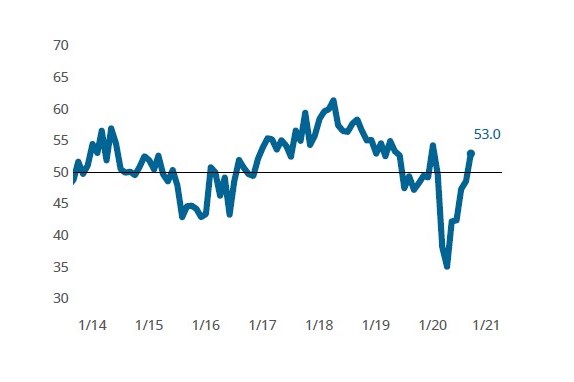

Composites Index marks first COVID-era expansion

Expanding new orders, production and employment activity send the Index over 50 for the month of September.

Composites Fabricating Business Index: September’s reading of 53.0 (51.6 when excluding the influence of supplier deliveries) marks the first time since January that the industry has reported an expansion in business activity.

The Composites Index registered 53.0 in September, marking an overall expansion in composites industry activity for the first time since the start of the COVID-19 pandemic. The Index was led higher by a combination of expanding activity in new orders, production and employment. The readings for new orders and production activity made significant moves in September with increases of 8 and 10 points, respectively.

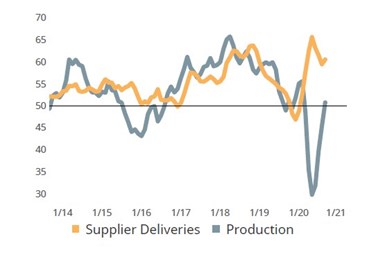

Can production activity continue to expand while supplier deliveries slow? Production activity expanded for a second month; however, supplier delivery readings remain stubbornly high, indicating that supply chains are still greatly disrupted. This combination raises the question of how long this situation can persist.

The supplier deliveries reading increased during the month, representing a slowing of deliveries activity. In the year-to-date period, supplier deliveries activity in the composites industry has been slower to return towards historical norms than for most other manufacturing disciplines tracked by Gardner Intelligence. The ongoing constraint in supplier deliveries puts into doubt the ability of fabricators to sustain the nascent expansion in production activity. Without further improvement in the supply chain, production may falter, causing headwinds for new orders and lengthening backlogs. Removing the inflationary influence of supplier deliveries from the September composites index result would have resulted in a lesser, but still expansionary, reading of 51.6.

Among the many end-markets served by the composites industry, electronics and custom processors have reported relatively better activity levels in recent months. These improvements have been offset by the well-publicized challenges facing the aerospace industry.

Related Content

-

Composites industry gained back some ground in December

The GBI: Composites Fabricating contracted a little more slowly in December, landing between August and September 2023 values.

-

Composites market shows signs of stabilizing as future outlook brightens

Improving supplier deliveries and strong future business index point to opportunities ahead.

-

Overall composites index contracting faster than previous month

New orders, production and prices components all improved over October, though the GBI is still seeing contraction.

.jpg;width=70;height=70;mode=crop)