CNTs ride a rising tide of nanotech optimism

Dr. Louis Pilato offers facts, figures and comment on the growing utility of carbon nanotechnologies in composites applications.

Nanotechnology continues to enjoy high global visibility as well as considerable governmental, industrial and private investment. The field is gaining acceptance as a promising chemical “toolbox” in a variety of market areas. In 2008, nanotechnology investment exceeded $15 billion (USD) with 28 percent of that amount spent in the U.S., followed by 25 percent in Western Europe, 20 percent in Japan and 23 percent in the rest of the world. Since the U.S. government established the National Nanotechnology Initiative in 2001, more than $8 billion in federal funds have been disbursed for nanotech R&D.

Among the many nanomaterials now available are several that have carbon content: the carbon nanotube (CNT), the carbon nanofiber (CNF) and the graphene platelet. CNTs are tubular structures formed from carbon atoms bonded together in a honeycomb lattice that resembles chicken wire. They come in two forms, defined by the number of tube walls. Single-wall carbon nanotubes (SWCNTs) are single tubes with a diameter of 1 nanometer (nm). Multi-wall carbon nanotubes (MWCNT) are made up of several (5 to 15) concentric tubes. This “tubes-within-tubes” arrangement typically has a diameter of about 20 nm.

Carbon nanofibers, by contrast, feature a “stacked cup” fiber configuration, with a diameter varying between 70 and 200 nm and a length of 50 to 100 μm.

Graphene, a “newcomer” discovered in 2004 by Prof. Andre Geim of the University of Manchester (Manchester, U.K.), is in the early stages of commercialization. Like CNTs, graphene has an atomic-scale lattice structure, but in the form of flat, one-atom thick planar sheets. Its availability from an environmentally benign source suggests low cost and high production rates. Furthermore, it is easily dispersed, allowing for high loadings.

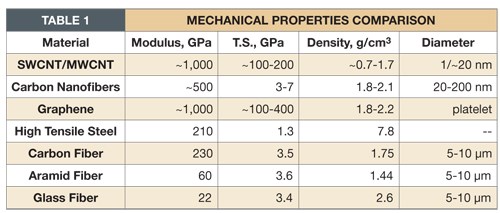

Table 1 compares these materials with conventional fibers and steel. Clearly, these carbon-containing materials have unusually high strength-to-weight ratios and extraordinary electrical properties.

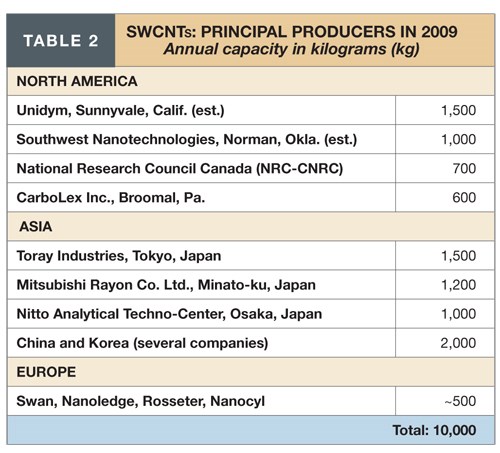

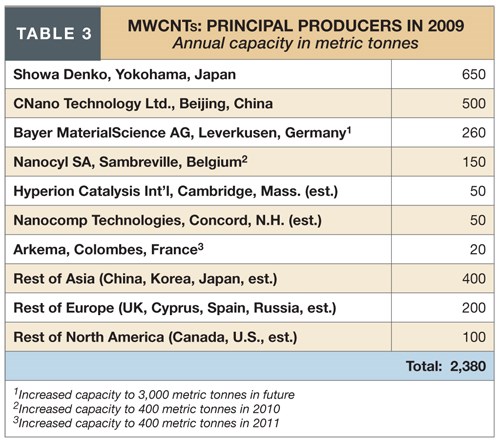

Of the three types, CNTs are, by far, the most prominent, based on recent plant expansions and future commitments reported by potential customers. There are in excess of 40 global producers of SWCNTs (see Table 2) and more than 60 producers of MWCNTs (see Table 3).

The earliest producer of CNTs was Hyperion Catalysis International (Cambridge, Mass.) in the 1980s. The company’s marketing strategy was based solely on masterbatches of MWCNT (known as FIBRIL) in a variety of thermoplastic resins, such as nylons, acetal, polyphenylene sulfide (PPS), and selected fluoropolymers for use in fabricating automotive components capable of electrostatic dissipation (ESD). The resulting MWCNT/Nylon 12 possesses favorable ESD characteristics and better mechanical properties than Nylon 12 with higher loadings of carbon black.

