Would you like carbon fiber with that car?

The challenge for composites use to grow in the automotive industry is making the advantages of autocomposites appealing not only to OEMs, but to car consumers.

My (immediate) family owns four cars. The oldest was manufactured in 2004. The youngest was manufactured in 2010. Three of them are hovering at or near 250,000 miles. Each of our cars, given its age and rate of use, is in decent if not great condition, but several are clearly near the end of their lives. When that end comes, the Sloan family will be in the market for a new vehicle.

Because our youngest vehicle is nine years old (and in possession of son #2), our exposure to new vehicles and new-vehicle technology is limited. That said, whenever I rent a vehicle during my travels, I appreciate the opportunity to assess makes, models, styles, comfort and features. These extended test drives give me a chance to evaluate everything from power to handling to sound system quality. Because of this, I have, over the years, become sensitive to the rate of vehicle feature evolution.

Sound systems, for example, have morphed quickly from glorified radios and CD players to high-fidelity sound and video systems that seamlessly meld with our phones to provide a host of directional, music, podcast and communication options. Safety systems also have enjoyed rapid evolution, with a proliferation of airbags designed to provide passenger protection from nearly any impact.

Conversely, some aspects of vehicle technology have evolved more slowly. For example, materials use in the cars I typically rent are substantially unchanged. And overall fuel efficiency, although improving, is not where I had hoped/thought it would be as we prepare to enter the third decade of the 21st century.

All of this (and more) came to mind in January when I visited the North American International Auto Show (NAIAS) in Detroit, where the latest in vehicle technology is poked and prodded. I usually come to this show with the intent of assessing how obviously composites are being integrated into new vehicles. But as I roamed the floor and drifted from vehicle to vehicle, seeing very few composites, I was struck by something.

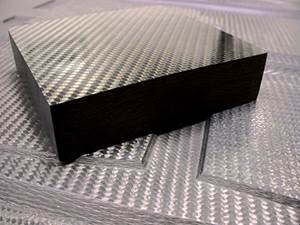

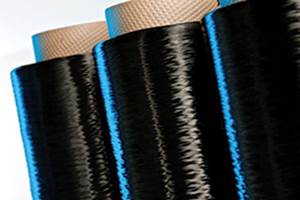

The big advantage of composites for automotive use — particularly carbon fiber — is weight savings, which engenders better fuel efficiency and reduced emissions. But in looking at the vehicles on exhibit in Detroit, and in looking at any marketing for any vehicle, reduced vehicle weight or reduced emissions are rarely if ever selling points. Nowhere at the auto show did I see a sign declaring, “Now with carbon fiber to increase efficiency!” or “Reduce your CO2 footprint with this lightweight beauty!” Even fuel efficiency often gets short shrift.

This is not to say that there were no composites at the show. They could be found, usually on high-end cars and usually with attention-getting clearcoat finish, in spoilers, wheels and side view mirrors. But even the largest carbon fiber structure at the show, the CarbonPro bed of the GMC Sierra Denali pickup truck, was found not on the exhibit hall floor, but in the hallway in the booth of Continental Structural Plastics, which makes the bed. On top of all of that, the two carmakers that have been the most aggressive in developing autocomposites, BMW and Audi, did not exhibit at NAIAS this year.

The composites industry faces a difficult challenge within the automotive industry: There are many arguments to be made to automotive OEMs in favor of composites use in cars and trucks, but there are very few arguments that can be made to car buyers in favor of composites use in cars and trucks. The features that draw consumers to a given vehicle are often aesthetic and tactile — designed to drive an emotional appeal. Composites, although eminently practical, do not feed that emotion.

I think it’s fair to say that affordable composites use in autostructures is not yet overwhelmingly and emotionally compelling to consumers, and without that “pull,” OEMs are unlikely to demand substantial increase in composites use. We can, however, make the practicality of composites use in autostructures impossible to ignore, and that’s where our future may lie — so that customers, like the Sloan family, are compelled to consider the advantages that composites bring to the market.

Related Content

Protecting EV motors more efficiently

Motors for electric vehicles are expected to benefit from Trelleborg’s thermoplastic composite rotor sleeve design, which advances materials and processes to produce a lightweight, energy-efficient component.

Read MoreMaterials & Processes: Resin matrices for composites

The matrix binds the fiber reinforcement, gives the composite component its shape and determines its surface quality. A composite matrix may be a polymer, ceramic, metal or carbon. Here’s a guide to selection.

Read MoreASCEND program update: Designing next-gen, high-rate auto and aerospace composites

GKN Aerospace, McLaren Automotive and U.K.-based partners share goals and progress aiming at high-rate, Industry 4.0-enabled, sustainable materials and processes.

Read MoreMaterials & Processes: Fibers for composites

The structural properties of composite materials are derived primarily from the fiber reinforcement. Fiber types, their manufacture, their uses and the end-market applications in which they find most use are described.

Read MoreRead Next

From the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;maxWidth=300;quality=90)