Composites Germany releases composites market survey

This is the fifteenth member survey from Composites Germany that identifies up-to-date key performance indicators (KPIs) for the fiber-reinforced plastics market.

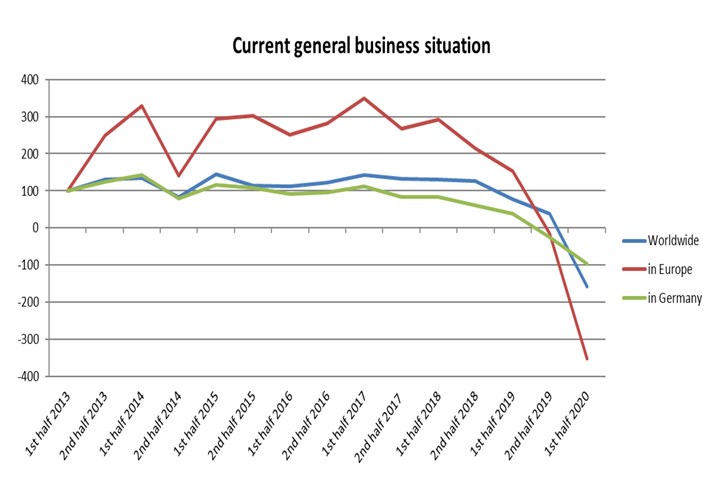

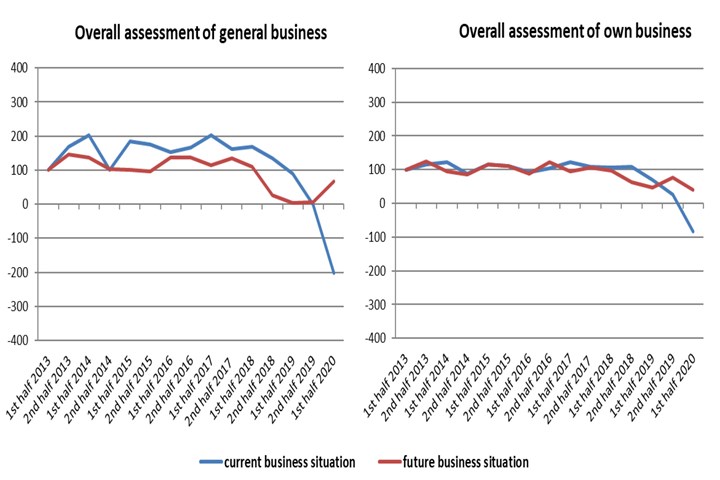

Figure 1: Composites Index portraying the current general business situation

Composites Germany (Berlin, Germany), a trade association with an aim to strengthen the German composite industry, particularly in the field of research, has made the results of its 15th Composites Market Survey available and identified the latest key performance indicators (KPIs) for the fiber-reinforced plastics market.

The survey also covers all the member companies of the three major umbrella organizations of Composites Germany including the Industrievereinigung Verstärkte Kunststoffe (AVK; Frankfurt, Germany), Leichtbau Baden-Württemberg (Stuttgart, Germany) and the VDMA Working Group (Frankfurt, Germany) on hybrid lightweight construction technologies. As before, to ensure a smooth comparison with the previous surveys, the organization notes that the questions in this half-yearly survey have been left unchanged and that the data obtained in the survey was largely qualitative and related to current and future market developments. It should also be noted that, while the current business situation is negative, the survey outlook is generally positive.

Negative rating of current business situation

Following the rather cautious rating of the prevailing business situation in the last survey earlier this year, the most recent survey is now continuing this trend. Partly due to the current impact of the coronavirus pandemic on numerous business segments and areas of application, many companies are facing negative circumstances. The general economic situation has been deteriorating further in recent weeks and months, and this is reflected in the negative ratings given by respondents. Ratings have reached the lowest figures since the surveys were started in January 2013 (see Fig.1).

