Will carbon fiber be ready to join the 54.5-mpg battle?

Guest columnists Lindsay Brooke, senior editor of the Society of Automotive Engineers’ (SAE) Automotive Engineering International magazine, says Carbon fiber’s decades-long promise in automotive composites might, indeed, be realized.

If ever there was cause for bold thinking in light-duty vehicles engineering and construction, it’s the latest round of U.S. Corporate Average Fuel Economy (CAFE) regulations. And with the new CAFE, the opportunity has arrived, finally, for carbon fiber to break into mainstream use. But will the strong, lightweight material and the processes needed to make it cost-competitive be ready?

CAFE calls for a 99 percent improvement, a corporate average of 54.5 mpg, in each automaker’s fleet fuel efficiency through 2025, compared with 2011. For an industry that prides itself on squeezing single-digit efficiency gains from its products, a leap like this in less than four product cycles will take a Herculean effort. The daunting task will be toughest for those full-line automakers with larger pickups and SUVs, the most frugal of which currently eke out 25 mpg on the highway.

As CT readers know, vehicle mass reduction is one of the strategic pillars in the drive to 54.5. Product planners want to reduce vehicle curb weights by as much as 750 lb/340 kg, without sacrificing the size and functionality customers love — and without raising cost significantly. It’s a tricky proposition. It will require new materials and new processing solutions, some of which already are appearing on the technology road maps of those full-line auto OEMs.

For the materials industries, the new CAFE regulations are heating up competition like it’s the 1980s again. Back then, the plastics industry was mustering an all-out blitz on steel’s dominance. Plastic-bodied concepts headlined auto shows. Plastic fenders and liftgates were replacing their steel counterparts on production cars. And GM was launching plastic-bodied spaceframe architectures for the Pontiac Fiero, the U-body “dustbuster” minivans and the multibillion-dollar Saturn program.

The plastics industry pushed hard and gained market share while it scrambled to resolve quality issues related to the thermal-expansion coefficients of some materials. But as hard as plastics pushed, steel responded to the threat by rolling up its sleeves and pushing back harder. Instead of allowing themselves to be swept under the tsunami of PC/ABS, MPPE/PA and SMC, the steelmakers innovated. They revamped manufacturing processes and brought new and lighter alloys to production. Most importantly, they worked with their customers on holistic, cost-saving processes.

It was a call to arms that became a case study in how an industry sector can respond successfully to a competitive challenge. As we march toward 2017-2025 CAFE, it appears the aluminum industry will challenge steel as the primary material for automotive body structures and exterior panels. The boldest example is Ford’s decision to switch its breadwinning F-Series pickups to an aluminum-intensive body and cargo box in 2015.

It will be a costly and somewhat risky move. But what other available material can enable significant mass to be shed yet meet the manufacturability, crashworthiness, repairability, long-term durability, cost, recyclability and part-per-minute throughput requirements of a mainstream vehicle program?

This is where I would cue the drumroll and trumpet fanfare for carbon fiber and advanced composites … but the band isn’t yet ready to sound those tones. When will it be, then? Recent progress has made me cautiously optimistic that carbon fiber’s decades-long promise to move beyond specialty applications may, indeed, be realized in time to help OEMs meet CAFE 2025.

My view comes from what’s happening on the front lines of carbon fiber development. The collective work is aimed at dramatically scaling up the capability to serve automotive volumes with robust products, improved process technologies and lower materials cost.

At their joint-venture plant in Moses Lake, Wash., BMW and SGL have placed a $100 million bet that carbon-fiber-intensive vehicle structures, initially for BMW’s 2014 i3, are indeed ready for prime time. (The facility and its managers made a quite positive impression on me during a recent visit.) In Walker, Mich., Plasan Carbon Composites’ new 200,000-ft2/18,580m2 facility has begun midvolume (40,000 to 50,000 units per year) production of the carbon composite hood and roof for the 2014 Corvette Stingray, using a new process technology that dramatically reduces machine and curing cycle times.

And at the U.S. Department of Energy’s Oak Ridge National Laboratory (Knoxville, Tenn.), a leader in carbon fiber R&D in the U.S. for years, there are ongoing and promising projects to develop low-cost precursors based on kraft lignin (a by-product of papermaking); to use commodity-grade polyacrilonitrile (PAN) as a precursor; to reduce precursor conversion costs using microwave energy-generated plasmas; and to slash equipment costs and precursor oxidation time.

The expanding list of precompetitive industry collaborations is encouraging, to say the least. Indeed, it’s getting easier to count the global OEMs who aren’t working together on carbon fiber projects. Besides BMW and SGL, Toray is working with Toyota, Fuji Heavy Industries, and Daimler while its major Japanese competitor, Teijin, has a venture with General Motors. Ford and DowAksa are partners. Audi is working with Voith, the third-largest shareholder in SGL, of which VW owns a minor share. There’s even a deal between Lamborghini, Quantum Composites and Callaway Golf.

Perhaps more remarkable, there’s CALM, the Coalition of Automotive Lightweighting Materials at the Center for Automotive Research in Ann Arbor, Mich. Formed last year with support from the American Chemistry Council (Washington, D.C.) and the Aluminum Association’s Aluminum Transportation Group (Arlington, Va.), CALM combines the strengths of the aluminum and composites/plastics industries with technology providers in design, fabrication and joining. Their collective goal is to support OEM efforts to reduce vehicle weight.

Whenever I air the words “carbon fiber” among industry engineers, the high cost of the raw material gets the greatest play. It’s difficult to talk about carbon fiber’s many attributes when its average price is $12/lb, compared to about $2.50/lb for aluminum and about $1/lb for typical high-strength steels. But industry leaders tell me that solutions for narrowing that big gap are coming at a faster rate.

“Our goal is to match the cost of aluminum,” said Dr. Joerg Pohlman, SGL Automotive’s managing director, during my visit to Moses Lake. “We’re not yet there, but we foresee the day in the next few years where we can match aluminum’s cost in a full-vehicle body structure.”

If Pohlman’s vision is realized, carbon fiber could play much more than a minor role in the CAFE battle.

Related Content

National Composites announces partners with compression toolmaker Laval

The new alliance will broaden National Composites’ capabilities in SMC and BMC and tooling, while providing customers with comprehensive solutions, from initial design to final delivery.

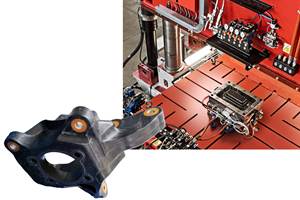

Read MoreA digital twin to validate SMC performance in suspension structures

High-fidelity, anisotropic behavior material card, integrated with process simulation, structural FEA and validated with CT and physical tests enables optimization proven in award-winning SMC suspension knuckle.

Read MoreComposite resins price change report

CW’s running summary of resin price change announcements from major material suppliers that serve the composites manufacturing industry.

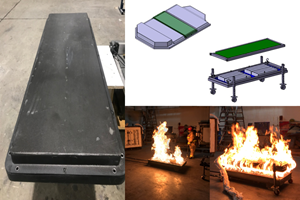

Read MorePrice, performance, protection: EV battery enclosures, Part 1

Composite technologies are growing in use as suppliers continue efforts to meet more demanding requirements for EV battery enclosures.

Read MoreRead Next

CW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More

.jpg;maxWidth=300;quality=90)