Making renewable energy greener. Wind energy is an increasingly popular form of renewable energy, but there are still aspects of the manufacturing, operation and end of life (EOL) of wind turbines that produce waste or harmful emissions, and/or consume a lot of energy. As wind energy suppliers, fabricators, OEMs and operators target fully sustainable, emissions-free, waste-free operations, one large focus area is the recyclability and circular economy of glass and carbon fiber composites used in wind blades. Globally, many near-, medium- and long-term goals and efforts are underway. Photo Credit: Vestas Wind Systems A/S

As many countries around the world have pledged to reach net-zero CO2 emissions by 2050, renewable energy, led by wind energy, continues to ramp up — with 2021 being the second-highest growth year for wind on record, according to the Global Wind Energy Council (GWEC). However, one unsustainable downside to the wind energy industry is that once a wind turbine is replaced at its end of life (EOL) or through a repowering initiative, there is not an obvious or simple solution for how to dispose of glass and carbon fiber composite materials used in wind turbine blades. More than 80% of a wind turbine itself is typically metallic and recyclable, but the increasingly long, high-performance composite blades pose more of a challenge.

Is there a sustainable solution for keeping wind blades out of landfills? Allan Korsgaard Poulsen, head of advanced structures and sustainability at wind energy company Vestas (Aarhus, Denmark), explains that there are three steps taking place across the value chain to make this happen. “For blades on the legacy fleet, we need to ramp up existing recycling methods, getting the technologies in place. The next step is to improve the existing recycling methods, to separate out the fiber and resin better for reuse. And then the final step is to look into how we actually design the materials to enter into a circular economy for future wind turbines.”

Suppliers, blade fabricators, OEMs and renewable energy developers around the world are working on wind blade recycling solutions, and there are a number of promising solutions on the market now and on the horizon. This report summarizes several of these efforts.

Near-term: Ramping up existing technologies

There are several inherent challenges to recycling wind blades. Jonas Pagh Jensen, EHS specialist at wind blade OEM Siemens Gamesa (Zamudio, Spain), explains, “One of the challenges is that you have built something that is meant to be extremely difficult to separate. So you have to invent technologies to break apart these bonds, and that requires energy, and can be costly.” Volume is another challenge. “In Denmark, we had 36 turbines taken down last year. It looks like a lot of blades on the front of a newspaper, but that would take you less than a week to digest in any type of machinery.”

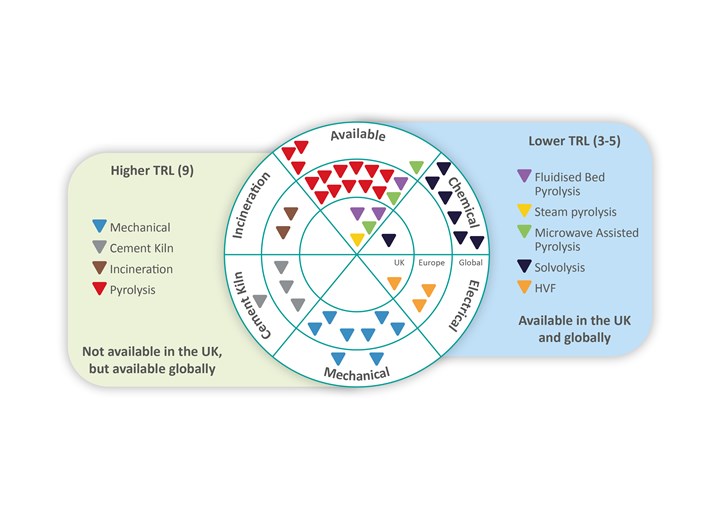

Mapping today’s available recycling technologies. The National Composites Centre (NCC) and its partners, through project SusWIND, track the technology readiness levels (TRL) and availability of various composites recycling technologies in the U.K. and globally. Today's most mature technologies include pyrolysis, cement kiln co-processing, incineration and mechanical recycling — though they are not widely available everywhere. Photo Credit: National Composites Centre

Still, he says that over the past five years, more facilities and technologies have become available commercially as options for wind energy operators. Among the most mature technologies today are cement kiln co-processing, mechanical recycling and pyrolysis. Cement kiln co-processing is the process of replacing fossil fuels like coal with shredded wind blades (or other materials outside of the wind market, such as used tires) in the production of cement. Mechanical recycling refers to various types of shredding or grinding of entire composite parts to produce ground-up or shredded material for use as filler, or in injection molding, 3D printing or other processes. Pyrolysis uses one of a variety of heat sources to thermally decompose resins and additives in a furnace, leaving short fibers that can be reclaimed and reused.

