Opportunities, challenges for composites in future aircraft

As the commercial aerospace sector prepares for a new round of major program launches, the question of where and how composites will be applied weighs heavily on the supply chain.

CompositesWorld recently released a special edition developed with CW’s sister publications Additive Manufacturing and Modern Machine Shop, titled “Next-Gen Aerospace: Advanced Materials and Processes.”

In it you will find reports on a variety of materials and processes targeted toward the coming wave of commercial aircraft programs expected to be announced by Boeing, Airbus and others. Topics include resin infusion of wing structures, resin transfer molding of door surrounds, advances in thermoplastic composites and more. During our research and reporting of these stories, CW editors developed some insights about how the commercial aerospace end market is evolving, and some sense of what the future might bring. Herewith is our take on what we learned.

Boeing vs. Airbus: Imminent Decisions on the Next High-Volume Aircraft

by Jeff Sloan, editor-in-chief

The next 24 months are likely to be pivotal for the commercial aerospace industry. There is a chess match afoot between Boeing and Airbus, with each carefully eyeing the other, the marketplace, its balance sheets and its supply chains. The first aircraft on the horizon almost certainly will be the long-awaited Boeing NMA (New Midsize Airplane, or 797), a twin-aisle, 200-270-seat, 4,000-5,000-nautical miles plane that would fit between the 737 MAX 10 and the 787-8 in the company’s lineup.

Boeing says it will decide this year whether to “offer” the plane, followed by an official “launch” in 2020, followed by entry into service in 2025. The “offer” phase, ostensibly, allows Boeing to line up NMA customers and suppliers ahead of launch. Call it a soft launch. In any case, according to several reports, the NMA likely will be a table-setter of sorts for what would follow: A 737 replacement. The thinking seems to be that Boeing will use manufacturing and business cases established for the NMA as a model for a new 737, which is the company’s highest volume and most profitable aircraft. The big unknown is how close to each other these two announcements will be. They could be coincident, or several months or years apart.

The dark cloud hanging over the NMA is the 737 MAX, which suffered two fatal crashes — one in late 2018 and the other in early 2019 — that grounded the entire fleet and has consumed Boeing’s business and technical attention for several months. How quickly the 737 MAX problems will be fixed, and how quickly the planes will be back in the air, likely will affect the timing of an NMA offer — meaning NMA could slip several months as Boeing gets the 737 MAX straightened out.

That said, watching all of this will be Airbus, and that company’s next moves will be predicated on whatever decisions Boeing makes. Conventional wisdom says that if and when Boeing announces a 737 replacement, Airbus will follow, soonish, with a new aircraft announcement of its own, most likely a replacement for the A320, another high-volume, high-profit aircraft, and one that competes most directly with the Boeing 737.

(Photo | Boeing)

If you are a supplier of composite materials or a fabricator of parts for the aerospace industry, all of this begs a couple of questions: Where and how will composites be used on these aircraft? How likely are non-traditional materials and processes to be used?

