Materials suppliers are hard at work developing higher performing thermoset and thermoplastic composites that meet current and future electric vehicle (EV) battery enclosure requirements of automakers and battery module producers. Photo Credit: Forward Engineering GmbH

WardsAuto.com reported that nearly one in four vehicles delivered globally in March 2022 was electric. The pace of vehicle electrification is increasing precipitously despite pandemic slowdowns, supply chain challenges, lack of broad access to charging infrastructure and consumer reluctance to embrace hybrid and battery electric vehicles (HEVs, BEVs). The latter is due to higher sticker prices, lingering concerns about driving range and the inability to recharge with the same speed and ease that petroleum-powered vehicles can be refueled. Still, to grow from 2.5% of new passenger vehicle sales globally in 2019 to almost 25% by the first quarter of this year is a remarkable achievement.

Last month, in “Price, performance, protection: EV battery enclosures, Part 1,” we discussed issues Tier suppliers face producing composite battery enclosures for electric vehicles (EVs). We also highlighted efforts made by CAE software providers and some Tier suppliers to make it easier to accurately simulate manufacturing and real-world performance of composite enclosures — particularly those with discontinuous fiber reinforcement. And we noted how graphene nanoplatelet technology is being applied to battery enclosures to enhance composite performance. This month’s focus is on work by materials suppliers to develop higher performing composites that meet current and future needs of automakers and battery module producers as performance and safety requirements become more demanding.

As noted previously, enclosures for high-voltage EV battery systems require balancing a complex set of requirements. First and foremost, they must provide long-term mechanical performance — including torsional, modal and bending stiffness — to carry heavy battery systems for the life of the modules while protecting cells from corrosion, electrical shorts, stone impingement, dust and moisture intrusion and electrolyte leakage. In some cases, enclosures are also designed to protect against electrostatic discharge (ESD) and electromagnetic interference/radio-frequency interference (EMI/RFI) from nearby systems, including radar from advanced driver assistance systems (ADAS).

Second, in the event of a crash, enclosures must physically protect the battery system from being crushed, impaled or shorting out due to water/moisture ingress. Third, EV battery systems must help keep battery cells within the ideal thermal operating range during charging/discharging in all types of weather. In the event of a vehicle fire, they must also keep fire out of the battery modules for as long as possible while simultaneously protecting vehicle occupants from heat and flames resulting from thermal runaway events inside the battery packs. And then there are all of the challenges of reducing mass to increase driving range per charge, ensuring that stack tolerances for multicomponent systems don’t exceed available packaging space (preventing assembly to the vehicle), cost, serviceability and end-of-life (EOL) reclamation. What follows is a summary of how eight material suppliers are tackling these challenges.

INEOS

A long-time supplier of unsaturated polyesters (UP), epoxy/vinyl esters (VE), and other hybrid resin systems, INEOS Composites US LLC (Dublin, Ohio, U.S.) also provides gelcoats and additives for use in prepregs, compression molded sheet molding compound (SMC) and bulk molding compound (BMC), and for liquid composite molding (LCM), resin transfer molding (RTM), infusion, spray-up, layup, pultrusion and casting processes. Unsurprisingly, the company’s materials have been featured on SMC battery covers in North America since the 2011 model year on HEVs and BEVs, and in the Chinese market for battery covers on multiple platforms.

“OEMs are rapidly developing more refined performance and materials specifications for EV battery enclosures, and most of these updates involve either flame retardance [FR] requirements or underside and side impact protection,” explains Dan Dowdall, INEOS Composites business development manager for transportation markets. “In response to these changing requirements, we’ve recently introduced a new high-performance, cost-effective resin system — Arotran 2502 — that was specifically formulated for SMC battery enclosures. The material provides high strength and high heat resistance. Its exceptional wetout and flow during compounding make it easier to achieve higher loadings of glass or carbon fibers for superior strength and stiffness, higher loadings of mineral fillers to reduce cost or boost FR performance and/or higher loadings of glass microspheres to reduce part weight. Also, resultant SMC flows well to fill complex part designs, enabling greater parts consolidation and making battery modules more volumetrically efficient.”