Step one of the recycling supply chain. For any composites recycling process, blades first have to be cut on site for land transport to a facility. These images show Vestas wind blades headed for a cement kiln co-processing facility. Photo Credit: Vestas Wind Systems A/S

The disadvantage of these processes is that none of them result in high-quality materials compared to virgin fiberglass or carbon fiber. Further, the processes themselves are generally more expensive than sending blades to a landfill and they consume more energy. However, they do have the potential to process large amounts of blades.

Companies and R&D groups are leaning in to optimize these processes, scale them up, build more facilities, and, for mechanical and pyrolysis processes, find uses for the recycled end product.

For example, one project working to mature and scale up shredding, pyrolysis and cement co-processing technologies is DecomBlades, a three-year, 10-partner Danish consortium launched in January 2021. Involving partners across the value chain from OEMs to recycling companies to academia, this project has been working to test and optimize its three technology areas, with the goal of providing the industry with design concepts for full-scale industrial shredding, pyrolysis and cement co-processing plants, and to begin building pilot facilities in Denmark. In May 2022, DecomBlades launched a set of new specifications detailing materials and components of Vestas, LM Wind Power and Siemens Gamesa blades, aiming to aid recyclers with industrializing blade disposal.

In the cement kiln co-processing landscape, GE Renewable Energy (Paris, France) has notably led several recent commercial efforts through partnerships with cement producer LafargeHolcim (Zug, Switzerland) and waste solutions provider Veolia North America (VNA, Boston, Mass., U.S.). Vestas has also established a cement co-processing partnership with Green America Recycling (Hannibal, Mo., U.S.) and says that in 2021, almost 300 blades from repowering projects were recycling through cement co-processing in the U.S.

Repurposing: A greener short-term solution?

While more efficient fiber and resin reclamation technologies are still under development, one cost-effective, potentially greener near-term alternative may be repurposing entire wind blades, or parts of them, for secondary uses.

The Re-Wind Network is an organization formed in 2017 that researches and develops solutions specifically in the area of repurposing decommissioned blades, involving faculty and students at the Georgia Institute of Technology (Atlanta, Ga., U.S.), University College Cork (Cork, Ireland), Queen’s University Belfast (Belfast, U.K.), Munster Technological University (Cork, Ireland) and City University of New York (New York, N.Y., U.S.).

Dr. Lawrence Bank, Re-Wind lead principal investigator, explains that while repurposing blades for infrastructure or similar projects will never be the only option, it should be the first solution to be considered, following the U.S. Environmental Protection Agency’s (EPA) waste management hierarchy, in which “source reduction and reuse” is labeled the “most preferred” waste management strategy. Until better long-term design and reclamation strategies come online, repurposing may also be able to reduce costs and emissions in the near-term compared to other methods.

A second life for wind blades? The Re-Wind Network has many ideas for high-utility projects that could repurpose a lot of blades. This rendering shows BladePole utility transmission poles, the first of which are expected to be installed in Kansas this year. Photo Credit: Re-Wind Network

“One thing that is not discussed often when people talk about grinding up or pyrolysis is the cost of doing these things,” Bank says. Shredders need to be replaced and need energy to run, and pyrolysis and other reclamation processes consume a lot of energy, he explains. Repurposing does require the labor and costs involved with cutting and transporting blades, but he says that as long as they stay at or under 75 feet in length, this isn’t any different than cutting and transporting blades to a landfill or recycling facility. And the labor associated with installing the blades into a new product — such as a bridge — would’ve been needed anyway, regardless of the material used.

