Spirit Aerosystems reports Q4 and full-year 2020 financial results

Revenue was down 55%, primarily due to the effects of the 737 MAX grounding and COVID-19. Total 2020 shipset deliveries was 920, down from 1,791 in 2019.

Spirit AeroSystems Holdings, Inc. (Wichita, Kan., U.S.) has reported fourth quarter and full-year 2020 financial results.

“2020 was one of the most challenging years in aviation history. For Spirit, the 737 MAX grounding and the COVID-19 pandemic created a dual-crisis. Our response focused on five critical actions: protecting employees, restructuring our cost base, strengthening our liquidity, implementing productivity projects and diversifying the business with our planned acquisitions,” says Tom Gentile, Spirit AeroSystems president and CEO. “With these actions, we worked to stabilize our liquidity and ended the year with $1.9 billion in cash while positioning Spirit to continue playing a leadership role in the aviation industry.”

During the fourth-quarter and full-year 2020 earnings call, management will address the preliminary assessment of the purchase accounting treatment related to the Bombardier acquisition.

|

Table 1: Summary Financial Results (unaudited) |

||||||

|

($ in millions, except per share data) |

4th Quarter |

Twelve Months |

||||

|

2020 |

2019 |

Change |

2020 |

2019 |

Change |

|

|

Revenues |

$877 |

$1,959 |

(55%) |

$3,405 |

$7,863 |

(57%) |

|

Operating (Loss) Income |

($101) |

$96 |

** | ($813) |

$761 |

** |

|

Operating (Loss) Income as a % of Revenues |

(11.6%) |

4.9% |

** |

(23.9%) |

9.7% |

** |

|

Net (Loss) Income |

($296) |

$68 |

** |

($870) |

$530 |

** |

|

(Loss) Earnings Per Share (Fully Diluted) |

($2.85) |

$0.65 |

** |

($8.38) |

$5.06 |

** |

|

Adjusted (Loss) Earnings Per Share (Fully Diluted)* |

($1.31) |

$0.79 |

** |

($5.72) |

$5.54 |

** |

|

Fully Diluted Weighted Avg Share Count |

104.0 |

104.6 |

103.9 |

104.7 |

||

**Represents an amount equal to or in excess of 100% or not meaningful.

Revenue

Spirit's fourth quarter of 2020 revenue was $877 million, down from $1.959 billion in the same period of 2019, primarily due to the significantly lower 737 MAX production resulting from the grounding of the program and the impacts of COVID-19. Deliveries decreased to 231 shipsets during the fourth quarter of 2020 compared to 452 shipsets in the same period of 2019, including Boeing 737 MAX deliveries of 19 shipsets compared to 153 shipsets in the same period of the prior year. Revenue for the full-year decreased to $3.4 billion, primarily due to the significantly lower Boeing 737 MAX production resulting from the grounding of the program and the impacts of COVID-19. Full-year deliveries decreased to 920 shipsets during 2020 compared to 1,791 shipsets in 2019, including Boeing 737 MAX deliveries of 71 shipsets compared to 606 shipsets in the prior year.

Spirit's backlog at the end of the fourth quarter of 2020 was approximately $34 billion, with work packages on all commercial platforms in the Boeing and Airbus backlog.

Earnings

Operating loss for the fourth quarter of 2020 was $101 million, down compared to operating income of $96 million in the same period of 2019. Included in the fourth quarter 2020 operating loss were excess capacity costs of $50.1 million and forward loss charges of $28.1 million, primarily driven by the lower production rates announced by Boeing and Airbus on the 787 and A350 programs. In comparison, during the fourth quarter of 2019, Spirit recorded $41.7 million of net forward loss charges and $13.5 million of unfavorable cumulative catch-up adjustments. Operating loss for the full-year of 2020 was $813 million, down compared to operating income of $761 million in 2019. Included in the 2020 operating loss were excess capacity costs of $278.9 million, abnormal costs related to COVID-19 of $33.7 million, and forward loss charges of $370.3 million, primarily driven by the lower production rates announced by Boeing and Airbus on the 787 and A350 programs. In comparison, during 2019, Spirit recorded $63.5 million of net forward loss charges. Additionally, during 2020, Spirit recognized restructuring expenses of $73.0 million for cost-alignment and headcount reductions and non-cash expenses of $86.5 million as a result of the voluntary retirement program (VRP) offered during 2020.

