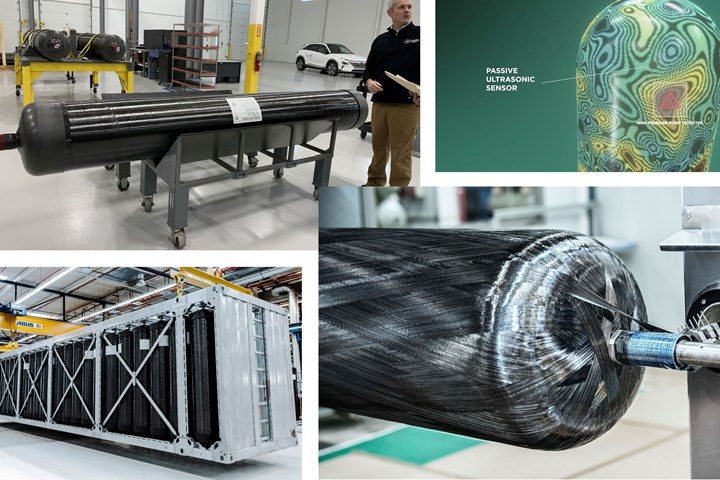

Top left, clockwise: Hexagon Purus Westminster, Hexagon Digital Wave, filament winding Type 4 tank and Hexagon Purus distribution module. Photo Credit: Hexagon Purus

Hexagon Purus (Oslo, Norway) opened its Westminster, Maryland site in the U.S. on January 26, 2023. In my report on that event, I explained the long history Hexagon has in Type 4 composite tanks and some of the background for this site in Maryland. I also shared some of my discussions with Hexagon Purus CEO, Morten Holum, and executive vice president (EVP), Dr. Michael Kleschinski. Here, I’d like to give more details about the Westminster team and the tank production it is now scaling, as well as further insights from my interview with Holum and Kleschinski.

Veteran team, tour in Westminster

Hexagon Purus Westminster facility and head of operations, Levi Haines, standing next to a hydrogen storage tank produced for fuel cell buses. Note the hydrogen-fueled car in the background. Photo Credit: Hexagon Purus and CW, Ginger Gardiner.

Jim Harris, managing director at Hexagon Purus Westminster, noted during the facility opening that the process leading to that day had been 11 years in the making. Harris’ experience in composite cylinders, however, goes back much further — 25 years — working first for Pressure Technologies Inc., which was later acquired by Cobham Mission Systems in 1998, before moving to MasterWorks where he became managing director. But that kind of experience isn’t unique to Harris; multiple members of the Westminster team have decades of expertise in designing and manufacturing technically demanding composite pressure vessels.

One example is the head of operations at Hexagon Purus Westminster, Levi Haines, who led my tour of the new facility. He has more than 25 years of experience in producing Type 3 and Type 4 pressure vessels, working initially at Pressure Technologies Inc., which was acquired by Cobham Mission Systems in 1998, before moving to MasterWorks and now Hexagon Purus.

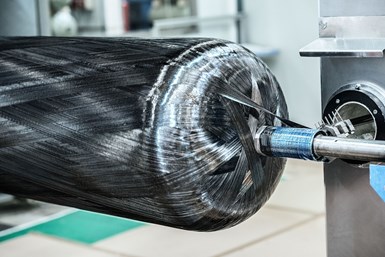

Haines started our tour at the east end of the building, adjacent to the engineering and administrative offices. He walked us through the first production cell, set up initially to produce 350-bar Type 4 hydrogen tanks for fuel cell (FC) buses and heavy duty trucks. The tanks start with industry standard plastic liners, which are placed into an automated filament winding machine with five spindles, the same number used by Hexagon’s automated systems in Kessel, Germany (see below). The carbon fiber is first impregnated with epoxy resin and then wound onto the liners. Once the automated winding process is completed, the tanks are then removed from the winder and cured in specially designed ovens.

After cure, the tanks are proof test in a special chamber. The proof pressure depends on the pressure rating for each type of tank. “This test proves the integrity of the tank,” says Haines. “We maintain a database of all test data that we have established over many years of production.” Hardware is then installed, including valves for integration into a vehicle’s fuel system and a thermal pressure relief device (TPRD) as required by transportation industry standards. The tanks are then leak tested.