According to Bank, repurposing is a viable short-term solution, especially for blades that have been decommissioned due to repowering, as opposed to reaching their EOL. “If you’ve made this very expensive, very strong composite blade that’s meant to last for 30-40 years, and then you take it down after 11, or even 20 [years], why not continue to use it for something? Once you grind it up, or pyrolyze it, you immediately lose a tremendous amount of its original value, and you can’t get it back.” He notes that all components built via Re-Wind and its partners are thoroughly tested prior to installation.

Re-Wind’s first project is a 5-meter-long pedestrian bridge — called BladeBridge — that was installed in Cork, Ireland, in January 2022, repurposing two donated LM 13.4-meter turbine blades as main girders. The second project, called BladePole and funded by Enel Green Power (Rome, Italy), is developing and testing the use of full blades as utility transmission poles. The first BladePole is expected to be installed in Kansas, U.S., this year. Bank anticipates that both of these demonstrator projects, and several others at earlier stages, can serve as examples for industry partners to repurpose large numbers of blades in similar ways. Re-Wind also recently published a catalog of design concepts to highlight how it thinks blades can be deployed in a second life.

Walking on wind blades. Re-Wind Network’s first BladeBridge pedestrian bridge was installed in Cork, Ireland in Jan. 2022. Photo Credit: Re-Wind Network

As an aid to this work, the Re-Wind Network has also developed a Geographic Information System (GIS) tool that identifies and locates wind blades in Ireland and conducted lifecycle assessment (LCA) and life cycle sustainability assessment (LCSA) analyses of wind blade EOL solutions.

Bank notes, “We’re looking for projects that use as much of the blade, and use as many blades, as possible. A bespoke project that uses one blade to make a sculpture helps raise awareness, but it’s never going to be able to solve the problem of massive quantities of blades coming out of service.”

Another example of blade repurposing is demonstrated by recycling company Anmet (Szprotawa, Poland), which served as a metals recycling company for many years before, in 2014, transitioning into wind blade recycling when it perceived a need for wind blade recycling solutions in the region. The company is working toward large-scale pyrolysis as well, but its first commercial composites venture has been to repurpose blade sections for use in outdoor furniture (through distribution partner Wings For Living UG; Dresden, Germany) and as the main structural element for pedestrian and bicycle bridges (with partner GP Renewables Group; Warsaw, Poland). Anmet’s first bridge was installed in Poland in October 2021.

Establishing a wind blade recycling supply chain

Perhaps the largest bottleneck, though, isn’t the recycling technology itself — but establishing a supply chain for wind farms to efficiently and cost-effectively cut and transport blades to convenient recycling facilities.

The DecomBlades project aims to provide LCAs for each of its recycling technology areas, factoring in transport and labor costs. Poulsen of Vestas, which is a DecomBlades project partner, says that one clear lesson learned so far is that the best short-term solution is the one that’s closest to the wind farm. “You have pyrolysis and cement co-processing and other methods, and you can compare the advantages and disadvantages of them, but today the main advantage is how far you have to transport the blades to the recycling facility. That’s the best way to lessen the environmental impact: lowering the carbon emissions related to transport.”

Another initiative attempting to better map out and solve the recycling supply chain issue is SusWIND, a three-year project led by the National Composites Centre (NCC, Bristol, U.K.) that began in early 2021 and involves 10 partners, including program board members Vestas, EDF Renewables (Paris, France), SSE Renewables (Perth, U.K.), Shell (London, U.K.) and the Net Zero Technology Centre (NZTC, Aberdeen, U.K.). Divided into three “pillars” — Recycle, Sustain and Design — SusWIND aims to seed a circular supply chain by analyzing and accelerating recycling technologies, sustainable manufacturing and materials development specific to wind blades.

