Gardner Business Index at 43.4 in January

Mid-sized U.S. production facilities expand; capital spending plans reach second highest level since August 2015.

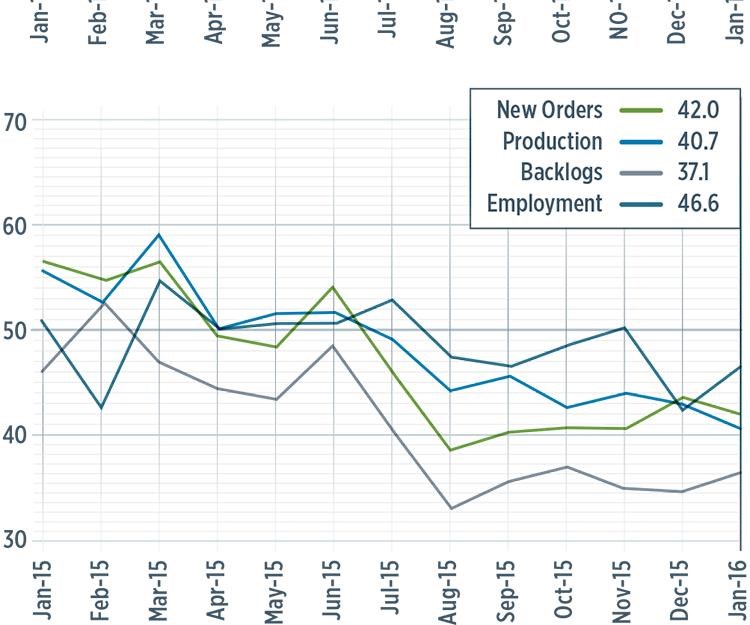

With a reading of 43.4, the Gardner Business Index for the U.S. composites industry in January of this year showed contraction for the ninth time in 10 months. At that time, the rate of contraction had been virtually unchanged during the past six months, although the index did improve slightly from December 2015.

New orders contracted in January for the seventh month in a row. However, that subindex had contracted at a generally decelerating rate since August 2015. The production index had contracted seven months in a row, too. However, its rate of contraction had generally accelerated since July 2015. The backlog subindex continued to contract at a significant rate, but in January it had improved since hitting a low point in August. Further, the rate of contraction had slowed somewhat since then. But the trend in backlogs indicated falling capacity utilization at plants operated by composites fabricators. The employment subindex also contracted for the second consecutive month, exports continued to contract because of the strength of the U.S. dollar, and supplier deliveries lengthened in January after shortening in December 2015.

Materials prices plunged in January, decreasing for the second month in a row. That subindex had dropped significantly since reaching a peak in July 2015. Prices received decreased for the fourth month in a row. In January, both of these subindexes were decreasing at their fastest rates since the GBI’s Composites survey began in December 2011. The future business expectations subindex in January dropped to its lowest level since November 2012.

After expanding significantly from September to November 2015, plants with more than 250 employees contracted in January for the second month in a row. The weakening conditions at large facilities had been a significant reason for the decline in the overall index. While the largest facilities experienced contraction, plants with 100-249 employees expanded for the third time in four months. Facilities with 50-99 employees continued to contract but posted their highest subindex figure since June 2015. Companies with 20-49 employees contracted at their fastest rate since the survey began, while fabricators with fewer than 20 employees saw conditions improve notably in January.

The four largest markets served by composites fabricators, based on the primary NAICS codes of CW’s circulation list, are job shops, automotive, custom processors, and aerospace. At the end of January, job shops had contracted for the preceding seven months while custom processors had contracted five of the previous six months. The automotive industry had mostly expanded since December 2013, but had contracted for three months. The aerospace industry had expanded significantly in October and November but then contracted significantly for two months.

Future capital spending plans in January reached their second highest level since August 2015. But they were still noticeably below the historic average and had contracted 24.3% compared with one year earlier.

Related Content

-

Materials & Processes: Resin matrices for composites

The matrix binds the fiber reinforcement, gives the composite component its shape and determines its surface quality. A composite matrix may be a polymer, ceramic, metal or carbon. Here’s a guide to selection.

-

Plant tour: ÉireComposites, Galway, Ireland

An in-house testing business and R&D focus has led to innovative materials use and projects in a range of markets, from civil aerospace to renewable energy to marine.

-

JEC World 2022, Part 1: Highlights in sustainable, digital, industrialized composites

JEC World 2022 offered numerous new developments in composites materials, processes and applications, according to CW senior editor, Ginger Gardiner, most targeting improved sustainability for wider applications.

.JPG;width=70;height=70;mode=crop)