The largest U.S. aircraft plant in the 1940s today comprises 1.4 million square feet of aerostructures, composites and metal-bonded manufacturing and is pioneering composites 4.0 digitized production. Photo Credit, all images: Middle River Aerostructure Systems, ST Engineering

Opened in 1929, the Glen L. Martin factory became the largest and most advanced aircraft manufacturing complex in the world during World War II. Famous for the B-10 and B-26 bombers, the iconic China Clippers for Pan Am, as well as a series of military seaplanes, the Martin Co. built more than 85 different designs and produced 11,000 aircraft, many with innovations never used before.

After Martin’s death in 1955, the Martin Co. merged to form Martin Marietta in 1961 and Lockheed Martin in 1995, producing missiles, rockets/launch vehicles and submarine structures. The part of the company specializing in composites, nacelles and thrust reversers, renamed Middle River Aerostructure Systems (MRAS, Baltimore, Md., U.S.), was then split off and sold to GE Aviation in 1998.

In 2019, MRAS was acquired by ST Engineering (Singapore), a $7 billion global technology, defense and engineering group, and the world’s largest provider of aircraft maintenance, overhaul and repair (MRO) services. With 25,000 employees worldwide and customers in more than 100 countries, ST Engineering’s major business units include commercial aerospace, satcom, defense and public security and urban solutions. The company describes digital transformation as a key mission across these businesses.

MRAS is a key site for designing and developing composite structures. It brings extensive manufacturing expertise to ST Engineering and offers increased capacity for structures production and MRO growth for customers worldwide. MRAS is also partnered with Safran Nacelles (Gonfreville-l'Orcher, France) in the joint venture Nexcelle (Baltimore, Md., U.S.), a global leader in design, production and support of aeroengine nacelles.

“Nacelles are not easy structures,” says Mitchell D. Smith, composites technology and sustainability leader for MRAS. He and Amy Diederich, MRAS lead manufacturing/process engineer, are my guides for this tour. “They [nacelles] have a lot of components with special requirements, such as noise attenuation and the ability to withstand high heat without catching fire.”

Current production programs at MRAS include the LEAP-1A engine for the Airbus A320neo, LEAP-1C for the Comac C919, the CF-6 engine for multiple civil and military widebody aircraft, the Passport 20 engine for Bombardier’s Global 7500 business jet, the CF34-10A engine for the Comac ARJ21 and the GE9X engine for the Boeing 777X.

Fig. 1. Aerostructures pioneer, past and future. The original Glen L. Martin Co.’s wood brick floor and 300-foot-wide roll-up door (top) to launch seaplanes and bombers in MRAS’ Building B contrasts with its AFP machines, sensors and machine analytics (bottom) as part of its ongoing digital transformation.

With 900 employees, Smith describes MRAS as “a mid-size business,” but with a flat organizational structure. “We’re a Tier 2 but have solid processes to enable scaling for increased production — we’re not afraid of rate 75. We run more like a small company,” he adds. “As part of GE Aviation, we had to make our financial contributions. So, we stood on our own, and that allowed us to stay entrepreneurial and drive innovation.” Smith adds that GE supported technology investment at MRAS. “They believed in automation and digitization, which allowed us to take significant steps forward.”

ST Engineering has continued that forward trajectory. “ST Engineering is a technology-based business, and we are increasing digitization in two ways: automation and machine analytics,” continues Smith. “We want to be ready to deliver scale whenever it’s needed, and part of that is getting high yield out of our equipment and technology. The other part is being ready for the future, increasing our flexibility, cost-effectiveness and sustainability.”

MRAS has already made impressive strides — 80% reduction in carbon fiber prepreg waste, 97% first-time yield (FTY) for composite nacelle structures at rate 60 and reduced cycle times (e.g., 4 hours to 12 minutes) across operations such as kitting, layup and preforming. And that’s just the beginning.

Nacelle components, acoustics

The MRAS manufacturing space comprises three buildings — A, B and C — totaling 1.4 million square feet. Composites and metal bond (e.g., aluminum skins to aluminum honeycomb) fabrication includes 250,000 square feet of cleanroom/layup space and 600,000 square feet for assembly.

