Exelis Aerostructures: Salt Lake City

Braided composite shafts and struts for aircraft are its specialty, but there’s much more to this Utah, US-based rising star.

A composites manufacturer that supplies parts to the aerospace industry must have, at the least, basic competencies in prepreg-based fabrication processes, including hand layup, automated fiber placement (AFP), automated tape laying (ATL) and autoclave-based cure. A number of composites industry players meet this requirement. But given the great diversity of fiber types and fiber reinforcement forms, resin systems, tooling types and materials and processing technologies available today, and several decades of composites development and application in aircraft of all types, almost every composites supplier of significant size and impact has developed a specialty — an area of expertise that has fueled and sustained the company’s growth.

Such is the case with Exelis Aerostructures. Based in Salt Lake City, UT, US, the company easily qualifies on the basics. AS9100C-, ISO14001-, Nadcap-, and Boeing Composite-certified, Exelis excels not only in the autoclaved prepreg arena, but has well-developed expertise in filament winding, resin transfer molding (RTM) and vacuum-assisted RTM (VARTM) as well. That said, Exelis is a standout in the aerospace composites supply chain, today, in large part due to its rich history in carbon fiber braiding, which has helped set this fabricator apart from its competitors.

Same game, new name, growing fame

Although the company’s Salt Lake City operations were established decades ago, the Exelis name itself is relatively new, introduced in 2011 when Exelis’ parent, ITT Corp. (White Plains, NY, US), split itself into three independent companies focused on defense and electronics, fluid technology, and motion-and-flow control. Exelis, with 10,000 employees and US$4.8 billion in revenue, represents the defense-and-electronics segment and is based in McLean, VA, US. The Exelis Aerostructures business operates two Utah facilities, managed by VP/GM Mike Blair.

Although the business is established and sizable, it’s neither hide-bound nor immobile. Blair is leading Exelis through an aggressive capacity-and-capabilities expansion, featuring forays into a variety of aerospace applications. Examples abound: Composite floor-beam struts for the Airbus (Toulouse, France) A380, the vertical tail and sponsons for the Sikorsky (Stratford, CT, US) CH-53K helicopter, the upper access covers, blade seal components and outboard wingskins for Lockheed Martin’s (Ft. Worth, TX, US) F-35 Lightning II, Section 41 and 43 fuselage frames for The Boeing Co.’s (Chicago, IL. US) 787-9 airliner, and the upper shell and other parts for Lockheed Martin Missiles and Fire Control’s (Orlando, FL, US) Joint Air-to-Surface Standoff Missile (JASSM).

Exelis’ business development director Jeff Sunderland, however, says the company’s expansion, although aggressive, is proceeding methodically and carefully. Enthusiasm is tempered by wisdom won over the long haul. “We are trying to be parochial about going to market,” he says. “We want to win work, run it flawlessly and then pursue other opportunities. We don’t want to bite off more than we can chew — one failure can lead to years of bad reputation.”

When CW was invited to tour both of the facilities Exelis operates in Salt Lake City in an industrial park due east of the SLC airport, Blair was our guide through the company’s original plant on Billy Mitchell Rd., built in 1969, and just a few blocks away, the company’s new Composite Design & Manufacturing Center (CDMC) on Amelia Earhart Dr.

Established core, exceptional commitment

The 13,935m2 Billy Mitchell Rd. plant is home to many of the legacy technologies with which Exelis has won work and built its business. The bulk of the building’s space is consumed by Exelis’ braiding operation. Exelis runs 18 braiding machines, some developed in-house. They range in operational complexity from 16 to 288 tows. Manufactured by Herzog Maschinenfabrik GmbH & Co. KG (Oldenburg, Germany), the 288-tow braider, also called Stargate, is characterized by Blair as a “solution seeking an application.” All of the braided products are processed via RTM or VARTM, with curing done in one of five Grieve Corp. (Round Lake, IL, US) ovens located in the braider room.

Exelis braids preforms in a variety of sizes — the largest for the fuselage of the JASSM, and the most complex, the variable bleed valves (VBV) for GE Aviation’s (Evendale, OH, US) GEnx engine. This carbon fiber/BMI part, also RTM’d, comprises several preforms and features a variety of difficult-to-mold angles and spaces. Exelis makes 11 different VBVs per engine and eventually will produce 12 shipsets per month at full rate production.

Blair notes that, despite its long history in composites manufacturing, braiding is not usually performed by fabricators. However, braiding is clearly an expertise that Exelis has cultivated carefully and invested in heavily. “Not many companies do their own braiding,” Blair points out, but explains, “It gives us more flexibility and makes us more lean.”

