Ceramic-matrix composites heat up

Lightweight, hard and stable at high temperatures, CMCs are emerging from two decades of study and development into commercial applications.

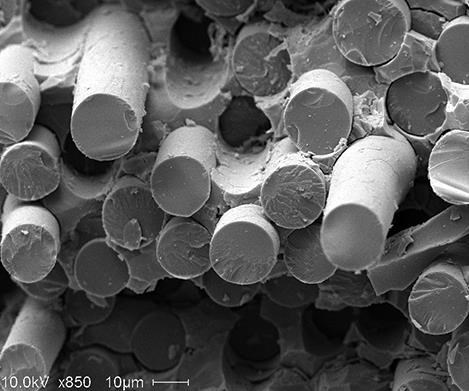

Ceramic-matrix composites (CMCs) comprise a ceramic matrix reinforced by a refractory fiber, such as silicon carbide (SiC) fiber. CMCs offer low density, high hardness and superior thermal and chemical resistance. That and their intrinsic ability to be tailored as composites make CMCs highly attractive in a vast array of applications, most notably internal engine components, exhaust systems and other “hot-zone” structures, where CMCs are envisioned as lightweight replacements for metallic superalloys.

Yet, despite more than 20 years of R&D, commercial successes for CMCs have been largely limited to missile structures, radomes and exhaust systems for fighter jets. Nevertheless, major development programs are currently underway, and there is growing investment in production-scale manufacturing. CMCs might well be at their tipping point.

Today, CMCs can be produced using a number of fabrication processes: chemical vapor or liquid phase infiltration, hot press sintering techniques and polymer infiltration and pyrolysis (PIP). In addition, reinforcements can come in many forms: continuous fibers, short fibers, whiskers, particles or a combination. In fact, research has shown that low fracture toughness and crack growth resistance can be overcome through secondary reinforcement phases with particles, whiskers or even fibrous structures like nanofibers.

As an example of the latter, ANF Technology Ltd. (Tallinn, Estonia) is commercially producing a trademarked aluminum oxide nanofiber, called NAFEN, that reportedly can improve the ductility of CMCs, keeping Young’s modulus high while increasing creep resistance and decreasing brittleness.

“Ceramics customers currently working with NAFEN are hoping for improvements in fracture resistance, impact toughness, abrasion resistance and structural reinforcement,” says Tim Ferland, business development manager at ANF Technology. He reports that there are programs in place with several global accounts that are testing or planning to test the material with CMCs, although he adds that adoption of CMCs has been slow compared to the use of NAFEN in polymer composites and polymer paints and coatings.

“There’s a lot of ground-swell activity going on, and as the industry becomes more knowledgeable about, and comfortable with, CMCs, the growth will continue,” says Scott Richardson, general manager of CMC component manufacturer COI Ceramics Inc., an affiliate of space systems developer ATK (both in San Diego, Calif.).

According to Todd Steyer, a manager at The Boeing Co.’s Huntington Beach, Calif., operation, factors behind the timeliness of CMC development include stable properties and increased production volumes of ceramic fibers (oxide and nonoxide), a maturing supplier base that is using established manufacturing processes, and good performance results from full-scale demonstrators and prototypes. Steyer, who reviewed aerospace-related presentations from the 4th International Congress on Ceramics in the American Ceramic Society’s (ACerS) International Journal of Applied Ceramic Technology (July 2013), serves as vice chair of the U.S. Advanced Ceramics Assn.

In fact, the demand for CMCs is expected to increase tenfold over the next decade, according to jet engine and aircraft systems manufacturer GE Aviation (Newark, Del.). GE made its intentions regarding CMCs clear in June when it announced plans to build a $125 million, 125,000-ft2 (11,613m2) manufacturing plant in Asheville, N.C., to produce CMC engine components (see “GE Aviation announces North Carolina composites facility,” under "Editor's Picks," at top right).

Many people view GE’s move as a game changer for CMCs. “GE has done more than just talk about CMCs; it made a serious commitment,” says Tom Foltz, director of business development of Specialty Materials Inc. (Lowell, Mass.), which manufactures SCS-brand silicon carbide fibers. “It could have as much of an impact as anything related to applications on the future of the technology,” he adds. “GE is going to be leading and pulling everyone along with them.”