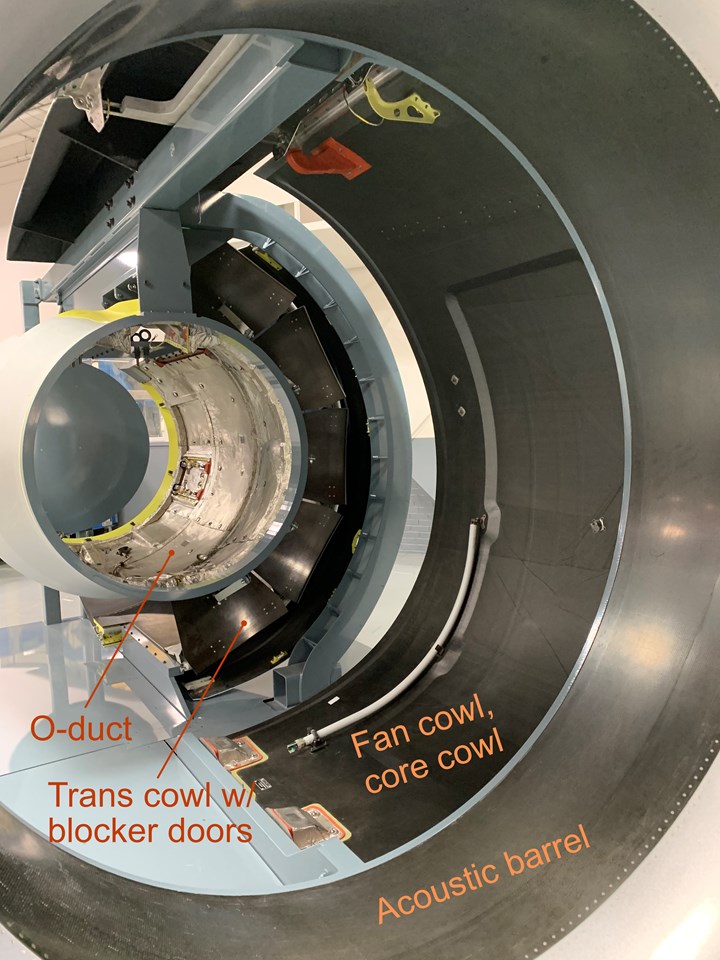

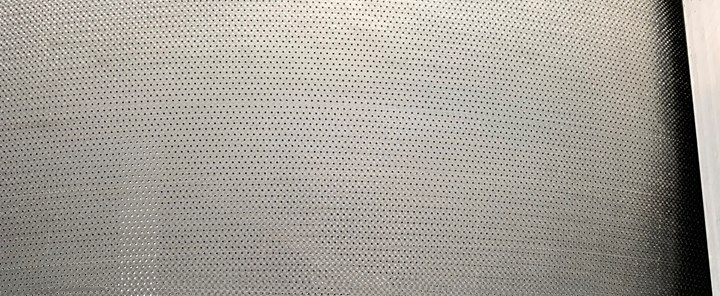

Fig. 2. LEAP engine nacelles, perf panels. This 2.5-meter-diameter display (top) highlights CFRP nacelle structures produced at MRAS, many featuring acoustic panels perforated with thousands of drilled holes (bottom).

The tour starts between Buildings A and B with a full-scale (5.2-meter-long, 2.5-meter-diameter) display showing parts that MRAS makes for A320neo and C919 LEAP engine nacelles. First is the inlet, with an extended aluminum lip skin, directed flow nozzle anti-ice system and one-piece, Nomex-cored carbon fiber-reinforced polymer (CFRP) acoustic barrel (Fig. 2), which features some specialty bonding. “When the engine’s fan is spinning,” explains Smith, “as each fan blade passes a seam in the honeycomb core, it creates a change in the pressure wave that propagates as noise out through the inlet and into the aircraft fuselage. For the LEAP nacelles, we bond multiple pieces of core so they are acoustically transparent at the seam, eliminating that noise.” This part also features thousands of drilled holes for acoustic treatment, as do many of the CFRP parts on the MRAS production floor.

Next is the two-piece CFRP fan cowl for the C919. For the C919 core cowl, instead of a traditional two-piece structure, a single-piece, metal O-duct is used. This design is part of Nexcelle’s Integrated Propulsion System (IPS), where the nacelle and the pylon connecting the engine to the wing are load-sharing.

