Gardner Business Index at 50.8 in February

New orders, production and future business expectations go up as small- and medium-sized fabricators see welcome expansion.

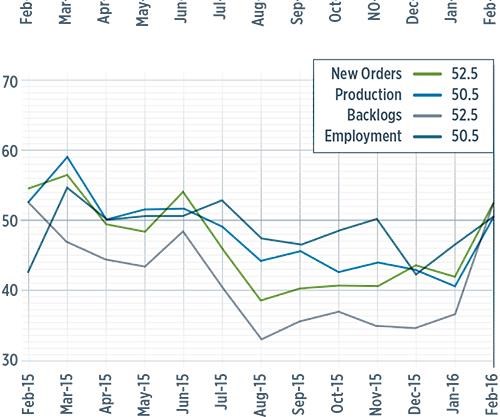

With a reading of 50.8, the Gardner Business Index for February of this year showed that the US composites industry had expanded for the first time since June 2015. The index jumped substantially from its level of 43.4 in January. Also, the index reached its highest level since March 2015.

New orders and production increased for the first time since June. Although both subindices increased a similar amount in February, new orders generally had increased more than production in the recently preceding months. As a result of those increases, the backlog subindex expanded for the first time since December 2014 and reached its highest level since May 2014, increasing to 52.5 in February from 37.1 the previous month. The rate of contraction in February, therefore, had slowed somewhat since August. The employment index increased for the second time in four months. Exports continued to contract because of the strength of the US dollar. However, the rate of contraction has slowed somewhat in recent months. Supplier deliveries length- ened for the second month in a row.

Materials prices increased for the first time since November 2015. But, that subindex remained, in February, at a historically low level. Prices received decreased for the fifth month in a row, but the rate of decrease was notably slower in February. The future business expectations subindex improved significantly from January but still appeared to be in a downward trend that had begun in early 2015.

Composites manufacturing plants of all sizes except those with more than 250 employees expanded during February. The largest plants (250+ employees), however, contracted for a third month in a row. Plants with 100-249 employees expanded for the fourth time in five months, although the rate of expansion slowed in both January and February. Companies with 20-49 and 50-99 employees both grew in February for the first time since June 2015. Composites fabricators with fewer than 20 employees grew for the first time since February 2015.

After contracting the previous two months, the aerospace composites sector expanded once again in February. It had expanded, by month’s end, for three of the preceding five months. Although the aerospace industry has performed well for composites fabricators recently, the general aerospace index, in February, had contracted five of the past six months. For composite fabricators that serve automakers, the index, by the end of February, had contracted four months in a row. This mirrored the overall trend for the automotive industry.

Future capital spending plans remained relatively weak. They were about 33% below their historical average. And, compared with one year ago, spending plans in February were down 44.1%. That was the second fastest rate of contraction since July 2015.

Related Content

-

Prefabricated composite panels, joining system ease catamaran construction

New Zealand-based G&T Marine reduces assembly and construction time with ATL Composites’ composite DuFLEX panels.

-

Modernizing the mechanical rotor sail

Composites are key for Norsepower’s award-winning redesign of a century-old rotor sail for reducing carbon emissions on passenger and cargo ships.

-

Large-format 3D printing enables toolless, rapid production for AUVs

Dive Technologies started by 3D printing prototypes of its composite autonomous underwater vehicles, but AM became the solution for customizable, toolless production.

.JPG;width=70;height=70;mode=crop)