No matter where the Exelis empire expands, it’s clear that the company’s core strengths are braiding and the products that result. But lessons learned as Exelis developed its braiding expertise are now applied to a variety of processes, including those used to produce its latest product line — struts, tubes and rods (STaR). “We’re basically going after galactic domination in struts and rods,” Blair quips.

From the braiding room, Blair moved us on to Exelis’ filament winding operation, where the process is used primarily to manufacture potable-water and wastewater storage tanks for aircraft. Here, Exelis operates several winders manufactured by Salt Lake City-based Entec Composite Machines Inc. and one system from Magnum Venus Products(MVP, Knoxville, TN, US). The tanks, which are about 1m long and 0.25m diameter, are wet wound with carbon fiber/epoxy and are outfitted with a variety of fixtures and attachments, all of which Exelis assembles in house. The wastewater tanks feature stainless steel liners; the potable-water tanks have blowmolded plastic liners. The company manufactures about 700 tanks per year, primarily for Boeing’s 737, 747, 757, 767 and 777 aircraft. In addition, Exelis is a certified FAA repair station for the tanks.

CDMC: Seeding the future

If the Exelis Billy Mitchell Rd. facility represents the company’s legacy processes and applications, then the CDMC site on Amelia Earhart Dr. represents its potential. This new (2012) 22,760m2 purpose-built plant houses the equipment and facilities necessary to meet all of the contemporary requirements of aerospace composites manufacturing — high-precision fiber and tape placement, cleanroom layup, large-format autoclave cure, precision machining, nondestructive inspection (NDI) and assembly. Most of all, the facility features space, and plenty of it, to accommodate fabrication of very large parts. And within that spacious environment, says Blair, Exelis has the room to invest in new equipment and develop the additional expertise that the aerospace industry might demand. “You have to build it and they will come,” Blair asserts. “If you want to do automated fiber placement, you need to invest — invest in capability, machines and people.”

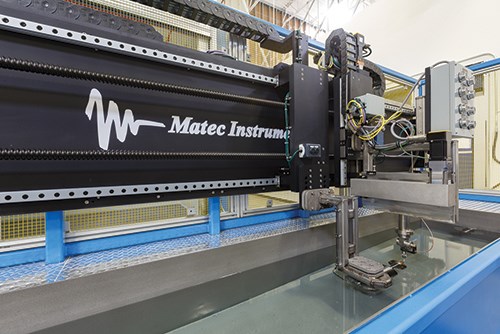

At the heart of this investment are two large machines. The first is a dual-station Fives Cincinnati (Hebron, KY, US) VIPER AFP machine, capable of laying down up to 32 tows of 3.2-mm carbon fiber. At the time of CW’s visit, Exelis was using this machine to demonstrate the capability to mold the upper wingskin of the F-35 Lightning II. Exelis hopes that it will win work fabricating this structure. The second machine is a Fives dual-station, gantry-style automated contour tape layer, with an 18.3 by 4.9 by 1.2m build envelope and the capacity to place 76-, 152- or 305-mm wide tape (see photo at left). This machine is being used to demonstrate Exelis’ flat-panel manufacturing capability for a number of aircraft components, including horizontal and vertical tail structures.

People-powered production

Adjacent to the fiber- and tape-placement space is Exelis’ 1,850m2 cleanroom, where technicians focus on hand layup of F-35 access covers, blade seals and wingskins, CH-53K sponsons and tails (vertical and horizontal), and S-76 helicopter rotor blades and flex beams. The room features four tool prep bays that each feed one of four production lines (cutting tables), with 12 workstations on each line. Prepreg is supplied from three freezers that line the cleanroom’s back wall, and finished layups are transferred immediately to autoclaves located in an adjacent space.

The work in the cleanroom is team-based, and Exelis has given employees in this area some ownership: “The people working closest to the product are the smartest about that product,” contends Darin Friess, director of engineering. For that reason, they are given a measure of authority and operate with a degree of autonomy. “They’ve developed their own kanban and troubleshooting,” he says, adding, “They are always looking for ideas to continuously improve.”

Exelis operates six autoclaves in Salt Lake City — four from ASC Process Systems(Valencia, CA, US), one from Taricco Corp. (Long Beach, CA, US) and one from American Autoclave Company (Jasper, GA, US). They range in size from 0.9 by 1.5m to 4.6 by 15.2m.

After cure, most parts are transferred to the machining shop for drilling, trimming, routing and cutting. Exelis operates eight 5-axis machining centers, including seven from Breton SpA (Castello di Godega, Italy) and one from Komo Machine Inc.(Lakewood, NJ, US), but most of the work done in this building runs on two Breton 1300 units, the facility’s most flexible CNC centers. Exelis, says Friess, favors cutting tools supplied by Precorp (Spanish Fork, UT, US), but has been testing other cutters, including one from LMT Onsrud LP (Waukegan, IL, US) that has fared well.

