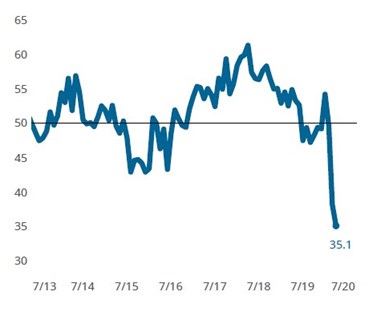

Composites Index contracts faster in second month of COVID-19 lockdown

April 2020 – 35.1

Composites Fabricating Index: The Index fell sharply in April for a second consecutive month. All measures of business activity reported worsening conditions. In certain end-markets readings moved higher while remaining below 50; such results indicate slowing contraction in business conditions for these markets.

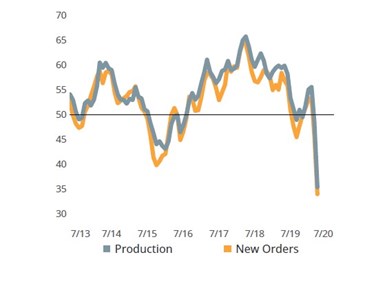

The Composites Index fell sharply for a second month in April to 35.1, setting consecutive all-time lows. Production and new orders in recent months have moved into territory that was formerly unthinkable with readings in the low 20s. The latest readings are approximately 15 points below the previous historic low readings. Gardner Intelligence would like to clarify for our readers that the Index’s readings represent the breadth of change occurring within the industry and are not to be confused with any rate of decline taking place. These low readings indicate only that a large proportion of fabricators reported a decreased level of business activity in the current month as compared to the prior month without quantifying the actual magnitude of the downward change.

Backlog sinks as new orders and production activity levels collapse: New orders and production activity indicators set new lows that were substantially worse than past low activity readings. New orders and production serve as leading indicators to the movement of backlog and employment activity, suggesting that future months of challenging readings lie ahead.

Although much of April’s data was challenging to digest, when segmented by end market, certain critical composites markets reported a slowing decline in overall activity relative to March. Fabricators serving aerospace, automotive, plastics and rubber products manufacturing all reported a slowing decline in April. Conversely, fabricators serving the electronics market reported an accelerating decline in overall activity.

Data tracking expected capital spending over the next 12 months has been significantly impacted by the coronavirus pandemic. Between January and April, larger fabricators have indicated that they plan to reduce their per-plant capital spending on average by more than 50 percent. As of the end of April, smaller firms, in contrast, reported only negligible changes to their forward-looking capital spending plans.

Related Content

-

November index slumps with multi-point losses

Significant declines in index components across the board lead to more than a season dip.

-

Composites Fabricating Index loses ground in April amid tariff uncertainty

Latest reading of 47.3 is fueled by a drop in new orders as markets react to quick changes in trade policy.

-

Composites Fabricating returns to expansion territory

June’s results build on May gains, returning the composites index to a reading that reflects positive growth.

.jpg;width=70;height=70;mode=crop)