Natural fiber composites: What’s holding them back?

Natural fiber reinforcements have been available for some time, but factors such as compatibility with current processes and geographic availability continue to limit widespread use.

Applications of natural fiber composites (NFC) can be traced back to the ancient Egyptians, who used to make bricks out of clay mud and straw. More recently, the use of natural fibers as a reinforcement in polymer composites has been gaining a lot of attention, especially in the research community, and there are numerous review articles published on the applications of NFCs. However, to date the commercial use of NFCs is limited to wood plastic composites and automotive inner door panels. Moreover, few clear statistics on the current market for NFCs are available, and in fact most reports I’ve come across discuss the envisioned potential markets rather than the current market.

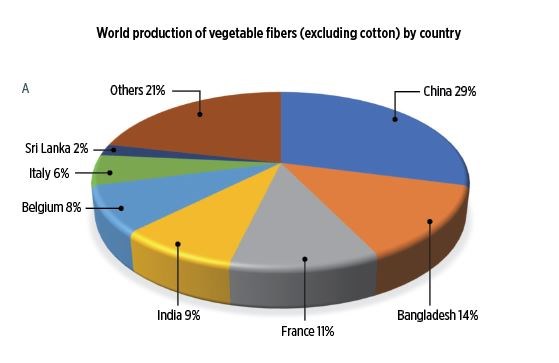

World consumption of natural fibers

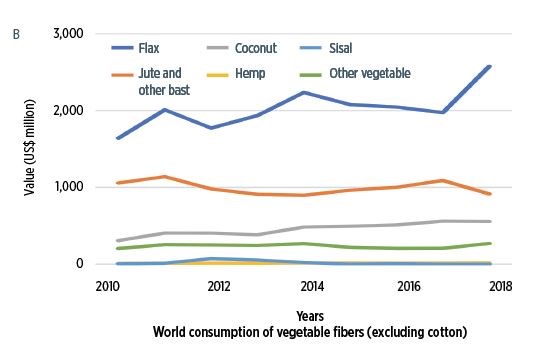

The world consumption of natural (also known as “vegetable” fibers since they are derived from plants such as hemp and flax) fibers that can be used as a reinforcement for composites totaled $4.3 billion in 2018, with a compound annual growth rate (CAGR) of 3.3% from 2010-2018. This low growth rate is a strong indicator that the market is not growing as quickly as anticipated, and raises a valid concern: What’s holding NFCs back? In other words, what are the barriers to the adoption of NFCs in the numerous applications of composite materials? To answer this question, one should refer to the diffusion of innovation theory developed by scholar E. M. Rogers, which explains how new ideas, technologies and products spread among participants in a social system.

Based on UN COMTRADE statistics, InTEXive calculates that China led global production of natural fibers in 2018.

What’s holding them back?

According to Rogers’ theory, there are five main factors that affect the diffusion of innovation: relative advantage, compatibility, complexity, trialability and communicability.

Relative Advantage. Natural fiber reinforcements have many advantages over their inorganic counterpart, glass fiber. For example, they have low density, high specific properties, are biodegradable, are derived from renewable resources, have a small carbon footprint and provide good thermal and acoustical insulation. Those relative advantages must be emphasized when developing new products from NFCs, and this explains why the automotive industry is at the forefront of NFC adoption — these are all requirements for modern-day vehicles, especially considering the growth of electric vehicles and the onset of stricter environmental regulations.

Compatibility. Where natural fiber reinforcements fall short is that their hydrophilic nature makes them incompatible with the existing hydrophobic resin systems used in the industry. Moreover, their low thermal resistance limits their compatibility with thermoplastic matrices with high melting temperatures. Furthermore, the high variability in their mechanical, chemical and physical properties and lack of standardization limit their compatibility with the quality standards set forth by certain industries such as aerospace. In addition, their coarse texture makes them difficult to spin using existing spinning lines; they are also difficult to convert into woven preforms. Because of this, most natural fiber reinforcements are used in nonwoven form. Moreover, the incompatibility of their surface functional groups with the functional groups in existing resin systems results in poor fiber-matrix interfacial adhesion and very low load transfer efficiency. Finally, their low annual availability, as well as their seasonality, makes them incompatible with the large and consistent consumption of certain supply chains, such as the wind energy and construction industries. Overall, I believe NFCs’ low level of compatibility with current manufacturing methods is the main reason preventing the widespread diffusion and adoption of NFCs.

