Arkema outlines growth plans in Specialty Materials

In a recent strategy update meeting, the chemical company said it will focus on growth on its Adhesive Solutions, Advanced Materials and Coating Solutions businesses.

Arkema headquarters in Colombe, France. Source | Arkema

Chemical company Arkema (Colombes, France) recently unveiled its company roadmap, objectives for 2024, and ambition to become a world leader in specialty materials at a strategy update meeting on April 2.

Since 2006, the Group says it has been progressively developing a leading position in the specialty materials space through targeted investments, an innovation policy focused on sustainable development trends and proactive portfolio management. These activities now account for almost 80% of its sales.

Today, Arkema’s vision revolves around growth of its Adhesive Solutions, Advanced Materials and Coating Solutions businesses. The Group has decided to align its organization and reporting with this vision, which now consists of:

- Three divisions that will be reported separately and will include all Arkema Specialty Materials: Adhesive Solutions, Advanced Materials and Coating Solutions; and

- An Intermediates division consisting of MMA/PMMA, Fluorogases and Asia Acrylics, consolidating activities with more volatile results and for which the Group will implement differentiated strategies. In particular, the Group will undertake a review of its strategic options for MMA/PMMA, explore possible alternatives to minimize its exposure to the most emissive applications of its Fluorogases, and rebalance its Asia Acrylics business between upstream and downstream.

By 2024, Arkema aims to become a pure specialty materials player, with a resilient and focused portfolio, characterized by high profitability and strong cash generation. Thus, Arkema aims to generate sales of €10 to 11 billion and an EBITDA margin of around 17% compared to 15.8% today for its Specialty Materials business. To carry through this latest stage in its development, the Group intends to build on its many innovation projects and investments in major projects such as the expansion of its specialty polyamides in Asia, which will help for example meet the challenges of material lightweighting, 3D printing, new energies and energy efficiency in buildings. Arkema also intends to continue playing an active part in the consolidation of the Adhesives market.

Arkema will also maintain strict financial discipline, with a net debt (including hybrid bonds) to EBITDA ratio of less than 2 and a return on capital employed (ROCE) in excess of 10% by 2024. Over the next five years, the Group’s cash generation is expected to grow further compared to the previous period (2015-2019). By maintaining the net debt (including hybrid bonds) to EBITDA ratio around end-2019 levels, it should allow Arkema to finance major organic growth projects and portfolio management operations, as well as raise shareholder returns, the goal being to achieve a dividend pay-out ratio of some 40% by 2024, the Group says. It is also expected to allow opportunistic share buy-backs under favorable market conditions.

Arkema also says that its 2024 targets are based on its current best estimates, and that achievement of the targets will depend on the duration and long-term economic impacts of the COVID-19 crisis.

In the short term, in the context of the pandemic, the Group is implementing crisis management measures to ensure the protection of its employees’ health as a priority, adjusting its supply chain and adapting its production facilities to best manage potential disruptions and ensure the continuity of supply to its customers in essential markets. The Group continues to monitor its cash generation and is taking active steps to reduce its investments and fixed costs from the levels initially forecast for 2020. In the first quarter, the impact of COVID-19 on the Group’s EBITDA is estimated at between €40 and 50 million.

Related Content

Novel dry tape for liquid molded composites

MTorres seeks to enable next-gen aircraft and open new markets for composites with low-cost, high-permeability tapes and versatile, high-speed production lines.

Read MoreSulapac introduces Sulapac Flow 1.7 to replace PLA, ABS and PP in FDM, FGF

Available as filament and granules for extrusion, new wood composite matches properties yet is compostable, eliminates microplastics and reduces carbon footprint.

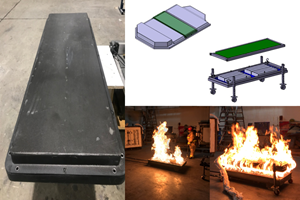

Read MorePrice, performance, protection: EV battery enclosures, Part 1

Composite technologies are growing in use as suppliers continue efforts to meet more demanding requirements for EV battery enclosures.

Read MorePEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MoreRead Next

Arkema inaugurates Global Center of Excellence for 3D Printing in Normandy

The center is dedicated to additive manufacturing based on high-performance polymers, specifically powder bed fusion.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More

.jpg;width=70;height=70;mode=crop)