Plenty of suitors as composites come of age

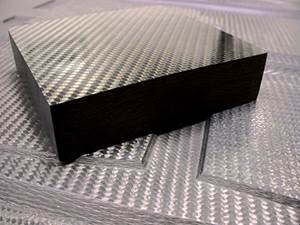

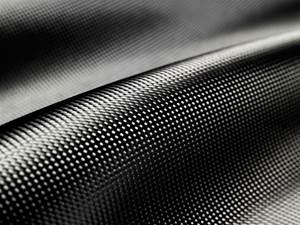

There is little doubt that composites are rapidly becoming mainstream technology within many industries, from aerospace to wind energy. At approximately $25 billion (USD) per year in the U.S. alone, it’s a high-value, high-tech market that requires a great deal of innovation and sophisticated human capital. In recent years, the upsurge in demand for composites, led by the aerospace industry, has been so great that production capacity — notably, capacity for carbon fiber — has been legitimately tested.

Readers of this magazine are certainly aware of composites’ material benefits — weight reduction and structural strength are givens. For example, greater use of composites in aerospace applications has reduced aircraft weight by as much as 10 to 40 percent and lowered design costs by 15 to 30 percent. Composites also afford the ability to fabricate complex and highly integrated components and to reduce part and fastener count. The focus is increasing on other desirable properties as well, such as low coefficient of thermal expansion as well as corrosion- and fatigue-resistance.

Growth rates for most composites application areas are in the double digits, despite the current economy, and I project that the total air transport segment will grow by 7.3 percent (compound annual growth rate, or CAGR), reaching $30 billion, annually, by 2026. Commercial air transport — the fastest growing among all aerospace segments at nearly 9 percent (CAGR) — should reach $18 billion by 2026, thanks to an all-time high in backlogged orders. Significant research-and-development dollars continue to be allocated toward aerospace composites and their advancement, with spending at about $1 billion per annum in the U.S. alone, which continues to result in a plethora of advanced composite structural components for the aircraft manufacturing industry. Boeing’s 787 Dreamliner and the Airbus A350 XWB aircraft designs have the greatest percentages of composites, each with 50 percent by weight, and the next generation of commercial aircraft and business jets will continue to drive a dramatic increase in composite material usage. On the military side, the F-35 Joint Strike Fighter will drive significant growth over the next 10 years, and for next-generation military platforms, including rotorcraft, planners are evaluating a shift to even greater use of advanced composite materials.

Once viewed as desirable but cost-prohibitive for commercial aircraft, composite materials have changed the value proposition, largely due to economic factors that now complement their performance benefits. Today, composites are increasingly viewed as the best value rather than simply the most advanced design option, particularly as production costs continue to fall due to greater automation in manufacturing and as airlines struggle to achieve higher levels of fuel efficiency.

That said, the aerospace sector, which has been around for decades and was the earliest adopter of composites, is far more mature than other market areas when it comes to advanced materials. For that reason, there is a relatively large corporate and private equity presence in the aerospace market. Robust mergers and acquisitions (M&A) activity in the overall aerospace and defense markets has spilled over to the composites subsegment. Because of the strong growth prospects I previously described and the high fragmentation (the presence of a large number of small, independent firms) in this sector, composites have generated strong interest among strategic and financial investors. This M&A interest continues to be strong, regardless of prevailing economic cycles or conditions in the broader M&A market. Companies that have proprietary design and engineering capabilities, vs. straightforward build-to-print operations, naturally command more attention in this marketplace.

What does this mean for the near term? Consolidation has been a trend in the composites subsector. That trend will continue, in my opinion, as companies divest slower-growing businesses to concentrate on markets with the most attractive growth opportunities. Strategic buyers have been and continue to be active in acquiring companies to enhance vertical integration; that is, they have the ability to supply materials, semifinished products, parts and complete assemblies, which can be very attractive to prime contractors. While M&A activity is down across the board over the near term, middle market valuations remain relatively unchanged. There is an ample amount of cash and capital available to strategic players looking for good buys, and while some private equity money has been sidelined, it has not disappeared. There is plenty of demand for premium assets in this subsector. Companies that persevere and continue to perform through these headwinds will emerge stronger and will offer attractive acquisition opportunities to strategic players.

This strong interest from the investment community is a testament to a maturing and confident industry with acceptable cycles — a market that’s finally come of age.

Related Content

Materials & Processes: Resin matrices for composites

The matrix binds the fiber reinforcement, gives the composite component its shape and determines its surface quality. A composite matrix may be a polymer, ceramic, metal or carbon. Here’s a guide to selection.

Read MoreMaterials & Processes: Composites fibers and resins

Compared to legacy materials like steel, aluminum, iron and titanium, composites are still coming of age, and only just now are being better understood by design and manufacturing engineers. However, composites’ physical properties — combined with unbeatable light weight — make them undeniably attractive.

Read MoreCarbon fiber in pressure vessels for hydrogen

The emerging H2 economy drives tank development for aircraft, ships and gas transport.

Read MoreJEC World 2022, Part 3: Emphasizing emerging markets, thermoplastics and carbon fiber

CW editor-in-chief Jeff Sloan identifies companies exhibiting at JEC World 2022 that are advancing both materials and technologies for the growing AAM, hydrogen, automotive and sustainability markets.

Read MoreRead Next

Strong aerospace, defense sectors to fuel more M&A

In 2006, I used this column to discuss how the strong growth in the advanced materials and composites industry, coupled with the fragmented nature of the sector, were fueling consolidation activity through mergers and acquisitions (M&A).

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More