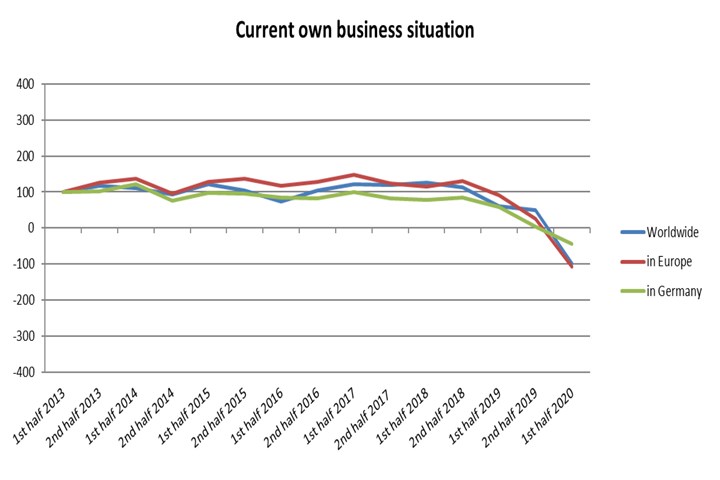

However, not only did companies give rather unfavorable assessments of the general business situation, Composites Germany says they also continued to be pessimistic about their own situations (see Fig. 2).

Figure 2: Composites Index portraying own current business situation

Although the tense situation is beginning to relax, e.g. in the automotive industry, and although the crisis has not yet taken full effect in other sectors, e.g. construction, many companies are nevertheless full of uncertainty. There has been a variety of opportunities and measures to stimulate industry and the economy in general, but it seems that they have not yet had the desired positive economic impact.

Variety of developments expected in the future

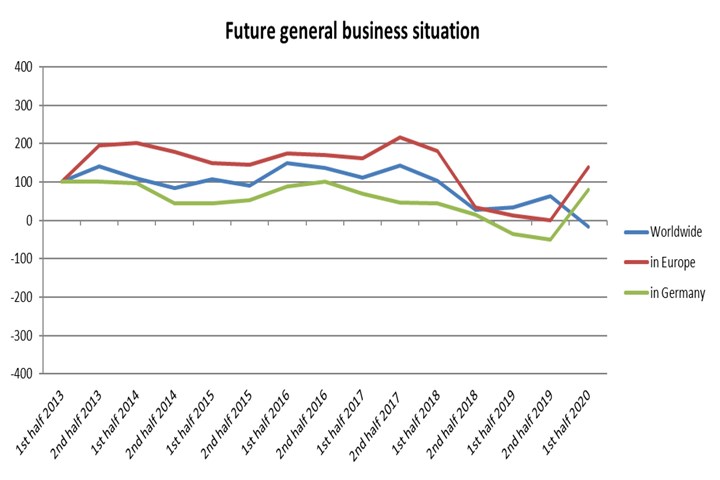

When asked about their expectations for future business developments, respondents give quite contrasting answers. While they are expecting to see an improvement in the

general economic situation, both in Europe and worldwide, they are still pessimistic about the outlook for Germany (see Fig. 3), and also with regard to their own business situation in the future.