Complexity. There are few in the composites industry with enough experience and knowledge of natural fiber reinforcements to work with them confidently; moreover, there is a large gap between different levels of the value chain. For example, processors of fibers often operate with comparatively low-tech equipment, while composites manufacturers are relatively high tech. Given this difference, there is a compelling need to bridge this gap between the different value chain actors and to educate the farmers, fiber processors and fabric makers on this new end-use of natural fibers, and to educate composites manufacturers on this new type of reinforcement and how it differs from synthetic fibers.

Trialability. Natural fiber reinforcements are mostly derived from plants grown in developing countries such as China, Bangladesh, India and Sri Lanka, while composites manufacturers are mostly located in the United States, western Europe and Japan. This geographic barrier makes it difficult for composites manufacturers to easily access natural fiber reinforcements for research. Moreover, the wide ban on planting hemp in certain countries significantly limits it trialability. Flax is an exception, since it’s mostly grown in France and Belgium, regions where many composites manufacturers are located. In fact, these regions’ easy and quick access to flax has significantly increased its trialability and has made it the most widely used natural fiber reinforcement.

Communicability. This term refers to how easy it is for the user to see the benefits of using NFCs. The most important benefits of using natural fiber reinforcements revolve around environmental sustainability. These benefits include reduced carbon footprint, biodegradability and renewability. While these benefits are important, they are not easily recognized and appreciated by the potential user. There are, however, other direct benefits that can be easily perceived, such as light weight, high specific properties, good thermal insulation and vibration damping. The fact that NFCs’ most important benefits cannot be easily seen by the user, however, significantly limits their spread and adoption.

According to InTEXive, flax fiber was the most-consumed natural fiber at the end of 2018.

Overcoming the barriers

There have been several projects aimed at improving the form compatibility of natural fiber reinforcements, with the goal of providing an off-the-shelf reinforcement similar to glass fiber and carbon fiber. Projects have included using NFCs for low-twist rovings, unidirectional tapes, woven fabrics, spread-tow fabrics and prepregs, and most of these have involved flax fibers provided by Bcomp Ltd. (Fribourg, Switzerland) and Composites Evolution (Chesterfield, U.K.). Another attempt to improve compatibility within the resin is the water-based acrylic resin Acrodur, developed by BASF (Charlotte, N.C., U.S.).

Moreover, a project called QUALIFLAX — by the FiMaLin association (Gruchet-le-Valasse, France) and AFNOR certification group (Saint-Denis, France) — has been developed specifically to control and ensure consistent technical performance, reliable supply and pricing of natural fiber reinforcements. In addition, projects like Fibragen (Valencia, Spain) aim to develop a genetically selected flax with improved and consistent properties.

Furthermore, there are several institutions leading the way in promoting awareness of natural fibers in the composites industry, such as the European Confederation of Flax and Hemp (CELC; Paris, France) and NetComposites (Chesterfield, U.K.), through its EcoComp conference.

However, there is still a need to explore novel natural fibers with high mechanical properties, but with greater annual availability and lower prices than flax or hemp. Promising work is being done in this area by Sunstrand LLC (Louisville, Ky., U.S.) with bamboo fibers and by inTEXive (Cairo, Egypt) with date palm midrib fibers.

In conclusion, natural fibers are emerging as strong sustainable candidates in the reinforcement of composites due to their unique properties. However, they are still in their early adoption stages and are facing some barriers like compatibility and availability which are preventing them from diffusing into the mass market. Hence, there is a need to clearly understand those barriers and to focus our efforts on overcoming them. Visionaries such as researchers, hobbyists, entrepreneurs and technology enthusiasts are leading the way in overcoming those barriers, and there are positive signs of adoption in the automotive and sporting goods industries. I strongly believe that the future is green and with the industry’s renewed interest in bio-based materials, natural fibers will prevail.

Related Content

The state of recycled carbon fiber

As the need for carbon fiber rises, can recycling fill the gap?

Read MoreBio-based acrylonitrile for carbon fiber manufacture

The quest for a sustainable source of acrylonitrile for carbon fiber manufacture has made the leap from the lab to the market.

Read MoreCarbon fiber in pressure vessels for hydrogen

The emerging H2 economy drives tank development for aircraft, ships and gas transport.

Read MoreRecycling end-of-life composite parts: New methods, markets

From infrastructure solutions to consumer products, Polish recycler Anmet and Netherlands-based researchers are developing new methods for repurposing wind turbine blades and other composite parts.

Read MoreRead Next

From the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;maxWidth=300;quality=90)