With the global COVID-19 crisis largely behind us, global passenger air travel began a recovery in 2022 that is expected to accelerate throughout 2023, bringing the commercial air travel industry close to activity levels not seen since 2019. This recovery will increase pressure on Boeing (Arlington, Va., U.S.) and Airbus (Toulouse, France), as well as the entire aerospace supply chain, to ramp up production.

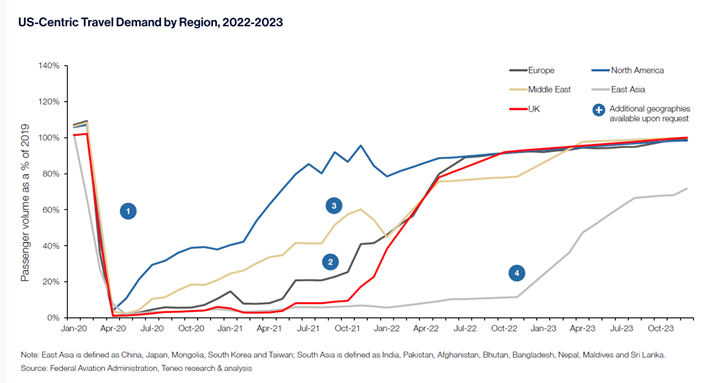

According to aerospace consultancy Teneo (New York, N.Y., U.S.), the loosening of COVID regulations in 2022 helped stimulate a broad recovery in passenger air travel in the U.S. In the U.K., where regulations remained in place longer, air travel recovery lagged, but followed similar patterns. Further, Teneo forecasts that by the end of 2023, most global air travel will be within a few percentage points of 2019 pre-pandemic levels (see chart below).

As predicted when the pandemic started in 2020, domestic air travel globally is recovering at a faster rate than international air travel, but 2023 should see international travel return close to pre-pandemic levels. And the return of international air travel heralds increased use of widebody aircraft, including the composites-intensive Airbus A350 and the Boeing 787, both of which saw their production rate drop precipitously when COVID struck.

Airbus and Boeing in 2023

Airbus, for its part, announced in September 2022 that is has begun a multiyear effort to gradually increase aircraft manufacturing rates in anticipation of continued demand increase. Specifically, Airbus says it intends to deliver close to 700 aircraft in 2022, although through September 2022 the company’s year-to-date (YTD) delivery total was 437 aircraft. At this rate, Airbus is on pace to deliver close to 600 aircraft, although the company says it will increase production for the balance of the year to reach the target.

Regardless, by 2025, Airbus intends to increase production to close to 1,000 aircraft per year, which means a monthly production rate of about 80 aircraft per month. Such a pace puts pressure not only on Airbus, but the company’s supply chain as well — including the composites aerospace supply chain.

The Airbus A321XLR is the latest and longest iteration of the Airbus A321neo lineup. This single-aisle plane is designed for long overwater routes and has been very popular with customers, who have ordered more than 500. The A321XLR is expected to enter into service in 2024. Photo Credit: Airbus

Boeing’s position in the market is weaker than Airbus’. The Seattle-based aircraft manufacturer has spent much of the last year getting its 737 MAX and 787 supply chain working again. Deliveries of the latter had been paused since 2021 pending a Federal Aviation Administration (FAA) assessment of manufacturing anomalies involving fabrication of some composite fuselage sections. Boeing resolved the anomalies and resumed 787 deliveries in September 2022.

Boeing delivered 51 aircraft in September 2022, with a total of 328 deliveries YTD through September. At this rate, Boeing is on pace to deliver 437 aircraft by the end of 2022 — substantially fewer aircraft than Airbus is targeting, but a big improvement for a company that has been beset over the last three years by safety and manufacturing challenges.

Boeing and Airbus long-term options

With production of the A350 and 787 just now starting to return to normal, the question hanging over the aerospace industry in general, and the composites industry in particular, is when will the next major aircraft program be announced?

Airbus does not need to announce a new program. It has aircraft in every major airplane category with few strategic weaknesses. Boeing, however, is relatively weak without a long-range, single-aisle plane to replace the 757 and compete with the Airbus A321XLR. This fact, combined with the architecture limits of the 737 (it is not easily extended), suggest that Boeing might announce a new long-range single-aisle program relatively soon.

