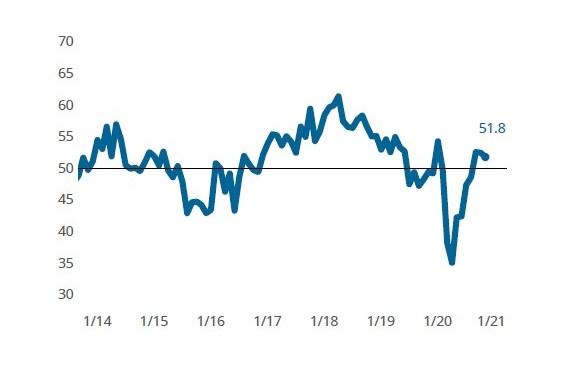

Composites activity expands for third straight month

Production may struggle under slowing new orders and supply chain challenges.

Composites Fabricating Business Index: Total business activity expanded for a third consecutive month in November 2020, helped by the slowing expansion in new orders and production activity. The supplier delivery reading elevated the overall Index by over 2 points, keeping the Index above 50.

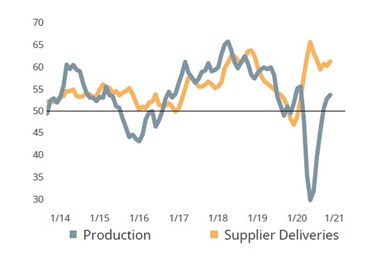

The Composites Index ended November at 51.8, signaling the industry’s third consecutive month of overall expanding business conditions, made possible by a multi-month trend of expanding new orders, production and employment. The spread between production and new orders activity widened in part due to a relatively greater slowing of new orders activity, causing backlog activity to contract. As of November, export orders readings had yet to return to their pre-pandemic levels, demonstrating both the severity and global impact of COVID-19.

Had it not been for an elevated supplier delivery reading in November, the Index would have registered its first overall contraction since August. Recent supplier delivery readings continue to signal extreme challenges to supply chains and logistics, especially considering that supplier delivery index values are closely tied to order-to-delivery times, with readings increasing as delivery times lengthen. The fourth quarter of 2020 will be made worse as seasonal package delivery demand and vaccine distribution compete for more of the transportation industry’s already diminished capacity.

Transport companies face increasing demand with diminished capacity: Supply chains issues will be made worse in the fourth quarter of 2020 and beyond as seasonal shopping and vaccine distribution consume more of the shipping capacity that could otherwise be used to deliver materials to composites fabricators for production.

November 2020, as many know, was also the month in which the FAA cleared the Boeing 737 MAX to return to service. It may not be a coincidence that aerospace activity for the month reported its first expansionary reading since before the pandemic. Among all end markets tracked by Gardner Intelligence, composites fabricators reported the quickest expansion in the automotive and electronics markets.

Related Content

-

Composites industry GBI stayed the course in February

The GBI: Composites Fabricating contracted in February to the same degree as January, maintaining its position in a contraction zone.

-

Composites industry heads into slightly accelerated contraction in November

The GBI: Composites Fabricating in November continued its general slow-going path of contraction that began in April 2023.

-

Overall composites index contracting faster than previous month

New orders, production and prices components all improved over October, though the GBI is still seeing contraction.

.jpg;width=70;height=70;mode=crop)