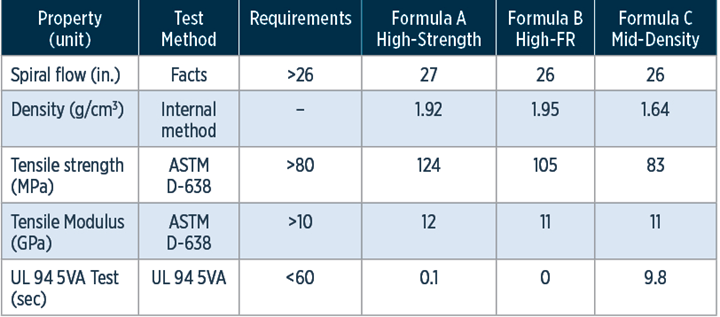

Typical properties for three SMC compounds using INEOS Composites’ new high-strength, high thermal-stability resin system, Arotran 2502. Chart from INEOS Composites US LLC

The company reports SMC using the new material passed the UL 94 5VA test at 2.0 millimeters, when some UP- and VE-based SMC formulations failed at that thickness, and it has fared very well in other flame tests. In an extended flame test used for internal screenings, panel integrity was maintained even after 10 minutes’ exposure to 800°C. In thermal gravimetric analysis (TGA) testing, the new material shows the highest primary temperature values, suggesting Arotran 2502 better resists thermal degradation than traditional UP and VE resins. Even in demanding UL box thermal runaway tests, Arotran 2502-based SMCs have shown very good results. Ongoing work is said to be focused on improving processing, cost, properties and sustainability.

“For EV battery enclosures, an important R&D objective is to develop composite resins for use with tailored preforms for much greater mechanical properties,” adds Dowdall. “We are also actively working with technology partners to develop EMI/RFI veils and blankets to meet enclosures’ evolving electronics shielding requirements.”

Johns Manville

Denver, Colo., U.S.-based Johns Manville (JM) produces insulation, roofing materials and engineered products, including fiberglass rovings for a range of composite types. Last fall, the company moved into the semi-finished goods segment by producing its line of polyamide 6 (PA6)-based Neomera organosheet from anionically polymerized caprolactam. Initial products are reinforced with fiberglass woven and non-crimp fabrics (NCF), but grades with other weaves and even longer chopped fibers — in glass or carbon fiber or both — are said to be in development and approaching launch.

A benefit of impregnating with caprolactam monomer instead of fully polymerized PA6 polymer is that viscosity is much lower, so organosheet achieves superior fiber wetout and higher fiber volume fractions (FWFs). This leads to composite parts with higher stiffness, strength and impact resistance. Another advantage of a glass-mat thermoplastic (GMT)/organosheet-type product is that as long as matrices are compatible, plies with different fiber types and architecture can be layered into the compression press before forming, providing significant freedom to selectively reinforce areas that require higher mechanicals with continuous fiber options, but also provide good flow and fiber penetration to fill complex geometries with discontinuous fiber options. Owing to the toughness of the fiberglass/PA6 composite, the material is reportedly being evaluated for a number of automotive applications, including structural battery enclosures.

“With the rapid increase of EV production, the mass/cost balance is still a driver, but we are seeing a shift of focus on two other materials-related fronts: sustainability and potential effect on the automotive assembly process,” explains Dana Miloaga, JM product leader – composites. “The sustainability aspect is very strong and a leading European OEM is offering specific guidance to materials suppliers on how solutions are being screened in terms of their impact on ambitious sustainability goals. Questions we’ve received regarding materials storage and integration into the manufacturing processes, factory footprint considerations and the sequence of assembly operations all point to a need for composite materials that are easy to handle and easy to use in automated operations, which, in turn, enable high-volume vehicle production.”

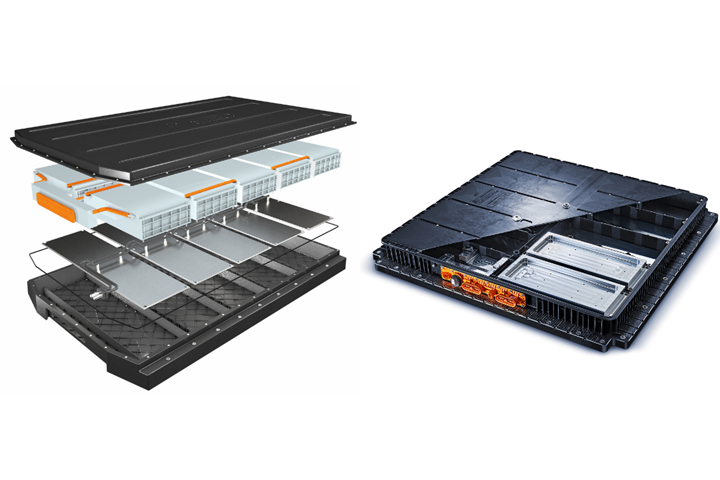

Johns Manville has been working with partners in North America and Europe to develop a fully thermoplastic concept for both battery trays and protective underbody shields and reports it has successfully molded a battery tray demonstrator. Photo Credit: Forward Engineering GmbH