Developing a new aircraft, however, requires money ($15-$20 billion), and Boeing is still rebuilding its cash in the wake of its challenges following the 737 MAX crashes and the pause in 787 deliveries. Financial and other challenges not withstanding, it’s clear that Boeing needs to develop a new aircraft to fill the void in its portfolio once occupied by the 757. This is the same space being filled by the Airbus A321XLR, a single-aisle that seats up to 200 passengers and has a range of 8,700 kilometers, making it the longest-range narrowbody in the industry. The A321XLR also has more than 500 orders and is expected to enter service in 2024.

Two Boeing 787s, with American Airlines livery. The 787 program spent much of 2021 and some of 2022 on delivery pause while the company and the FAA worked out some composites-related manufacturing anomalies. Fortunately, the timing coincided with a massive slowdown in international air travel caused by COVID-19. Deliveries of the plane have since resumed. Photo Credit: Boeing

Boeing has unofficially floated a few concept aircraft in the market over the last few years, testing interest in a variety of configurations and sizes. This included the new midsize aircraft (NMA), a composites-intensive twin-aisle smaller than the 787. While the NMA has yet to mature beyond the early design stage, by all accounts Boeing continues to assess new design options for a cleansheet aircraft. When that aircraft might be announced is the subject of much speculation, but seems unlikely before the end of 2023.

Aerocomposites supply chain jockeying

In the meantime, fabricators up and down the aerocomposites supply chain are avidly repositioning themselves to meet the needs of whatever aircraft program is announced next. Even if the aerospace industry is unsure about the dimensions and specifications of the next aircraft program, there is much we do know about materials and process (M&P) expectations.

As the aerospace industry trends away from widebody architectures and toward narrowbodies, it’s widely understood that whatever aircraft is developed next by Boeing and/or Airbus, it will be for a market that will demand as many as 100 aircraft a month. Further, a new aircraft will certainly have composite wings, and likely a composite fuselage as well.

Producing 100 shipsets of composite primary aerostructures a month will require composite M&P combinations heretofore not seen in the commercial aerospace industry. The main thrust of this M&P trend will be away from the bottleneck represented by the autoclave and toward liquid processes, like resin transfer molding (RTM), resin infusion, compression molding and thermoplastic composites. M&P trends will also favor more automation, improved process control, more parts integration, less touch labor and few fasteners.

One of the challenges of this migration out of the autoclave is that fiber/resin combinations are being considered for use in structures where they have not been used before. Such innovation is good for the composites industry, but it will require qualification programs to prove the viability of these materials in their intended applications. Such qualification is time-consuming and expensive — but necessary if the aerocomposites industry is going to meet the needs of next-generation aircraft manufacturing.

Anticipating these trends, Tier 1 and Tier 2 aerospace composites fabricators are working avidly to modernize their operations to be prepared to meet the needs of the aircraft OEMs. Much of this jockeying for M&P position can be seen in some of the recent technologies and applications developed by composites fabricators. Examples of this work follow:

Teijin noncrimp fabric, cut and prepped for preforming, for the GKN Aerospace Wing of Tomorrow (WOT) one-piece spar. Photo Credit: GKN Aerospace

One-piece, one-shot 17-meter wing spar for high-rate aircraft manufacture. The Airbus Wing of Tomorrow (WOT) program features several new composite M&P technologies designed to advance wing fabrication and reduce weight. One of the largest structures in the WOT is the one-piece, 17-meter carbon fiber composite spar, developed and fabricated via RTM by GKN Aerospace (Western Approach, U.K.). What makes the C-shaped spar unique is that it is uncommonly large for a single RTM part, and it uses a noncrimp fabric (NCF) from Teijin (Tokyo, Japan) that GKN managed to place on the tool without cutting or darting. Airbus has assembled the first WOT demonstrator and will perform tests to assess viability of the design and the materials. It remains to be seen if and how technologies in the WOT will be deployed in an aircraft.