“There’s no lower bifurcation in the O-duct,” notes Smith. “Most commercial thrust reversers have a core cowl with upper and lower bifurcation flanges that split the bypass air. In contrast, the IPS technology enables increased bypass area — increasing the bypass ratio and engine efficiency — by sharing load through all the other structures.” The last piece in the display is the LEAP-1A translating cowl with five acoustically treated blocker doors that deploy during landing to reverse thrust.

Digitized cutting/kitting

From here, we walk toward the back of the building, which faces toward the Middle River. Building A, to our right, mostly houses A320 trans cowl production, while Building B contains the stockroom, drilling centers for acoustic treatment of large structures and large CNC machining centers. Building B also has a large mezzanine assembly area where subassemblies are manufactured. “I think it was the largest production mezzanine in the world when it was installed,” says Smith. Building C, to our left, includes shipping and receiving, MRO and the ply cutting and kitting cleanroom — our next destination.

Here, two Eastman (Buffalo, N.Y., U.S.) conveyor cutting machines are used with Plataine (Waltham, Mass., U.S.) AI-based software to nest and cut plies. Smith notes that MRAS previously outsourced most of this operation. “But now we are bringing this back in-house as we advance along our automation and digitization strategy. Carbon fiber prepreg costs $60-100/pound, and we were throwing away 15-20%. Our first target was to reduce this waste.”

“For us, it was the integration with engineering, ERP and MRP that was key,” says Diederich. “Plataine integrates into all of this. It manages the raw materials coming in, generates cut plans per our engineering and marks the labels on the kit plies. We can dynamically nest up to 10 parts. The Plataine software uses AI to recommend which rolls of raw material should be cut next.” What is dynamic nesting? “Optimizing the nests on the fly as the software receives new inputs or when we query it,” says Diederich. “It can also send us alarms to change materials or operations.”

Fig. 3. Dynamic nesting, 80% less waste. Eastman conveyor cutters feature “cut and collect” software that projects colored light onto plies to match sorting tables for kitting. MRAS has integrated Plataine AI-based software to dynamically nest plies for up to 10 parts and reduced its prepreg waste by 80%.

The sorted ply information is output to the Eastman systems, which have “cut and collect” software that identifies plies for kits using different colored lights (Fig. 3). These match stacking tables at the conveyor’s end. “You simply put all of the green lit plies onto the green lit cart, etc.,” says Diederich. “That software came with the Eastman cutters, but Plataine assisted us with the programming for color light projection onto the cut plies to interface with their nesting software. We are already realizing benefits and optimizing our materials use.” Indeed, Smith notes MRAS has cut its prepreg waste by 80% and Diederich says it enables bulk transfer of kits which, for this size facility, is more energy efficient versus constant transport of individual kits.

“But a kit can have more than 600 plies,” says Diederich, “and with nesting plies for 10 parts, sorting becomes an issue, which is still pretty laborious.” Smith notes MRAS is looking at robotic ply sorting and stacking systems, for example, from Airborne (The Hague, Netherlands) and Zund America (Oak Creek, Wis., U.S.). “That repetitive motion isn’t good for our workers,” he explains.

Diederich adds MRAS is also automating the front end of the system. “We’re incrementally adding automation to the incoming material and backlit table that will allow us to inspect all the materials coming through the cell so that the system can identify and isolate problem areas and adjust nesting before it starts cutting. It’s about integrating the whole process.” Smith notes this cleanroom has plenty of room for growth and adding more machines.

Carousel freezer, RFID tracking

We exit the cleanroom and enter a 30 × 20-foot prepreg storage room through a large door. Inside the storage room, five-shelf racks for rolls of prepreg cover three walls. “The problem with prepreg freezers,” says Smith, “is every time you open and close the door, you cycle the compressors as well as a lot of moisture and air in and out. Opening up a door this size 20 times a day is very inefficient. We’ve instead built a large refrigerator, which we’ll keep at 40°F, because once thawed, we can store our prepreg rolls for 80 days at this temperature. We don’t want to put each roll back in the freezer after use because it takes 16 hours to thaw. Once we thaw it the first time, we just keep it in the refrigerator, and then we’ll pull from it each day.”

