Carbon Fiber 2016 Report

Conference speakers predict the outlook for carbon fiber supply and demand.

CompositesWorld’s annual Carbon Fiber Conference, Nov. 9-11 in Scottsdale, AZ, US, offered its usual insightful look at the current and anticipated application of carbon fiber composites in a variety of markets and products. The opening session kicked off with a seminar presented by Chris Red of Composites Forecasts and Consulting LLC (Mesa AZ, US) on the global outlook for carbon fibers and carbon fiber composites. As usual, Chris included his assessment of carbon fiber supply and demand — this time, through 2025.

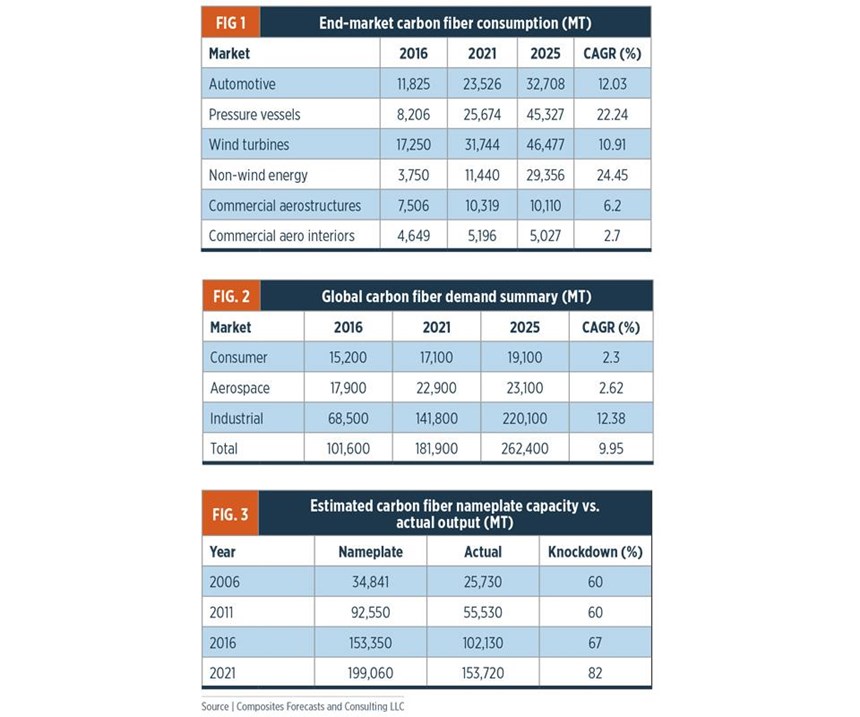

In terms of consumption by volume, Red noted that the vast majority (75%) of carbon fiber is used in the industrial market, which includes the automotive, pressure vessels and wind energy sectors. The remainder goes to the aerospace market (14%) and the consumer market (11%). The biggest drivers of carbon fiber use over the coming decade, says Red, will be in categories he labels automotive, pressure vessels, wind turbines, non-wind energy, commercial aerospace structures and commercial aero interiors. His outlook for these is charted in Fig. 1.

Globally, Fig. 2 summarizes how Red sees total carbon fiber demand adding up during the coming decade. Note that in five years, Red expects the industrial market alone will use more carbon fiber annually (141, 800 MT) than the entire world consumes yearly today (101, 600 MT).

On the supply side, Red says to expect an increase in global carbon fiber manufacturing capacity in the 2020-2024 timeframe of 100,000 MT to meet a surge in demand. His carbon fiber output estimates are collected in Fig. 3.

Dan Pichler, of Germany-based Carb Consult GmbH (Hofheim am Taunus) offered his own summary of the carbon fiber supply and demand situation, and his assessment is more conservative. He estimates that 2015 carbon fiber demand was 58,000 MT, followed by 2016 demand of 65,000MT. Further, he anticipates 2025 carbon fiber demand will total 175,000 MT. On top of that, Pichler estimates that current actual carbon fiber capacity is 95,000 MT, which means the current market is almost 40% over- supplied. Pichler believes this overcapacity might persist through 2025. Finally, Pichler foresees the addition of more carbon fiber suppliers in Asia, followed by consolidation among carbon fiber manufacturers over the next several years.