Leaks vs. hydrogen permeation

At this point, the tour is joined by Matthew Buchholz, director of business development for Hexagon Purus Westminster. Buchholz has 14 years of experience in engineering and production of Type 4 tanks. I ask him about industry hearsay that “all hydrogen tanks leak”. He notes there is a difference between leaks and the permeation that occurs due to the very small size of hydrogen molecules.

“This leak test that we perform for every tank assures there are no leaks,” he explains. “However, when held in Type 4 tanks at high pressures like 700 bar, the very small hydrogen molecules will eventually move through the plastic liner and composite laminate via molecular diffusion. This has been well-studied and documented and is taken into account in the tank designs and international standards that these tanks are tested to. This permeation of hydrogen is measurable but at a microscopic scale. You have to put the tank into a vacuum, and it takes a significant amount of time to generate enough gas molecules to even measure. But we’re constantly looking at this and working on developments that may increase the tank liner’s permeability resistance.”

Completed tanks, growth in H2 vehicles

Completed tanks can then be shipped to Hexagon Purus’ systems assembly facility in Kelowna, British Columbia, Canada where its battery systems for North America are also assembled. He adds that Hexagon Purus is working with a number of companies in the U.S. that are exploring/developing H2-powered vehicles, including its publicly announced customers New Flyer (Winnipeg, Maniotoba, Canada), Toyota Motors North America (TNMA, Plano, Texas, U.S.) and Nikola (Phoenix, Ariz.. U.S.). The company is also exploring new high-pressure tank designs. During the facility’s opening ceremony, Kleschinski explained that this facility is not only a top-of-the-line production site but also a technical center of excellence, providing engineering and research and development for Hexagon Purus. Thus, staying at the front edge of H2 tank technology is key and a capability of the Westminster team and facility.

Q&A, Nikola as a first mover

After the tour ends, I continue this discussion about heavy duty vehicles with Holum and Kleschinski, who graciously give their time to answer my questions. “I think Nikola has the right business model,” notes Holum. “Because if you want to ensure uptake of these fuel cell electric trucks, you have to take responsibility for rolling out the infrastructure needed to refuel them and supplying these refueling stations with green hydrogen.”

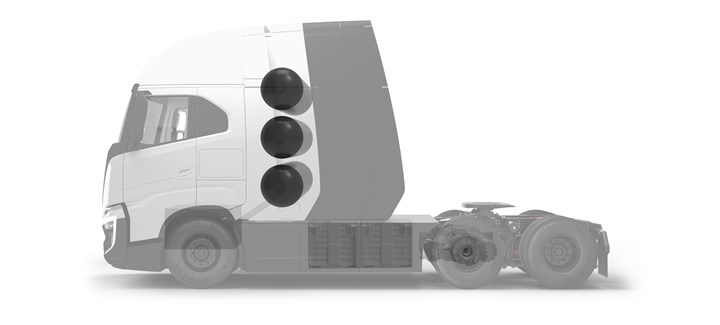

Hexagon Purus Westminster supplies hydrogen tanks for Nikola’s Tre FCEV truck (top). The company spans the hydrogen ecosystem through its HYLA brand, including products for producing, distributing and dispensing hydrogen to its FCEV trucks. Photo Credit: Nikola

As announced in January 2023, Nikola has created a new global brand, HYLA, encompassing its products for producing, distributing and dispensing hydrogen to fuel its zero-emissions trucks. “Nikola is the only company that is successfully integrating a revolutionary new product, the hydrogen fuel cell truck, and the full hydrogen energy infrastructure supply chain under one roof,” said Nikola CEO and President Michael Lohscheller. With five three Hexagon Purus Type 4 tanks onboard, the Nikola Tre FCEV has a range of 500 miles (>800 kilometers) and can be refueled in <20 minutes. HYLA is establishing five hydrogen production sites in North America and is pursuing 60 hydrogen refueling stations (HRS) in place by 2026, beginning in California. Production of the Tre FCEV at its Coolidge, Arizona plant is slated to begin 2H 2023.