When Hyperion’s patents expired, many firms entered the lucrative CNT market. Two notable examples are major resin manufacturers that use MWCNTs in composites to enable electrostatic painting of lightweight exterior auto body panels without the need for a special conductive primer. The MWCNTs also improve body panel strength properties and help ensure a Class-A surface finish. SABIC Innovative Plastics (Wixom, Mich.) incorporates them into its Noryl GTX PPO/nylon alloys, which have been used to mold front fenders for several European autos. Exterior door and roof panels are under evaluation. Similarly, Lanxess Corp. (Leverkusen, Germany) nano-enhances its Triax nylon/ABS alloys.

Nanotubes offer the best method to make a plastic conductive while maintaining acceptable mechanical properties. They are particularly helpful in retaining toughness at low temperatures, ensuring that thermoplastic composite body panels won’t shatter on impact in extreme cold weather. At <5 percent loading, MWCNT-enhanced thermoplastic composites increase mechanical properties, thermal resistance and flame retardance, and have better cold-temperature toughness than an otherwise similar composite that contains carbon black at loadings up to 20 percent.

MWCNTs also are used in composite electronics applications. MWCNT-enhanced PEEK (polyetheretherketone), PEI (polyetherimide) and PC (polycarbonate) have been used in cleanrooms for the manufacture of computer chips and hard drives, because they dissipate static electricity and, therefore, won’t attract airborne contaminants. Suppliers report that cleanliness is the main issue, giving CNTs an advantage over chopped or milled carbon fibers. However, the nanometer-sized materials also provide much more uniform conductivity.

Current research aims to improve the interfacial adhesion between CNTs and polymers. This functionalization significantly improves mechanical properties (see “The key to CNTs: Functionalzation,” under "Editor's Picks," at right). In collaboration with Arkema (Philadelphia, Pa.), Zyvex Performance Materials (Columbus, Ohio) has developed proprietary functionalization technology, trademarked Nanosolve, using Arkema’s CNTs. Nanosolve functional resins, mostly thermoset resins, have contributed to improved mechanical performance in many sports, marine and antiballistics applications. Amroy Europe Oy (Lahti, Finland) has functionalized CNTs supplied by Bayer MaterialScience (Leverkusen, Germany and Pittsburgh, Pa.) within epoxy systems for use in wind energy blades as well as sports components. And structural reinforcement of advanced composite materials for aerospace and military applications, using functionalized CNTs, is an ongoing activity in many academic, government and industrial laboratories. For example, CNT materials can be transformed into sheets or paper, the latter known as buckypaper (see “Learn More”). Notably, Nanocomp Technologies (Concord, N.H.) has prepared CNT sheets as large as 1.2m by 2.4m (about 4 ft by 8 ft). These differ from buckypapers produced elsewhere in that they contain nondispersible, long CNTs. Raw sheet strength is high (200 MPa to 1 GPa), with electrical conductivity of >2 x 106 S/m. Sheet preparation involves a chemical vapor deposition (CVD) process, which yields nonwoven, textile-like sheets directly from the reactor without the need for post-processing. The U.S. Air Force is considering this material for potential deployment in advanced electromagnetic interference (EMI) and electrostatic discharge (ESD) shielding systems on manned and unmanned aircraft, and for use in armor and composites.

Also of note, Prof. Zhiyong Richard Liang of Florida State University reported at the SAMPE Fall Conference in Wichita, Kan. (October 2009) that his research team has aligned or stretched (to 40 percent elongation) MWCNT sheets supplied by Nanocomp and incorporated them into MWCNT/bismaleimide (BMI) composites. Results include record-high mechanical and electrical properties — tensile strength and Young’s modulus of 2,088 MPa and 169 GPa, respectively, and an electrical conductivity value of 5,500 S/cm-1. These composites exhibit higher modulus than, and tensile strength comparable to, unidirectional carbon fiber composites reinforced with either Toray T700 UD (Toray Carbon Fibers America, Flower Mound, Texas) or Hexcel’s (Dublin, Calif.) IM7 UD fiber.

An application expected to consume large amounts of CNTs is the $30 billion rechargeable battery market. Although metal hydride batteries are used in current hybrid electric vehicles, such as Toyota’s Prius, lithium-ion batteries (presently used for portable electronics) are expected to dominate in emerging plug-in hybrid vehicles and the all-electric vehicles that will follow. The latter exhibit high specific capacity, high specific energy and long cycle life, and should be available at moderate cost when compared to other battery systems.