The freezer is much smaller, which saves energy, and is now located behind a long window with a lift-up door along the one wall without racks. “Instead of having the operators in a freezer, they are in this more comfortable environment,” says Smith. “When they need a roll of prepreg, they enter the number, and the carousel presents the roll to them through this window. This is a much more efficient storage system, both for manufacturing and energy use.” The carousel-based retrieval system is being digitized and coordinated with the Plataine software.

“We started with implementing the Plataine software four years ago,” says Smith, “and we pushed very far forward, putting RFID tracking on everything: tools, parts, materials. But there were issues; for example, the tags can’t go into the autoclave. And if we had two parts stacked on top of each other, the RFID antenna would only read the top one. There was also a lot of frustration within our workforce to incorporate the system into our processes. Their buy-in is really important. So, we took a break and re-evaluated how we wanted to implement that technology. We then restarted with just ply cutting and kitting and using barcode scanning. But we also have several other types of sensors we’re trialing, including Bluetooth. We will always move forward, but often that is not in a straight line. You must be comfortable with failure and learn to pivot and adapt when implementing new technology.”

And the Plataine software will work with these sensors? “Yes,” says Diederich, “but it’s also open architecture, so we can keep integrating new functionalities. I’m constantly working with the Plataine system and coming up with new ideas. The AI guides analytics for predictive actions. In the future, this will help me plan the materials we need to buy. We are also adding in machine analytics that will allow us to do predictive maintenance, versus waiting for unplanned events which could disrupt production.”

AFP onto RTM fan case

We walk back across the aisle to a second cleanroom. Here, we see a large post and rotator Electroimpact (Mukilteo, Wash., U.S.) automated fiber placement (AFP) machine. Developed for GE, the configuration of this one-off machine enabled true helical fiber paths. At MRAS, it is used for finishing the GE9X engine fan case for the Boeing 777X. Smith notes the 777X program has been dormant for a few years, but is scheduled to restart in 2023.

This machine, one of four Electroimpact AFP machines at the plant, features two AFP heads, each capable of applying up to 16 0.25-inch-wide tows. The 3.4-meter/11-foot-diameter composite GE9X fan case is produced by Safran Aircraft Engines (Courcouronnes, France) in partnership with Albany Engineered Composites (Rochester, N.H., U.S.) using a co-developed 3D woven composite preform technology and resin transfer molding (RTM) with Solvay (Alpharetta, Ga., U.S.) Cycom PR520 liquid epoxy resin.

“This is one of the largest RTM parts that I’ve seen,” notes Smith. “We receive the shell and then apply a composite structure that aids during a blade-out scenario. This structure gets cured at 250°F by placing the whole fan case in the autoclave. We had one of the few autoclaves large enough within GE Aviation for it to fit into.”

“We then add acoustic panels, internal structure and abradable panels. Once the 777X picks up again, this whole cleanroom will be dedicated to GE9X parts. At rate, it’s more than 12 engines/month and this fan case requires multiple steps for us to complete and send on. We could have 15-20 of these in progress at any given time.”

While the 777X and the GE9X are on hold, MRAS repurposed this area to help resolve an unexpected supply chain issue — manufacturing composite blocker doors for the A320neo trans cowl for the LEAP-1A engine. “We made more than 300 composite tools and layup aids to manufacture the doors and went from zero to 60 doors/week in 6 months for rate 12 aircraft production. But we could easily accommodate a higher volume.” This supply chain issue was scheduled to be resolved by the end of 2022, and MRAS production phased out.

Growing MRO

Next, we walk into a large open area where performance improvement package (PIP) work is completed for the 2.8-meter-diameter GEnx-1B fan case. “We strip out the guts of the fan case and put in a new composite structure to accommodate a configuration that improves engine performance,” explains Smith. “This includes all new composite panels. We mirror GE Batesville’s new-build operations, but as an MRO provider. We can do this because we’re a one-stop shop with FAR 145 repair station certification and the layup, autoclave, waterjet machining and nondestructive inspection [NDI] capabilities required. We launched engine MRO work with GE Aviation, and ST Engineering is growing that with nacelles as well. Our facility lets ST Engineering mirror its Europe and Asia capabilities in North America. The company is also a leader in full aircraft overhaul and passenger-to-freighter conversions. This enables them to send us nacelles and thrust reversers to overhaul as part of those services.”