Fourth quarter EPS was $(2.85), compared to $0.65 in the same period of 2019. Fourth quarter 2020 adjusted EPS was $(1.31), which excluded the impacts from the Bombardier acquisition, the now-terminated Asco acquisition, restructuring costs, the VRP offered during 2020, and the $150.2 million deferred tax asset valuation allowance established during the fourth quarter of 2020. During the same period of 2019, adjusted EPS was $0.79, which excluded the impact of the Asco acquisition and the VRP offered during 2019. Full-year 2020 EPS was $(8.38), compared to $5.06 in 2019. Full-year 2020 adjusted EPS was $(5.72), which excluded the impacts from the Bombardier acquisition, the now-terminated Asco acquisition, restructuring costs, VRP offered during 2020, and the deferred tax asset valuation allowance. In comparison, full-year 2019 adjusted EPS was $5.54, which excluded the impact of the Asco acquisition and the VRP offered during 2019. (Table 1 above).

Cash

Cash from operations in the fourth quarter of 2020 was $(132) million, down from $204 million in the same quarter last year, primarily due to negative impacts of working capital requirements and significantly lower production deliveries, partially offset by favorable cash tax. Free cash flow in the fourth quarter of 2020 was $(181) million, down compared to $91 million in the same period of 2019. Full-year cash from operations was $(745) million, down from $923 million in 2019, primarily due to negative impacts of working capital requirements, significantly lower production deliveries and restructuring costs of $73 million, partially offset by $215 million received as a result of the February 2020 MOA with Boeing as well as favorable cash taxes. Full-year free cash flow was $(864) million, down compared to $691 million in 2019. Cash balance at the end of 2020 was $1.9 billion, compared to $2.4 billion at the end of 2019.

Segment Results

Fuselage systems

Fuselage Systems segment revenue in the fourth quarter of 2020 decreased 59% from the same period last year to $426 million, primarily due to lower production volumes on the Boeing 737, 787 and Airbus A350 programs. Operating margin for the fourth quarter of 2020 decreased to (4.7%), compared to 5.8% during the same period of 2019. This decrease was primarily due to forward losses recognized on the Boeing 787 and Airbus A350 programs as well as lower profit recognized on the Boeing 737 program due to excess capacity costs of $31.2 million with significantly fewer deliveries. In the fourth quarter of 2020, the segment recorded pretax $0.2 million of favorable cumulative catch-up adjustments and $14.0 million of net forward losses. In the fourth quarter of 2019, the segment recorded pretax $4.2 million of unfavorable cumulative catch-up adjustments and $24.1 million of net forward losses.

Propulsion systems

Propulsion Systems segment revenue in the fourth quarter of 2020 decreased 59% from the same period last year to $219 million, primarily due to lower production volumes on the Boeing 737 program. Operating margin for the fourth quarter of 2020 decreased to 0.6%, compared to 18.7% during the same period of 2019, primarily due to lower margin recognized on the Boeing 737 program due to excess capacity costs of $10.3 million with significantly fewer deliveries. In the fourth quarter of 2020, the segment recorded pretax $0.7 million of favorable cumulative catch-up adjustments and $2.7 million of net forward losses. In the fourth quarter of 2019, the segment recorded pretax $6.3 million of unfavorable cumulative catch-up adjustments and $12.0 million of net forward losses.

Wing Systems

Wing Systems segment revenue in the fourth quarter of 2020 decreased 45% from the same period last year to $216 million, primarily due to lower production volumes on the Boeing 737 and Airbus A320 and A350 programs. Operating margin for the fourth quarter of 2020 decreased to 7.4%, compared to 10.0% during the same period of 2019, primarily due to forward losses recognized on the Boeing 787 and Airbus A350 programs as well as lower margin recognized on the Boeing 737 program due to excess capacity costs of $8.7 million with significantly fewer deliveries. In the fourth quarter of 2020, the segment recorded pretax $3.7 million of unfavorable cumulative catch-up adjustments and $11.4 million of net forward losses. In the fourth quarter of 2019, the segment recorded pretax $3.0 million of unfavorable cumulative catch-up adjustments and $5.6 million of net forward losses.

Visit here to view the company’s full Q4 and full-year 2020 financial report.

Related Content

Plant tour: Spirit AeroSystems, Belfast, Northern Ireland, U.K.

Purpose-built facility employs resin transfer infusion (RTI) and assembly technology to manufacture today’s composite A220 wings, and prepares for future new programs and production ramp-ups.

Read MoreCryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

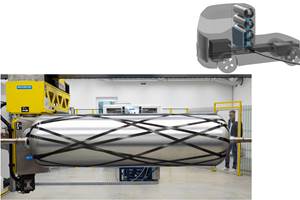

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MorePEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreRead Next

Composites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More