CW Blog

Designing an infused, two-piece composite baseball bat

With its Icon BBCOR bat, Rawlings leveraged its experience in braided fabrics and RTM to create an optimized, higher-performance two-piece design.

WatchFrom the CW Archives: The life and death of the BMW i3

A look back at the ambitious and impressive composites production system BMW developed for production of the all-electric i3 EV.

Read MoreAviation-specific battery system uses advanced composites to address electric, hybrid flight

BOLDair’s composite enclosure, compression structures and thermal runaway management enables high-performance electric energy storage.

Read MoreAutomated robotic NDT enhances capabilities for composites

Kineco Kaman Composites India uses a bespoke Fill Accubot ultrasonic testing system to boost inspection efficiency and productivity.

Read MoreCreating a composite battery insert-stud solution for EV trucks

Bossard worked with an OEM and Tier supplier team to meet tight electrical insulation and packaging tolerances while reducing tooling, molding and assembly costs.

Read MoreJEC World 2024 highlights: Forwarding initiatives surrounding sustainability and mobility

Themes at the forefront of JEC World 2024 included solutions for mobility applications and sustainable materials, technologies and processes for composites manufacturing.

Read MoreComposites end markets: Batteries and fuel cells (2024)

As the number of battery and fuel cell electric vehicles (EVs) grows, so do the opportunities for composites in battery enclosures and components for fuel cells.

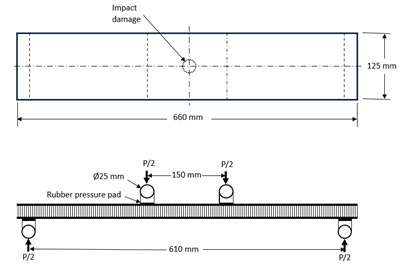

WatchDamage tolerance testing of sandwich composites: The sandwich flexure-after-impact (FAI) test

A second new ASTM-standardized test method assesses the damage tolerance of sandwich composites under flexural loading.

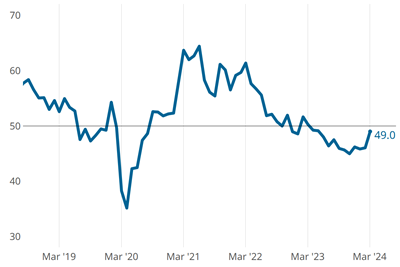

Read MoreComposites industry activity meaningfully slowed contraction in March

The GBI: Composites Fabricating still contracted in March, though it landed just one point shy of 50, which could eventually lead it into expansion territory.

Read MoreOptimizing robotic winding of composite tanks and pipes

Pioneer in mandrel-based reinforced rubber and composite products, TANIQ offers TaniqWindPro software and robotic winding expertise for composite pressure vessels and more.

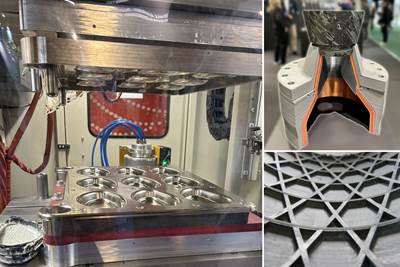

WatchJEC World 2024 highlights: Thermoplastic composites, CMC and novel processes

CW senior technical editor Ginger Gardiner discusses some of the developments and demonstrators shown at the industry’s largest composites exhibition and conference.

WatchJEC World 2024 highlights: Glass fiber recycling, biocomposites and more

CW technical editor Hannah Mason discusses trends seen at this year’s JEC World trade show, including sustainability-focused technologies and commitments, the Paris Olympics amongst other topics.

Read More