Building A

The first area we walk through in Building A is “autoclave row,” which houses all MRAS autoclaves, says Smith, “except for the 15-foot-long, 15-foot-diameter Autoclave #3 in Building C for MRO work. Autoclaves #5, #6 and #7 are the largest (50-foot long, 15-foot diameter), from Thermal Equipment Corp. [Rancho Dominquez, Calif., U.S.] and our workhorses. Autoclaves #8, #9 and #10 (30-foot long, 13-foot diameter) are from ASC Process Systems [Valencia, Calif., U.S.], newly installed for the A320neo LEAP-1A production [Fig. 4], while #1, #2 and #4 are our older autoclaves for small parts — efficient due to their smaller volume for heating.”

“We have one control center, which you see here,” he continues, “and we’re upgrading our controllers and control software to gain efficiencies in our operations. For us, software is not just about efficient “rack and pack,” but also about thermal management of the cure cycle to optimize our cycle times and reduce energy usage.”

Fig. 4. Autoclaves to meet rate, tiltable layup tools

MRAS added three new autoclaves to meet rate for the A320neo LEAP engine nacelle structures and uses tiltable tools throughout its layup operations (shown here in vertical and horizontal positions) to improve ergonomics for its technicians.

From the autoclave room, we walk through the CF6 metal bond shop. Smith points out another bond shop on the mezzanine level above where MRAS manufactures the ARJ21-10A composite structures. We then enter an adhesive reticulation room where aluminum honeycomb cores and perforated acoustic skins are prepared for the 747-8 and C919 engine cowls.

“This was one of our first robotic systems,” says Smith. “It uses a combination of infrared heating and a hot air knife to melt and reticulate the adhesive used to bond the skins and cores. We also have a few barrel reticulators that use a hot air knife on a rotating tool for reticulating adhesive used in CF6 core cowl structures.”

Layup, bonding, tiltable tools

Next, we enter a large open area where technicians at 26 stations are building acoustic skins and cored structures for the A320neo trans cowls. This allows MRAS to meet a rate of 36 half shells/18 engines/nine aircraft per week. Smith notes that MRAS achieves a 96-98% FTY (first-time yield) on these parts.

Each station has twin Virtek Vision (Waterloo, Ont., Canada) laser projectors where hand layup of multiple CFRP prepreg plies is completed. The tools for these layups can be moved to present a horizontal or vertical position, improving ergonomics for the layup technicians, which in turn helps to maximize efficiency. “They are a key part of the success of our team,” says Smith. “This is detailed, tedious work requiring expertise that does not come quickly or cheaply. We want this team to stay with us for years, and they can’t do that if they are injured or if this job puts strain on them.”

Skin layup starts with prepreg ply kits from Web Industries (Marlborough, Mass., U.S.). “Web is an excellent supplier, but eventually, this will be brought in-house as we complete our roadmap for cutting/kitting digitization,” says Diederich. “We need to make sure we are ready for such high-rate programs.” I notice the plastic envelope “traveler” that contains each part’s paper trail. “Each of these kits has a paper traveler for now,” she says, “but we will eventually get to a fully paperless system.”

“We complete layup for the acoustic skin and then cure it,” says Smith, “due to a ridge detail in the skin geometry that would cause disbonds and laminate voids if co-cured. We then strip off the peel ply and complete the layup by adding the core details, bag-side composite laminate and the tail skin.” The machined pieces of Nomex honeycomb core in these layups are also kitted and placed in each station’s materials corral. Supplied by Hexcel’s (Stamford, Conn., U.S.) Pottsville, Pa., site, they are among the most expensive details that MRAS buys.

Next, we move to a large production area for 747 thrust reverser structures, which again features molds on tiltable platforms that also raise and lower. As these parts are clearly much larger than those for the A320neo, the technicians also use mobile scissor-lift carts that allow easier reach along the height and curvature of the mold, tilted on its side for better efficiency.

Virtek projectors are suspended above the layup stations. “We can also integrate these into our Plataine software,” notes Diederich, “but we haven’t done that yet.” Why would you do this? “To know what layups are coming up next so we can optimize our autoclave schedules,” she says. “And again, the AI will do analytics and give us suggestions for efficiency and predictive maintenance in tools, etc.”

