Composites GBI is headed toward contraction

The GBI: Composites Fabricating in October continued its deceleration trend, though it fared better than most of the manufacturing industry.

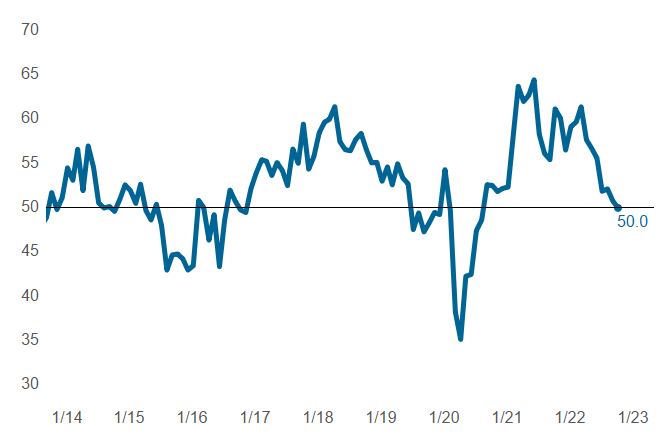

On the brink. There was no dodging “flat,” or little to no growth, in October. The reading reflects a 0.7-point decrease from September, remaining at the point at which fabricators who say business is looking up is about the same as those who say it is slowing down. Photo Credit, all images: Gardner Intelligence

The Gardner Business Index (GBI): Composites Fabricating activity continues to teeter on the edge between contracting and expanding, closing October at 50.0. This follows a similar reading of 50.7 in September. While the composites industry is faring better than most manufacturing sectors, contraction still appears to be a common — and ongoing — theme.

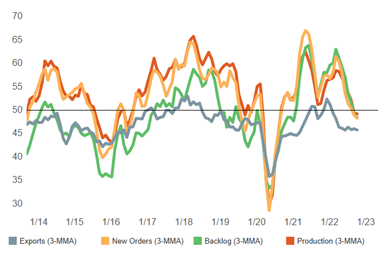

October trends. New orders, production and backlog contracted again in October, but held their own, as did exports. (This graph is on a three-month moving average.)

The three components that started to contract in September, new orders, backlog and production, stayed about the same in October. Supplier deliveries lengthened at a slowing rate, suggesting supply chain pain may have eased a bit. Employment expansion stayed about the same in October, as did exports contraction.

Related Content

-

Overall composites index contracting faster than previous month

New orders, production and prices components all improved over October, though the GBI is still seeing contraction.

-

Index remains in expansion territory despite uncertainties

The composites market saw a slight decline in the index, component and future business results but maintained a positive reading overall.

-

Composites Fabricating Index loses ground in April amid tariff uncertainty

Latest reading of 47.3 is fueled by a drop in new orders as markets react to quick changes in trade policy.