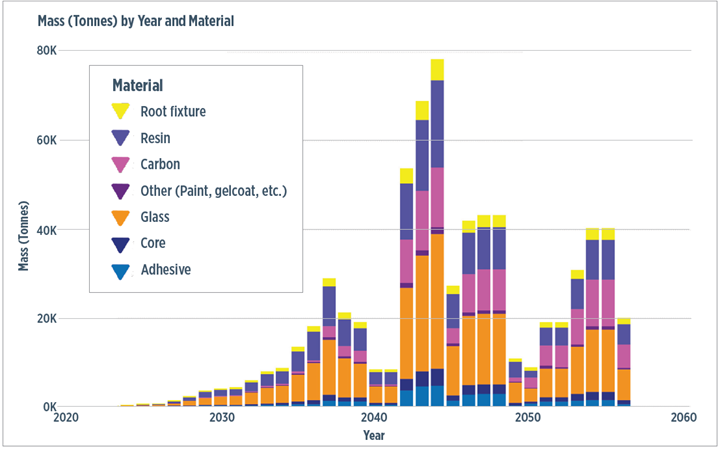

Part of the Recycle work stream has included putting together a geospatial forecasting map (see image below), using data from Renewable UK and working with the Offshore Renewable Energy Catapult, to provide “a full profile of decommissioning for U.K. blades,” explains Jonathan Fuller SusWIND lead engineer at the NCC. The tool essentially charts out existing and planned turbine installations in the U.K. and forecasts which blades — and not just the blades, but the mass and types of materials from those blades — will reach EOL and when, through 2055. In order to effectively find uses for recycled blade materials, Fuller explains, “We need to understand what will be available, where it will be and when.”

Mapping available wind blade materials. Aiming to help inform the supply chain for recycled material resuse, the NCC and SusWIND have mapped out forecasted masses of various offshore wind blade materials that will be available per year in the U.K. through 2050. The project leaders report a significant increase in waste from 2030 onward. Photo Credit: National Composites Centre

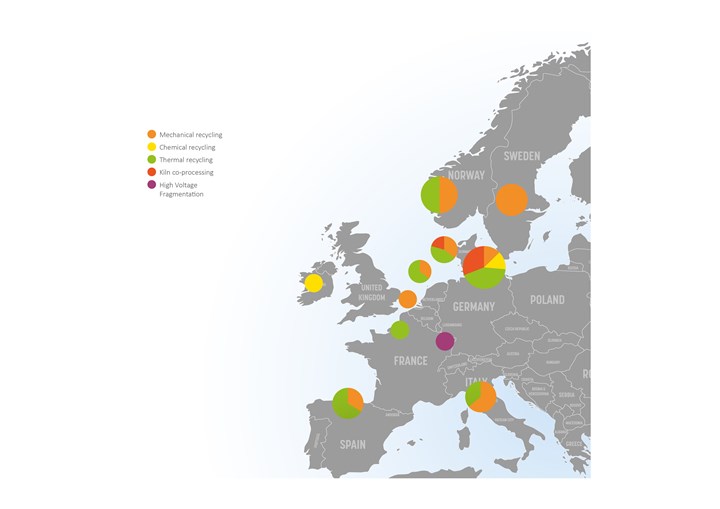

The teams have also been mapping out the supply chain — from wind farm through to the recycled composite product — in the U.K., Europe and beyond (see image below). “The key finding from that work has been one that we didn’t perhaps expect,” Fuller admits. “There is no commercially ready supply chain for EOL composites in the U.K. So now we’re focused on changing the situation.”

Today’s supply chain. The NCC and SusWIND’s assessment of current composite recycling facilities in Europe that are above TRL 6. One of today’s main challenges with wind blade recycling is availability of recycling facilities near wind farms. Photo Credit: National Composites Centre

One of the main goals for this year, he says, is to deliver, along with industry partners, technical demonstrations of mechanical recycling and cement co-processing technologies using wind blade materials. “This will be the first demonstration of its kind in the U.K. with wind blade material,” Fuller explains. “We’re going to try to get as much data out of the process as we possibly can.”

The teams also have been investigating the global recycling technology landscape, which includes looking ahead to identify emerging technologies that could be ready to scale up and join the recycling landscape commercially in the next several years.

Medium-term: Developing more efficient recycling

Looking further ahead, numerous research projects led by academic and industry leaders aim to develop alternative fiber and/or resin reclamation technologies, many of which are geared specifically toward wind blade recycling. Some of these technologies promise less energy use, or potential for larger scale-up, or, importantly, the ability to separate out higher quality fibers and/or resins for reclamation and reuse. Many of these efforts include optimizing pyrolysis processes or developing industrial-scale solvolysis (chemical-based) processes.