We walk through a door to an adjoining production room for GE9X fan case, C919 and Passport 20 composite nacelle structures bonding. “We lift the parts up and/or flip them over to enable layup,” says Smith. “Again, our goal is to improve ergonomics and keep our workers healthy.” Next, we walk past Passport 20 engine fan cowl and apron layup stations, each with a mechanized system to lift and rotate the mold tools. This area also produces the core cowl and inlet structures (inner and outer barrels) for the C919 and Passport 20 nacelle inlets.

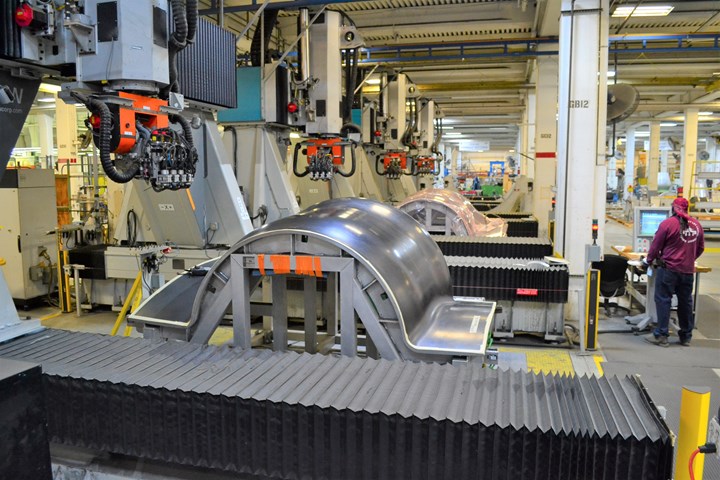

Performing 38,000 AFP operations/day

At the end of this production area is a large AFP robot and a fixed gantry system comprising two AFP machines, all from Electroimpact. Here, MRAS can build a part roughly every 4-6 hours, says Smith. “We can comfortably support production for 40 aircraft/month or more if needed.” The fixed-gantry AFP machines share a common axis and four interchangeable 8-tow AFP heads. Each machine has two sleds (see additional images at bottom), so when one part is finished, that sled moves out and the other enters for changeover in less than a minute. “If we have a piece of equipment, we want it to run all day with as little downtime as possible,” notes Smith. “These machines lay up the external skin for the A320neo trans cowl.”

“The large AFP robot,” he continues, “has a 16 × 0.25-inch-wide tow servo creel head. That head was the first of its kind and produces flat blanks that are hot drape formed into hollow hat stiffeners for the external panels on the A320neo trans cowl. It also lays up the 8-ply tail skins that are bonded onto the acoustic structure. Why use AFP for only 8 plies? Because we reduce layup time from 4 hours to 12 minutes. I’ll take a 3-hour cut in cycle time wherever I can get it on a high-rate program like this. This large AFP robot, which was installed in 2019, can easily outpace the gantry machine for building hats and tail skins.”

Robot used for AFP head changeout for maintenance and material loading in MRAS’ multi-unit Electroimpact AFP cell.

A centralized AFP command center is managed by two operators. “Originally, we had an operator station for each machine located on each side of the room,” says Smith. “This setup is much more efficient.” The command center also features a smaller robot that presents AFP heads to the operators for maintenance and material loading. “It takes 30-40 seconds for each machine to swap out heads and restart,” says Smith, noting that it is possible to achieve utilization rates of >90%. “When we were running hot before COVID, we were putting down slit tape more than 20 hours out of every day.”

“We do more individual add and/or cut operations in a week (~38,0000/day) than a commercial widebody airframe shop might do in a month,” he continues. “Using Electroimpact’s EI4.0 software, we can interrogate by part and job number. Every single part is 100% traceable, including what machine, operator, AFP head(s) and layup tool was used. We also have a record of every single tow error by course and tow number. For every single build, we can see all ply details.” MRAS is working to integrate this AFP data with the other data it’s collecting via the Plataine software. “That’s the beauty of its open architecture,” adds Smith, “we can pull in these other data streams. The software can then use AI to see where we can improve our operations.”

Standardized materials, Park slit tape

The slit CF/epoxy prepreg tape run on these AFP machines is from Park Aerospace Corp. (Newton, Kan., U.S.). “We use their materials for almost everything we build,” says Smith. As Smith joined MRAS, the primary material used for most of its composite structures was being discontinued. One of his first tasks was to find a new prepreg. His team screened more than 18 materials and finally chose Park.

