GWEC reports 51.3 GW of new wind capacity in 2018

The Global Wind Energy Council’s latest data shows that China led both offshore and onshore wind energy installation in 2018.

The Global Wind Energy Council (GWEC, Brussels, Belgium) reported in late February that the global wind energy industry installed 51.3 gigawatts of new capacity in 2018. Since 2014, the global wind market’s growth has been stable, installing more than 50 gigawatts of new capacity each year.

Despite a 3.9 percent decrease in the global onshore market in annual terms, there was promise shown by growth in developing regions such as Latin America, Southeast Asia and Africa, which were responsible for 10 percent of new onshore installations in 2018, totaling 4.8 gigawatts.

The global offshore market grew by 0.5 percent in 2018, with new installations of 4.49 gigawatts, reaching a total installed capacity of 23 gigawatts. For the first time, China installed more offshore capacity than any other market (1.8 gigawatts), followed by the United Kingdom (1.3 gigawatts) and Germany (0.9 gigawatts). GWEC forecasts that offshore wind will become an increasingly global market. If governments remain committed, and projects and investments continue, annual installations in Asia could reach 5 gigawatts or more each year, according to GWEC. In the U.S., GWEC expects the developing offshore wind market to reach 1 gigawatt by 2022 or 2023.

GWEC forecasts that new installations will reach 55 gigawatts or more each year until 2023. Stable volume is predicted to come from mature regions in Europe and the U.S., while significant growth is forecast to be driven by developing markets in Southeast Asia and the global offshore market.

According to GWEC’s report, total installed wind capacity reached 591 gigawatts at the end of 2018, a growth of 9.6 percent compared to the end of 2017. Total installed onshore wind grew by 9 percent, while total offshore wind grew by 20 percent, reaching 23 gigawatts.

“2018 was a positive year for wind in all major markets, with China leading both onshore and offshore growth,” says Ben Backwell, CEO of GWEC. “We expect huge growth in Asia through the coming decade and beyond as part of the continuing shift from Europe to Asia as the driving region for wind development. However, government support and policy are key to enabling faster market growth in key regions such as Southeast Asia.”

“Since 2014, the global wind industry has added more than 50 gigawatts of new capacity each year, and we expect 55 gigawatts or more to be added each year until 2023,” says Karin Ohlenforst, director of market intelligence at GWEC “In particular, the offshore market will grow on a global scale and will reach up to 7-8 gigawatts of new capacity during 2022 and 2023.”

These latest figures released by GWEC form the statistical release of the Global Wind Report, GWEC’s flagship publication. The full report will be released on April 3, 2019. GWEC will host a webinar about the report’s findings on April 3.

According to GWEC’s findings, the top 10 onshore markets in 2018:

- China – 21,200 MW

- USA – 7,588 MW

- Germany – 2,402 MW

- India – 2,191 MW

- Brazil – 1,939 MW

- France – 1,563 MW

- Mexico – 929 MW

- Sweden – 717 MW

- United Kingdom – 589 MW

- Canada – 566 MW

Top offshore markets in 2018:

- China – 1,800 MW

- United Kingdom – 1,312 MW

- Germany – 969 MW

- Belgium – 309 MW

- Denmark – 61 MW

Related Content

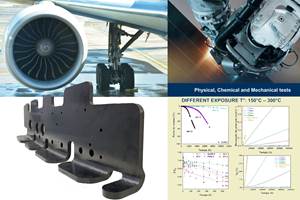

Daher CARAC TP project advances thermoplastic composites certification approach

New tests, analysis enable databases, models, design guidelines and methodologies, combining materials science with production processes to predict and optimize part performance at temperatures above Tg (≈150-180°C) for wing and engine structures.

Read MoreTU Munich develops cuboidal conformable tanks using carbon fiber composites for increased hydrogen storage

Flat tank enabling standard platform for BEV and FCEV uses thermoplastic and thermoset composites, overwrapped skeleton design in pursuit of 25% more H2 storage.

Read MoreCryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreHigh-performance, high-detail continuous 3D-printed carbon fiber parts

Since 2014, Mantis Composites has built its customer and R&D capabilities specifically toward design, printing and postprocessing of highly engineered aerospace and defense parts.

Read MoreRead Next

From the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read More

.jpg;width=70;height=70;mode=crop)

.jpg;maxWidth=300;quality=90)