Nondestructive inspection is done at 10 work centers, ranging from single- to 5-axis capability, using methods that include pulse echo, through-transmission, hand-scan and bond-scan.

One of the largest spaces at the CDMC facility is devoted to the assembly of a variety of structures for which the rest of the facility makes component parts. These include the vertical and horizontal tails and the sponsons for the CH-53K, for which Exelis fabricates a total of 193 different composite parts, made with prepreg supplied by Hexcel (Stamford, CT, US). Exelis has already manufactured seven shipsets of parts for Sikorsky, for the helicopter’s system design and development phase. This will be followed by four more shipsets that will be used as test articles. This work, assuming positive test results, could be followed by contracts for low-rate production and, perhaps, rate production of up to two shipsets a month by 2021.

Struts and tubes: STaR power

One of the newest operations at the CDMC harkens back to the Exelis’ filament winding legacy. The company has licensed technology from Bodair SA (Oupeye, Belgium) for Exelis’ STaR (struts, tubes and rods) product line. Exelis plans to use Bodair’s manufacturing cell, which encompasses filament winding equipment, curing technology, machining, drilling, NDI, painting, priming and bushing installation, to produce a variety of floor beam and wingbox struts, control rods and torque tubes for aircraft. Notably, STaR enables easy reconfiguration of fittings and bushings to meet customer and application requirements. “The combination of the unique manufacturing process and automation technology positions us to meet the market demands, with the ability to produce upward of 40,000 STaR parts per year,” Blair adds. STaR’s production flexibility and potential unit output helped Exelis land one of its largest programs to date — manufacturing the main deck floor beam struts for the Airbus A380 aircraft. Exelis makes 95 A380 struts per shipset and will manufacture 240 struts per month at rate production.

Plugging into potential ventures

Our final stop in the CDMC revealed a new Exelis venture that has nothing to do with aerospace, but demands all of the performance hallmarks of the company’s other work. The product, called the Bear Claw, is a filament wound “plug” used during drilling in oil and gas production (see “Composites boon from hydraulic fracturing?” under "Editor's Picks"). Sized from 114 to 140 mm in diameter, Bear Claws measure about 0.75m in length. The plugs are assembled at Exelis up to a certain point, beyond which they can be customized easily to meet customers’ different end-use requirements. Exelis currently makes 1,100-plus plugs per month and delivered more than 12,000 in 2014. “It’s a high-temperature, high-pressure, pretty demanding environment,” Blair says. “It’s not aerospace, but it’s like aerospace.”

Bear Claws are a harbinger of ventures yet to come. In fact, if known growth opportunities at Exelis come to fruition as planned, the company expects to add another 13,000m2 to the CDMC in 2015.

The activities and expansion at Exelis Aerostructures’ Salt Lake City location are attracting attention from not only new customers but also other OEMs within the aerostructures community, including Boeing, Northrop Grumman (Palmdale, CA, US) and Spirit AeroSystems (Wichita, KS, US). “A lot of us look at this as a chance to build a legacy,” Blair notes, but adds that despite the serious challenges inherent to the advanced composites territory, “It’s a lot of fun.”

Albany Engineered Composites Inc.

Matec Instrument Companies Inc.

Related Content

The making of carbon fiber

A look at the process by which precursor becomes carbon fiber through a careful (and mostly proprietary) manipulation of temperature and tension.

Read MoreMaterials & Processes: Fabrication methods

There are numerous methods for fabricating composite components. Selection of a method for a particular part, therefore, will depend on the materials, the part design and end-use or application. Here's a guide to selection.

Read MoreMaterials & Processes: Composites fibers and resins

Compared to legacy materials like steel, aluminum, iron and titanium, composites are still coming of age, and only just now are being better understood by design and manufacturing engineers. However, composites’ physical properties — combined with unbeatable light weight — make them undeniably attractive.

Read MoreCAMX 2022 exhibit preview: Current Inc.

Current Inc. produces thermoset-based products such as tubing rods, sheets and more with high electrical and mechanical characteristics and different color combinations.

Read MoreRead Next

Composites boon from hydraulic fracturing?

Hydraulic fracturing — commonly known as frac'ing — has become an efficient, if controversial, method for oil and gas extraction. Composite materials are helping pave the way in this very demanding application.

Read MoreA critical market sector: Downhole composites in oil and gas

Tremendous secrecy and non-disclosure has kept this profitable composites application out of the spotlight, while it has enabled the current shale oil energy boom.

Read MoreComposites boon from hydraulic fracturing?

Hydraulic fracturing — commonly known as frac'ing — has become an efficient, if controversial, method for oil and gas extraction. Composite materials are helping pave the way in this very demanding application.

Read More

.jpg;maxWidth=150;quality=70)

.jpg;maxWidth=400;quality=70)