“We weren’t a big enough account for Hexcel or Solvay to give much time or effort to,” says Smith. “It was also tough to manage those 30- and 40-week lead times. So, our metrics included not only mechanical properties, but also the supplier’s responsiveness to our needs. Park can get us material within a week if we really need it. We also wanted to move our material technology forward, and Park was willing to work with us on that. It is a real partnership.”

As an example, Smith shows me a piece of slit tape from Park that is fairly stiff and feels dry at room temperature. “There is almost no tack until it is heated during layup,” he says. “This characteristic is what makes thermoplastic tapes so efficient for automated processing and we have leveraged that when developing our [thermoset] AFP materials.” Smith then shows me a trans cowl layup that has a first ply of lightning strike protection (LSP) with embedded copper mesh. “The Park LSP is dual use, also acting as the tackifier,” he explains. “The operator just lays it down by hand without a debulk on a cold tool, and it provides an excellent starting surface for the AFP machine, which needs grip for the first ply down. This part by hand used to take more than 12 hours, and now, it’s down to 4.5 hours using AFP.”

HDF hat stiffeners

Fig. 5. Hot drape forming. AFP prepreg blanks are preformed using this four-station hot drape former (top). The rigid preforms are then co-cured with AFP skin layups to produce trans cowls for A320neo LEAP nacelles (bottom).

Between the AFP cell and adjoining A320neo trans cowl production area is a hot drape forming (HDF) cell to form the flat blanks made on the large AFP robot into four different-sized hat stiffeners. These are co-cured to each trans cowl AFP skin (Fig. 5). The machine was built by Coldwater Machine Co. (Coldwater, Ohio, U.S., now part of Cleveland-based Lincoln Electric). “We worked with them and helped design it,” says Smith. Four HDF stations are heated and cooled with water. Each lower semicircular HDF tool receives a flat blank. Release film is placed on top of the blank, followed by an orange silicone caul. Partial vacuum holds the assembly in place as the upper semicircular tool is lowered to apply pressure. The tools are heated to 130°F, full vacuum is applied and the blanks are formed, followed by a cool down. “We can cycle every 12 minutes per station,” says Smith. “This whole cell was designed and developed to meet the A320neo rate.”

CNC cells

We next enter a centrally located NDI room with two large gantry C-scan systems, supplied by Matec Instrument Companies (Northborough, Mass., U.S.), each with water squirters and a spinner table. A closed system treats and reuses the water for these machines.

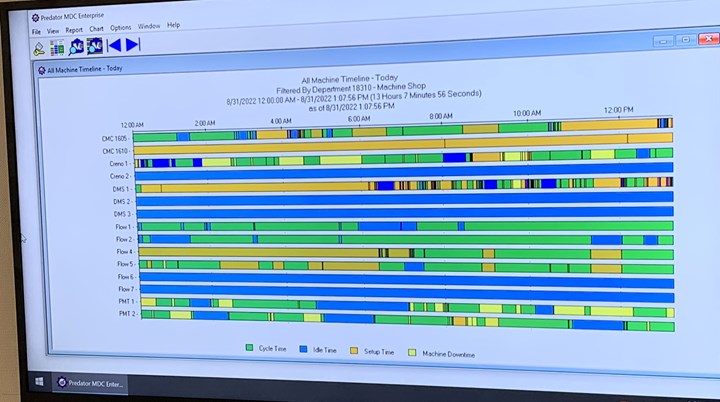

Predator MDC software (top) tracks 17 CNC cells at MRAS while CRENO micro-drilling centers (bottom) can drill up to 35 holes/second for the myriad CFRP acoustic panels produced.

MRAS is using digital tools here as well. The Predator MDC app (Predator Software, Beaverton, Ore., U.S.) monitors all 17 CNC machines at MRAS, including the trim room which features two Fives Machining Systems (Hebron, Ken., U.S.) automated, 6-axis gantry cells.

We pass through an area with two CRENO (Annecy, France) 5-axis micro-drilling machines (Fig. 6) with up to 28 spindles per drilling head that can drill up to 35 holes per second. “These are very efficient for drilling perforated panels,” says Smith. Indeed, nearly all of the programs at MRAS require perforated panels and these machines easily handle that workload.

A320 trans cowl assembly

Fig. 7. A320neo trans cowls. A320neo nacelle parts cover most of Building B, the outer structures featuring copper lightning strike protection (top). Blue Ducommun closeout panels can be seen at the top corners of fan cowls (bottom).