Miloaga says JM has been working with the Royal Oak, Mich., U.S. offices of Forward Engineering GmbH (Munich, Germany), a global transportation design and engineering consultancy specializing in lightweight polymer, composites and multi-material solutions. The company — which has particular expertise designing battery enclosure systems as well as providing battery-enclosure-specific prototyping, testing and validation — ran comprehensive mechanical and crash simulations on JM’s all-thermoplastic enclosure design. This, in turn, defined specific layups for advanced material card development for use in crash simulations to support application-specific customer projects. As was reported in Part 1, there is considerable need in the auto industry for accurate material cards on composite materials, particularly those with discontinuous reinforcement.

“Over the last four years, we’ve seen a sharp increase in demand for our high-voltage battery enclosure development support,” says Adam Halsband, Forward Engineering North America managing director. “Whereas earlier our work focused on design and simulation of composites-intensive structures with the goals of achieving the highest crash performance and mass savings, more recently our focus has expanded to the more complex challenges of managing thermal runaway performance, electromagnetic compatibility [EMC] and battery cell and module environmental protection, such as against liquid and containment intrusion.”

Looking ahead, he says, Forward Engineering has seen a significant shift in interest among OEMs about meeting sustainability goals, life cycle analysis [LCA] assessments and EOL disposition. “As the auto industry embraces a battery electric future, pressures to meet these requirements in the most capable and cost-effective manner are creating new opportunities for flexible, scalable solutions, which positions fiber-reinforced polymers to capture a greater share of the vehicle material mix,” Halsband adds.

Lanxess

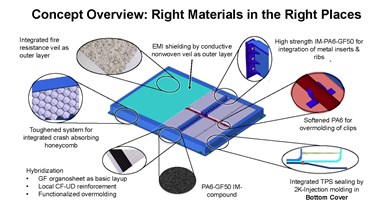

Specialty chemicals company Lanxess AG (Köln, Germany), which also produces thermoplastic composites in several formats — short-fiber thermoplastic pellets, and fabric or unidirectional (UD) glass or carbon fiber-reinforced consolidated blanks/organosheet — announced late last year that it is collaborating with automotive Tier supplier Kautex Textron GmbH & Co. KG (Bonn, Germany) to explore using thermoplastic composites to replace steel and aluminum on large-format EV battery enclosures. Kautex contributed component and process development, while Lanxess was responsible for material development. The two companies not only developed but validated — by comparing predicted performance versus measured results from near-series production physical parts — an all-thermoplastic composite battery housing technology demonstrator.

The goal was to show the benefits of composites for mass and cost reduction, functional integration and electrical insulation for the 1,400- x 1,400-millimeter battery enclosure for a C-segment (mid-size) sedan. The system consists of a tray connected to an integral crash structure and underbody protection plus a cover. Components are compression molded from Durethan B24CHM2.0 fiberglass-reinforced PA6 direct long fiber thermoplastic (D-LFT), a compound specifically tailored for compression D-LFT, a one-step process well suited to producing large parts quickly and cost competitively. The tray’s crash structure is locally reinforced with Tepex dynalite continuous fiberglass-reinforced PA6 to meet the application’s very high structural requirements. Reportedly the enclosure has passed the external fire test ECE R.100.

Kautex Textron and Lanxess collaborated to develop and validate an all-thermoplastic composite EV battery enclosure and benchmarked results against a commercial aluminum part that Kautex produces. Up to 15% mass savings, 20% cost savings and 45% CO2 footprint reduction were achieved while providing structural performance, integral thermal management and insert-molded hardware to facilitate assembly. Photo Credit: Kautex Textron GmbH & Co. KG

“Depending on vehicle class, housings for today’s high-voltage batteries are primarily made of extruded steel or aluminium [sic] profiles and the complete enclosures can be well over 1,500 millimeters in width and 2,000 millimeters in length,” explains Christopher Hoefs, Lanxess project manager e-Powertrain. “The size, number of components and the many manufacturing and assembly steps — including welding, punching and riveting — make metal housings very cost intensive, not to mention very heavy. Additionally, metallic components must be protected against corrosion by cathodic dip coating. With composites, on the other hand, we can fully exploit their design freedom by integrating fasteners and thermal-management components, greatly reducing the number of individual components for a battery housing. That simplifies assembly and logistical effort and reduces production cost. Composites are also corrosion resistant and much lighter, which increases driving range per charge. Also, they are electrically insulating, which reduces system risk of short circuiting.”