CMCs in the “hot zone”

GE’s Global Research Center (Niskayuna, N.Y.) and GE Aviation, with its pilot-scale production facility in Delaware, have been developing and producing CMC technology — both the material and the machines used in its manufacture — for more than 20 years. The company tested a CMC turbine blade in GE’s F414 engine in 2010 and also ran CMCs in the hot section of its F136 engine. More than 1 million hours of testing have been logged, including more than 15,000 hours in land-based gas turbines that are generating electricity. The company believes the material is flight-ready.

SiC CMCs can withstand temperatures greater than 2400°F/1316°C. This and their reduced weight (one-third the weight of nickel superalloys) make them attractive to engine manufacturers that are looking for weight reduction in the engine hot zones in pursuit of greater fuel efficiency. Additionally, CMC components have greater durability and heat resistance and, therefore, require less cooling air than the nickel-based superalloys that currently dominate gas turbines and jet engines.

“Removing cooling air allows a jet engine to run at higher thrust and/or more efficiently,” GE Aviation claims. “Incorporating the unique properties of CMCs on a turbine engine increases engine durability and reduces the need for cooling air. These gains improve combustor efficiency and reduce fuel consumption.”

Today’s high-efficiency jet engines emit hotter exhaust gas — hot enough to exceed the limits of traditional materials, such as titanium and superalloys. In jet engine propulsion history, the average rate of technology progress for turbine engine material temperature capability has increased 50°F/10°C per decade, according to GE. However, with the introduction of CMCs, GE believes it will increase material temperature capability by 150°F/66°C in this decade alone.

Currently, the CMC high-pressure turbine shroud (a stationary ring that encircles the moving blades on the second stage of the high-pressure turbine) for the much-publicized Leading Edge Aviation Propulsion (LEAP) jet engine has undergone more than 20,000 hours of testing. It could mark the first use of CMCs in a commercial engine. The LEAP engine is being developed by CFM International, a joint venture between GE and Snecma (a subsidiary of Safran, Courcouronnes, France). Its first flight is expected in 2016.

The use of CMCs reportedly allows GE to shed hundreds of pounds of engine weight and improve thrust by 10 percent. The CMC shroud weighs approximately 1 kg/2.2 lb — one-third the weight of an equivalent nickel superalloy shroud. In terms of design, the weight savings multiplier effect is much more than 3:1 because everything down the chain is affected as well.

GE froze the design of the first two versions of the LEAP engine in June 2012. The LEAP-1A for the Airbus (Toulouse, France) A320neo began ground testing in September 2013 and is on track to enter service in 2016.

GE also is studying the use of CMCs for a variety of applications beyond the LEAP engine, including a CMC turbine blade upgrade on the F414, which powers the Boeing F/A-18E/F Super Hornet and the Hindustan Aeronautics Ltd. (HAL, Bangalore, India) Tejas light combat aircraft. Within the 2016-2018 time frame, GE expects to mold up to 800 CMC components per day to meet current CMC commitments.

CMC acoustic nozzle

GE isn’t the only company turning to CMCs for commercial jet hot zones. CMC components, including a turbine blade track and an acoustic engine exhaust nozzle, are in development as part of the Federal Aviation Admin. (FAA) Continuous Lower Energy, Emissions, and Noise (CLEEN) program. The five-year, jointly funded R&D effort is focused on airframe and engine technologies that speed the reduction of aircraft engine fuel burn, emissions and noise.

Boeing Research & Technology (BR&T, Huntington Beach, Calif.) has led development of the acoustic nozzle, which is designed to make engines quieter, lighter and more efficient. “The reason companies like Boeing have begun looking at alternative materials in the exhaust area is due to increasing temperatures,” confirms ATK-COI’s Richardson. “Existing material solutions may not be able to meet thermal requirements in the coming years.” Given that reality, Richardson says of the acoustic nozzle, “This is the largest component ever made in oxide CMCs, and marks a significant feat for CMCs.”

