Selling your business, Part 2: Finding the right buyer, closing the deal

In Part 2 of this two-part series, author Adrian Williams, co-founder and managing director of Future Materials Group (Cambridge, UK), consider the final three steps in a five-step process for owners and shareholders looking to sell their businesses.

In Part 1 of this two-part series, we highlighted why the composites industry is attractive to certain investor groups and discussed the first two steps in our five-step process for owners and shareholders looking to sell their business: 1) Effective positioning and presentation to those groups; and 2) Intelligent research about those groups. Understanding your firm’s fit with these targets is the key to achieving the right sale, and the right deal, for both parties (see “Selling your business, Part 1: The best price with the best deal,” under "Editor's Picks," at top right). In this installment, we will consider the final three steps in the process.

3. Identify, select, and approach the right buyers

What are your prospective buyers looking for? Like any sale, researching the purchaser’s financial and operational needs and goals, and ensuring your value proposition, saves time and money. Look at the value of your business from every angle, and don’t just focus on your good points. As a player in the high-growth, technology-driven composites sector, your strong emerging market position is more valuable to a traditional trade buyer, eager to enter new sectors that its advisors have pinpointed as strategic areas of operation, than to one of your high-tech competitors. Your over-stretched local manufacturing operations may mark down your price to a new market entrant but increase your value to a buyer with under-utilized overseas plants. Quite rightly, small-to-medium enterprises (SMEs) in composites concentrate on building customers and products, with operations following demand. Investors with strong finances and well-founded strategies will seek to leverage their expertise and assets to make improvements. Your high cost base may worry you, but it could be an easy-to-fix opportunity for a private equity investor that is adept at efficiencies.

Find the best fit. Finding the best new owner for your business is not all about plugging into an advisor’s network and playing the field. In our experience, the best value for both parties is achieved by understanding that every business has a very different worth to each potential owner, based on the strategy each has adopted. Target buyers whose future needs fit with your business and are potentially the best owners. Most trade buyers and, certainly, private equity firms, clearly articulate why they are buying and what criteria they use. It may take work to determine the price they place on each criterion, but that’s a job for you and your advisors.

4. Create and manage a competitive process

Hired hands or DIY? Take a look at your senior team: Are the competencies needed for marketing and selling your firm in place? Management time is at a premium. Taking your eye off the ball, either while running the business or making progress toward the sale, often results in nasty surprises in the form of lower-than-expected sales and profits, increased operational costs or incomplete or inaccurate information offered to buyers for due diligence. This might not derail the deal but can result in significant late-stage price reductions and aggressive negotiations. So, finding and hiring a dedicated external team to do the deal can be a sensible policy. But a large, experienced, advisory team can be cost-prohibitive for many SMEs.

So what to do? Our advice is that for most SMEs, a good intermediary — a corporate finance or boutique investment bank — with an understanding of the sector complemented by an experienced legal advisor will be affordable and avoid compromise. But ensure that the bank and/or advisor do not hand off the engagement to less experienced juniors once their senior teams have impressed you.

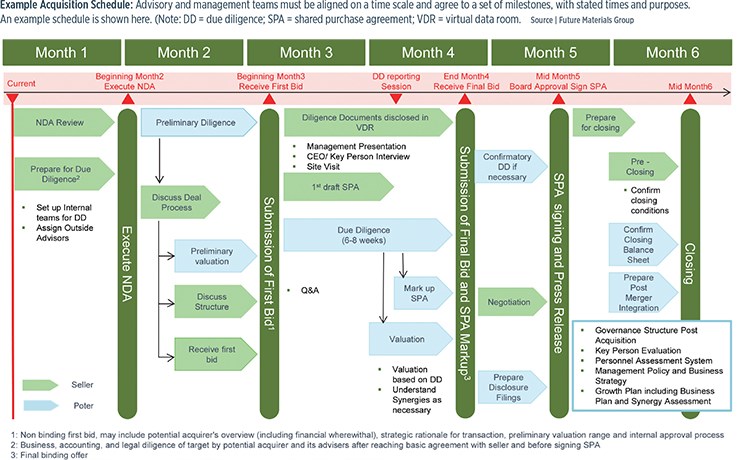

Control costs from the start. External and internal costs may rack up, especially when the chase is on and buyers are in sight. Avoid overspending by setting a budget. A good rule of thumb is 10% of the likely deal quantum. Then set a realistic timeframe. Six to nine months keeps the work fresh and attractive, and avoids any feeling that preparing for a sale is a chore. Your advisory and management teams must be aligned on the timescale and agree to a set of milestones (see the “Example Acquisition Schedule,” p. 6).