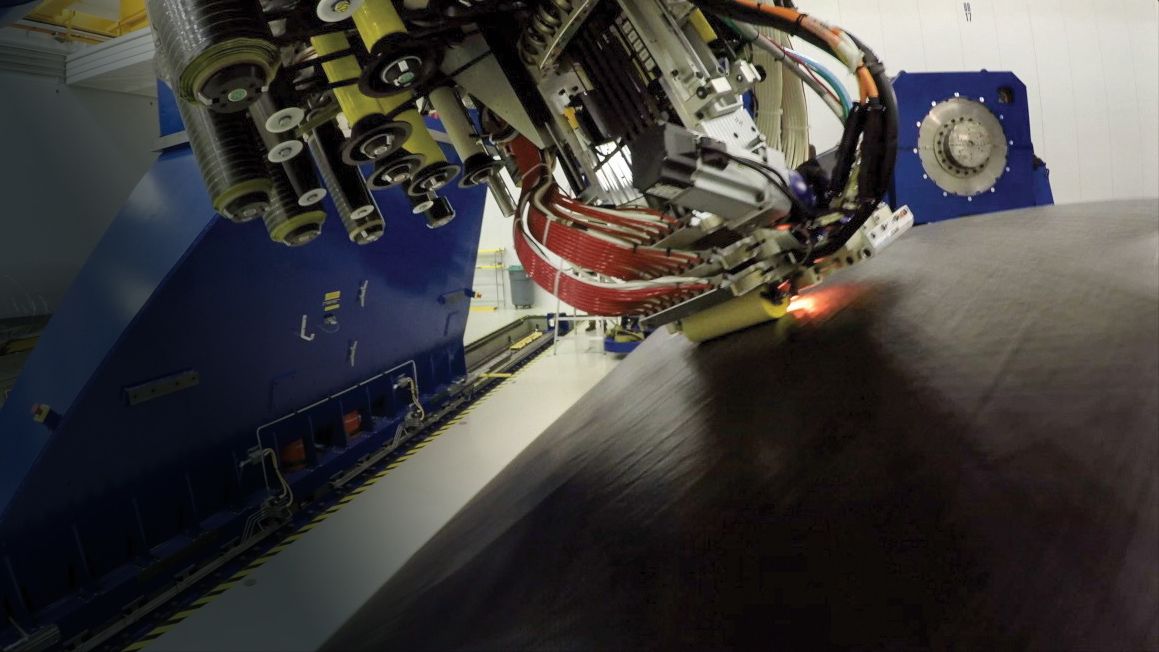

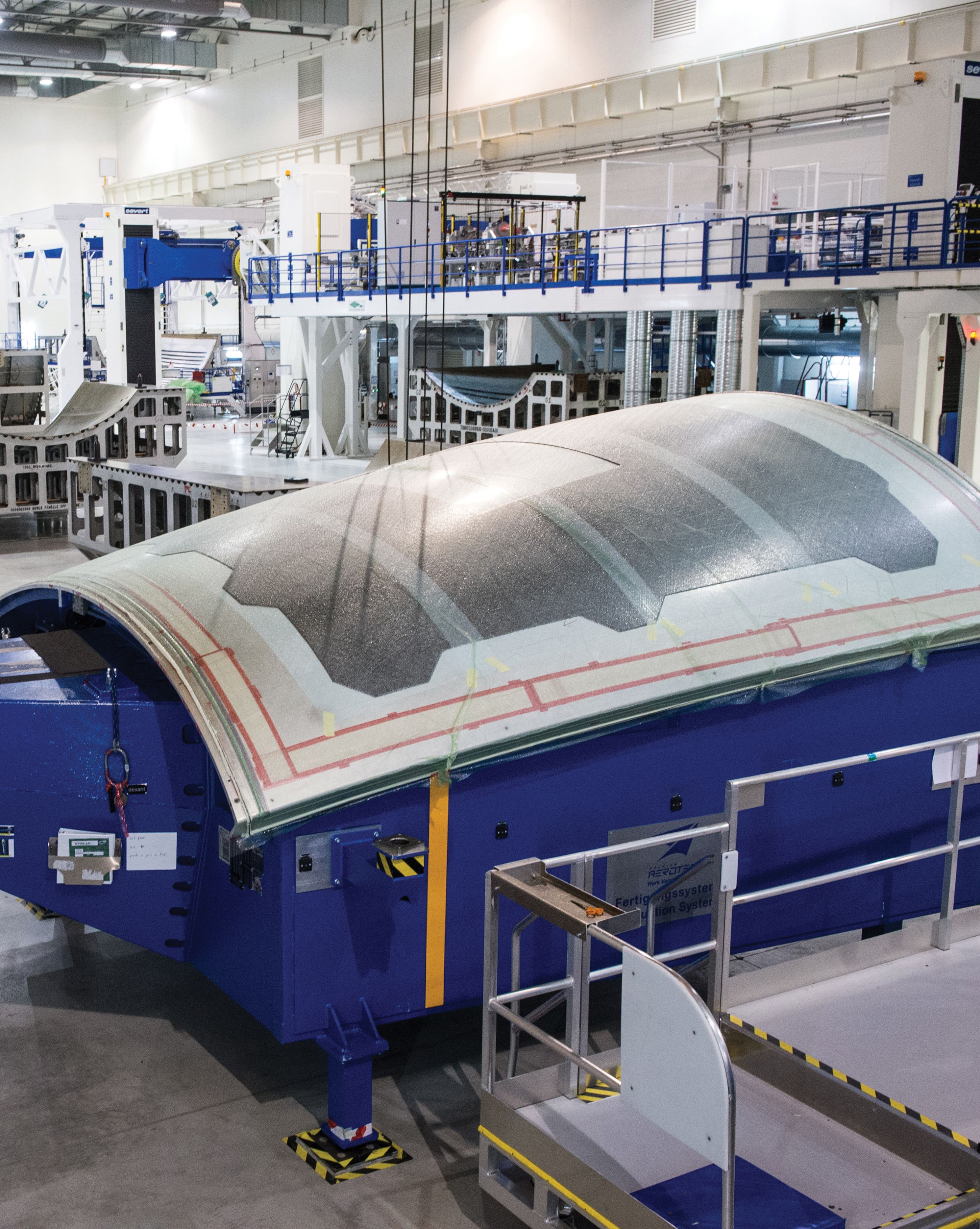

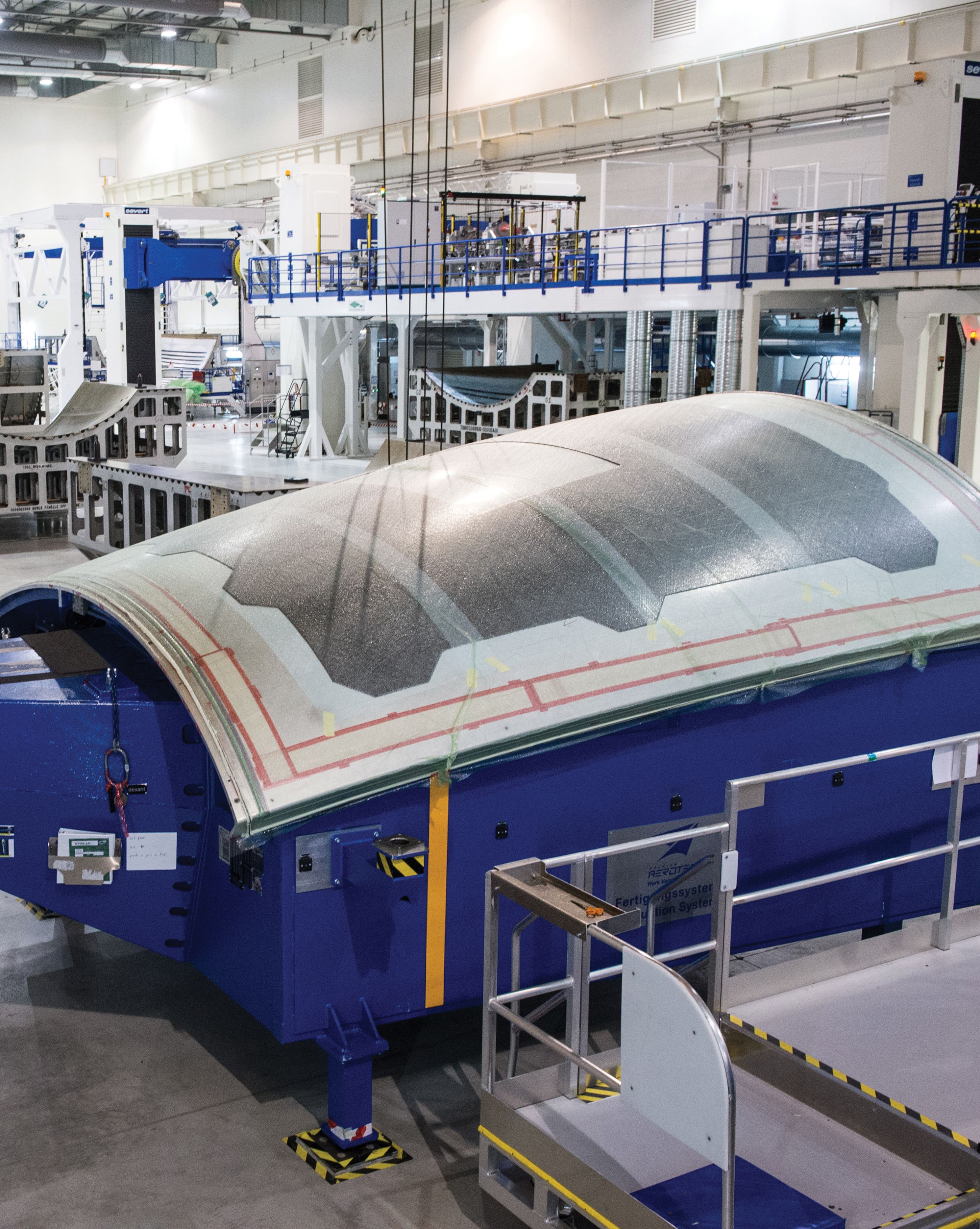

Opinions offered during my reporting for the Next-Gen Aerospace special edition varied broadly, but on one matter there was universal agreement: Wings and fuselage for the Boeing NMA will almost certainly use autoclave-cured prepregs. Boeing just stood up a massive manufacturing plant in Everett, Wash., U.S., to fabricate carbon fiber composite wings for the 777X using the latest fiber and tape placement technology from Electroimpact (Mukilteo, Wash.), as well as the world’s largest autoclaves (from ASC Process Systems, Valencia, Calif., U.S.). That much capital equipment investment almost demands application to more than one aircraft program. Further, Boeing has in Charleston, S.C., U.S., substantial composite fuselage manufacturing capability (automated fiber/tape placement), which could be expanded to the NMA. The same goes for Spirit AeroSystems (Wichita, Kan., U.S.), which makes the carbon fiber composite forward fuselage section for the Boeing 787. (See "Spirit AeroSystems invests in qualification program with Toray prepreg" in the Next-Gen Aerospace special edition.)

Boeing 777X (Image: Boeing)