Furthermore, with new recycling technologies comes the need to develop new uses for the reclaimed materials. According to Stephen Nolet, principal engineer and senior director of innovation and technology at wind blade manufacturer TPI Composites Inc. (Scottsdale, Ariz., U.S.), developing better reclamation technologies is only the first part of the solution. “The challenge is finding a higher value-add use for the recovered fiber. Simply pulverizing it and using it as a filler in bulk molding compound [BMC] is of low value and will not likely offset the costs of its recovery,” he says.

For example, a U.K.-based, three-year project begun in February 2022, led by Composites UK (Berkhamsted) and with main commercial partner Aker Offshore Wind (Lysaker, Norway), aims to commercialize a pyrolysis process developed by researchers from the Advanced Composites Group at the University of Strathclyde (Scotland). Mark Robertson, project development manager at the University of Strathclyde, explains that the technology has been developed and demonstrated at the lab scale at the university; the goal of the program is to build and evaluate a pilot plant in the U.K. to scale up the technology.

The proprietary method separates glass fibers from resin, leaving a reusable, high-performance short glass fiber product — up to 90% of the properties of virgin fibers, Robertson says — that can be reprocessed and remolded for use in many application areas like automotive or construction. According to Robertson, the method can recover energy from resin while reclaiming fibers from EOL parts like wind blades, or glass fiber manufacturing scrap. “We’re also looking at how we might modify the process slightly to also recover resin,” he adds.

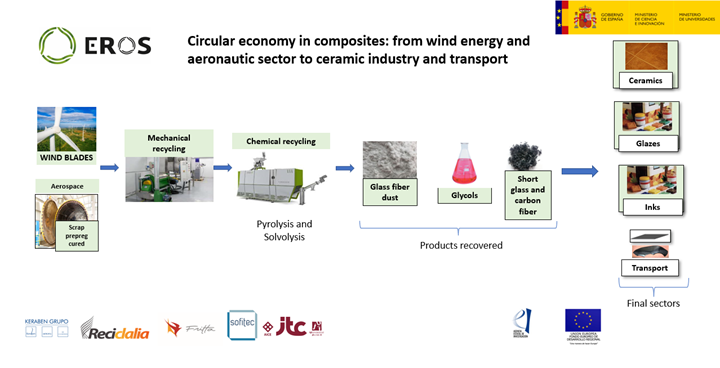

Another R&D program looking to develop and scale up various composites recycling technologies is EROS, which began in summer 2020 and is led by AIMPLAS, the Plastics Technology Centre (Valencia, Spain) with the Institute of Ceramic Technology (ITC, Castellón, Spain) and Spanish industry partners Keraben Group (Barcelona), Fritta (Onda), Sofitec (Sevilla) and Reciclalia (Madrid). Within EROS, the researchers are looking at both wind blades and aerospace manufacturing scrap, evaluating existing mechanical, pyrolysis and solvolysis methods to determine which method results in the purest fiber (free from volatile organic compounds (VOC)). Importantly, uses for end products are also being evaluated. In the case of wind blades, end products include glass fiber dust and glycols (from solvolysis), which can be fed into applications such as ceramics, glazes and inks. In early 2022, AIMPLAS finished its first lab-scale recycling trials. The resulting recovered materials were sent to industry partners to be manufactured as demonstrators for testing.

Reuse for ceramics. Studying both EOL wind blades and aerospace manufacturing scrap, AIMPLAS and EROS project partners aim to optimize mechanical and chemical recycling operations with the goal of reuse for specific end markets. Photo Credit: AIMPLAS

Dr. Nora Lardiés Miazza, a chemical recycling researcher at AIMPLAS, explains, “Next we’ll get feedback from our partners at the end of the value chain, who will tell us whether the retrieved materials were OK or not OK.” Then the recycling methods will be optimized accordingly, with the ultimate goal of producing scalable recycling solutions that can be ramped up commercially. Lardiés Miazza explains that ceramics were targeted because it’s a large industry that produces a lot of products, meaning it shows potential to absorb large amounts of decommissioned wind blade materials. Additional recycled glass fiber dust can be used to make ceramic tiles and similar aesthetic products that do not require raw materials with high mechanical properties.

