Electric vertical takeoff and landing (eVTOL) aircraft do not represent the first opportunity for composites to be applied in the mobility industry. The success of composites in the aerospace, automotive and marine end markets is no secret. But what makes the eVTOL industry as good as gold for the composites industry is the degree of penetration.

For instance, the Boeing 787, which acted as a torchbearer for the use of composites in aircraft, has ~50% of its structure made from composite materials. For the automotive industry, the numbers are significantly lower, with composite materials accounting for 8-12% of the vehicle’s weight in light vehicles. However, for eVTOLs, that same figure shoots up to an average of ~70% of the material mix, regardless of the maker.

Since most eVTOLs will be battery-powered, lightweighting is necessary in more than one way (i.e., making lighter components and also choosing designs that would require less components). On top of that, eVTOLs impose strict structural requirements. Because of this, composites are an obvious solution for eVTOL manufacturers.

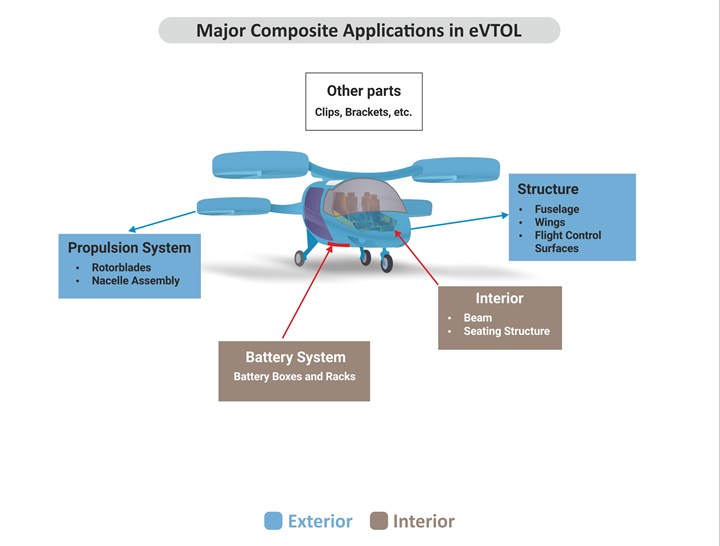

From primary exterior structures like wings and fuselages to small secondary components like clips and brackets, composites will find applications in every cubic meter of an eVTOL. The image below highlights some major applications of composites in this aircraft type.

Major applications of composites in eVTOLs. Photo Credit, all images: Stratview Research

According to Stratview Research, around 75-80% of the composite materials used in any eVTOL program will find use in structural components and the propulsion system, followed by interior applications like beams, seating structures, etc., accounting for another 12-14%. Battery systems, avionics and other small applications will, combined, account for the remaining 8-12%.

More than 90% of the composites used in eVTOLs will be carbon fiber. About 10% of composites will use fiberglass reinforcement in the form of protective films.

Aerospace quality at semi-automotive volumes

The choice of material and the fabrication process for any composite part usually depends on factors like performance requirements, part size and complexity and production volume. In the case of eVTOLs however, there’s one additional parameter for choosing the material: ease of certification.

The top priority for OEMs is to get their aircraft certified as quickly as possible, and they are doing this by picking tried-and-tested materials instead of focusing on innovation. Since thermosets have, until now, been the most used resin type in the aerospace industry, and because regulatory authorities are most familiar with thermoset matrices, more than 90% of eVTOL OEMs are entering into certification with thermoset-rich platforms.

Thermoplastic resin systems, on the other hand, are only being used in smaller parts of first-generation eVTOLs. However, as production volumes increase to a few thousand aircraft per year, a transition toward thermoplastic-intensive structures becomes inevitable, and applications can grow beyond small parts. That said, this shift is expected to be gradual and will likely comprise <10% of total composite material use in eVTOLs until 2030.

Among the OEMs that have managed to make headlines, Jaunt Air Mobility (Dallas, Texas, U.S.) is the only one working on a thermoplastic-rich model and has a vision of making an aircraft that’s 99% recyclable. Another OEM making significant use of thermoplastics is Vertical Aerospace (Bristol, U.K.). Components like rotor blades, battery enclosures, interiors and brackets used in Vertical’s VX4 have all been made by using thermoplastic prepregs.

Though the adaption of thermoplastics will be a bit slow, one can say that key composite material suppliers like Hexcel, Toray, Solvay and Teijin are already ahead of the curve in terms of material offerings for the advanced air mobility (AAM) market. In spite of the current supremacy of thermosets in the industry, the urban air mobility (UAM) material offerings by all of the above-mentioned suppliers include a wide range of thermoplastics, with applications stretching from smaller secondary components like rotor blades and brackets to primary structures like wings and fuselages.

Also, since eVTOL production volumes will be semi-automotive — volume numbers that are higher than aerospace, but far less than the automotive industry, i.e., an annual production volume of 6,000-8,000+ aircraft — and since eVTOLs will provide intracity travel, they will be invading the automotive market more than the aerospace market. Because of this, the eVTOL industry has a fair involvement of some key players from the automotive value chain. Joby’s partnership with Toyota and Archer’s partnership with Stellantis are two such examples.