Hexagon Purus will also be supporting Nikola in Europe, where Nikola and its partner IVECO will supply 100 Tre FCEV trucks to GP Joule starting in 2024 from the joint venture’s production facility in Ulm, Germany.

“This approach taken by Nikola we have also seen taken by Alstom, which has been the first mover in hydrogen for rail,” notes Kleschinski. “We support Alstom with hydrogen systems. And they also saw that you need to bring the whole ecosystem, which includes not just refueling but also maintenance operations. And this is especially true for the public transit market where their first trains operate, because you must commit to a cost per mile.”

“These companies like Nikola and Alstom are important because they are demonstrating that hydrogen-powered mobility works,” says Holum. “And it is impressive. For example, we visited Nikola and were able to ride in one of their FC trucks. They have built a new test track and it is amazing to be onboard this vehicle — which is 82,000 pounds loaded — and to be smoothly accelerating to 60 miles per hour. Of course, we as Hexagon Purus know these vehicles are a reality. But Nikola is changing the user’s perspective, so that truck operators can also see this is real.” He notes that the total cost of ownership (TCO) for these H2-pwered trucks must still be demonstrated. That is, a TCO that meets the industry’s needs. Holum adds, “but hydrogen mobility is no longer ‘on the horizon’ — it is here and growing.”

Distribution market, new production lines

Is Hexagon Purus Westminster producing H2 tanks for distribution and refueling?

“It can, but it is not doing so today,” says Holum. “We have a very live business in distribution modules in Europe but here in the U.S., it is just beginning to develop. However, we have the space here to accommodate production of those cylinders. “The building design and access is well-suited for that,” adds Kleschinski, “and the equipment is capable.” Holum notes the building can also be expanded, if needed.

When more production lines are added in Westminster, will they feature increased digitization and automation?

“Westminster is still in the early stages of transitioning from a low-volume, specialty tank facility to more toward what is established at our Kassel, Germany facility, which is a narrower range of tank products but at much higher volume,” says Kleschinski.

Hexagon Purus is entering the next phase of industrial scale-up worldwide (top), including increased digitization and automation in its hydrogen tank production facilities (bottom). Photo Credit: Hexagon Purus and Capital Markets Day presentation 2022.

“We have a global approach to developing a subsequent archetype for our production lines,” he continues, “with a focus on production efficiency at scale. And we have this experience through decades of production at Hexagon Composites, which is the largest Type 4 tank manufacturer in the world. With our LPG production lines, for example, we produce a tank every 10 seconds. So, we will apply this knowledge and experience as the high-pressure tank market begins to scale up. We have a pilot line now in Europe which is testing this with higher digitalization and integrated systems to control the line. We will roll this out first in Europe and in parallel at our facility in China. We will then deploy this, say “1.0 system” in the U.S. and further develop it globally to “2.0” and beyond.”

“Hexagon Purus will use this advancement,” notes Kleschinski, “to get more out of the carbon fiber materials its uses.” Indeed, these materials represent the highest cost input for Type 4 tanks.

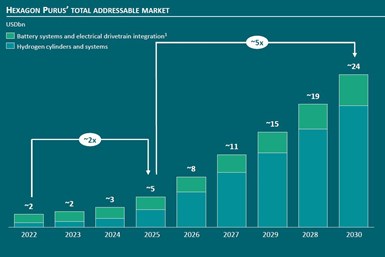

Hexagon Purus is projecting significant growth in both battery systems (green) and hydrogen tanks (teal) to 2030. Photo Credit: Hexagon Purus Capital Markets Day presentation 2022.

How much of the growth that Hexagon Purus is projecting over the next decade will come from the U.S. versus Europe and Asia?

“We previously thought that China would be higher and the U.S. would be lower with Europe in the middle,” says Holum. “But now we see the market in the U.S. coming sooner. For example, the Inflation Reduction Act in the U.S. provides a direct subsidy for hydrogen production and hydrogen-powered vehicles. The regulations in California from CARB [California Air Resources Board] are also driving the bus and heavy truck market.”