The left-hand and right-hand halves for the A320neo trans cowls move down two separate assembly lines to receive the ancillary pieces and systems required. Smith points out the blue fin-like “beaver tails” that protrude from the top two corners of each cowl. The supplier, Ducommun (Santa Ana, Calif., U.S.), says these composite close-out panels use its proprietary VersaCore Composite technology to provide an integrated component design with high part integrity and strength at lower cost.

At the side of this assembly line is an Electroimpact robotic assembly cell with twin stations, where CFRP parts with located metallic hardware are drilled, countersunk and then fasteners with sealant are installed (see additional images at botttom). An external cartridge filled with various types of fasteners sits next to the control center operated by a single technician. As a new part enters the cell, the system pulls the needed fasteners from the cartridge and installs them. The dual stations enable work on a new part to begin immediately as the finished subassembly exits.

We next enter a large, climate-controlled room where the one-piece aluminum lip is attached to the CFRP inner barrel and bulkheads for the C919 and Passport 20 nacelle inlets. “The climate control is crucial because aluminum expands and contracts with temperature swings,” says Smith, “making it difficult to assemble with the CFRP components.” Back outside, we walk through the thrust reverser and fan cowl assembly areas for the Comac ARJ21 regional jet engines, where Smith notes MRAS is currently producing 50 shipsets/year.

Not “finished” for digitization, sustainability

We have now returned back to the entry area between Buildings A and B. Smith points out that MRAS’ full materials and certification lab is located in the basement below. “It’s capable of almost any type of material and/or mechanical testing, including those needed for full material qualification and developing design allowable databases, as well as design and certification of larger structures.”

We walk ahead a few steps to the final assembly area for CF6, Passport 20 and 747-8 nacelles. I ask about a CFRP cascade being installed in a thrust reverser (see image below) and Smith notes these are supplied by Nikkiso (Tokyo, Japan), which has 90% of the market.

So where does MRAS go from here? “We have a vision for being a leader in sustainability, automation and digitization that is integral to our strategy as a business,” says Smith. “ST Engineering is a forward-looking company and completely supports our strategy. We will keep developing and driving new technology into the business. You can’t wait until there’s a perfect time. We fit it into production, even when it is uncomfortable. Sometimes, being uncomfortable is a good thing because that means we’re learning and pushing boundaries.”

Where is MRAS’ finish line for its digital transformation? “There is no such thing as finished,” says Smith. “My job is to help set up what it takes for this business to be successful decades from now. Hopefully, in 20-25 years, some other technologist will be having this same discussion, sharing their vision for MRAS’ next era.”

Related Content

Plant tour: Brembo, Bergamo, Italy

Brake systems pioneer advances both design and industrialized production of customized C/C products that meet the highest performance requirements.

Read MorePlant tour: Hexagon Purus, Kassel, Germany

Fully automated, Industry 4.0 line for hydrogen pressure vessels advances efficiency and versatility in small footprint for next-gen, sustainable composites production.

Read MorePlant tour: Collins Aerospace, Riverside, Calif., U.S. and Almere, Netherlands

Composite Tier 1’s long history, acquisition of stamped parts pioneer Dutch Thermoplastic Components, advances roadmap for growth in thermoplastic composite parts.

Read MorePlant tour: Sekisui Aerospace, Orange City, Iowa, Renton and Sumner, Wash., U.S.

Veteran composites sites use kaizen and innovation culture to expand thermoplastic serial production, 4.0 digitization and new technology for diversified new markets.

Read MoreRead Next

Tours and Technology Trends in 2022: CW Trending Episode 9

It has been a busy year for the CW team. In episode 9 of CW Trending, editor-in-chief Jeff Sloan and senior technical editor Ginger Gardiner discuss their recent plant tours and trends in the industry.

Read MorePlant tour: Renegade Materials Corp., Miamisburg, Ohio, U.S.

Renegade Materials is known for high-performance prepregs for aerospace applications. Following its acquisition by Teijin in 2019, the company has expanded capacity and R&D efforts on a range of aerospace-targeted materials.

Read MoreThermoplastic composite materials and processing interactions

Selection of product material formats and their interactions with various process methods heavily influence a final TPC part’s properties and fabrication options.

Read More