Nickel metal hydride batteries will continue in hybrids, but plug-in hybrids and all-electrics require much more energy than is available from current metal hydride technology. Lithium-ion batteries for plug-ins and all-electrics would weigh from 180 to 300 kg (397 to 661 lb) and require 15 to 20 ft³ (0.42 to 0.57m³) of space — about half the weight and size of the metal hydride batteries such vehicles would require. Accordingly, huge investments are being made to scale up lithium-ion technology in the U.S. and Europe in an attempt to “catch up” with Japan, China and Korea in the Far East market, where lithium-ion technology is predominant. Most CNT producers’ sales, in fact, are to satisfy the demand for them in lithium-ion batteries.

In Japan, Prof. Morinubo Endo of Shinshu University, a CNT pioneer, has championed their use in lithium-ion batteries. Endo collaborates exclusively with Yokohama-based Showa Denko, a raw material supplier for the lithium-ion market. Showa Denko has increased CNT capacity from 400 to 650 metric tonnes/yr (881,850 to 1.43 million lb/yr) for use in composite lithium-ion anodes and cathodes as well as a new grade of shape-controlled micro-graphite (SCMG) as anodes. The volume of SCMG is expected to increase from 1,000 metric tonnes now to 3,000 metric tonnes (2.2 million lb to >6.6 million lb) by 2012. According to Endo, CNTs shorten recharge time, improve conductivity and prolong electrode endurance.

Germany is betting heavily on CNTs in a broad spectrum of applications. In 2008, its federal government created Inno.CNT (www.cnt-initiative.de), an interdisciplinary alliance with more than 80 enterprises — a “who’s who” of German industrial and scientific companies that includes Bayer, BASF, Evonik, SGL, Clariant, Siemens, Rhein Chemie and BYK. Inno.CNT has mapped out strategic areas that include not only advanced fiber composites and lithium-ion battery applications, but also mixed membranes for desalination of seawater and gas separation, conductive inks for solar cells, ultrahigh-strength concrete, high-strength CNT-based particle foams for energy absorption, and incorporation of CNTs into lightweight metals to increase their strength, hardness, etc.

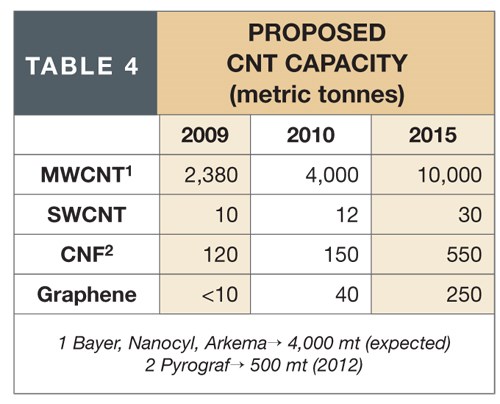

These activities are stimulating increases in proposed capacities for CNTs and related technologies (see Table 4). MWCNT capacity will more than double by 2015, driven by composites applications in lithium-ion battery, auto components, electrical/electronic and other markets. (SWCNT growth will be steady but not as great as that of MWCNTs, due to difficulty in isolating metallic SWCNT from semiconductive tubes within the SWCNT composition for flat panel displays, improved indium tin oxide and flexible circuits.) However, graphene production capacity should increase significantly on the strength of its favorable economics and because both its anticipated applications and performance characteristics are expected to be comparable to those of CNTs.

Related Content

JEC World 2022, Part 1: Highlights in sustainable, digital, industrialized composites

JEC World 2022 offered numerous new developments in composites materials, processes and applications, according to CW senior editor, Ginger Gardiner, most targeting improved sustainability for wider applications.

Read MoreNovel composite technology replaces welded joints in tubular structures

The Tree Composites TC-joint replaces traditional welding in jacket foundations for offshore wind turbine generator applications, advancing the world’s quest for fast, sustainable energy deployment.

Read MoreInfinite Composites: Type V tanks for space, hydrogen, automotive and more

After a decade of proving its linerless, weight-saving composite tanks with NASA and more than 30 aerospace companies, this CryoSphere pioneer is scaling for growth in commercial space and sustainable transportation on Earth.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreRead Next

The key to CNTs: Functionalization

An emerging supply base is integrating carbon nanotubes into commercial products that enable composites manufacturers to optimize part performance.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;maxWidth=300;quality=90)