Opportunities a few thousand feet up

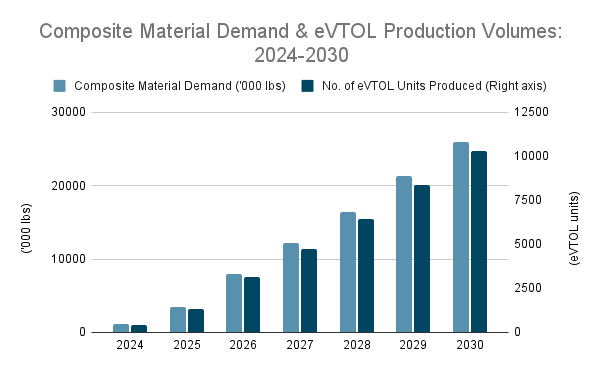

Since eVTOL OEMs plan to scale up production quickly, consequent demand for composite materials will follow a similar trajectory. According to a recent report by Stratview Research, the demand for composite materials from the eVTOL industry is expected to grow ~20 times over a span of six years — from around 1.1 million pounds in 2024 to 25.9 million pounds in 2030.

Composite material demand and eVTOL production volumes: 2024-2030.

In 2030, the demand for composite materials from the eVTOL industry is estimated to reach $673 million, from just $36.2 million in 2024. A fair share of this opportunity has already been captured by Toray (Morgan Hill, Calif., U.S.) since it has already partnered with Joby Aviation (Santa Cruz, Calif., U.S.) and Lilium (Wessling, Germany), two of the leading players that are also ahead of others in the certification race. Hexcel (Stamford, Conn., U.S.) and Solvay (Alpharetta, Ga., U.S.) are also among the early entrants and have signed contracts with Archer Aviation (San Jose, Calif., U.S.) and Vertical Aerospace respectively.

The eVTOL industry will not only create opportunities for the composites industry, but for several other players across the value chain. Listed below are some key manufacturing and supply partnerships in the eVTOL industry.

|

OEM |

Partner |

Product/Service |

|

Joby |

Toray |

Composite materials |

|

Toyota |

Manufacturing and sharing of expertise |

|

|

Lilium |

Toray |

Composite materials |

|

Aciturri |

Wings, fuselage and other structures |

|

|

Diehl Aviation |

Cabin interiors |

|

|

Archer |

Stellantis |

Manufacturing |

|

Hexcel |

Composite materials |

|

|

FACC |

Fuselage and wings |

|

|

Vertical Aerospace |

Solvay |

Composite materials |

|

Leonardo |

Composite fuselage |

|

|

GKN Aerospace |

EWIS and wings |

|

|

Overair |

Toray |

Composite materials |

|

Airbus |

KLK Motorsport and Modell- und Formenbau Blasius Gerg GmbH |

Rear fuselage |

|

Eve Air Mobility |

Thales |

Feasibility study, avionics, electric, flight control, navigation, communication and connectivity systems |

Table 1: Some key manufacturing and supply partnerships in the eVTOL industry.

The eVTOL industry is not expected to face — at least not initially — any production capacity limits. Many experts told Stratview Research that initial eVTOL program production volumes of <1,000 aircraft annually can be achieved efficiently with the existing technology and capacity. However, as production scales up and program volumes approach 2,000 aircraft annually, it will be difficult to meet volume requirements without the integration of automation.

One consequence could be raw materials — specifically, carbon fiber — supply constraint. AAM represents a new, high-growth, high-volume vertical market that depends on composite materials to meet basic and critical vehicle weight targets. Couple this with existing and new applications of composites in commercial aerospace and automotive programs and it’s not difficult to recognize the potential for supply tightening during the initial years of commercialization of eVTOLs.

How clear is the sky ahead? The opportunity in the eVTOL industry is significant and real, but the “revolution” is facing some headwinds: Certification, manufacturing bandwidth, pilot supply shortage, availability of AAM infrastructure and customer acceptance. This last challenge — customer acceptance — is a significant one. The safer and more comfortable an individual feels while flying in an eVTOL, the quicker will be the adoption.

The prospect of safe, affordable, convenient, inter- and intracity air mobility is not far off and likely will be a very attractive option for travelers looking to escape ground traffic. That said, market excitement and anticipation are nothing if expectations are not met. The next few years will be the most crucial for AAM’s stakeholders, given how close they are to delivering on what they’ve been promising. The world could witness a new era of mobility in the next few years and let’s hope that eVTOLs will turn out to be worth more than the excitement.

About the Author

Aniket Roy

Aniket Roy is a business analyst at Stratview Research (Detroit, Mich., U.S.), a business consulting firm serving different industry verticals globally, with proven expertise in the composites and mobility domains. He has a knack for numbers and strongly believes that business decisions should always be data-driven and not intuitive. As an analyst, he always strives to simplify the decision-making process for the stakeholders he is involved with, and “quality has no substitute” is his motto at work.

Related Content

Augmenting engineered thermoplastics with natural fibers

The Paris Climate Accord mandate for net-zero carbon by 2050 has kick-started an innovation revolution for natural fibers and sustainably engineered resins.

Read MoreFrom sailplanes to composites repair: Growing composite training opportunities over the years

Mike Hoke discovered his interest in the composites industry at a young age. His journey eventually led him to Abaris Training Resources, which he owned and evolved for more than 30 years.

Read MoreOpportunities and challenges for composites in electric vehicles

Polymer and material specialists at chemical consulting firm ChemBizR reflect on the role of composites in current and future efforts to make electric vehicles more efficient — and more attractive for consumers.

Read MoreCreating a culture of excellence in aerocomposites

ST Engineering MRAS discusses the importance of addressing human factors to reduce separator inclusion in bonded structures.

Read MoreRead Next

Stratview Research publishes new report on composites use in the AAM/eVTOL markets

The detailed thought leadership report explores the highly profitable synergy that is going to take place between the composites and the eVTOL industry in the coming years, including an analysis of 500+ eVTOL programs and inputs from 20+ industry experts.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;maxWidth=300;quality=90)