Our biggest clue, however, might be the timeline: With a potential launch in 2020 and a planned entry into service in 2025, and assuming substantial composites use, Boeing does not have time to qualify new materials or processes. The fully qualified and in-service prepregs used on the 787 and the 777X from Toray Composite Materials America (Tacoma, Wash., U.S.) will serve the NMA just fine. And it might serve a 737 replacement just fine as well, particularly if Boeing does, in fact, leverage manufacturing and supply chain advantages from NMA production for a cleansheet 737. On the other hand, a 737 replacement in development in the early to mid 2020s could benefit substantially from innovation in composite material and fabrication technology, thereby opening the door for thermoplastic composites and out-of-autoclave (OOA) manufacturing processes.

Airbus A220-300 (Photo: Airbus)

Airbus, meanwhile, is moving aggressively to evolve several composites technologies, including resin infusion and thermoplastic composites fabrication. Infusion, already used to make the wings for the Airbus A220 (by Bombardier in Belfast, Ireland) and the Irkut MS-21 (by AeroComposit in Moscow, Russia), is being developed for potential use to make wing structures for an A320 replacement. This effort is being directed by Airbus through its Composites Technology Center (CTC) in Stade, Germany, with some work being done at the National Composites Centre in Bristol, U.K., which hopes to have a full-scale, infused wing structure complete by 2021.