Preparing for the process. This will be the biggest single sale you’ve ever made, and often with only one final buyer in the frame. It must be done professionally: Accurately address the buyer’s known needs, answer all questions (including the awkward ones), and overcome objections. Prepare marketing collateral, including management presentations and more. You’ll also need to set up a data room — a central repository of financial, operational and marketing information, updated regularly, and the place where due diligence communication takes place, enabling easy monitoring and responses to queries. This space should be secure, shared only by the core buy-side and sell-side teams, and managed by a senior member of your team.

You’ll need to free up senior management time for planning, preparation, presentations and meetings. This extends to ensuring team availability during due diligence to quickly and accurately answer all the questions that will be thrown at you. You must be keen and able to engage your new investors, supported by the team, with high-quality marketing, sales, operations and financial data.

5. Avoid legal, regulatory and tax pitfalls

Back your sales offer with evidence. Effective due-diligence gives the potential buyer’s team confidence that they are purchasing exactly what you are presenting. Agree upfront on the due-diligence timeframe, process and the elements critical to the buyer. As you move on, ensure that the day-to-day due diligence is well-managed whilst, together with your advisors and legal team, you focus on the deal terms and conditions as well as the negotiations.

Trade buyers looking for strategic acquisitions, or trade buyers seeking to enter new and (to them) unfamiliar markets by buying your firm, have complex, cumbersome decision-making processes that might not suit your timescale and could tie up inordinate amounts of your scarce time. Consequently, coordinating these buyers in a drawn-out process is challenging, so aim for an efficient and quick solution. An auction, with an agreed date and duration for bids, has the merit of giving all parties confidence that a fair price has been obtained. If a single buyer emerges early with an offer that you believe is fair, meets your selling criteria and can close on time, then you could go with that on an exclusive basis.

Everyone, buy-side and sell-side, benefits when a transparent, short and limited time is allocated to receiving, evaluating, negotiating and accepting/rejecting offers. Costs are kept down, the less serious buyers are filtered out, and opportunities for gaming the process are reduced.

Finally, divestiture is costly not only financially, but also emotionally. You and your team might be asked to stay on and deliver to new targets under service agreements that ratchet more money for you. Or you may be required to pass the baton to new management, possibly a previous competitor. Consider whether from now on you are the best owner of your firm, in whole or in part. Can you achieve, with your team and your existing funding, the scale and innovation for world-class operations? Can you fend off competition on more fronts than ever before? Are you confident about sustainability and growth, or is change crucial? The answers to these and other questions are integral to your company’s survival. They should be reflected in your strategy and then filter down to your tactical operations.

And now ... it’s time to make that sale.

Related Content

Bio-based acrylonitrile for carbon fiber manufacture

The quest for a sustainable source of acrylonitrile for carbon fiber manufacture has made the leap from the lab to the market.

Read MorePlant tour: Middle River Aerostructure Systems, Baltimore, Md., U.S.

The historic Martin Aircraft factory is advancing digitized automation for more sustainable production of composite aerostructures.

Read MoreASCEND program update: Designing next-gen, high-rate auto and aerospace composites

GKN Aerospace, McLaren Automotive and U.K.-based partners share goals and progress aiming at high-rate, Industry 4.0-enabled, sustainable materials and processes.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreRead Next

Selling your business, Part 1: The best price with the best deal

Adrian Williams, co-founder and managing director of Future Materials Group (Cambridge, UK), begins a two-part advisory for owners of composites manufacturing businesses interested in placing their companies on the market.

Read MoreSelling your business, Part 1: The best price with the best deal

Adrian Williams, co-founder and managing director of Future Materials Group (Cambridge, UK), begins a two-part advisory for owners of composites manufacturing businesses interested in placing their companies on the market.

Read MoreSelling your business, Part 1: The best price with the best deal

Adrian Williams, co-founder and managing director of Future Materials Group (Cambridge, UK), begins a two-part advisory for owners of composites manufacturing businesses interested in placing their companies on the market.

Read More

.jpg;maxWidth=300;quality=90)