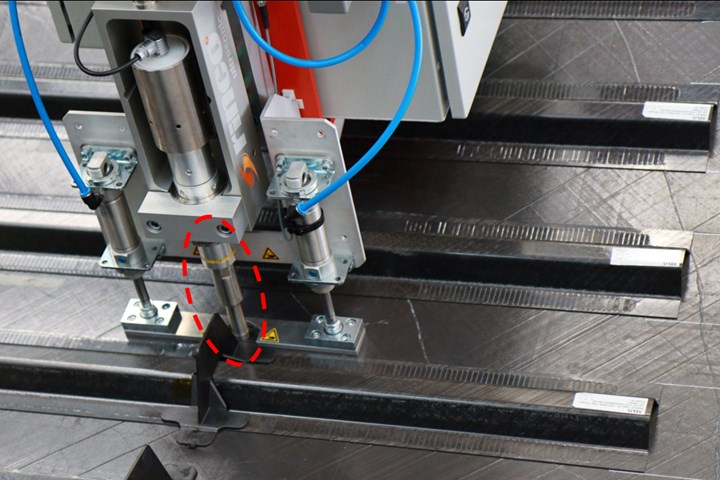

SAM|XL welding technology uses an end effector with suction cups and a sonotrode to place omega stringers and tack weld them to the skin. Welding of thermoplastic aerostructures is being evaluated for next-gen aircraft programs. Photo Credit: SAM|XL

Thermoplastic composites welding advances for more sustainable airframes. The Multi-Functional Fuselage Demonstrator (MFFD) project, operated by the EU’s Clean Aviation program, is assessing the potential use of thermoplastic composites in an aircraft fuselage structure, including skins, stringers and frames. Work is being done by GKN Aerospace (lower half), DLR (upper half; Cologne, Germany) and Fraunhofer (assembly; Munich, Germany). One of the goals of MFFD is to leverage the weldability of thermoplastics as an assembly technology for the fuselage to reduce use of mechanical fasteners. MFFD is assessing several welding technologies, measuring the speed of welding, quality of welding and other variables. Thermoplastics are an attractive option for aerostructures overall as they offer out-of-autoclave (OOA) processability combined with easy material handling and good toughness performance.

Automated fiber placement (AFP) was an enabling technology for composites use on the 787 and A350. It will likely be even more important for the next generation of commercial aircraft. This Electroimpact AFP machine is installed at the National Institute for Aviation Research (NIAR) at Wichita State University (WSU). Photo Credit: NIAR

An epicenter of manufacturing technologies for next-generation composites manufacturing is quickly evolving at the National Institute for Aviation Research (NIAR) at Wichita State University (WSU, Wichita, Kan., U.S.). CW visited NIAR early in 2022 and published this report of what we found there. In short, NIAR is aggregating a variety of manufacturing technologies at its ATLAS facilities to provide the composites industry and WSU students demonstration options for M&P development. ATLAS features an Electroimpact (Mukilteo, Wash., U.S.) automated fiber placement (AFP) machine, a Coriolis (Quéven, France) AFP machine, a Mikrosam (Prilep, Macedonia) tool-less fiber placement system, a Cevotec (Munich, Germany) automated patch placement (APP) system, a KraussMaffei (Munich) injection overmolding system, an Engel (Schwertberg, Austria) injection overmolding system, an ASC Process Systems (Valencia, Calif., U.S.) autoclave and a Solvay Composite Materials (Alpharetta, Ga., U.S.) lab. NIAR is also home to the Advanced Virtual Engineering and Test (AVET) lab, focused on development and validation of virtual mathematical modeling techniques that enable aerospace manufacturers to minimize full-scale physical testing from the conceptual design state to certification by analysis. The goal here is to shorten the materials testing and qualification cycle to allow new materials to move into aerospace structures more quickly.

Qarbon Aerospace’s patented robotic induction welding technology for unidirectional (UD) composites has been advanced to TRL 5 for closed-box aerostructures, such as the wing box demonstrator. Companies like Qarbon are expanding their thermoplastic composites manufacturing capabilities. Photo Credit: Qarbon Aerospace

CW also visited Tier 1 aerostructures manufacturer Qarbon Aerospace in 2022 and published this report on its facilities in Milledgeville, Ga., and Red Oak, Texas, both in the U.S. Qarbon is a classic example of an aerospace manufacturer in transition, comprised primarily of former Triumph facilities that were acquired by private equity and renamed. The company has long experience with legacy programs in aerospace and defense using hand-laid, autoclave-cured prepregs. It’s also developing expertise with thermoplastic composite materials and innovating some welding technologies for aerostructures.

Advanced air mobility

Looming on the horizon of the composites industry is the advanced air mobility (AAM) market, which plans to provide air taxi service in and around major cities to help passengers bypass ground traffic. AAM aircraft consist almost entirely of three-to-six-passenger, all-electric, composite-intensive eVTOL aircraft that have a range of up to 150 kilometers.

