Evolving For Future Growth

Alex Gutierrez is the founder and president of Agata LLC (Dallas, Texas), an international business development and marketing firm focused on composite materials. For more information, visit the Agata Web site: www.agatadev.com While walking the aisles at a recent industry trade show, I talked to a random selection

While walking the aisles at a recent industry trade show, I talked to a random selection of composites executives about their business challenges. As if their responses were coordinated, their answers centered around two common themes: how fast things are changing and how their biggest challenge is long-term growth.

A common phrase was, "Just two years ago...," referring to the breakneck speed of change. The reality of competing not just regionally or nationally, but internationally, and doing so through the Internet, was only a theoretical possibility just a few years ago. But market dynamics have been transformed drastically by globalization, the consequences of which have been increased competitive pressures as composites manufacturers gain access to low-cost labor and implement new and enhanced material systems and more efficient molding processes. The result is a high-velocity environment, in which composites companies have been forced to look beyond their current product offerings and diversify -- often into untapped markets and new applications -- to continue to grow successfully.

Faced with these unprecedented challenges, we have to answer the classic question, Is our glass half empty or half full? High energy prices are producing short-term challenges, but they also are simultaneously accelerating demand for weight-reduction solutions, particularly in transportation markets dependent on oil for fuel. The American Society of Materials reports that a 10 percent weight reduction in a road vehicle can yield a 7 percent gain in fuel efficiency. The need to increase fuel economy has already stimulated large-scale use of composites in commercial aviation (e.g., the Boeing 787 and the Airbus A380) and this trend will spread to ground transport, in cars, trucks, buses and rail cars. Rising oil prices have driven up resin costs, but prices of competitive materials, steel in particular, have gone up as well. We could choose to see great opportunities ahead!

I believe our greatest challenge is how to prepare our industry and our individual companies to take advantage of these opportunities. While a number of associations and societies have made efforts to gain marketshare in the overall materials sector, much more could be done to gain on traditional materials. We must prepare our individual composites manufacturing organizations for a necessary evolution in the way we do business. The following are some proposed action items to get you thinking:

Regularly revisit your business strategy. As the movement of capital, information and technology continue to accelerate, so will the rate of change. Strategy formulation must become an ongoing, dynamic process. Set aside time to gather your management team and focus on strategy. Revisit the strategy you develop every six months, and have a formal annual review.

Look at the bigger picture. Understand who your competitors are and how they are positioned. In addition to your direct competitors (those who make products like yours, using similar materials and processes), understand the indirect threats to future success: Sources of cheaper labor, less expensive tooling technology, faster molding processes and better materials that new or existing competitors may mine to erode your marketshare. Evaluate your existing and potential competitors by performing a strength and weakness evaluation on each.

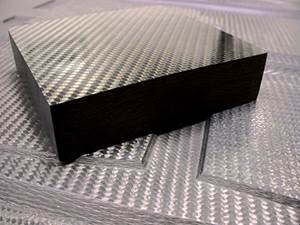

Establish standard materials and processes. Composites companies tend to sell their design flexibility and offer customers many possible combinations of materials and processes. While this "jack of all trades" approach has been useful in initial applications development, future markets and customers will expect you to be a solutions provider. When you seek new business, understand your target customers, come to them with a clearly defined solution (specific materials and one process) that will meet their specifications -- and be prepared to quantify the benefit to them.

Collaborate when appropriate. Both the steel and the aluminum industry are doing it (e.g., www.autoaluminum.org, www.steel.org) yet composites manufacturers have been very reluctant to collaborate technically to foster growth. Consider combining resources with companies that manufacture complementary products, if not your direct competitors, to fund development of material databases and/or educate potential customers in target applications.

Invest in expertise. We have all heard how "the people make the company," but few act on it. Make it personal! Hire the best talent available, educate your workforce, and give them the authority and the tools they need do their jobs.

Related Content

Materials & Processes: Resin matrices for composites

The matrix binds the fiber reinforcement, gives the composite component its shape and determines its surface quality. A composite matrix may be a polymer, ceramic, metal or carbon. Here’s a guide to selection.

Read MoreMaterials & Processes: Fabrication methods

There are numerous methods for fabricating composite components. Selection of a method for a particular part, therefore, will depend on the materials, the part design and end-use or application. Here's a guide to selection.

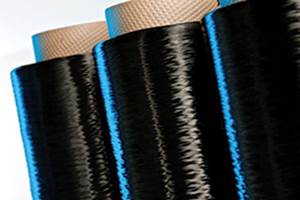

Read MoreMaterials & Processes: Fibers for composites

The structural properties of composite materials are derived primarily from the fiber reinforcement. Fiber types, their manufacture, their uses and the end-market applications in which they find most use are described.

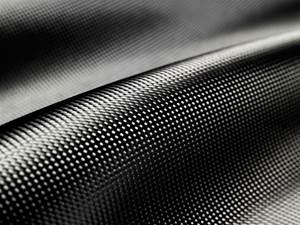

Read MoreMaterials & Processes: Composites fibers and resins

Compared to legacy materials like steel, aluminum, iron and titanium, composites are still coming of age, and only just now are being better understood by design and manufacturing engineers. However, composites’ physical properties — combined with unbeatable light weight — make them undeniably attractive.

Read MoreRead Next

From the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;maxWidth=300;quality=90)