The Irkut MC-21 features fully infused and integrated wing box, wing skins and, shown here, wing spars. They are fabricated by Moscow-based AeroComposite and feature one-piece construction. (Photo | Alexander Popov)

Also in the wings is the CRAIC 929, a twin-aisle plane being developed by United Aircraft Corp. (UAC, Moscow) and Commercial Aircraft Corp. of China Ltd. (Comac, Shanghai). UAC owns Irkut, which is producing the MS-21, so the odds seem good that the 929 will have infused wings as well. (See "Large, high-volume, infused composite structures on the aerospace horizon" in the Next-Gen Aerospace special edition.)

Regardless of the material or technology that wins the day on replacements of the 737 or A320, one major hurdle to be cleared will be rate. The production volumes being quoted by Boeing and Airbus for these planes is 60-100 per month. That’s two planes per day, at minimum. Can composites manufacturing processes be matured quickly enough to meet this rate affordably and efficiently? Consensus seems to be that, if given three or so years, infusion has a fighting chance, enabled mainly by the component integration it enables. In any case, the next decade is shaping up to be among the most active and interesting for the aerocomposites industry.

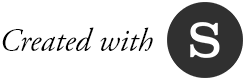

Automated fiber placement (AFP) head from Electroimpact (CW Photo | Scott Francis)

Boeing 777X (Image: Boeing)

The Airbus A220 features wing structures infused and then autoclave consolidated by Bombardier Aerosructures and Engineering Services in Belfast, Northern Ireland. The infused structure uses Solvay resin and Teijin's TENAX carbon fibers. (Photo | Teijin)

Airbus A220-300 (Photo: Airbus)

The Irkut MC-21 features fully infused and integrated wing box, wing skins and, shown here, wing spars. They are fabricated by Moscow-based AeroComposite and feature one-piece construction. (Photo | Alexander Popov)

The Irkut MC-21 features fully infused and integrated wing box, wing skins and, shown here, wing spars. They are fabricated by Moscow-based AeroComposite and feature one-piece construction. (Photo | Alexander Popov)

New Processes, Hybrid Materials

by Ginger Gardiner, senior editor

The majority of composites production in the aerospace industry today involves carbon fiber-reinforced thermoset epoxy prepreg made with hand layup for smaller, secondary structures (shown in CW’s July 2018 Aerospace Tours supplement) or automated fiber and tape placement (AFP, ATL) for larger, primary structures. The latter was highlighted in my tour of STELIA Aerospace (Méaulte, France) and its production of Airbus A350 fuselage panels (see the STELIA Aerospace tour feature in the Next-Gen Aerospace special edition). For the next generation of aircraft, at least in Europe, this preponderance of prepreg is already changing. The advance is on multiple fronts, including resin transfer molding (RTM), thermoplastic composites, hybrid metal-composite structures and 3D-printed parts in metal, plastic and composites. The driver is enabling future production rates of 60-100 aircraft per month with further reductions in weight, where possible, but drastically reduced cost, waste, assembly time and environmental impact.

RTM is already flying via the main fitting for Airbus A330/A340 spoilers. FACC (Ried im Innkreis, Austria) developed the process and then refined it for the A350 spoilers (click to learn more). The A350 passenger doors and surrounding door frames (in the fuselage) are also made using RTM by Airbus Helicopters in Donauworth, Germany. This technology has now been advanced via a high-pressure RTM (HP-RTM) A350 door frame, demonstrated by Airbus Helicopter and Alpex Technologies (Mils, Austria), achieving a 30% cost reduction and using a two-part resin as well as in-mold cure sensors (see the feature on HP-RTM for serial production in the Next-Gen Aerospace special edition). Composites Technology Center (CTC), a subsidiary of Airbus Operations GmbH, has also demonstrated HP-RTM parts sized 1-2 meters with 60% fiber volume, less than 2% voids and a cycle time of 20 minutes. CTC has worked with Airbus suppliers to identify a number of parts — many including numerous carbon fiber composite components per shipset — that are being transitioned to HP-RTM this year in order to meet higher A320 production rates. A lot of these parts are produced manually, so the more automated HP-RTM process offers significant efficiency improvements.

After layup, CFRP fuselage shell structures are prepared for autoclave cure. (Photo | STELIA Aerospace)

After layup, CFRP fuselage shell structures are prepared for autoclave cure. (Photo | STELIA Aerospace)

Cured CFRP shells are loaded onto handling tools and transported through assembly steps. (Photo | STELIA Aerospace)

Cured CFRP shells are loaded onto handling tools and transported through assembly steps. (Photo | STELIA Aerospace)

STELIA Aerospace has also developed resin infusion and RTM, pursuing industrialized production of large, closed-box structures such as wing components, horizontal tail planes and vertical tail planes. Though its current production of A350 fuselage shells involves autoclave-cured prepreg, the process is highly automated. STELIA’s Factory of the Future initiative, started five years ago to meet ramps in A320 and A350 production, focused on eliminating waste in labor, movement, materials and process. STELIA also achieved a 10-20% increase in production on its A320 line and devotes a large portion of its STELIALAB R&T efforts to more efficient assembly methods using robotics, additive manufacturing and thermoplastics. Automation will be prerequisite for next-gen aircraft production. STELIA also states that the future will be composites and metals.