Figure 3: Assessment of general business situation in the future

Varied expectations for application industries

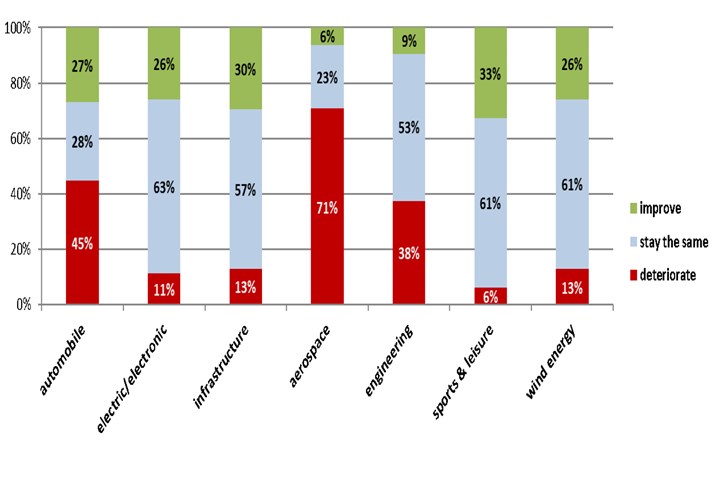

Like expectations for the development of the business situation, expectations for selected areas of application have also turned out to be extremely diverse.

The automotive and aviation industries are the main areas where respondents are expecting to see a deterioration in the market environment. However, other sectors, such as sports and leisure and infrastructure/construction, are expected to develop far more positively (see Fig. 4).

Figure 4: Assessment of the development of selected areas of application

Growth drivers developing at different rates

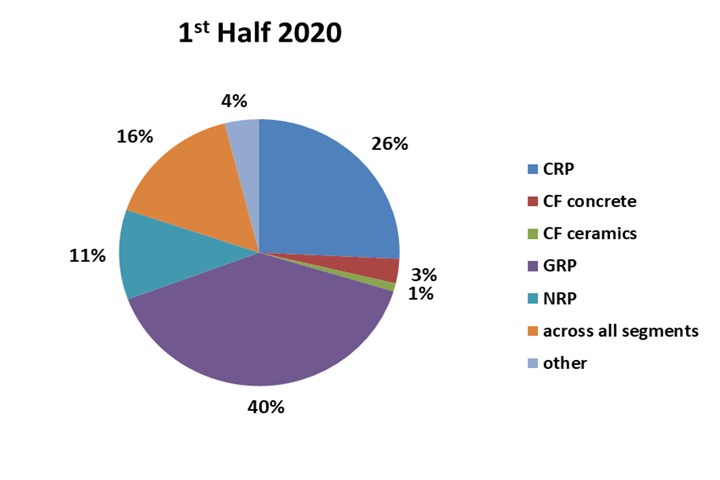

While, as in the last surveys, growth stimuli for the composites segment can mainly be expected to come from Germany, Europe and Asia as global regions, we can observe a paradigmatic shift with regard to materials.

Whereas, in the first 13 surveys, respondents always believed that the composites segment would receive its prevailing growth stimuli from carbon fiber-reinforced plastics (CRP) as a material, the current survey is now the second one where respondents have mentioned glass fiber-reinforced plastics (GRP) as the most important material (see Fig. 4). Considering the number of times it is mentioned, this trend is in fact increasing.

Figure 5: Materials that are growth drivers

Composites Index continues to decline

The current situation has created major uncertainty, not only in the composites sector. The mood in companies continues to be negative. This is partly due to production losses and a sharp decline in both investment and consumer confidence caused by the coronavirus pandemic, and partly also due to political uncertainties and squabbles about economic policies. Many of the measures that have been taken still seem to be insufficient to create a positive environment. Although expectations of the future business situation are generally becoming more positive, this is not yet leading to a more positive assessment of the companies’ own positions in the market. Following these assessments, the Composites Development Index is therefore continuing to fall, sometimes significantly (see Fig. 6).

It remains to be seen how the economy will develop in the rest of the year, especially in the autumn. Over the last few years there has been success in establishing composites in many new areas of application, thus achieving an almost consistently positive development. Composites therefore remain important materials for the future, not least because of their positive and diverse qualities, so that they will continue to find their way into industry, despite the current crisis.

Figure 6: Composites Development Index

The next Composites Market Survey will be published in February 2021.

Read Next

TPI Composites announces second quarter 2020 earnings results

Returning to pre-COVID capacity levels, the company has extended two supply agreements and added production lines, adding approximately $800 million of potential contract value.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More