Hoefs adds that moving forward, Kautex and Lanxess will continue virtual optimization of design and production details to save cost and shorten time to market and will use the results of their study to interest OEMs in developmental programs for production vehicles. Integration into an actual BEV is planned, followed by real-world testing.

LyondellBasell

Calling itself the world’s largest licensor of polyethylene (PE) and polypropylene (PP) technologies, LyondellBasell Industries (Houston, Texas, U.S.) also produces basic chemicals, monomers, a broad range of thermoplastic and thermoset polymers, plus fuels. Additionally, the company’s Engineered Composites division formulates SMC and BMC in UP, VE, epoxy, bismaleimide (BMI) and blends with continuous and discontinuous glass or carbon fiber reinforcement for customers globally. It is no surprise then that LyondellBasell has supplied SMC for commercial EV battery enclosure programs since 2016 in multiple geographies, although the company cannot identify its customers.

“Battery enclosures were once just a container,” explains Justin McClure, LyondellBasell marketing manager – engineered composites. “However, we’re seeing opportunities where [battery] enclosures are becoming part of the vehicle’s structure, and requirements for thermal-event management have become more stringent, and that’s pushed us to advanced materials offerings to meet these evolving requirements.”

He notes that the need for higher mechanical performance has given the company opportunities to co-mold its Forged Preg continuous uni-, bi- and triaxial carbon fiber-reinforced hybrid SMC with its high-strength Premi-SMC and high-temperature Quantum-ESC SMC grades to optimize mass and performance. “We feel we’re well prepared for these market shifts given the breadth of our product offerings, which enable us to tailor stiffness, strength, impact, torsional or bending loads, flame retardance, cycle times and mass while taking advantage of compression molding’s ability to change materials with little or no tooling changes.”

He adds that additional benefits of compression molding include the ability to mold very large parts (>113 kilograms), to optimize fiber orientation in critical locations by changing the type of reinforcement and charge pattern (without need to move gates, as in injection molding), the ability to mold inserts, to vary thickness across the part and the option to use multiple cavities with smaller parts. Also, despite SMC’s higher initial material costs, compared with multipiece metal stampings, castings and extrusions that must be machined, coated and assembled, compression tooling for programs of <50,000 units/year is less costly, giving SMC a cost advantage. For instance, versus steel stampings, there’s typically a 35% tooling cost savings on programs of 30,000 parts/year and a 20% savings for programs producing 40,000 parts/year.

Regarding tougher thermal runaway performance, McClure had this to add: “Given the inherent challenges of full-scale testing of EV battery systems during thermal runaway scenarios, we’re closely watching the test standard UL is developing that uses a scaled-down cell configuration to screen materials for battery pack enclosures. We follow new regulations and test standards closely to optimize our offerings. Each application is different and may require a different resin system, additive package or coating in a secondary process.”

Electrical shielding is also a topic LyondellBasell is watching closely. “As EVs incorporate more sensors and wireless communications links for ADAS safety features and semi-autonomous driving, we expect there’ll be an increased need for enclosure materials with specific electrical properties to help isolate interference and dissipate electrostatic charges. We have solutions for ESD, EMI and RFI that can be tailored to meet changing requirements.”

Mitsubishi Chemical

Mitsubishi Chemical Group Corp. (MCG, Tokyo, Japan) produces a variety of composite technologies. These include acrylonitrile and polyacrylonitrile (PAN) carbon fiber precursor, carbon fiber itself, carbon fiber intermediates, thermoplastic and thermoset semi-finished products and molded parts. On the thermoplastics side, the company offers injection moldable short glass PP and ultrashort carbon fiber-reinforced engineering resins; compression moldable GMT/organosheet reinforced with either fiberglass or basalt and with PP, PA6 or PA6/6 matrices; and recycled thermoplastics and carbon fiber-reinforced thermoplastics produced with a novel dry impregnation technology. On the thermoset side, the company produces carbon, glass, aramid and hybrid fiber-based UD tapes, woven fabrics, prepregs and towpregs in a variety of resin systems, as well as carbon fiber-reinforced SMC (CF-SMC) and split-tow CF-SMC with enhanced moldability. In addition to recycling thermoplastics, MCG also recycles carbon fiber in Europe and Japan, which is subsequently milled, chopped and compounded, or made into nonwovens or veils. The group’s advanced composites molder produces thermoset carbon composite components for the premium automotive, motorsports and aerospace industries. Additionally, an engineering services group develops materials cards on thermoplastic composite materials for use in simulation work on applications like battery enclosures.