Also working on both recycling solutions and new end-use products is the Sustainable Manufacturing Technologies Group at Oak Ridge National Laboratory (ORNL, Knoxville, Tenn., U.S.,), led by Soydan Ozcan, senior R&D scientist. The researchers’ ongoing work includes researching and optimizing mechanical and pyrolysis recycling methods, as well as developing new uses for the reclaimed materials, such as Class A structural automotive parts and pellets for 3D printing.

In a related effort, TPI Composites is working on an R&D program with an advanced materials technologies company Carbon Rivers (Knoxville, Tenn., U.S.) and the University of Tennessee (Knoxville) to recover short fibers from pyrolysis and use them to create new yarns and textiles for reuse in new applications. “Leaving [the fibers] intact and creating a nonwoven textile to put to use in a sheet molding compound [SMC] or finding other ways to use the material is attractive [for many applications],” Nolet explains.

The need for new applications of reclaimed composite materials has also resulted in several new startups with developing solutions. As one example, fiberglass and concrete roofing concept developer ST Bungalow (Croton-on-Hudson, N.Y., U.S.), a spin-off from solar technology company Solar-Tectic LLC, is working to develop new solutions for recycled fiberglass from wind blades. Targeting the construction market, the company has developed and patented prototype designs for a flat, concrete roofing system, developed for holding solar panels or for housing, that uses less concrete by replacing rebar with lightweight fiberglass composite formworks manufactured from shredded and remolded EOL composites.

Ultimate reuse goal: Circularity of materials back into wind blades

While many reclamation technologies are aiming for recycling (sometimes called downcycling) of materials that can be re-used in products in other industries, there are also efforts targeting circularity, where the reclaimed fibers and/or resins would be looped back into reuse for new wind blades.

One project headed in this direction is called Circular Economy for Thermosets Epoxy Composites (CETEC), a three-year initiative launched in May 2021 with the goal of developing a chemical-based method (which the project partners call “chemcycling”) for reclamation of epoxy resins from wind blades for reuse as new epoxy for new wind blades. Partly funded by Innovation Fund Denmark, CETEC project partners are Vestas, the Danish Technological Institute (DTI), Aarhus University (Denmark) and epoxy supplier Olin (Clayton, Mo., U.S.).

Chemistry leading to circularity. The CETEC project is working toward solvolysis reclamation of epoxy resins from wind blades. The goal is to not only reclaim the material for reuse, but to add it back into the wind industry and the manufacture of new wind blades. Photo Credit: CETEC

The CETEC chemcycling process requires two steps. In the first, an acidic solution is introduced that separates the fiber from the epoxy. The fiber is then removed to be potentially reused elsewhere. In the second CETEC step, a second catalyst is introduced to the reclaimed epoxy, and is designed to break down the epoxy into its original chemical constituents. According to Poulsen, these materials carry essentially the same properties as their originals — “unlike glass fibers, which can show damage and reduced strength from their use on an active wind blade, when you break down the polymer, the constituent parts don’t have a ‘memory,’” he says — and can be remade into epoxy resin for use in new wind blades or other products.

As of spring 2022, the CETEC partners had developed a proof of concept ready to be scaled up and ultimately commercialized. “This will not just be a solution for Vestas, or even just for the wind industry,” Poulsen notes. “It’s important that this process shows potential for high yields of commodity chemicals like BPA, that is the basic component for epoxy and is used in many markets, meaning this could drive down the costs of recycling and make the use of a circular resin more attractive, for us and for everyone. A truly scalable solution should create a higher level of value for all involved stakeholders. Once a sustainable solution can also present the most attractive business case, widespread adoption will naturally follow.

Long-term: Design for recyclability and circularity

Looking even longer term, the ultimate goal is to design wind blades for recyclability or circularity. The NCC’s Fuller explains that the Sustain and Design “pillars” of SusWIND are developing models to assess the cradle-to-grave impacts of alternative materials and manufacture, as well as novel circular design methods. “We’ve started from the point of view of trying to establish what circularity means for blade design,” Fuller says. This means starting from the raw materials, manufacturing of the blade, operation, through EOL — “We’re trying to understand what the opportunities are in each of these areas. Aiming to take it from the theoretical to an actual set of guidelines to follow.”

