Low-density SMC: Better living through chemistry

Proprietary sizing, special glass roving and microspheres strip 9 kilos of weight from Corvette body panels.

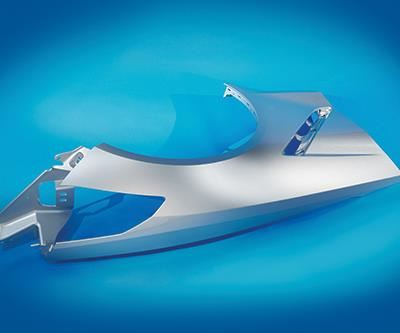

A new, low-density sheet molding compound (SMC), formulated and molded by Continental Structural Plastics (CSP, Auburn Hills, MI, US), is responsible for reducing mass by 9 kg on body panels for 2016 model year Chevrolet Corvette sports cars from General Motors Co. (GM, Detroit, MI, US). CSP calls the new material TCA (tough Class A) Ultra Lite. At a specific gravity (SG) of 1.2, it offers a 28% mass reduction vs. CSP’s mid-density TCA Lite (1.6 SG) grades, and a 43% reduction vs. conventional 1.9 SG grades of SMC. More importantly, TCA Ultra Lite not only offers mechanical performance comparable to TCA Lite (both feature a matrix of unsaturated polyester from AOC LLC, Collierville, TN, US), but also reportedly bonds more effectively to paint and adhesive. Although this first commercial use of TCA Ultra Lite is on painted Class A body panels, the company says it’s equally appropriate for fabrication of structural parts.

TCA Ultra Lite was introduced as a running change in the summer of 2015 to replace TCA Lite on all Corvette exterior body panels except the hood and roof, which are molded in carbon fiber-reinforced epoxy by another supplier. Notably, neither tooling, process adjustments nor part thickness changes were necessary during the material transition. “One day we were running TCA Lite, and the next day we were running TCA Ultra Lite,” explains Dr. Probir Guha, CSP’s VP, advanced R&D, “and there were no other changes.”

Aluminum is the real competition

Although the transition reportedly occurred without hiccups, the technology that made that smooth transition possible was five years in the making. Guha credits Frank Macher, who became CSP chairman in October 2010 and CEO in February 2011, with making TCA Ultra Lite’s invention possible.

“When he came on board, Frank said, ‘Stop everything and focus on R&D. Our competitor isn’t another composite, it’s aluminum,’” recalls Guha. “True to his word, he gave us the resources to dig deeper into the chemistry so we could under- stand what was going on at the molecular level.”

SMC already offered a host of benefits vs. steel and aluminum. It’s typically 40% lighter than metals in specification-comparable geometries. It also provides better low- and high-speed impact performance (energy management), so it brings safety benefits to vehicle occupants. Although it won’t rust or corrode and doesn’t need such treatment, it has the thermal and chemical resistance to survive the automotive electrophoretic (e-coat) deposition process used as a rust preventative on metallic chassis components. Hence, SMC parts can be attached to the body-in-white (the preferred assembly method) and don’t require special post e-coat assembly.

Far greater design flexibility is another SMC advantage (especially vs. aluminum), and that’s a real boon to automakers who favor the use of surfaces with compound curves, which are either difficult and costlyor impossible to duplicate in metals, owing to the deep draw. Parts-consoidation opportunities and insert molding enable previously multiple subcomponents to be molded as a single complex composite part, reducing the number of tools (dies) and post-mold assembly operations necessary to make the same part from metal. Even better, because it’s molded on compression presses, SMC offers this styling freedom at lower tooling costs than metals at both low and moderate production volumes (typically 50-70% tooling cost savings vs. steel or aluminum at build volumes of less than 150,000 per year). Historically, at higher volumes, the greater raw material cost of SMC vs. metals and the slower part production cycle cancel out SMC’s overall cost advantage: SMC takes 2.0-3.5 minutes vs. 20-30 seconds for metals, despite the fact that that’s per die for a metal version of the part that requires multiple subcomponents, which need subsequent assembly. So the SMC molder must multiply the number of tools and machines to maintain competitive production rates at the higher volumes. This normally puts SMC out of the running in the per-part cost sweepstakes.