Many Mitsubishi materials are used on composite EV battery enclosures globally, including its GMT and GMTex materials, which are used on Japanese and European EVs and have been evaluated as battery protection plates to help safeguard battery modules and passenger compartments from impact damage.

A and B sides of production EV battery cover compression molded in GMT and GMTex organosheet composites. Photo Credit: Mitsubishi Chemical Advanced Materials

“We’re taking a multipronged approach to solving performance and processing challenges in this segment,” explains John Conn, Mitsubishi Chemical Group Advanced Materials engineering project manager. “Not only do we look at material composition and function, but we also prioritize design for manufacturing by taking advantage of our vertical integration to solve production challenges and assure a manufacturable part that meets cost and production targets. For example, we’re using additives to improve flame performance across our thermoplastic and thermoset product offerings while trying to minimize material thickness to achieve functional lightweight solutions. And we’re leveraging our knowledge from aerospace to meet and exceed evolving EV requirements by always striving for material innovation, which, combined with optimized engineering and manufacturing design, leads to effective industry solutions.” He adds that it’s incumbent on materials suppliers to develop cost-effective materials-based solutions that add value to OEMs.

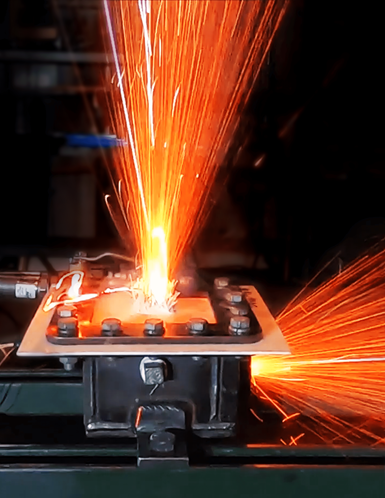

Developing materials that can withstand thermal runaway conditions is one example of the company’s multipronged approach. “During a thermal runaway event, the battery cover takes center stage, as it’s key to protecting passengers,” says Conn. “The battery enclosure has to maintain high structural properties to resist impact loads and prevent cell damage, which could lead to a thermal runaway event. Should that happen, the cover must be able to resist the high temperatures — typically exceeding 800°C — plus particles and kinetic energy from degrading cells. Not only are we thoroughly characterizing our existing materials, but we’re also developing innovative multifunctional materials to withstand thermal runaway events, like a new flame-retardant thermoplastic composite for battery enclosures that’s passed five-plus minutes’ exposure to a 1,000°C flame.”

He adds that the company also has developed a custom material screening test that can replicate the temperatures and energy seen during thermal runaway in a simple setup without the high costs and complexity associated with using actual EV batteries. “This allows us to perform a quick, realistic and cost-effective screening of new materials before committing to the major expense of full-scale battery tests.” Conn adds that several OEMs are considering using the test themselves.

As interest in sustainability grows, the company says it’s well positioned to respond to the increased demand for greener materials while meeting performance requirements at similar price points. “We’re currently exploring the use of bio-based thermoset resin systems for our glass and carbon fiber-reinforced prepregs, and we have an experienced thermoplastic recycling business that works with companies to develop the best method for recycling their plastic production waste,” explains Conn. “This business saves precious resources by regularly taking back, cleaning, upcycling and reselling a variety of fluoropolymers, as well as PEEK [polyetheretherketone], polyamides and polyolefins. Additionally, our carbon fiber recycling business provides a broad portfolio of customizable recycled carbon fiber-reinforced intermediate and semi-finished products. These efforts are supported by our take-back service for carbon fiber-reinforced production scrap and end-of-life parts, which helps us manufacture carbon composites at an industrial scale with a lower emissions footprint while contributing to a cleaner, more sustainable future for everyone.”