Another market driver is the world’s new focus on energy independence, especially in Europe, after Russia’s invasion of Ukraine. “For decades in Europe, 40% of our power came from cheap, Russian gas,” says Holum. “Now, there is a focus for each country to establish energy independence, not just from Russia, but for sustainability and the future of our planet.”

“This growth is also about the worldwide growing commitment to solve the climate crisis,” he continues. “I was much more pessimistic about this a few years ago. But I’m more positive now and believe that we will solve this. It’s not just the explosion of new technologies and startups, but the capital markets that are supporting this with massive investments and the investment and strategies being announced by governments.”

Hexagon Purus R&D imperatives

Thermoplastic composite tanks to provide recyclability?

“Thermoplastic matrix materials are just not there yet in terms of cost,” says Kleschinski. “There are other ways to recycle and reuse,” says Holum. “For example, our composite cylinders have a much higher lifetime than the vehicles they are used in. So, recertifying holds more promise than pursuing how to chop up or unwind a tank. We have 25-30 years yet before we have to start doing that.”

“It is more important right now to make the tank manufacturing process more sustainable,” he continues, “and as the major energy and emissions component, carbon fiber has a large role to play. This is where we see the emphasis needed. Carbon fiber manufacturing must become more sustainable.”

Conformable tanks?

Holum notes that the automotive industry has accepted there won’t be a single standard platform. “OEMs are working on both battery and fuel cell platforms,” he says. “BEV platforms have maturity and scale, so it makes sense to look at how to bring 6 kilograms of hydrogen into the flat space where batteries are located. We too are developing this flat storage, not so much from a single cylinder approach, but as a whole system.” Note, Hexagon Purus already supplies flat battery systems for heavy trucks and other mobility, while its Type 4 packs for buses and trucks are flat modules. “For passenger cars Wwe are working on this development with BMW and Bosch,” says Holum. “BMW is developing a pilot fleet of FCEV cars while Bosch is also supporting Nikola with fuel cells.”

Sensors in every tank?

“Yes,” says Kleschinski. “We have invested in modal acoustic emission via Hexagon’s Digital Wave business,” he adds, noting that even though this is a slower technology for inspecting or monitoring a whole pressure vessel, “there is a way to develop a sensor along these lines.” Holum says it’s just a matter of time. “We’re doing a lot of work on this. The benefits for structural health maintenance and recertification of tanks are clear.”

Questions about carbon fiber

Is there a sufficient supply of carbon fiber?

“Hexagon Composites has a decades-long history with the main carbon fiber supplier and with Mitsui,” says Holum. “We, as Hexagon Purus, are part of that.” Holum is referring to Mitsui & Co., Ltd. (Tokyo, Japan) which formed a strategic alliance with Hexagon Composites in 2016. The two companies announced they would extend that alliance for another five years:

“Mitsui has been a strong supporter of Hexagon Composites’ strategic development of new markets and new segments. With its comprehensive industrial background and global reach Mitsui has opened doors for Hexagon to geographies worldwide and industrial segments, like carbon fiber, natural gas and hydrogen where it has extensive expertise,” says Jon Erik Engeset, CEO of Hexagon Composites. “We have not only supported growth of Hexagon Composites as a shareholder, but also supported its business growth by leveraging the synergy between Hexagon’s competitive solutions and products - and our assets, activities, and global network,” says Hiroshi Kakiuchi, general manager of Mitsui’s Functional Materials Division.

“Over the past 12 months, I’ve seen a shift on the carbon fiber supply issue,” says Holum. “We see that the carbon fiber manufacturers are seeing the hydrogen market as an interesting opportunity now, where in the past they were not taking it very seriously. Both the Japanese and the Chinese see a sizeable market opportunity. I’m not as concerned about carbon fiber supply today as I was two years ago.”

Kleschinski agrees, “There is a different sentiment now. They major players understand that they need to move. We want security of supply, of course, but I don’t see this as an issue that will constrain us. I can see, however, that new entrants into this market may indeed be struggling.”

