November 2006 Editorial

I just got back from the Pira-Intertech Carbon Fiber Conference in Budapest. Since six of the seven major carbon fiber producers have announced capacity expansions, the expert consensus at the conference was that carbon fiber capacity is slated to grow around 8 percent annually – somewhat less than the 10 percent

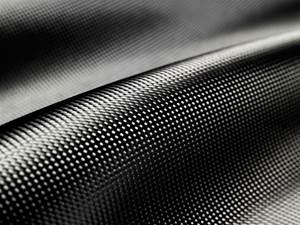

I just got back from the Pira-Intertech Carbon Fiber Conference in Budapest. Since six of the seven major carbon fiber producers have announced capacity expansions, the expert consensus at the conference was that carbon fiber capacity is slated to grow around 8 percent annually – somewhat less than the 10 percent increase in demand projected through 2008. Because it will take some time to bring all the new capacity on line, supply won't catch up with demand until 2009 or 2010. Even then, the high cost of oil-derived PAN precursor and the energy it takes to carbonize it will keep prices from falling much, but prices aren't expected to spike either, which is good news for industrial end-users. (For more thorough coverage of the carbon fiber situation, see the January 2007 issue, which will include input from the Carbon Fiber panel discussion at SAMPE Tech in Dallas.)

Commercial aerospace is considered a major driver of the capacity expansions: Each Boeing 787, for example, will use about 165,000 lb of carbon fiber composites; each Airbus A380 will use about 65,000 lb. It appears, at first glance, that Airbus' additional year's delay of the A380 could lend some flexibility to the carbon fiber supply. But since the A380's production problems are in the electrical system, it's also possible that composite part production could go forward as scheduled, and our supply might not be affected by the delay.

The as-yet-unannounced plans for Airbus' A350 XWB will certainly add to carbon fiber demand, but the aircraft isn't expected to go into production until 2012, which gives producers plenty of time to ramp up. Although Airbus has made no official commitment as yet, it is expected to switch from the metal fuselage design on the original A350 to a composite fuselage on the A350 XWB to match benefits offered by the 787 – an ironic turn of events, considering that earlier this year, Airbus pronounced a composite fuselage "too risky."I'm assuming they meant from a production perspective. While Boeing is tape laying the 787 fuselage barrel in several large sections, rumor has it that Airbus will choose composite panels to build the A350 fuselage.

As an insurance policy against the kind of crippling delays Airbus is suffering, Boeing just announced another big increase in its R&D budget, bringing the total devoted to the 787 to more than $600 million for this year. Although delays are more the rule than the exception when introducing a new aircraft, Boeing has a lot riding on the 787, figuratively and literally – the company chose the number "8"in 787, in part, because in China it means good luck and it's the year, 2008, when Beijing hosts Olympic Games. Boeing has promised to deliver at least one new plane to each of its six Chinese airline launch partners in time for the Games.

The Far East, of course, is everyone's promised land these days; the question is how close to the vest one plays one's cards. In an October mission to China, French President Jacques Chirac announced a new Airbus contract with the Chinese government for 170 aircraft, valued at nearly $10 billion. Many of these planes will be assembled in the just-announced Airbus A320 assembly plant in Taijin, China. Airbus says that this plant will not manufacture parts and, therefore, will not involve the transfer of closely held technology. Meanwhile, Boeing continues to limit its decades-long commercial involvement with China to aircraft maintenance and repair. Since the Chinese government's public commitment to the development of high-tech, high-value industries includes the establishment of a commercial aircraft industry, some observers question whether Airbus is taking unnecessary risks. All of this brings to mind the McDonnell Douglas failed Chinese venture in the early 1990s.

We all know globalization is inevitable, and the far East is undeniably attractive. The challenge is how best to build and sell cutting-edge technologies in emerging markets, yet protect intellectual property. It's a classic double-edged sword.

Related Content

Cryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreMaterials & Processes: Fabrication methods

There are numerous methods for fabricating composite components. Selection of a method for a particular part, therefore, will depend on the materials, the part design and end-use or application. Here's a guide to selection.

Read MoreMaterials & Processes: Composites fibers and resins

Compared to legacy materials like steel, aluminum, iron and titanium, composites are still coming of age, and only just now are being better understood by design and manufacturing engineers. However, composites’ physical properties — combined with unbeatable light weight — make them undeniably attractive.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreRead Next

CW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More

.jpg;maxWidth=300;quality=90)