Time to catch our breath?

The wind industry as a whole, and blade designers and manufacturers in particular, should use this temporary pause in the growth rate to catch their breath and apply lessons learned.

Wind energy has been getting a lot of attention in the composites industry, and rightfully so. In the U.S., alone, new wind farm installations have grown at an average annual rate of 32 percent over the past five years. In 2008, records were set for new installed capacity, both in the U.S. (8,545 MW) and worldwide (28,190 MW). For turbine blades, this corresponds to ~680 million lb (~310,000 metric tonnes) of finished blade structure, globally.

Recent years also have seen an influx of manufacturing to the U.S. In 2006, new blade manufacturing facilities were opened by Gamesa (Ebensberg, Pa.) and Suzlon (Pipestone, Minn.), and in 2008, plants were opened by LM Glasfiber (Little Rock, Ark.), Vestas (Windsor, Colo.), TPI Composites (Newton, Iowa), Molded Fiberglass Companies (Aberdeen, S.D.), and Knight and Carver (Howard, S.D.).

In 2009, however, economic, social and political dynamics have made it less certain that these growth trends will continue. On one hand, we’ve experienced a global economic crisis unprecedented in generations. On the flipside, concerns about climate change and dependence on imported energy have motivated broad support for renewable energy. But the net impact on the wind energy industry remains to be seen. In the first half of 2009, new installations in the U.S. totaled 4,000 MW. While this is significantly higher than the 2,900 MW for the first six months of 2008, expectations are that even if 2009 production matches the 2008 mark, it will fall far short of the rapid growth seen in previous years.

As an industry veteran, I do not see this as an entirely bad thing. Concurrent with the growth in new turbine installations has been a similarly rapid growth in the size of the machines themselves. Current production blades are typically 35m to 45m (115 ft to 148 ft) in length with the largest production blades exceeding 60m/197 ft. To constrain weight growth as blades get larger, engineers seek higher performance from the composite materials, with the result that blades may be more sensitive to manufacturing flaws. In addition, extensive new manufacturing capacity is being deployed in India and China.

The challenges are cumulative. Manufacturers are simultaneously ramping up production rates, adjusting tooling and processes for larger blades, and working to maintain or improve manufacturing quality — all while introducing new facilities across varying languages and cultures. It begs the question: How fast can we go? It is in no one’s best interest that we simply increase production capacity and blade size. We must do it in a way that ensures cost-effective energy production and robust performance of the equipment.

The wind industry has experienced some predicable growth pains in this process. For example, several Gamesa G87 blades failed in 2007 due to a bondline problem and, in 2008, Suzlon announced a $25 million (USD) retrofit, involving more than 1,250 of its S88 V2-style blades. Other companies have experienced similar problems, particularly when scaling up to multi-MW turbine size. The current pause in the production growth could offer individual manufacturers and the industry as a whole an opportunity to apply lessons learned and avoid similar problems in the future.

Given the complexity of the challenge, there is no single “answer” to these issues. Increased use of automated processes could help ensure quality and consistency. Nondestructive inspection methods (ultrasonic scanning, thermography and others) can be used to verify critical features of the laminate, blade assembly and geometry. Condition monitoring technology (based on strain, acoustics or vibrations) can provide early detection of blade problems and help prevent catastrophic failures. Development in each of these technology areas is rapid, and the feasibility for cost-effective application to wind turbine blades is being demonstrated.

Although the details and timing of our economic recovery remain uncertain, wind energy development and wind blade manufacturing are poised to resume strong growth. In the U.S., the production tax credit (PTC) has been extended through 2012. Renewable electricity standard (RES) polices currently exist in 28 states, and there is strong momentum to establish a national RES. The importance of the North American market is evidenced by Vestas’ decision to open new plants and ramp up production in the U.S even as it closes its Isle of Wight blade production facility (see “Learn More”). Similar confidence motivated Nordex to begin construction of a $100 million blade-and-nacelle plant in Jonesboro, Ark.

Accordingly, the wind industry as a whole, and blade designers and manufacturers in particular, should use this temporary pause in the growth rate to catch their breath and apply the lessons learned to ensure success when we once again ramp up production.

Related Content

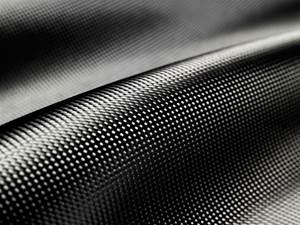

Materials & Processes: Composites fibers and resins

Compared to legacy materials like steel, aluminum, iron and titanium, composites are still coming of age, and only just now are being better understood by design and manufacturing engineers. However, composites’ physical properties — combined with unbeatable light weight — make them undeniably attractive.

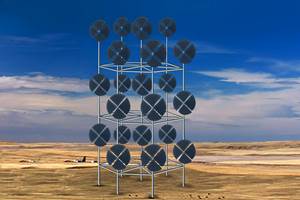

Read MoreDrag-based wind turbine design for higher energy capture

Claiming significantly higher power generation capacity than traditional blades, Xenecore aims to scale up its current monocoque, fan-shaped wind blades, made via compression molded carbon fiber/epoxy with I-beam ribs and microsphere structural foam.

Read MoreForvia brand Faurecia exhibits XL CGH2 tank, cryogenic LH2 storage solution for heavy-duty trucks

Part of its full hydrogen solutions portfolio at IAA Transportation 2022, Faurecia also highlighted sustainable thermoplastic tanks and smart tanks for better safety via structural integrity monitoring.

Read MorePlant tour: ÉireComposites, Galway, Ireland

An in-house testing business and R&D focus has led to innovative materials use and projects in a range of markets, from civil aerospace to renewable energy to marine.

Read MoreRead Next

CW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More