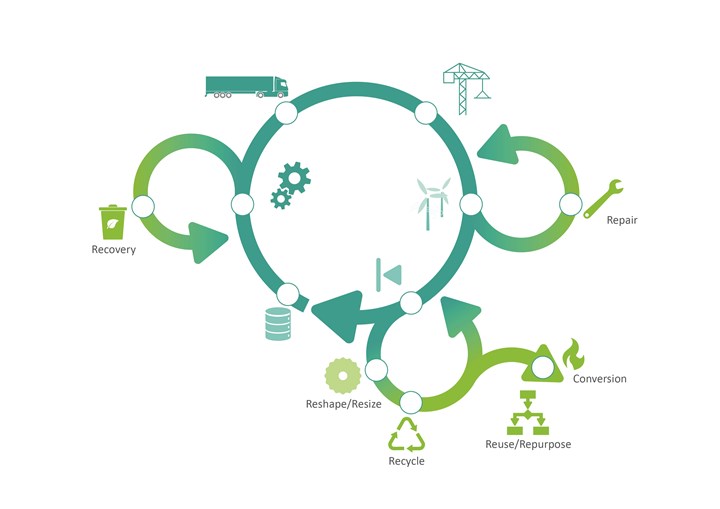

A winding path to circularity. There are many ideas for the best way to repurpose, reuse and/or recycle wind blades and their materials, for new industry applications or even toward the production of new wind blades in a circular economy solution. Photo Credit: National Composites Centre

TPI Composites’ Nolet notes that shifts in design and materials use are coming, but will begin with resins. “Epoxy, polyester and vinyl ester have served our industry so well, but by their very design they’re meant to withstand decomposition for thousands of years. That’s why we use them, because they’re so stable, and robust and chemically resistant.” In preparation for next-generation wind blade design, TPI has conducted several R&D studies with the Institute for Advanced Composites Manufacturing Innovation (IACMI, Knoxville, Tenn., U.S.), working with two commercially available resins for recyclability, Arkema’s (Colombes, France) Elium and Aditya Birla’s (Mumbai, India) Recyclamine.

Elium is a liquid thermoplastic resin used in a range of commercial applications, from helmets to boats, and is said to process and behave similarly to a liquid thermoset, while retaining the thermoformability/recyclability of a thermoplastic.

To test the structural properties of the Elium resin, the U.S. National Renewable Energy Laboratory (NREL, Goldon, Colo., U.S.) worked with Arkema, TPI Composites and other partners to build and test 9- and 13-meter demonstrator blades. The researchers found that the fiberglass/Elium blades showed similar stiffness and up to seven times the level of structural damping of an epoxy blade.

Recyclamine is a thermoplastic epoxy — a thermoset resin that, unlike a traditional thermoset, dissolves with heat and a mild acid solution such as acetic acid. Ed Rose, business development manager at Aditya Birla, explains: “Recyclamine allows you to take a thermosetting resin with novel polyamines to create a cleavable bond. So, whereas a thermoset is permanent, it’s set once the crosslinks are bonded, this Recyclamine curative allows for a cleavable spot on the crosslink, leaving a space where you can separate it out with recycling technology.” The product platform is said to be compatible with a range of curing agents for various reactivity and temperature resistance requirements.

Natural fibers, more sustainably produced or sourced glass and carbon fibers, and bio-based resins may also be considered as they become more mature, Fuller says. Siemens Gamesa’s Jensen says he sees the most potential in carbon fiber production methods that are made more sustainable by emitting less carbon or consuming less energy. “We’re seeing an increase in biomass-based carbon fibers, or in using renewable energy to power facilities and lower the footprint of the process. But it’s still early days,” he says.

Developing and launching fully recyclable wind blades

Several wind energy companies have begun pledging to develop turbine blades that are fully recyclable, and/or manufactured with zero waste.

The first commercialized entrant into the recyclable blade market is Siemens Gamesa’s RecyclableBlade, launched in September 2021. This is an offshore wind blade manufactured via the same process and using the same fiberglass materials as the company’s typical offerings, though using Aditya Birla’s Recyclamine thermoplastic epoxy as the resin matrix.