After layup, CFRP fuselage shell structures are prepared for autoclave cure. (Photo | STELIA Aerospace)

Source | STELIA Aerospace

Note the conjunction of more efficient assembly — in other words, reduced assembly — with liquid molding and additive manufacturing (for single-piece, integrated structures) as well as thermoplastics (for highly automated, welded structures). STELIA demonstrated the latter via the all-thermoplastic composite helicopter fuselage/tailboom developed in the ARCHES TP program. Lightning strike protection (LSP) was integrated during layup using AFP carbon fiber/polyetherketoneketone (PEKK) tape and laser heating. Frames and stringers were stamp-formed, with the latter attached using automated, dynamic induction welding.

Cured CFRP shells are loaded onto handling tools and transported through assembly steps. (Photo | STELIA Aerospace)

A final summary-view is provided by the Clean Sky 2 program’s next-generation Multifunctional Fuselage Demonstrator (MFFD). Clean Sky 2 is a joint effort of the European Commission and the European aeronautics industry to develop technologies for the next generation of aircraft, from 2025 onward. Drastic reductions in assembly time and components, elimination of fasteners and “dust-less” joining — no drilling of holes — are the mantra for the MFFD project, which aims to produce an 8-meter-long thermoplastic composite fuselage barrel by 2022. Led by Airbus with partners GKN Fokker (Hoogeveen, Netherlands), DLR (Stuttgart, Germany), TU Delft (Delft, Netherlands), NLR (Amsterdam, Netherlands), Fraunhofer-Gesellschaft (Munich, Germany) and others, this project’s goals include enabling production of 60 aircraft/month while reducing recurring costs and fuselage weight by 1 ton, the latter also reducing fuel-burn and emissions. It will validate high-potential combinations of airframe structures, cabin, cargo and system elements into a multifunctional fuselage, underpinned by Industry 4.0 design for automation, sensors and analysis of big data.

As explained in the latest MFFD updates, although thermoplastics are more expensive, they enable automation and greater integration of structure, systems and interior elements to reduce the amount of successive assembly steps. Using thermoplastic joining technologies — such as overmolding and welding — molded elements can be combined into larger components/system modules, reducing overall aircraft manufacturing costs and recurring costs. "Airframers outside Europe are also looking at similar opportunities, but if we are successful this will be a big step forward for European aeronautics,” says Ralf Herrmann, project manager for airframe research & technology typical fuselage at Airbus Operations GmbH.

There are dozens of Clean Sky 2 projects demonstrating novel composites technologies for next-gen aircraft. The preponderance now is for liquid resin infusion/RTM and thermoplastics. Almost all are seeking design and manufacturing improvements for reduced weight, cost and environmental impact. The race for the future is on, and whichever technologies win, the ultimate goal is a sustainable future for the aircraft industry and our planet.

Next-Gen Automation Leading Inspection and Thermoplastics

by Scott Francis, senior editor

The nature of forecasting is to look for the next big thing. The aerospace industry seems constantly on the brink of some new breakthrough in innovation. The need for stronger, stiffer, yet lighter materials never ends, nor does the research and development to improve materials and processes. Aerospace suppliers and OEMs say it usually takes about 25 years for technology to work its way into full adoption. That said, a tipping point moment seems imminent for thermoplastic composites (TPCs) in commercial aerospace (see "Thermoplastic composites: Poised to step forward" in the Next-Gen Aerospace special edition). Currently, the industry is seeing increased adoption of TPCs for larger parts and structural components. Trends seem to indicate we’ll continue to see more thermoplastic composites in a variety of applications. These materials have undergone a great deal of testing and many are being qualified. In January, Teijin (Tokyo, Japan) announced that Boeing (Chicago, Ill., U.S.) added its TENAX carbon fiber and carbon fiber/thermoplastic unidirectional pre-impregnated tape (TENAX TPUD) to its qualified products list (see CW's coverage). The case for TPCs seems to have been made, and the current focus seems to be on ramping up production rates.

The processes used to fabricate parts are also more mature. Automation, such as AFP and ATL, is moving the needle on the ability to meet the needed production rates. To that end, thermoplastic polymers continue to evolve in the quest for faster processing. The latest example is Victrex’s (Lancashire, U.K.) low-melt polyaryletherketone (PAEK), which is said to work well in AFP, as well as welding and stampforming. Solvay (Alpharetta, Ga., U.S.) has also indicated it is working to develop tailored polymers that are customized for different fabrication processes.

When it comes to process technologies, we’re likely to see increased collaboration between aerospace and automotive markets in order to achieve high-volume production of composite parts. The IRG CosiMo consortium, which includes Solvay, Premium Aerotec (Augsburg, Germany) and Faurecia Clean Mobility (Columbus, Ohio, U.S.), is aimed at just that. The project focuses on developing synergies between companies and organizations along the thermoplastic composites process chain from materials to machinery to applications.

Inspection technology is another area where OEMs are seeking improvements in overall production rates (see "Automated, in-situ inspection a necessity for next-gen aerospace" in the Next-Gen Aerospace special edition). While AFP technology has the ability to rapidly produce larger parts, much of the inspection is still manual and can cause a productivity bottleneck. New in-situ inspection technologies are in development that will likely play a big role in production ramp-ups. A recent example is a next-generation sensor for in-process inspection developed by Fives (Hebron, Ky., U.S.) and the National Research Council Canada (NRC, Ottawa). Based on optical technology that uses infrared light waves to precisely measure distance, the In-Process Inspection (IPI) technology is said to reduce processing time by up to 30% compared to layup operations using manual inspection.