SABIC

SABIC (Riyadh, Saudi Arabia) is active in petrochemicals, chemicals, polymers, fertilizers and metals. The company’s Specialties business produces neat, short- and long-fiber thermoplastic (LFT) resins, as well as alloys and compounds in high-temperature engineering thermoplastics, many of which are used in the development of thermoplastic composite tapes reinforced with UD fiberglass or carbon fiber, plus other composites. The group also produces thermoset polymers and additives. The company’s Petrochemicals business specializes in short- and long-fiber PP, polycarbonate, styrenics, thermoplastic polyesters and blends/alloys.

The Specialties business reports that its Noryl modified polyphenylene ether (MPPE) has been used for battery covers on HEVs for some time. To meet the more demanding requirements of BEVs, the group developed several new materials within its Noryl and LNP specialty compounds. Noryl GTX MPPE/polyamide is said to withstand electrophoretic (rustproofing) coating (e-coat), yet also provides low-temperature impact performance to -30°C and is often used in plastic/metal hybrid structures. Noryl SA low-molecular weight bifunctional oligomers are used as additives for epoxy and cyanate ester-based thermosets to reduce dielectric constant (Dk) and loss factors to enable better performance in higher frequency applications. New LNP compounds, which use 30 base resins and more than 200 filler combos to achieve specialized effects, include LNP Konduit with non-halogenated frame retardance plus low Dk/dissipation factor (Df) for transparency to RF signals for battery cell retainers and covers; LNP Faradex compounds, which use metal fibers to meet EMI shielding requirements; and LNP Stat-Kon compounds formulated for radar absorption.

The 1.6- x 1.4-meter cover (shown on B side (top) and A side (bottom)) for a Honda HEV in the Chinese market is one of industry’s largest and is said to have been the first polymeric battery enclosure to pass the demanding China GB 18384-2020 flame retardancy spec without losing impact strength. The short-glass PP compound with intumescent FR package was also optimized to deliver high mechanical performance and manufacturability. The part was a finalist in the 2021 SPE Automotive Innovation Awards Competition in the Chassis/Hardware category and the 2022 Silver Edison Award winner in the Thermodynamics category. Photo Credit: SPE Automotive Div. (top) and SABIC (bottom)

SABIC’s Petrochemicals business reports its materials also are used for battery enclosures on many HEVs and BEVs. The company supplied the highly flame-retardant short-glass PP resin that debuted late last year on one of industry’s largest battery covers for an HEV from Honda Motor Co. (Minato City (Tokyo), Japan) for the Chinese market. The non-halogenated PP compound was formulated to form an intumescent char when exposed to flames. That charring behavior leads to self-extinguishing and was the first cover to pass the new China GB 18384-2020 spec. Compared to metallic battery enclosures, where thermal blankets are required, adding significant weight, cost and environmental concerns, the injection molded thermoplastic delivers 40% weight savings, contributing to extended driving range. Functional integration simplifies assembly and reduces costs. The part can be fully recycled at EOL and has a smaller CO2 footprint.

“We see the materials mix changing as the value chain increases collaboration on the design of EV battery packs and their individual components,” explains Dhanendra Nagwanshi, SABIC senior business manager – automotive marketing-polymers. “We see flame-retardant thermoplastics potentially becoming a larger share of the mix because they can offer tremendous advantages, including inherent thermal and electrical isolation, intumescent qualities, lightweighting, parts integration and potentially parts elimination, which supports cost reduction. Additionally, they’re recyclable, reusable and they lower environmental impact — not only through weight savings but also by lowering greenhouse gas emissions roughly 10-15% as verified by LCA studies. The future is bright for thermoplastics in the EV battery space.”

One area his team is working on involves battery trays. “Trays are harder because of their weight, complexity and structural requirements,” Nagwanshi continues. “We’ve done teardown feasibility studies and have seen 60-kilogram weight and 50% cost reductions by realizing the benefits of hybrid systems, where cooling channels are integrated into the tray, which, in turn, is optimized not only for cooling but to fit in the available packaging space. Thermoplastic composites not only reduce weight significantly and improve FR and thermal efficiency, but they also reduce the risk of electrical shorts and high-voltage shocks. Given concerns about the possibility of sharp objects puncturing the bottom of the tray, allowing electrolyte to spill out and potentially cause a fire, we’ve evaluated different ribbing, fiber and FR combinations and even looked at hybrid systems with metals to keep trays protected. Right now, the whole industry is trying to understand which materials work for which chemistries and geometries. Everyone is looking at everything and everything is on the table.”