With aluminum as their target, CSP researchers focused on ways to make SMC cost-competitive at any production volume. The key was to target specific gravity: “We kept running the numbers and our calculations kept telling us that we could take on aluminum if we could get to 1.2,” explains Guha. “We got down to basics and started analyzing each component’s contribution.”

SMC typically contains resin, glass fiber, mineral filler and additives. One way the company reduced its product density was by replacing some percentage of its typical calcium carbonate (CACO3) filler with hollow glass microspheres (affectionately called “bubbles” in the industry). However, microspheres can crush easily during compounding or molding. “When that happened, our mechanicals would go south and our density would go up,” recalls Guha. “We felt we needed both a tougher bubble and to do work on the surface of the bubbles to improve interfacial adhesion.”

Chemistry is key

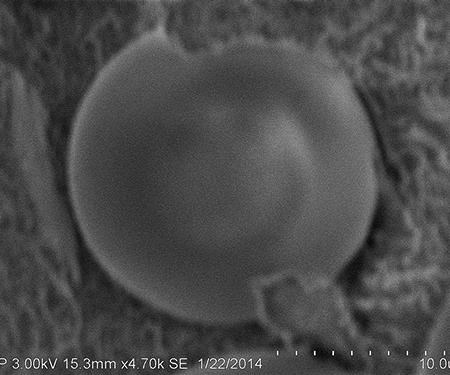

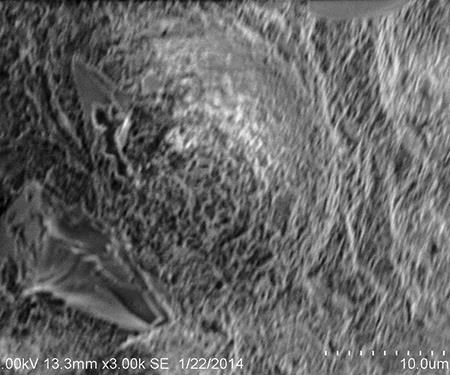

As luck would have it, part of the Macher-approved R&D investment included a state-of-the-art scanning electron microscope (SEM). Researchers lost no time mixing new formulations, molding and testing parts, then sectioning samples and looking at morphology via the SEM to try and understand how the structure they were seeing related to the performance they were measuring and the chemical tinkering they were doing. What they saw led to a three-pronged solution, and a number of different ways to improve the resin/reinforcement interface.

First, they looked at numerous types of microspheres, eventually switching to a tougher, higher performance microsphere from 3M (St. Paul, MN, US). Although CSP won’t divulge specifics, Guha does say the product has higher crush strength and has not been used previously in automotive composites applications with unsaturated polyester resins. Second, they strengthened the resin/ microsphere bond with a proprietary sizing that was developed and patented by CSP researchers, rather than using those offered by microsphere or additive suppliers. The sizing’s formulation is said to work with the free-radical reaction mechanism used in unsaturated polyester and vinyl ester. According to Guha, the difference between the new sizing and previous versions was “like night and day” — not only performance-wise, but also clearly visible on SEM images.

Serendipitously, as researchers dug deeper into the chemistry and physics of the resin/microsphere interface, they discovered that a longstanding issue with paint adhesion on certain SMC parts wasn’t the fault of a poor bond between paint and the surface of the composite, as everyone had assumed. SEM scans of part surfaces from which paint had flaked off revealed that not only the paint but the entire top layer of the composite’s resin matrix had detached from microsphere surfaces. CSP researchers discovered that their work on strengthening the resin/microsphere interface not only met or exceeded target mechanicals at lower density, the intended result, but also provided the additional benefit of improving the SMC’s capacity to bond well with paints and adhesives.