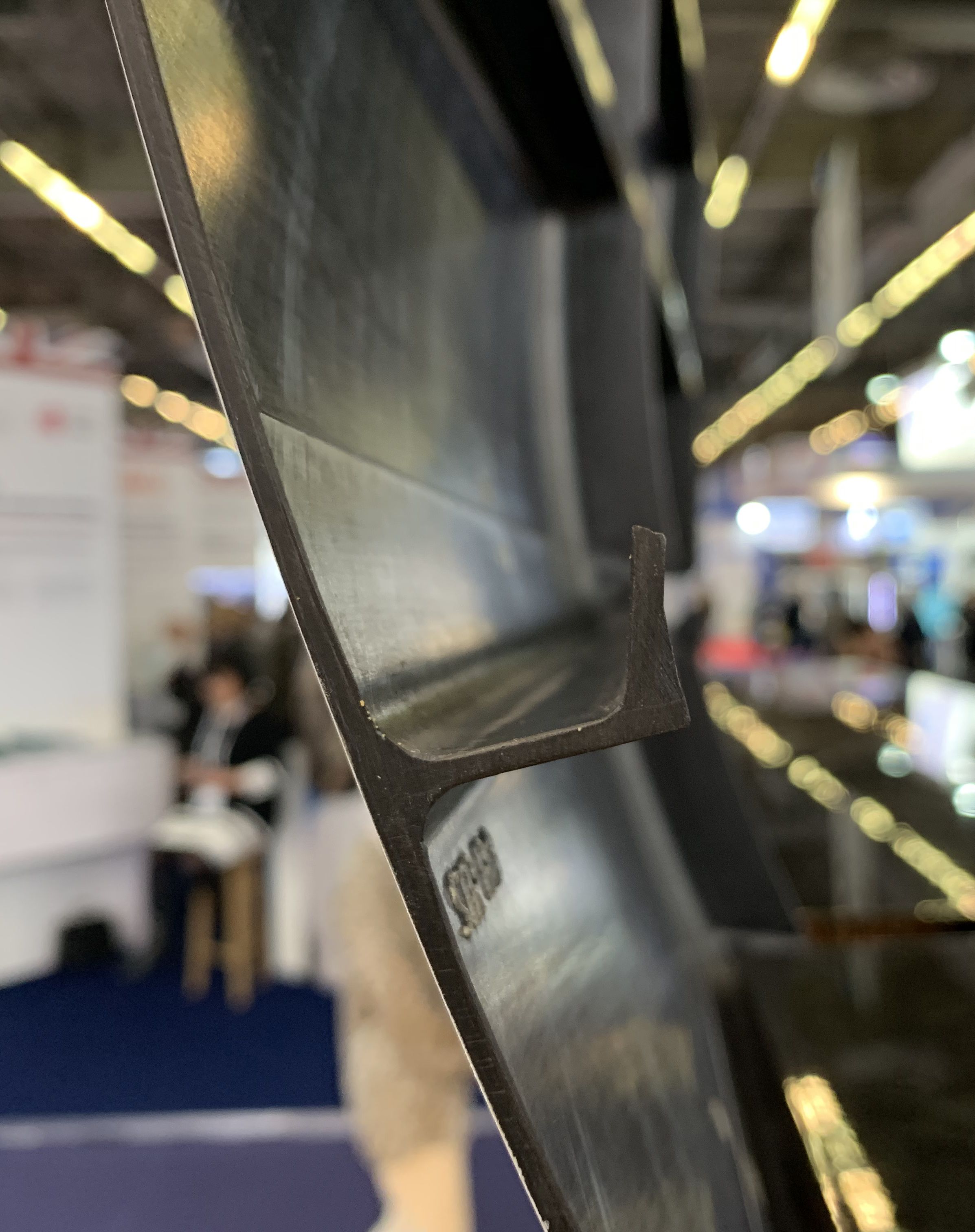

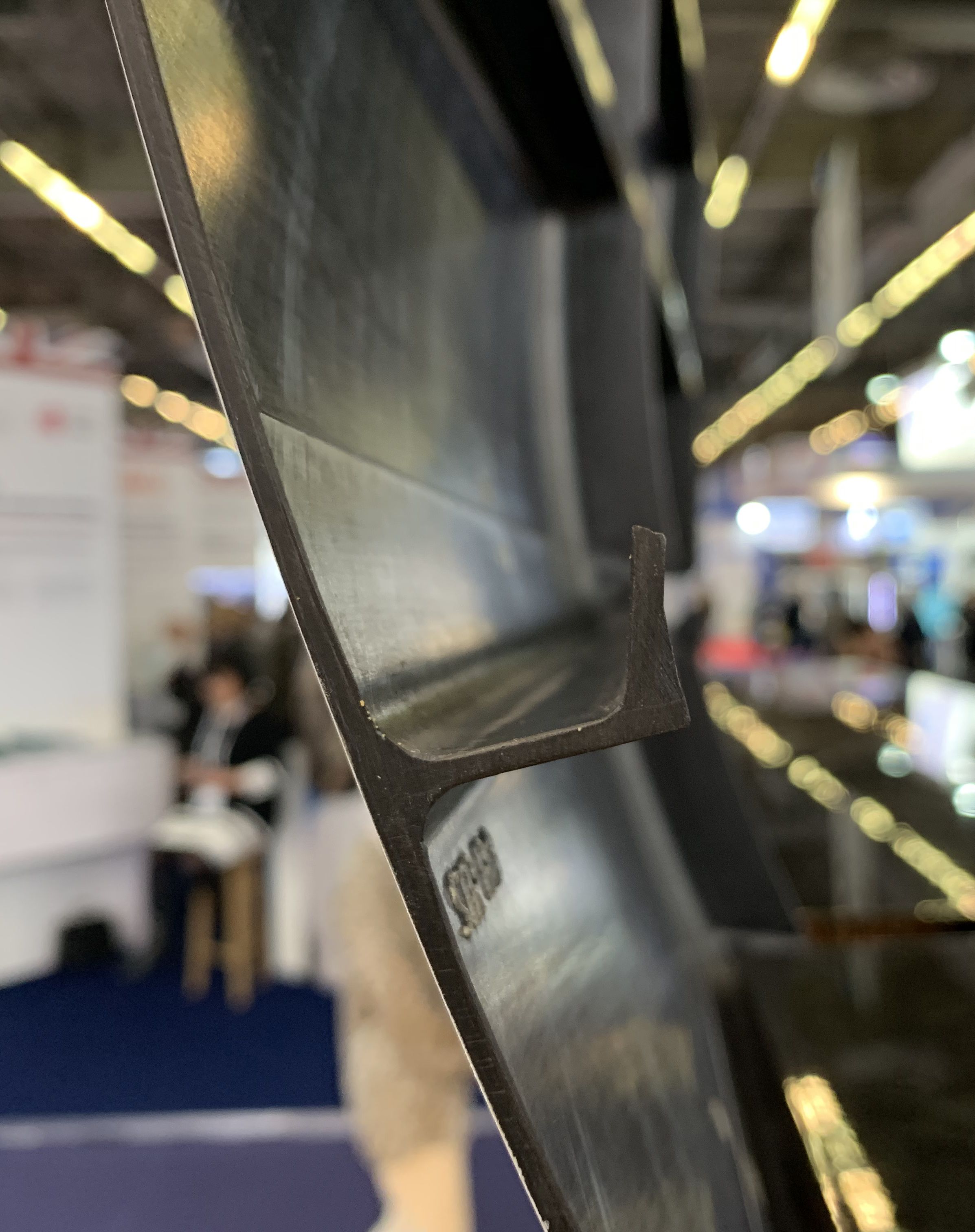

Meanwhile, joining and welding of TPCs offer the potential to cut costs and improve the reliability of parts by reducing the need for rivets and fasteners, contributing to weight reduction and cutting down on production time and material costs. Companies like GKN Fokker (Hoogeveen, Netherlands) have been leading the charge in developing TPC welding. At JEC World 2019, GKN Fokker unveiled an area-ruled (shaped to reduce drag) thermoplastic composite panel it developed with Gulfstream Aerospace (Savannah, Ga., U.S.), featuring fully welded frames and a butt-jointed grid system to provide stiffness.

Thermoplastic fuselage panel by GKN Fokker and Gulfstream Aerospace featuring simple "butt-jointed" orthogrid stiffening and fully welded frames. (Photo | Jeff Sloan)

New material technologies are being explored to improve mechanical and thermal properties for leading edges. Earlier this year, Aeronova (Álava, Spain), Grupo Antolin-Ingenieria (Burgos, Spain) and Airbus, working as partners in the European Union-funded Graphene Flagship (Gothenburg, Sweden) consortium, produced a leading edge for an Airbus A350 horizontal tail plane using graphene-enhanced composites. The material reportedly increases the mechanical properties of the leading edge, allowing for a thinner construction, decreasing its weight while maintaining its functions.

Graphene Flagship partners Aernnova, Grupo Antolin-Ingenieria and Airbus produced a leading edge for an Airbus A350 horizontal tail plane using graphene. (Photo | Graphene Flagship)