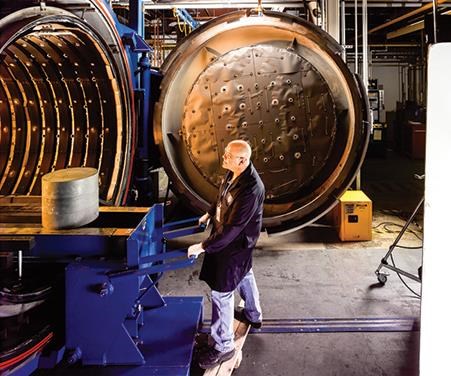

Although BR&T conceived the vision and developed the design for the nozzle system, it contracted with ATK-COI to manufacture and deliver the two large CMC components that make up the nozzle. The outer ring, called the nozzle, measures approximately 5.25 ft/1.6m in diameter and is about 3 ft/1m long; the tail cone, which sits inside the front end of the nozzle, is approximately 7 ft/2.1m long (see fifth and sixth photos, at left).

In terms of manufacturing, Richardson explains that he and his team look at the process simplistically. “It’s generally akin to a polymer-based composite material in the front end,” he explains. “Typically, you can use the same kinds of techniques in terms of forming — anywhere from hand layup to resin transfer molding.” ATK-COI built the BR&T nozzle components using hand layup, after which the parts were cured. “That’s typically where a polymer composite would be finished,” Richardson notes. “In the case of CMCs, at this stage it must be converted to ceramic, which is done through either sintering or pyrolysis.” In this case, ATK-COI used a sintering process.

The material system included a continuous filament alumina fiber (Nextel 610) from 3M (St. Paul, Minn.). ATK-COI mixes the matrix, or slurry, material in-house, and Boeing supplies the core material.

A major program milestone was reached in January 2013, when the nozzle was installed on the back of a Rolls-Royce (Reston, Va.) Trent 1000 engine rig at NASA’s Stennis Space Center in Mississippi for accelerated testing (see top photo at left). The nozzle performed as expected during the 73-hour engine test, with no thermal or structural stress issues. In terms of service life, Richardson notes, the “specifications asked for 55,000 hours, which is what we tested to. Predictions indicate that the nozzle could continue in service well above that.” The nozzle will be installed next on a Boeing 787 Dreamliner. Flight tests are expected in late 2013, with commercialization later this decade.

More CMCs ahead for engines

Elsewhere in engine development, specifically for narrow-body jets, Pratt & Whitney (P&W, East Hartford, Conn.), a United Technologies Corp., isn’t as bullish about CMCs. The company has taken a decidedly different approach in handling thermal management, preferring to focus on the “advanced cooling” provided by its variable bypass engine, with adaptive fan design, and advances in nickel alloys. In fact, P&W has openly questioned the maturity of CMCs for aircraft engines and whether they will pay off in the short to medium term. Still, the company points to a long-term goal of resolving what it sees as “cost and reliability” issues with CMCs and believes the materials have the potential to enable gear-based turbofans to operate with greater fuel efficiency.

Rolls-Royce, on the other hand, has taken the plunge with its recent purchase of Hyper-Therm HTC Inc. (Huntington Beach, Calif.), which manufactures CMCs, such as C/SiC and SiC/SiC. “We expect CMCs will revolutionize the weight and performance of engines that currently rely on single-crystal super alloys found in today’s most advanced engines,” says John Gallo, Rolls-Royce North America’s executive VP of operations.

Hyper-Therm has been working with CMCs for more than a decade. And although much of the current development and testing in CMCs has been done using small-diameter yarns (10 µm to 15 µm diameter), Hyper-Therm has collected considerable data on CMCs reinforced with a large-diameter silicon carbide monofilament, specifically SCS-Ultra, from Specialty Materials.

SCS-Ultra SiC fiber was initially designed for use in titanium aluminide metal-matrix composites, but it is reportedly effective in CMCs as well. Produced primarily in 5.6-mil diameters, SCS-Ultra contains very fine SiC crystallites (200 nm or less) and is stable at temperatures of 2500°F/1371°C and higher.

