Additive manufacturing a new frontier for composites

Leading additive manufacturing authority Terry Wohlers (Wohlers Associates Inc., Ft. Collins., Colo.) comments on two decades of AM progress and AM's prospects as a composites manufacturing solution.

During more than two decades of R&D and commercial application, additive manufacturing (AM) processes have had a tremendous impact on the field of design, in the form of rapid prototyping and toolmaking and, more recently, part production. My previous AM report for CT (see “Editor's Picks," at right) was written in late 2008, as this growth peaked and recessionary storm clouds gathered. In a subsequent survey, I collected data from 29 system manufacturers and 65 AM service providers who supply to approximately 5,000 clients worldwide in a wide range of markets. The results revealed that while AM is not recession-proof, it is a resilient technology and one that has yet to reach its full promise, particularly in the field of composites. My findings show that AM equipment manufacturers began to see sales decline by the third quarter of 2008, yet unit sales on the year were up 1 percent. Through December 2008, Stratasys Inc. (Eden Prairie, Minn.) had sold 11,366 total fused deposition modeling (FDM) systems, compared to an estimated 4,274 systems by 3D Systems (Rock Hill, S.C.). With an overall base of 4,975, 3D printing system manufacturer Z Corp. (Burlington, Mass.) pulled ahead of 3D Systems in 2008 with the second-largest number of installations worldwide.

Laser-sintering system manufacturers 3D Systems and EOS GmbH (Munich, Germany) accounted for 28 percent of all AM systems delivered to service providers in 2008. But 3D printing systems from Objet Geometries (Rehovot, Israel) are among those gaining the most in popularity. Although they represent only 3 percent of the world’s installed base among service providers, they accounted for 12 percent of the systems added by those companies in 2008.

In 2008, several companies introduced new AM systems to the market: EOS GmbH, Objet Geometries, Mcor Technologies (Ardee, Ireland), MTT Technologies Group (Staffordshire, U.K. and Knoxville, Tenn.), and three U.S. companies: 3D Systems, Optomec (Albuquerque, N.M.) and Z Corp. And in fourth-quarter 2008, Huntsman Advanced Materials (Basel, Switzerland) surprised many when it announced an entirely new AM process and machine, the Araldite Digitalis. The system uses a micro-mechanical shutter mechanism that can quickly expose large areas of resin to UV light.

In 2009, things were quite different: The top AM system providers Stratasys and 3D Systems, for example, reported declines of 20.6 percent and 22.2 percent, respectively, in the third quarter of 2009. Yet, the poor economy over the past 12 months did not deter a number of AM equipment and material suppliers from making new product introductions. In early 2009, Stratasys introduced the $14,900 uPrint system based on FDM technology. Later, F&S GmbH (Bielefeld, Germany) introduced its FS-ReaLizer system, and Bits from Bytes (North Somerset, U.K.) also introduced an open-source system. I expect to see machine sales return to healthier levels as the economy improves worldwide and manufacturers see renewed activity, based, in part, on pent-up demand.

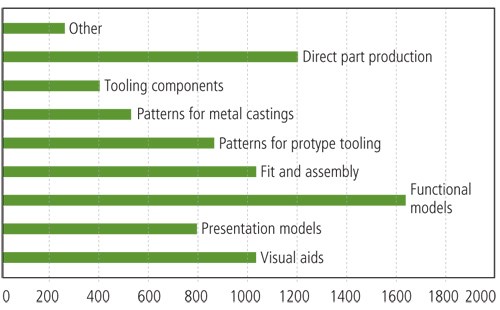

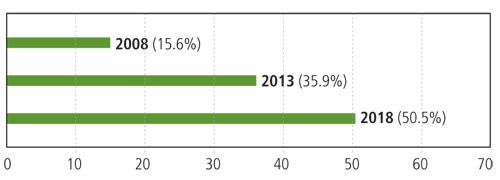

According to our survey, AM technology is used increasingly for functional modeling, the number one application of the technology as shown in the chart at right. (The bars indicate the number of customers who use AM technologies for particular purposes. Note that a part may be used for more than one of the listed purposes.)