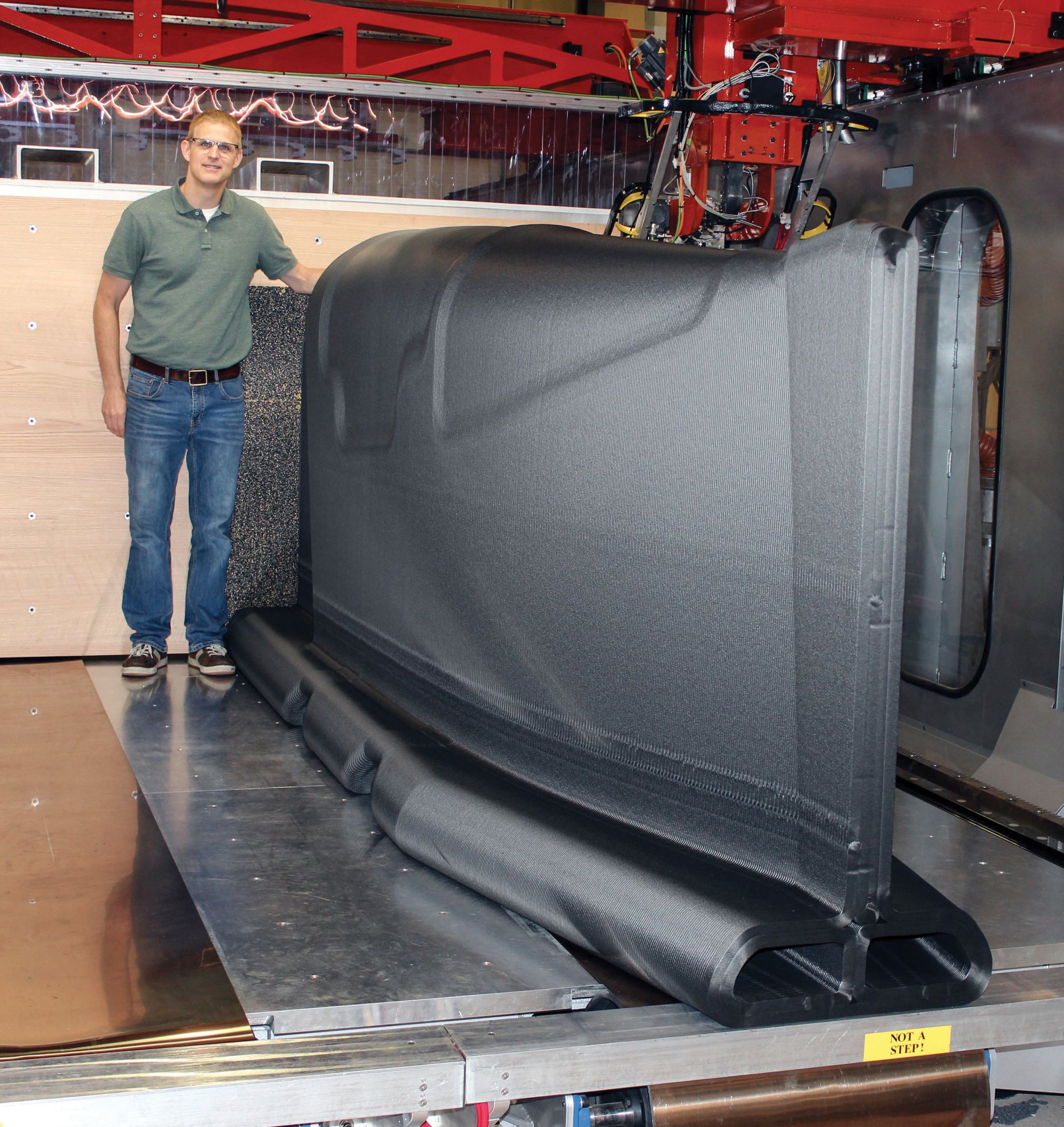

Additive manufacturing is playing an increasing role in aerospace composites as well (see "Big additive machines tackle large molds" in the Next-Gen Aerospace supplement). Boeing’s 777X uses a 3D-printed layup tool from Cincinnati Inc. (Harrison, Ohio, U.S.) for its carbon fiber wing tips, as well a large, single-piece tool created by Thermwood Corp. (Dale, Ind., U.S.) using its Large Scale Additive Manufacturing (LSAM) machine and Vertical Layer Print (VLP) 3D printing technology.

This trim tool for Boeing's 777X wing tip was additively manufactured by Cincinnati Inc. in collaboration with Oak Ridge National Laboratory. (Video | Oak Ridge National Laboratory)

Thermwood worked with Boeing to build this demonstrator tool for the 777X. It was fabricated using large-format additive manufacturing and includes vertical bead placement. (Photo | Thermwood)

Of course, with the growing need for more planes — and the increased use of composites on them — comes an increased demand for small and interior components, airline seating solutions and composite repair technology. Plenty of challenges remain to meet the need for higher-volume production, but at the same time there is also plenty of opportunity for the composites world to rise to the challenge.

Thermoplastic fuselage panel by GKN Fokker and Gulfstream Aerospace featuring simple "butt-jointed" orthogrid stiffening and fully welded frames. (Photo | Jeff Sloan)

Thermoplastic fuselage panel by GKN Fokker and Gulfstream Aerospace featuring simple "butt-jointed" orthogrid stiffening and fully welded frames. (Photo | Jeff Sloan)

Graphene Flagship partners Aernnova, Grupo Antolin-Ingenieria and Airbus produced a leading edge for an Airbus A350 horizontal tail plane using graphene. (Photo | Graphene Flagship)

Graphene Flagship partners Aernnova, Grupo Antolin-Ingenieria and Airbus produced a leading edge for an Airbus A350 horizontal tail plane using graphene. (Photo | Graphene Flagship)

Thermwood worked with Boeing to build this demonstrator tool for the 777X. It was fabricated using large-format additive manufacturing and includes vertical bead placement. (Photo | Thermwood)

Thermwood worked with Boeing to build this demonstrator tool for the 777X. It was fabricated using large-format additive manufacturing and includes vertical bead placement. (Photo | Thermwood)