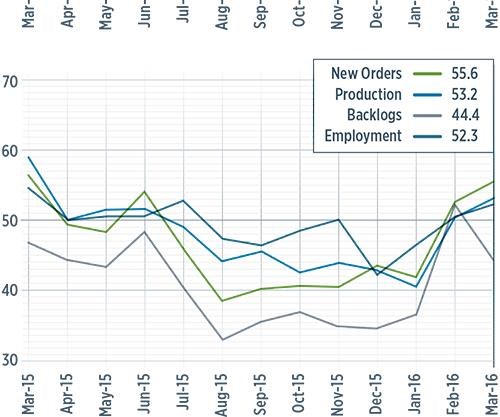

Gardner Business Index at 50.0 in March

New orders and production are up. Capital spending plans foreshadow equipment investments.

With a reading of 50.0, the Gardner Business Index showed that conditions in the composites industry were largely unchanged in March from February. Prior to February, the industry had seen a period of contraction from July 2015 through January 2016.

New orders and production increased in March for the second month in a row. And both subindices grew at a faster rate in March than they had in February. As March closed out, new orders, generally, had increased more than production in recent months. Although the backlog subindex expanded for the first time since December 2014 in February, it fell back into contraction in March. But the rate of contraction was significantly slower than that seen in the second half of 2015. The employment subindex, in March, increased for the second month in a row and the third time in five months. Exports continued to contract because of the strength of the US dollar. However, the rate of contraction, when March survey results were in, had slowed steadily in recent months. Supplier deliveries shortened at the fastest rate since the Index began in December 2011. This indicated increasing slack in the supply chain.

Materials prices increased for the second month in a row in March. Although this subindex rebounded sharply, it was still relatively low compared with the levels seen during the course of the past three years. Prices received decreased in March for the sixth month in a row, but the rate of decrease decelerated for the second month in a row. The future business expectations subindex improved modestly after a significant increase in February.

Larger composites manufacturing facilities struggled for the second month in a row in March. Plants with more than 250 employees contracted for the fourth straight month, although the rate of contraction had slowed each of the previous three months. Facilities with 100-249 employees contracted for the first time since November 2015. Companies with 50-99 employees grew for the second month in a row. Conditions at these companies, in March, had improved notably since November. Companies with 20-49 employees expanded at a very strong rate for the second month in a row. In fact, February and March were the strongest months of growth for this fabricator category since March 2015. Composites fabricators, generally, fell back into contraction after expanding the previous month.

By the end of March, the aerospace industry had expanded four of the previous six months. The growth in February and March was very strong, with the industry growing at its fastest rate in March since May 2012. Although the aerospace industry had performed well for composites fabricators recently, the automotive industry showed signs that it was struggling. In March, the automotive subindex contracted for the fifth month in a row.

Future capital spending plans in March increased 37% compared with one year ago. This was the first month-over-month increase in spending plans since August 2015. The annual rate of change continued to contract at a significant rate, but the rate of contraction did slow from the figure logged in February. This could indicate the early stages of a recovery in capital equipment spending.

Related Content

Materials & Processes: Fibers for composites

The structural properties of composite materials are derived primarily from the fiber reinforcement. Fiber types, their manufacture, their uses and the end-market applications in which they find most use are described.

Read MoreJEC World 2022, Part 1: Highlights in sustainable, digital, industrialized composites

JEC World 2022 offered numerous new developments in composites materials, processes and applications, according to CW senior editor, Ginger Gardiner, most targeting improved sustainability for wider applications.

Read MoreForvia brand Faurecia exhibits XL CGH2 tank, cryogenic LH2 storage solution for heavy-duty trucks

Part of its full hydrogen solutions portfolio at IAA Transportation 2022, Faurecia also highlighted sustainable thermoplastic tanks and smart tanks for better safety via structural integrity monitoring.

Read MoreMaterials & Processes: Fabrication methods

There are numerous methods for fabricating composite components. Selection of a method for a particular part, therefore, will depend on the materials, the part design and end-use or application. Here's a guide to selection.

Read MoreRead Next

Composites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read More

.JPG;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)