“A large monofilament like ours doesn’t lend itself to complex-shaped parts,” admits Specialty Materials’ Foltz. “Yet, from a materials standpoint, we have the highest creep resistance at high temperatures of any SiC fiber.” To date, the material has been used mainly to mold jet engine vanes and blades.

Notably, Hyper-Therm was contracted by the Marshall Space Flight Center (Huntsville, Ala.) to devise a cost-effective methodology for manufacturing axisymmetric CMC structures. This led to the development of the first-ever actively cooled, continuous fiber-reinforced SiC-matrix composite thrust chamber for liquid rocket propulsion systems. These devices are cooled with cryogenic liquid hydrogen to protect against combustion environments that are capable of reaching temperatures greater than 6500°F/3593°C. Hot-fire testing was performed at NASA Glenn.

CMCs for ultrahigh temperatures

For applications that face the most extreme environments — such as leading edges for hypersonic and supersonic vehicles that must withstand temperatures in excess of 2000°C/3632°F, corrosive atmospheric plasma and the shock of extreme temperature variations — typically nonoxide, ultrahigh-temperature (UHT) CMCs are required. Although much of the development work in the CMC industry has focused on oxide CMCs, nonoxides can be well suited for applications in solid rocket motor propulsion systems; missile structures and thermal protection systems; and profiles for hypersonic and supersonic vehicles.

“Whereas silicon-based or oxide CMCs are targeted at applications that require longer life (100,000 hours of cycle time and more), ultra-high-heat CMCs are employed where temperatures are much hotter but the mission durations are a lot shorter,” explains Dr. Edward J.A. Pope, CEO of MATECH (Westlake Village, Calif.), a manufacturer of both oxide and nonoxide fibers and CMC components.

“Nonoxides are characterized by low porosity, wear resistance, high matrix density and extremely high-temperature capability,” explains Bill Meiklejohn, president of Lancer Systems (Allentown, Pa.). “They display the highest heat handling capability of all CMCs and derive much of their mechanical performance from the matrix,” he adds.

“Our ultrahigh-heat CMC materials are designed for temperatures greater than 3000°F [1650°C] and reaching 5000°F [2760°C],” says Pope. “There aren’t really many material systems of any kind that can withstand that temperature range, except for gas-heavy refractory metal alloys,” he continues, “but those are heavy and can become ductile at the high-end of the temperature range. Plus, our material has the advantage of being very lightweight in comparison.” MATECH’s nonoxide CMC’s range from 2 to 3 g/cm3 compared to 10 to 22 g/cm3 for oxide CMCs.

The reportedly impressive qualities of UHT CMCs do come at a price. They are generally processed via chemical vapor deposition, and the raw materials can cost 10 times as much as oxide-based systems, according to Meiklejohn. Nonoxide systems also require significantly longer processing times than oxide systems.

“We work primarily with the missile defense industry in ultrahigh-temperature applications,” says Pope. Other UHT materials developed by MATECH include tantalum carbide (TaC) ceramic fiber and a hafnium carbide (HfC) ceramic fiber. Both are suitable for solid propellant rocket nozzles. The company also produces oxide materials and other CMCs for hot temperatures. With funding from the Air Force Research Laboratory (Wright-Patterson Air Force Base, Ohio), the company developed a stoichiometric SiC ceramic fiber, which is targeted at nuclear-fuel-clad tubes in light water reactors, gas turbine hot-section components and hypersonic leading edge materials. The company also produces silicon nitride/silicon carbide (SiNC) fibers that are melt spun in continuous 50- to 500-filament tow. Reportedly, the SiNC fibers have improved creep resistance and are chemically stable up to 1350°C/2462°F, with less than 2 percent oxygen content.

CMCs in petrochemical applications

Meanwhile, significant research into carbon fiber-reinforced SiC CMCs is yielding promising materials for hard-use applications, where strength, durability and ductility are every bit as important as heat management. Earlier this year, for example, Lancer purchased CeraComp, a carbon fiber-reinforced SiC CMC developed by Greene, Tweed (Kulpsville, Pa.). “We believe ceramics are going to be a significant growth opportunity for us in the future,” says Lancer’s Meiklejohn. Lancer already uses CMCs in small arms applications, with programs in place related to jet aircraft exhaust systems, and the company is now expanding CMCs into the oil and gas, chemical processing and power generation industries.