“We also see Chinese market moving aggressively,” adds Holum. “The fiber properties have improved significantly, and the quality continues to improve. Of course, we are testing products there to support our new production facility in Hebei. Hexagon has long relationships in this market as well.”

Carbon fiber sustainability?

This is not an issue that I introduced, but one that Holum emphasized. “There are indeed key issues with carbon fiber manufacturing,” he asserted. “Foremost is that the carbon fiber must be produced more sustainably. We all have ESG [environmental, social, governance] requirements and we, as a clean energy solutions company, are committed to being as sustainable as possible. In our products, carbon fiber is the most challenging component for energy and emissions reduction. As carbon fiber consumers, we need a product with significantly lower carbon intensity and more sustainable precursors. The manufacturers also need to develop a lower cost method of manufacturing. All carbon fiber manufacturers will increasingly feel this pressure to be more sustainable because it is a global imperative.”

Notably, Mitsui Chemicals announced in 2022, a project with Microwave Chemical to install a demonstration facility for eco-friendly carbon fiber by December 2023.

Deviation in carbon fiber properties?

Some tank manufacturers have noted that there is deviation in carbon fiber properties. Is there any value or sustainability improvement possible if this is reduced? “If you can bring down the deviation in fiber properties, then you can exploit this in the tank designs,” says Kleschinski. “These currently must accept a certain knockdown in properties because the peak tensile strength cannot be used, but instead only the consistent, guaranteed strength. Also, note this is a composite strength, not the strength of the fiber tested alone. So, translation of the fiber’s properties into the composite is key as well.”

“We do have discussions with our regular suppliers on topics of carbon fiber improvements long-term,” adds Holum.

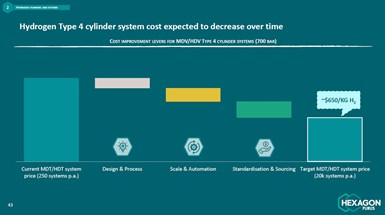

Projected reduction in cost with scale. Photo Credit: Hexagon Purus Capital Markets Day presentation 2022.

Price of carbon fiber?

“Pricing throughout the hydrogen supply chain will come down: for the hydrogen fuel, for the tanks and the vehicles and for the refueling,” says Holum. “As the industry scales, the prices of everything will come down, including the price of carbon fiber. Deployment of this technology at scale demands that costs come down. And this is our mission at Hexagon Purus and our business: to scale solutions that accelerate the transition to clean energy.”

Related Content

PEEK vs. PEKK vs. PAEK and continuous compression molding

Suppliers of thermoplastics and carbon fiber chime in regarding PEEK vs. PEKK, and now PAEK, as well as in-situ consolidation — the supply chain for thermoplastic tape composites continues to evolve.

Read MorePlant tour: Albany Engineered Composites, Rochester, N.H., U.S.

Efficient, high-quality, well-controlled composites manufacturing at volume is the mantra for this 3D weaving specialist.

Read MoreCycling forward with bike frame materials and processes

Fine-tuning of conventional materials and processes characterizes today’s CFRP bicycle frame manufacturing, whether in the large factories of Asia or at reshored facilities in North America and Europe. Thermoplastic resins and automated processes are on the horizon, though likely years away from high-volume production levels.

Read MorePlant tour: Joby Aviation, Marina, Calif., U.S.

As the advanced air mobility market begins to take shape, market leader Joby Aviation works to industrialize composites manufacturing for its first-generation, composites-intensive, all-electric air taxi.

Read MoreRead Next

Hydrogen is poised to fuel composites growth, Part 1

Applications abound for composite tanks to store compressed H2 gas, but challenges exist in cost, size, efficiency and limited carbon fiber capacity.

Read MoreHexagon Purus opens new U.S. facility to manufacture composite hydrogen tanks

CW attends the opening of Westminster, Maryland, site and shares the company’s history, vision and leading role in H2 storage systems.

Read MoreFrom the CW Archives: The tale of the thermoplastic cryotank

In 2006, guest columnist Bob Hartunian related the story of his efforts two decades prior, while at McDonnell Douglas, to develop a thermoplastic composite crytank for hydrogen storage. He learned a lot of lessons.

Read More