What an acquisition tells us about our industry’s future

The aerospace composites supply chain is diligently assessing its ability to meet the needs of those who will build next-generation aircraft.

As I write this, we here at CW are just back from JEC World 2018 in Paris, France (March 6-8), and I’m reminded, again, that no matter how long you’ve worked in the composites industry, spending even a few hours at JEC World is akin to drinking water from a firehose. The show encapsulates in one (large) physical space all of the dynamism and creativity that composite materials and manufacturing processes have to offer. To absorb and comprehend even a fraction of it all would seem a Herculean feat.

Still, if you are there all three days and visit with as many people as we do, it’s always possible to discern recurring ideas, themes and trends that offer a few signals, at least, about where composites are, and where they are headed.

Indeed, we heard repeatedly at the show that the two major commercial aircraft OEMs, The Boeing Co. (Chicago, IL, US) and Airbus (Toulouse, France), are both in the throes of conducting serious trade studies of potential materials for use on next-generation commercial aircraft.

The particular aircraft in question are the Boeing NMA (New Mid-market Airplane, a replacement for Boeing’s 757), the Boeing 737 and the Airbus A320. The NMA is necessary because Boeing now has a product gap between its largest 737 variant and the composites-intensive 787. The 757 had filled that gap, but Boeing stopped making that plane in 2004. The official launch of the NMA has been “imminent” for several months, reportedly because Boeing is still finalizing details of the plane’s configuration. A sticking point appears to be the size and manufacturer of the plane’s engines. Boeing reportedly is targeting 2025-2026 for its entry into service.

The 737 and the A320, the workhorses of the commercial aerospace industry, are highly profitable for their respective OEMs, and represent the world’s largest-volume commercial aircraft. Although both planes were updated a few years ago, with new engines and other features, they are due for clean-sheet redesigns, possibly starting in the early 2020s.

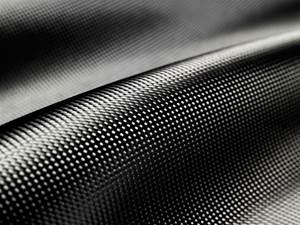

So, as Boeing and Airbus watch the aerospace world evolve, the question facing the engineers who must design the NMA and redesign the 737 and A320 is, Where and how do we apply composites? And while that is not a settled matter, one thing is becoming increasingly clear: When composites are next applied on major aerostructures, there’s a good chance they’ll have a thermoplastic matrix (see Part 2 of CW’s ongoing discussion of promising research toward that end). This fact has the aerospace composites supply chain diligently assessing its ability to meet the needs of those who will build next-generation aircraft.

It was to that end that on March 14, less than a week after the show, the world’s largest carbon fiber manufacturer, and supplier of almost all carbon fiber for the Boeing 787, Toray Industries (Tokyo, Japan), announced that it will pay more than US$1 billion (€931 million) to acquire TenCate Advanced Composites (Nijverdal, The Netherlands), a specialist in thermoplastic as well as thermoset prepreg. There had been talk before JEC that TenCate was seeking a strategic partnership, and at the show TenCate officials confirmed that the company was on the market.

In the composites industry, US$1 billion acquisitions are rare and, thus, important. Second, and more specifically, Toray is well known for its careful and thoughtful decision making. Many will recall that it committed to vast increases in its carbon fiber output only after Boeing and others committed to carbon fiber for commercial airframes. Indeed, the suddenness of the TenCate acquisition and the investment’s size alone are enough to make the entire industry sit up and notice. Now, Toray has, effectively, placed a US$1 billion bet on its future. Given this, is it not reasonable to conclude that Toray must firmly believe thermoplastic composite structures will be a major part of one or more next-generation aircraft program? If so, it must firmly believe that TenCate is necessary to help it meet that demand.

Time will tell if this bet is a good one, but early signs suggest it is.

Related Content

Thermoplastic composites welding advances for more sustainable airframes

Multiple demonstrators help various welding technologies approach TRL 6 in the quest for lighter weight, lower cost.

Read MoreThe state of recycled carbon fiber

As the need for carbon fiber rises, can recycling fill the gap?

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreMaterials & Processes: Composites fibers and resins

Compared to legacy materials like steel, aluminum, iron and titanium, composites are still coming of age, and only just now are being better understood by design and manufacturing engineers. However, composites’ physical properties — combined with unbeatable light weight — make them undeniably attractive.

Read MoreRead Next

CW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More