CeraComp was designed for greater fracture toughness, similar corrosion protection, and wear characteristics equivalent to, monolithic SiC ceramics used in sleeve bearings in magnetic coupled pumps. OEM pump manufacturers have used monolithic SiC bearings for stationary and rotating components in pumps for decades. Although it has been the preferred material, it is vulnerable to fractures caused by thermal and mechanical shock. A splintered piece of a fractured bearing, because of its hardness, can lead to catastrophic pump failure.

Using CeraComp, Lancer developed a high-pressure, high-temperature CMC bearing that it believes will have a longer life. Carbon fibers in the CMC prevent crack propagation, improving impact and thermal shock resistance. SiC particles are included to enhance the stability of the composite, improve wear resistance and reduce shrinkage of the SiC matrix during densification. The bearings are currently undergoing field tests.

Lancer also is finding applications for CMCs in its fiber-optics business. Lancer supplies harsh-environment optical connectivity solutions to the energy, aerospace and military markets. The American Petroleum Institute’s (API) Specification 6A, which requires wellheads used in oil and natural-gas extraction to withstand 1800°F/982°C while maintaining 5,000-psi pressure throughout, is providing a new opportunity for CMCs, says Meiklejohn. Conventional wellheads aren’t surviving under the new standards, he points out. In answer, Lancer is building CMC containers that encapsulate the wellheads and protect them from heat. “We received an order within the last year to start a prototype and will begin testing in a month.”

Meiklejohn believes Lancer will find an advantage as it optimizes its CMC manufacturing process, which uses PIP. “We’re working to develop better chemistry to limit the amount of volatiles that come off during burn-off cycles in order to make the part denser after every PIP cycle,” he explains. “We’re also looking at optimizing the burn-off cycles by determining the optimal ramp-up time, cool-down cycle, and temperature. The more we can shorten the cycle time, the more cost-effective CMCs will become.”

“Over the next year,” he adds, “we’re going to add people and we’re looking at a new facility. A lot of that is wrapped around the growth potential we see in CMCs.”

Roadblocks to overcome

A plethora of other CMC development programs abound worldwide: vanes for high-pressure turbines, advanced nuclear reactor components, self-healing CMCs for aircraft engine blades and vanes, structures for reusable thermal protection systems and more. The question is, how many of these programs will result in commercial applications?

Barriers remain. “The risk of introduction is the biggest roadblock,” says ATK-COI’s Richardson. “And the biggest part of that is the customer having confidence in the material system.”

“CMCs are well suited for applications in the aerospace and defense industries, which are by nature conservative,” says Meiklejohn. “Just as it took time to go from metal to composites, it will take time to go to CMCs … [and] for people to build confidence in these materials.”

Cost continues to be an issue. “Ultimately, as we move into production, the volumes and the ability to work through lean activities are going to be huge for bringing down costs,” says Richardson.

Meiklejohn agrees, adding, “When customers consider the time and cost associated with CMC processing, it slows down adoption of the material. If we can get the processing time down, it will open up a number of applications.”

For now, everyone concurs that the investment by GE signals a changing tide for CMCs — one everyone is hoping will help them all scale the barriers.

3M Advanced Materials Division

Related Content

The state of recycled carbon fiber

As the need for carbon fiber rises, can recycling fill the gap?

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreComposite rebar for future infrastructure

GFRP eliminates risk of corrosion and increases durability fourfold for reinforced concrete that meets future demands as traffic, urbanization and extreme weather increase.

Read MorePlant tour: Joby Aviation, Marina, Calif., U.S.

As the advanced air mobility market begins to take shape, market leader Joby Aviation works to industrialize composites manufacturing for its first-generation, composites-intensive, all-electric air taxi.

Read MoreRead Next

Composites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read More

.jpg;maxWidth=300;quality=90)