From the Publisher - 3/1/2008

I just attended COMPOSITESWORLD’s first Composites Industry Financial Forum (CIF) in New York City, where composites industry, M&A and banking specialists and a Merrill Lynch analyst — in a show of notable accord — agreed that we will see unprecedented opportunities for growth in the use of composites during the

I just attended COMPOSITESWORLD’s first Composites Industry Financial Forum (CIF) in New York City, where composites industry, M&A and banking specialists and a Merrill Lynch analyst — in a show of notable accord — agreed that we will see unprecedented opportunities for growth in the use of composites during the next decade. Aerospace, of course, is setting the pace with net orders for 2,764 commercial aircraft in 2007, many coming from growing Asian markets. American air carriers haven’t even weighed in yet, but as they become more profitable (which they are) and their fleets age, they will want newer, more efficient, lower-maintenance, double-aisle aircraft.

Trevor Bohn from RSM Equico Capital Markets (Costs Mesa, Calif.) pointed out that acceptance of composite materials is fueling M&A activity, and he asserted that projects that require from $50 million to as much as $150 million will find funding, despite the tight credit market. A strong case was made for continuous growth in the next 20 years: After the Boeing 787 and forthcoming Airbus A350, all future aircraft will use increasing amounts of structural composites — not only large passenger planes but also regional/business jets and general aviation aircraft as well as jet engines, said Chris Red, an HPC contributing writer and VP of Market Research for Composites Market Reports (Scottsdale, Ariz.). Meanwhile, high fuel costs and demand for greener, more efficient engines will require replacement of workhorse single-aisle planes — Boeing’s 737 and the Airbus A320 — for which new designs will be ready around 2015-2017. Kevin Michaels (Aerostrategy, Ann Arbor, Mich.) valued airframe production in all markets (including engines and MRO services) at around $125 billion in 2006 and predicted that figure will double by 2026.

Brian C. Yerger, research analyst at Jesup and Lamont Capital Markets (New York, N.Y.), estimated that by 2010, revenue directly related to alternative energy applications, such as wind turbine blades and pressurized natural gas and hydrogen fuel tanks, will be $1.08 billion for carbon fiber at $16/lb and $1.45 billion for fiberglass at $3/lb. He emphasized that usage will not be cyclical and that the market for investment will become increasingly favorable as governments and their citizens up their demand for cleaner energy.

Len Poveromo of Northrop Grumman (Beth Page, N.Y.) discussed lessons learned on the U.S. Navy’s Zumwalt-class DDG 1000 destroyer, for which Bath Iron Works has received a $1.4 billion construction contract. Although they are extensively used in boatbuilding elsewhere, composites have been a long time coming to Navy vessels. However, Poveromo says they are finally earning their way on board in the antenna (the large deckhouse structure) on the DDG at nearly a million lb per copy, and he says the Navy is considering them for the antennae on the next generation CVN-X aircraft carrier.

In the midst of these opportunities, however, CIF speakers noted challenges. The consensus is that fiber supply is growing rapidly to meet demand, but parts manufacturers will need to add capacity and automate to produce the expected high volumes. Ed Carson, COO of HITCO Carbon Composites (Gardena, Calif.), explained how his company’s in-depth analysis of market trends convinced it that investing in automation was a necessary strategy (see this issue’s feature on HITCO’s transformation by clicking on “Automate or Emigrate,” in Related Content, at left). And Jim Mondo, president of Automated Dynamics (Schenectady, N.Y.) provided very practical advice about some affordable automated machinery options and strategies.

Paul Pendorf, president of AMT ll Corp. (Los Angeles, Calif.), emphasized that it is always difficult for a new material to gain acceptance. “The benefits of composites substitution for metal are not intuitively obvious to the layman,” he noted, nor are they clear to busy investment bankers, analysts, brokers or congressmen. His advice? Don’t over explain: what we’re about is metal replacement.

CIF facilitated a valuable exchange between companies who are bringing our exceptional technologies to market and the companies who will help us raise the money to make it happen. I hope to see you there next year.

Related Content

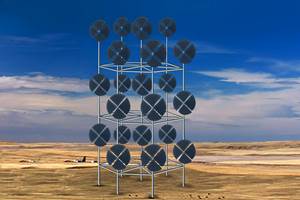

Drag-based wind turbine design for higher energy capture

Claiming significantly higher power generation capacity than traditional blades, Xenecore aims to scale up its current monocoque, fan-shaped wind blades, made via compression molded carbon fiber/epoxy with I-beam ribs and microsphere structural foam.

Read MoreJEC World 2022, Part 3: Emphasizing emerging markets, thermoplastics and carbon fiber

CW editor-in-chief Jeff Sloan identifies companies exhibiting at JEC World 2022 that are advancing both materials and technologies for the growing AAM, hydrogen, automotive and sustainability markets.

Read MoreForvia brand Faurecia exhibits XL CGH2 tank, cryogenic LH2 storage solution for heavy-duty trucks

Part of its full hydrogen solutions portfolio at IAA Transportation 2022, Faurecia also highlighted sustainable thermoplastic tanks and smart tanks for better safety via structural integrity monitoring.

Read MoreMoving toward next-generation wind blade recycling

Suppliers, fabricators and OEMs across the composite wind blade supply chain ramp up existing technologies, develop better reclamation methods and design more recyclable wind blades.

Read MoreRead Next

CW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More

.jpg;maxWidth=300;quality=90)