There are several hundred AAM aircraft manufacturers in business globally, but only a handful that have financial backing sufficient to enter service, as shown on the AAM Reality Index. The very early movers in this market are scheduled to enter into service (EIS) in 2022 and 2023, with several others to follow in 2024 and 2025.

Opinions vary about how quickly this market will evolve and what its ultimate size may be. Optimists see the potential for thousands of air taxis in service around the world by 2030. Skeptics see limited service by a few providers in a few cities, with a longer runway to maturity. There are multiple hurdles for AAM to clear before it becomes reality. The largest hurdle is regulation/air traffic control. The U.S. FAA and European Union Aviation Safety Agency (EASA) in Europe must create entirely new standards and protocols for managing the airspace in which AAM craft will fly — much of which is overcrowded urban areas into which an AAM craft should avoid crashing.

The second hurdle is infrastructure. Air taxis will take off from and land on vertiports, which will be located on top of buildings, near airports, at regional airports and other locations. This infrastructure does not exist and must be created and sustained, mostly by AAM manufacturers. There’s a Reality Index for AAM infrastructure as well.

The final hurdle, and the one most pertinent to the composites industry, revolves around M&P. If the AAM market reaches the type of maturity hoped for by optimists, the market demand for new aircraft could exceed 10,000 units per year. This is orders of magnitude more than the highest manufacturing rate in commercial aerospace and represents a level of high-performance composites manufacturing industrialization heretofore unseen anywhere in the world.

Some observers like to call this paradigm shift in composites manufacturing “automotive quantity, aerospace quality,” and although this has a ring of truth to it, the fact is that AAM aircraft will be composites-intensive in a way that the automotive industry is not, and will require the fabrication of parts unseen in the automotive industry. Take, for example, propeller blades. Each AAM craft has multiple rotors and will require high-volume production of aerospace-quality propeller blades in significant quantities — as many as 60,000 per year with even just a conservative maturation of AAM.

The ALIA 250c AAM aircraft, developed by Beta Technologies, features four tiltrotors for takeoff and landing, as well as a pusher rotor near the back. The ALIA will enter service first as a plane to transport donated organs, before it enters the air taxi market. Photo Credit: Beta Technologies

Consider as well that prototype and demonstrator AAM aircraft are being manufactured primarily with hand-laid, aerospace-qualified prepregs cured in the autoclave. Second- and third-generation aircraft, however, will require adoption of OOA M&P to meet higher rates and higher quality. This means no touch labor, strong process control, liquid molding, in-process inspection, fast cure and easy assembly — none of which currently exists at scale anywhere in the world.

This begs the question: Who will do composites fabrication for AAM? It depends on the manufacturing model. Some AAM manufacturers will likely contract with Tier 1s like Spirit AeroSystems, GKN Aerospace and Daher, but even they would need to acquire the capital and technology to meet the need. Alternatively, other AAM manufacturers like Joby Aviation (Santa Cruz, Calif., U.S.) are doing their own composites manufacturing in-house, which presents similar scale-up and industrialization challenges.

And all of this ignores the question of carbon fiber demand and supply. Fast maturation of AAM would put significant demand stress on a carbon fiber supply chain that is already struggling to meet customer needs, with strong growth in commercial aerospace, wind energy and hydrogen storage promising to complicate matters even more. Further, carbon fiber manufacturers are loathe to invest the time and money to add capacity unless there is a definitive, long-term promise of demand for the fiber a new line might produce. It remains to be seen if AAM can provide such a definitive, long-term promise.

Related Content

Plant tour: Spirit AeroSystems, Belfast, Northern Ireland, U.K.

Purpose-built facility employs resin transfer infusion (RTI) and assembly technology to manufacture today’s composite A220 wings, and prepares for future new programs and production ramp-ups.

Read MoreCryo-compressed hydrogen, the best solution for storage and refueling stations?

Cryomotive’s CRYOGAS solution claims the highest storage density, lowest refueling cost and widest operating range without H2 losses while using one-fifth the carbon fiber required in compressed gas tanks.

Read MoreCarbon fiber in pressure vessels for hydrogen

The emerging H2 economy drives tank development for aircraft, ships and gas transport.

Read MoreMaterials & Processes: Fabrication methods

There are numerous methods for fabricating composite components. Selection of a method for a particular part, therefore, will depend on the materials, the part design and end-use or application. Here's a guide to selection.

Read MoreRead Next

From the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;maxWidth=300;quality=90)