Solvay

With a global manufacturing footprint, Solvay SA (Brussels, Belgium) produces resins and polymers, structural adhesives and surfacing products, thermoset and thermoplastic composites, carbon fiber, composite tooling and ancillary materials. The company has supplied flame-retardant prepreg materials — in glass/epoxy as well as carbon/epoxy — for battery enclosures for more than a decade.

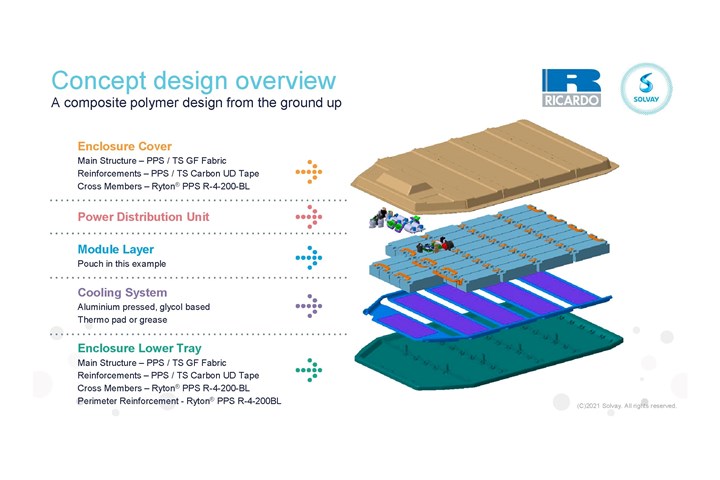

Solvay recently partnered with automotive design and engineering consultancy Ricardo Plc. (Shoreham-by-Sea, U.K.) to complete a virtual design and simulation project in which an EV battery module produced by Ricardo with a metal enclosure and compliant with all global standards was benchmarked against a multi-material FR composite cover and tray. The main structures of both could be produced in either epoxy or polyphenylene sulfide (PPS) reinforced with a high areal weight fiberglass fabric and locally reinforced with UD carbon fiber tapes. More than just a demonstration of composites’ lightweighting opportunities, the team wanted to address the issue of volumetric efficiency when packaging large battery modules in passenger vehicles.

“If you look at how composites are being portrayed in the market in this segment, the entire focus is on lightweighting, which is important, to be sure, but it can’t be the only reason that composites are used,” explains Mark Wright, Solvay Specialty Polymers, thermoplastic composites, transportation marketing manager. “In this project we set out to uncover not only where the pain points were for manufacturers but also what other benefits composites-intensive battery enclosures can bring to enclosure design and performance. We returned to first principles design and focused on how composites’ design freedom and parts consolidation can improve internal volume in the X, Y and Z axes within the battery enclosure to address the well-known limitations of geometry and thickness that metal-forming has. We also considered tooling cost avoidance and environmental resistance.”

As designed and benchmarked against an all-metal battery enclosure system developed by Ricardo Plc., Solvay’s multi-material thermoplastic composite enclosure is targeted at the premium/low-to-medium volume vehicle segment. The virtual design was evaluated against key mechanical performance requirements, including modal stiffness analysis, China crush tests and various abuse cases, including jacking. Photo Credit: Solvay SA.

Benchmarking results showed an 18% reduction in enclosure volume — 45% of which came from reduced height — versus the metallic design due to parts integration and greater design freedom. That translates to packaging benefits since it frees up space to fit additional batteries, which increase driving range, or enables vehicle interior space to be increased, which improves occupant comfort. Total mass was reduced 53%, saving 75 kilograms, and part count was reduced from 22 to two, greatly simplifying pack assembly and reducing the total number of seals required. Plus, the composite cover won’t corrode and offers thermal-management benefits. The team is now moving from virtual to physical testing of prototypes for mechanical performance, thermal runaway, fire protection, thermal management and EMI shielding.

In parallel with the design project, Solvay reports it also has been working on an ambitious materials characterization study for EV battery systems that is described as agnostic between thermoset and thermoplastic chemistries. The company is evaluating flame-retardant, high glass transition temperature (Tg) thermosets (e.g., epoxy, phenolic, BMI) and thermoplastics (PPS, PEEK, polyetherketoneketone (PEKK)) from its own portfolio reinforced with fiberglass and/or carbon fiber in a variety of fiber architectures to see which combinations work best for specific battery components on different vehicle classes as well as advanced air mobility (AAM) aircraft. The materials are being subjected to high structural loading, crush testing, side impact testing, intrusion, modal stiffness, flame retardance, thermal runaway, thermal diffusion and more.