Third, researchers re-examined their options for glass rovings, selecting ME1975 multi-end glass roving, then newly formulated by Owens Corning (Toledo, OH, US) specifically for unsaturated-polyester SMC applications that require high strength and corrosion resistance. Here, too, the surface chemistry of this E-glass variant was the key contributor to performance improvements seen in surface finish and mechanicals.

Throughout the development process, as CSP researchers found something that seemed to improve performance, they evaluated the formulation not only by means of standard, small-scale mechanical tests, but also with a lab-scale setup that simulated e-coat processing conditions. As their confidence grew with each formulation refinement, they took samples around to multiple automakers and did trials in OEM labs and factories. Eventually, with the formulation more or less set, they began looking for their first commercial application.

Vetting the technology

That first application, on GM’s flagship Corvette, now totals 21 body panel assemblies (depending on model), including doors, decklids (trunks), hatches, door surrounds, quarter panels, fenders, convertible tonneau assemblies, and coupé roof bows (read more online about how the the current Corvette also represents the first use of a new out-of-autoclave carbon composite production method in “Faster cycle, better surface: Out of the autoclave" under Editor's Picks at the right). The technology has fulfilled its promise to reduce costs vs. aluminum at all volumes: Life-cycle analyses done by CSP reportedly show that even at volumes as high as 350,000-400,000 vehicles per year, TCA Ultra Lite costs less per part than aluminum.

“In materials engineering, shaving off a single pound per car is a significant accomplishment,” notes Corvette chief engineer Tadge Juechter, “so saving 20 lb per car is monumental.”

Judges at two recent industry events seemed to agree. At CAMX 2015 in Dallas, TX, US, CSP won the conference’s Unsurpassed Innovation award. A month later, the SPE Automotive Division’s blue-ribbon judging panel selected TCA Ultra Lite as its Materials category and Grand Award winner as the year’s most innovative use of plastics at the 45th-annual SPE Automotive Innovation Awards Gala in Livonia, MI, US.

What’s next? Guha says the company is hard at work on new formulations of carbon fiber-reinforced SMC, as well as carbon composite prepreg and carbon material suitable for RTM. Key bogies are reducing offal, exploring the most efficient use of hybrid glass/ carbon reinforcement systems and finding a carbon-neutral way to recycle carbon fiber from scrap parts (that is, to recover fiber without burning). He predicts that in the not-too- distant future, we’ll see carbon composites on high-volume, moderate-cost vehicles, not just on high-cost, high-performance vehicles.

Related Content

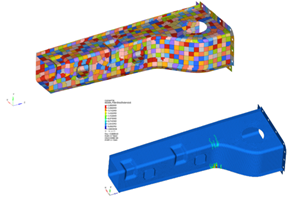

SMC simulation tool enhances design optimization

CAMX 2023: FiRMA, Engenuity’s new approach to SMC, uses a predictive technique that accurately reflects material properties and determine the performance range an SMC part or structure will exhibit.

Read MoreCAMX 2022 exhibit preview: Cimbar Performance Minerals

Cimbar’s halogen-free ATH solution for thermoset applications reduces resin costs in formulation, provides better wetout and faster line speeds and improves mold flow.

Read MoreWAG Wernli to produce composite brackets for Dufour Aero2 drone

The Swiss company was chosen for its C-SMC expertise, which will replace original aluminum brackets to enhance weight savings, corrosion resistance and adhesive bonding capabilities.

Read MoreComposite resins price change report

CW’s running summary of resin price change announcements from major material suppliers that serve the composites manufacturing industry.

Read MoreRead Next

From the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read MoreCW’s 2024 Top Shops survey offers new approach to benchmarking

Respondents that complete the survey by April 30, 2024, have the chance to be recognized as an honoree.

Read MoreComposites end markets: Energy (2024)

Composites are used widely in oil/gas, wind and other renewable energy applications. Despite market challenges, growth potential and innovation for composites continue.

Read More

.jpg;maxWidth=300;quality=90)