The most interesting growth has been in the use of AM to produce finished production parts. This category has grown from almost nothing seven years ago to the second most common application. As a group, the surveyed companies said that AM part production was 15.6 percent of their business in 2008. Further, they indicated that they believe part production will represent 35.9 percent of their business by 2013, and more than half (50.5 percent) of their business by the end of 2018.

AM’s impact on the composites industry has been difficult to gauge, but it is clear that several of the technologies, laser sintering especially, offer opportunities to manufacturers for whom part size is within the AM machinery build window and part counts are relatively low. AM processes offer reduced costs and time associated with the development of tooling, especially for complex parts. And because multiple small parts can be built simultaneously, production efficiency is inversely proportional to part size, which makes the process very attractive in terms of individual part cost.

AM material suppliers offer glass fiber- and carbon fiber-reinforced thermoplastic materials for laser sintering. Advanced Laser Materials LLC (Belton, Texas), for example, offers a line of glass-filled polyamides, specially formulated for high thermal stability, including a highly recyclable polyamide composite material for laser sintering — and offers custom formulations. EOS markets PA 3200 GF material, a glass-filled polyamide that withstands high mechanical loads, and CarbonMide, a carbon fiber-filled polyamide powder that produces stiff, lightweight parts. The latter is targeted at the motorsports industry and works well for shielded electronic housings. CRP Technology (Modena, Italy) developed Windform XT, a carbon-filled polyamide, and Windform Pro, an aluminum- and glass-filled polyamide. Composite materials for stereolithography include 3D Systems’ Bluestone and Accura Greystone nanocomposite resins. DSM Somos (Elgin, Ill.) also offers a nanomaterial.

One obstacle is a technical issue with laser sintering. A fiber-filled material can offer improved strength in the x-y direction of a part, but it typically offers little or no additional strength in the z-direction because the fibers do not span the divide between build layers. Currently, laser-sintered parts must be designed with that limitation in mind. On the positive side, some materials manufacturers are flexible and willing to work with manufacturers to develop materials that meet design specifications.

I see a need, and an opportunity, for the composites and AM industries to cooperate. Both have a lot to gain by jointly solving some of these problems and offering a wider range of materials. Additive manufacturing represents a relatively new and exciting frontier for composites manufacturers.

Note: Parts of this column were excerpted from Wohlers Report 2009, a global study on the advances in additive manufacturing, available at www.wohlersassociates.com.

Related Content

Composites end markets: New space (2025)

Composite materials — with their unmatched strength-to-weight ratio, durability in extreme environments and design versatility — are at the heart of innovations in satellites, propulsion systems and lunar exploration vehicles, propelling the space economy toward a $1.8 trillion future.

Read MoreReinforcing hollow, 3D printed parts with continuous fiber composites

Spanish startup Reinforce3D’s continuous fiber injection process (CFIP) involves injection of fibers and liquid resin into hollow parts made from any material. Potential applications include sporting goods, aerospace and automotive components, and more.

Read MoreSulapac introduces Sulapac Flow 1.7 to replace PLA, ABS and PP in FDM, FGF

Available as filament and granules for extrusion, new wood composite matches properties yet is compostable, eliminates microplastics and reduces carbon footprint.

Read MoreOtto Aviation launches Phantom 3500 business jet with all-composite airframe from Leonardo

Promising 60% less fuel burn and 90% less emissions using SAF, the super-laminar flow design with windowless fuselage will be built using RTM in Florida facility with certification slated for 2030.

Read MoreRead Next

Prototyping and manufacturing by additive fabrication

Additive fabrication (AF) technology, such as laser sintering (LS) and fused deposition modeling (FDM), encompasses a wide range of applications. The earliest was rapid prototyping to support design, concept modeling, fit/function testing, and pattern making without the need to construct expensive tooling for prototypes and test articles. Manufacturers also are using AF to produce jigs, fixtures, drill guides, and other manufacturing and assembly tools.

Read MoreRapid Manufacturing, Part II: Pioneer Applications

Harbingers of what could be a significant trend, these composites manufacturers demonstrate the potential of additive fabrication and several innovative materials in tool-free manufacture of complex components.

Read MoreRapid Manufacturing, Part I: The Technologies

An outgrowth of rapid prototyping, tool-free additive fabrication is shortening product development cycles for manufacturers of smaller, limited-run composite parts.

Read More