Composites Growth Realizing Its Global Potential

Dr. Sanjay Mazumdar is president and CEO of E-Composites Inc. (Grandville, Mich.), a business consulting firm that provides market forecasts and competitive analyses. He has directed compilation of more than 15 multi-client market reports, published more than 25 technical papers in journals and conference

The first, large-scale commercial applications of composite materials began during World War II in the military sector in the late 1940s and early 1950s. Since then, global use of composite materials has grown rapidly from 158,800 metric tonnes/350 million lb in 1960 to 6.1 million metric tonnes/13.5 billion lb in 2004 — representing 3,800 percent growth in the last 45 years. Today, it is hard to find an industry in which composite materials are not used.

The reasons for selecting composite materials differ from industry to industry. In the aerospace industry, the light weight and higher stiffness of composites are driving factors; whereas in the automotive industry, styling flexibility, parts consolidation, reduced tooling costs and the ability to achieve a Class A finish are the key usage drivers. The marine industry favors the use of composites because of their corrosion resistance, while the wind energy industry relies on their ability to mold large complex parts such as blades, which range from 10m to 40m (32.8 ft to 132.8 ft) long, which are hard to make cost-effectively with other materials. In the wind energy market, composite materials are used in virtually all rotor blade production.

From 1970 to 1990, transportation, construction, electrical and electronics, marine, pipe and tank, and consumer goods applications drove the growth of composite materials. During 1990 to 2000, the highest rates of composites growth were recorded in the transportation and construction markets. However, growth in these markets slowed in developed nations between 2000 and 2004. During this time period, global growth was driven by the Asian-Pacific region, especially China.

The global composites industry saw an average annual growth of 3.6 percent during the last six years1. The global composites industry saw a drop of 4.8 percent in 2001; however, it recovered in 2002. Since 2002, the global market has increased at a very healthy rate of over 5 percent, mainly due to growth in Asia. In 2004, the composites industry experienced good growth across all regions. The growth rate in the composites industry in 2004 was 8.7 percent as compared to global economic growth rate of 4 percent in 20041.

Future global composites industry growth will come from Asia, mainly from China and India. These two countries have enormous potential for growth. Currently, China consumes 0.8 kg/1.8 lb of composites per capita, and India consumes 0.09 kg /0.2 lb of composites per capita; much lower than the 7 kg/15.6 lb of composites consumption per capita in the United States1. Average growth rates in India and China have been in the double digits during the last six years. The pipe and tank, construction, electrical and electronics market are driving the growth of composite materials in the Chinese composites industry. China is not only fast-growing, but it also is increasing at a pace where composites volume shipment is projected to exceed that of the U.S. by the year 2013.

| In 1999, North America ranked first, Europe ranked second and the Asian-Pacific region ranked third in terms of composites consumption. The latter moved to the number two position in 2004, and is expected to replace North America by 2006 as the top region in the world for composites consumption. The world's top consumers of composites are the United States, China, Japan, Germany, France, Italy, the United Kingdom, Taiwan, Canada and Spain, which together account for 82 percent of total global composites shipments1. |

In terms of markets, wind energy, transportation and construction will drive the growth of composite materials over the next five years. There are some niche FRP applications, such as thermoplastic composite applications, wind energy, infrastructure applications, military and defense applications, industrial rollers, fuel cells and others that are enjoying good growth. Overall, the future of the composites industry looks healthy, with volume shipments projected to increase to 17.5 billion lb per annum globally by 2010.

Reference:

| 1This article is based on a February 2005 market report, Global Composites Market 2004-2010, published by E-Composites Inc., which estimates market size and forecasts trends for composite materials in various market segments and regions. |

Related Content

Forvia brand Faurecia exhibits XL CGH2 tank, cryogenic LH2 storage solution for heavy-duty trucks

Part of its full hydrogen solutions portfolio at IAA Transportation 2022, Faurecia also highlighted sustainable thermoplastic tanks and smart tanks for better safety via structural integrity monitoring.

Read MoreMaterials & Processes: Fabrication methods

There are numerous methods for fabricating composite components. Selection of a method for a particular part, therefore, will depend on the materials, the part design and end-use or application. Here's a guide to selection.

Read MoreMoving toward next-generation wind blade recycling

Suppliers, fabricators and OEMs across the composite wind blade supply chain ramp up existing technologies, develop better reclamation methods and design more recyclable wind blades.

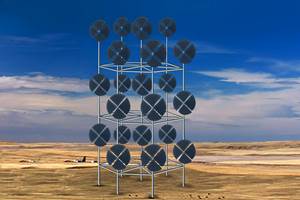

Read MoreDrag-based wind turbine design for higher energy capture

Claiming significantly higher power generation capacity than traditional blades, Xenecore aims to scale up its current monocoque, fan-shaped wind blades, made via compression molded carbon fiber/epoxy with I-beam ribs and microsphere structural foam.

Read MoreRead Next

From the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read More

.jpg;maxWidth=300;quality=90)