Keynoting the conference was Paul Oldroyd, technical fellow, manufacturing and engineering process development, at Bell Helicopter/Textron Inc. (Fort Worth, TX, US), who offered his assessment of the future of carbon fiber application in aerostructures. He noted that the current aerocomposites formula — low volume, high performance, high cost — “has to be changed.” He sees in the wind and automotive markets lessons to be learned, respectively, about how to increase speed and efficiency. He pointed to three variables that he thinks deserve attention and improvement: Optimization of fiber placement with thinner plies and off angles to improve laminate stiffness without sacrificing strength; shorter and more efficient material qualification cycles; and the applica-tion of out-of-autoclave processes (from automotive and wind) that can speed manufacturing of aerocomposites.

From outside the composites industry and looking in was Bill Bihlman, president of consultancy Aerolytics LLC (South Bend, IN, US). He offered what he said was an “agnostic” view of mate rials use in aerostructures, focused primarily on the advantages and disadvantages of aluminum and carbon fiber composites. He noted the well-known hurdles of composites, including relatively high cost ($300-$350/lb of finished part), the difficulty of damage detection and the labor intensity of composites manufacturing. He emphasized, however, that airlines increasingly drive airframe material choice, in the process factoring in price, weight, aircraft capacity, range and speed. Bihlman also argued that the direct operating cost of aircraft maintenance should be given greater weight by airlines when considering material use. This is where composites excel, offering operators a chance to lengthen the time interval between major maintenance operations. Regardless, looking forward to replacements for The Boeing Co.’s (Chicago, IL US) 737 and the Airbus (Toulouse, France) A320 passenger jets, Bihlman said “conventional wisdom says aluminum will be featured in narrowbody fuselages,” while the wings will be made with carbon fiber. He said these craft are being designed now, and to expect entry into service around 2025.

On the autocomposites front, Tom Pilette, VP of product and process development at Magna Exteriors (Troy, MI, US), was decidedly upbeat about carbon fiber’s future in cars and trucks. He said Magna sees persistent demand for lightweighting to offset mass added by new vehicle features and amenities, as well as batteries. This will, he argued, push carbon fiber increasingly into parts like hoods, roofs, doors, and body- in-white (or, body-in-black, he noted). “We would not be in the lightweight composites market if we thought it would remain a niche product,” he noted. Indeed, by 2020, Magna expects carbon fiber penetration will be 20% in the luxury car market, and 5-10% in the mainstream automotive market. This could, he estimated, double global carbon fiber demand by 2020. The challenge, he said, will be scaling up composites manufacturing capacity to meet the demand. In this regard, he noted, “The good thing about the automotive industry is that things take time,” thus, giving the industry a chance now to start solving capacity problems.

By the end of the conference, overall sentiment seemed to favor the mindset that increased carbon fiber consumption, at least during the next decade, is a given. The question, then, is not if it will grow, but how much. That remains to be seen.

Related Content

AM method enables tool-free, energy-efficient thermoset composites production

University researchers highlight how the combination of a thermally curable resin system with photothermal curing eliminates the post-curing steps involved in discontinuous, continuous fiber parts fabrication.

Read MorePrepreg compression molding supports higher-rate propeller manufacturing

To meet increasing UAV market demands, Mejzlik Propellers has added a higher-rate compression molding line to its custom CFRP propeller capabilities.

Read MoreComposite resins price change report

CW’s running summary of resin price change announcements from major material suppliers that serve the composites manufacturing industry.

Read MoreBladder-assisted compression molding derivative produces complex, autoclave-quality automotive parts

HP Composites’ AirPower technology enables high-rate CFRP roof production with 50% energy savings for the Maserati MC20.

Read MoreRead Next

Ceramic matrix composites: Faster, cheaper, higher temperature

New players proliferate, increasing CMC materials and manufacturing capacity, novel processes and automation to meet demand for higher part volumes and performance.

Read MoreUltrasonic welding for in-space manufacturing of CFRTP

Agile Ultrasonics and NASA trial robotic-compatible carbon fiber-reinforced thermoplastic ultrasonic welding technology for space structures.

Read MoreCutting 100 pounds, certification time for the X-59 nose cone

Swift Engineering used HyperX software to remove 100 pounds from 38-foot graphite/epoxy cored nose cone for X-59 supersonic aircraft.

Read More