According to Harald Stecher, materials engineer at Siemens Gamesa, the RecyclableBlade has been in development since 2016. “Recyclability had become one of the main targets for our development strategy, and we began talking with different suppliers, including Aditya Birla.” The companies then began working more closely together to adapt Recyclamine to meet Siemens Gamesa’s specific needs. “In evaluating the technology, we soon noticed how close it is to the resins that we are currently using, with only minor changes,” Stecher explains.

The first RecyclableBlades. Siemens Gamesa launched its first offshore recyclable blade in September 2021. The blades are made using epoxy with Recyclamine hardener, enabling the resin to be separated from the fiber, with the goal of facilitating a simple, low-energy reclamation solution for EOL blades. Photo Credit: Siemens Gamesa

Jensen adds, “It was important for us to not have to change too much. We wanted to add recyclability to what we’re already doing, not to try to fit what we’re doing into recyclability. It would quickly become quite costly if we needed to change factories and systems and processes and so on,” Jensen explains. The resin went through a series of critical lab evaluations and coupon-level tests before going into the first proof-of-concept blade.

Integrating recyclability into existing processes. Of importance for wind blade fabricators and OEMs is that recyclability and circularity solutions be easily integrated into existing operations. Because of this, drop-in replacement resins like Elium and Recyclamine show promise as first solutions (Siemens Gamesa’s RecyclableBlade shown here). Photo Credit: Siemens Gamesa

As of spring 2022, six full-size RecyclableBlades had been produced. The first customer blades are expected to be installed this year. Jensen notes, “There is a huge amount of interest for recyclable blades, but it’s an ongoing process. It’s new to the market and there are still questions about properties such as impact and so on. There’s more information-sharing that needs to be done [to let customers know] that ‘recyclable’ does not mean lower properties.” RecyclableBlades also come at a higher cost premium.

The company started with offshore blades, but recyclable onshore blades are likely on the horizon as well, Jensen says, moving toward the Siemens Gamesa’s goal to have fully recyclable blades by 2030, as well as recyclable composite nacelle covers.

Another ongoing project is called the ZEBRA (Zero wastE Blade ReseArch) consortium, which began in 2020 and includes research institute IRT Jules Verne (Bouguenais, France), Arkema, R&D center CANOE (Pessac, France), wind farm operator ENGIE (La Défense, France), wind blade OEM LM Wind Power (Kolding, Denmark), glass fabric supplier Owens Corning (Toledo, Ohio, U.S.) and recycling specialist Suez (Paris, France). IRT Jules Verne announced in March 2022 that the first 62-meter prototype blade had been built using Elium resin and Owens Corning glass fabrics. The blade is now undergoing testing by LM Wind Power, with the next step of validating recycling methods for the blades. Automation methods to reduce energy and waste during manufacture are also being developed as part of the project.

Of course, as more recyclable blades begin to come to market and mature through these and other industry efforts, the recycling supply chain will need to be available to handle eventual EOL blades as well. “There will be a lot of learning and optimization with our recycling partners along the way,” Jensen says.

Ultimately, the technologies and supply chain investments made in wind blade recycling provide the rest of the composites industry with solutions as well. Vestas’s Poulsen says, “I would love for other composite industries to pick this up and to invest in development and use of resin systems that are easier to recycle or [are] even circular. The wind industry has large, concentrated amounts of EOL composite parts, but we aren’t the industry with the most composite waste. What happens to composite boats at their end of life, or the PCBs in electronics? My hope is that the wind industry is the pioneer, and that other industries will follow suit.”

Related Content

Materials & Processes: Resin matrices for composites

The matrix binds the fiber reinforcement, gives the composite component its shape and determines its surface quality. A composite matrix may be a polymer, ceramic, metal or carbon. Here’s a guide to selection.

Read MoreForvia brand Faurecia exhibits XL CGH2 tank, cryogenic LH2 storage solution for heavy-duty trucks

Part of its full hydrogen solutions portfolio at IAA Transportation 2022, Faurecia also highlighted sustainable thermoplastic tanks and smart tanks for better safety via structural integrity monitoring.

Read MorePlant tour: ÉireComposites, Galway, Ireland

An in-house testing business and R&D focus has led to innovative materials use and projects in a range of markets, from civil aerospace to renewable energy to marine.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreRead Next

CW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)