“The idea is to see how each of these materials behaves in different environments, particularly with regard to three important areas: fire protection, thermal runaway protection and EMI shielding,” adds Wright. “We’re looking at short-fiber, long-fiber and continuous-fiber options and trying to cover all the bases with our materials characterization approach.” He adds that Solvay is a major supplier of battery cell chemistry as well as materials that lie between the cells and the enclosure, so current research could well have broader implications. “Thermosets are easier to implement in the short term, but thermoplastics support higher-rate manufacturing,” he adds. “We definitely don’t want to be siloed.”

Westlake Epoxy

Earlier this year, Westlake Chemical Corp. (Houston, Texas, U.S.) acquired the epoxy business of Hexion Inc. (Columbus, Ohio, U.S.). Now called Westlake Epoxy, the company is a leading producer of specialty coatings and composites globally for industries ranging from wind energy to automotive. Epoxy and phenolic resin systems are used to form composite battery covers, trays and other battery-barrier applications on multiple commercial EV platforms sold in North America and Europe, and Westlake will have more than five high-volume programs active as of 2023.

“Our Epikote epoxy resins and Epikure curing agents for LCM and HP-RTM [high-pressure resin transfer molding] and our Epokote/Epikure 06150 and 06170 systems have specifically been tailored for high-rate automotive-scale production volumes and large-format, continuous-fiber composite components, such as battery covers and trays,” explains Stephen Greydanus, Westlake Epoxy North American automotive business development manager. “We also produce industry-leading phenolics — notably our Eponol 06921/Epikure 06931/06941 systems— that provide unique FR performance and are compatible with a wide range of reinforcement types and processes, such as LCM and compression molded SMC.” He adds that the company sees growing interest in phenolics as automakers look for materials that can survive demanding thermal runaway requirements. Westlake is also considering the polymer system for use as a barrier/containment system inside and surrounding the battery pack.

Westlake fiberglass/epoxy composite being subjected to a flame test at 1,200°C. The test was stopped after eight minutes, 36 seconds, with no burn through. Photo Credit: Westlake Epoxy

“Auto industry players are familiar with FMVSS 302 [U.S. Federal Motor Vehicle Safety Standard 302, which tests the flammability of interior materials] and UL 94 V-0 [Underwriters Laboratories 94 V-0 vertical burn test], but most don’t have a toolbox of existing metallic or polymeric materials designed to survive the extreme temperature and other conditions of a thermal runaway event,” Greydanus continues. “As such, OEMs and Tier players are now evaluating new materials under new test conditions to establish that toolbox of viable materials. However, as the aerospace industry has known for decades, within the sphere of polymeric materials, phenolics are in a league of their own in terms of FST [flame/smoke/toxicity] performance.” He adds that the company’s new ultra-low formaldehyde Eponol 06921 phenolic resin, coupled with Epikure 06931 and 06941 catalysts, permit high-rate production of FR composites for a range of manufacturing processes, including compression molded SMC and LCM. He also adds that the system is being used to produce commercial EV battery enclosure components in a high-rate program owing to its thermal protection performance. Furthermore, the company’s Epokote 06710/Epikure 06170 epoxy resin system is being used for a large-format, structural EV battery tray produced via LCM that’s also in production.

“As a resin supplier, Westlake Epoxy has formulated its latest-generation phenolic and epoxy systems to be compatible with SMC, LCM, HP-RTM, pultrusion and other manufacturing formats [processes] to cover many areas of application for thermoset composites in multi-material battery-enclosure designs,” Greydanus concludes.

Related Content

Moving toward next-generation wind blade recycling

Suppliers, fabricators and OEMs across the composite wind blade supply chain ramp up existing technologies, develop better reclamation methods and design more recyclable wind blades.

Read MoreComposites manufacturing for general aviation aircraft

General aviation, certified and experimental, has increasingly embraced composites over the decades, a path further driven by leveraged innovation in materials and processes and the evolving AAM market.

Read MoreAutomotive chassis components lighten up with composites

Composite and hybrid components reduce mass, increase functionality on electric and conventional passenger vehicles.

Read MoreNatural fiber composites: Growing to fit sustainability needs

Led by global and industry-wide sustainability goals, commercial interest in flax and hemp fiber-reinforced composites grows into higher-performance, higher-volume applications.

Read MoreRead Next

From the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read More

.jpg;maxWidth=300;quality=90)